Comparative standing of Kazakhstan pension system performance: learning policy lessons from Canadian experience

DOI:

https://doi.org/10.15587/2706-5448.2022.271585Keywords:

pension system, retirement savings, pension asset portfolio, asset structure, pension payout, pension marketAbstract

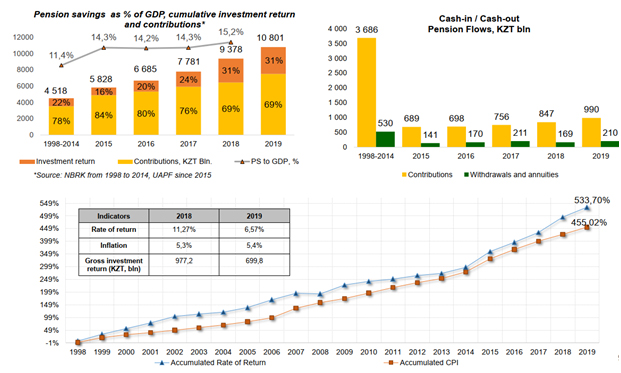

The study examines the current state of Kazakhstan public pension system in terms of its performance and asset structure as compared to that of the OECD countries as well as structural and regulatory issues confronting the national pension market as an impediment to ensuring adequate retirement savings of the population. The underlying issue to be addressed is current low real rate of return by the national pension fund, which translates into its future inability to provide for pension payouts that would meet retirement needs of the nation accounting for recent elevated inflation rates. As a likely solution, the paper investigates the Canadian pension system as a successful case of pension market ecosystem embodying a three-layer pension market structure that fuels diversified sources of pension payouts thus ensuring a sustainable flow of pension income to Canadian retirees. In particular, it advocates for introducing group (employer-based) and private (individual) registered pension programs of investments that have for long been adopted in developed countries demonstrating their effectiveness in generating substantial supplementary sources of pension income. As a prerequisite, favorable legislative and taxation frameworks should be adopted to secure motivation by both the employers and working citizens to contribute to the respective pension plans. By way of learning Canadian experience, suggestions as per prospective ways to reconfigure the Kazakhstan pension system are made that may solidify its overall performance and sustainability to ensure solid real rate of return and consequently adequate pension payouts to its future retirees.

Supporting Agency

- Presentation of research in the form of publication through financial support in the form of a grant from SUES (Support to Ukrainian Editorial Staff).

References

- Unified Accumulative Pension Fund. Available at: https://www.enpf.kz

- World Bank Global Economic Monitor. Available at: https://public.knoema.com/qhpqgye/world-bank-global-economic-monitor

- Reforming Kazakhstan’s Pension System. Report by the Asian Development Bank. Available at: https://www.adb.org/sites/default/files/publication/28591/kaz-proj-brief-pension-system.pdf

- Interview with Dmitry Sochin (2022). Almaty.

- Global Pension Statistics. Available at: https://www.oecd.org/finance/private-pensions/globalpensionstatistics.htm

- ENPF: Kazakhstantcy samostoiatelno smogut upravliat svoimi pensionnymi nakopleniiami (2018). Available at: https://www.banker.kz/news/sapf-kazakhstanis-will-be-able-to-independently-ma/

- Bank of Japan. Available at: https://www.boj.or.jp/en/

- Korean Ministry of Employment and Labor. Available at: https://www.moel.go.kr/english/

- Pension System of the Republic of Kazakhstan. Available at: https://www.enpf.kz/en/pension-system/overview-of-the-kazakhstan-s-pension-system/

- Dynamic of Fund's Indices (2021). Available at: https://www.enpf.kz/upload/medialibrary/db6/db6d3baa2ae8239376fd2c209ed8df0f.pdf

- Investing for Canada on the world stage. Available at: http://files.newswire.ca/29/Infographic_ENG.pdf

- Preqin Special Report: The Private Equity Top 100 (2014). Available at: https://docs.preqin.com/reports/Preqin-Special-Report-The-Private-Equity-Top-100-February-2017.pdf

- Actuarial Report (27th) on the Canada Pension Plan – OSFI-BSIF (2015). Available at: https://www.osfi-bsif.gc.ca/eng/docs/cpp27.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Almaz Tolymbek

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.