An investigation into the financial challenges affecting the success of entrepreneurs in South Africa

DOI:

https://doi.org/10.15587/2706-5448.2023.292555Keywords:

financial constraints, liquidity constraints, entrepreneurs, financial literacy, entrepreneurship, innovationAbstract

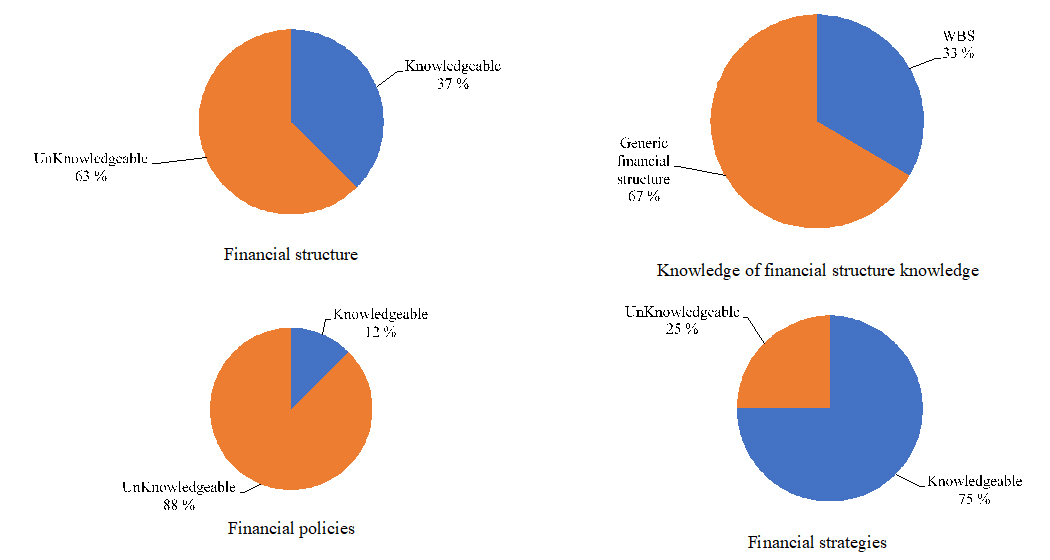

The object of this study is the financial difficulties that impacted the success of business owners in Hatfield, Gauteng province, South Africa. Compared to a global failure rate of 50 %, five out of every seven entrepreneurs in Hatfield, South Africa fail during the first year of operation. This study aimed at looking into the relationship between entrepreneur failure and financial literacy. The methodology employed in this study is interpretive philosophy-based qualitative research. An ethnographic research technique was also used to analyze the current economic condition of business owners in Hatfield. The population was sampled using non-probability purposive sampling techniques. Semi-structured interviews were used to gather the study's leading source of data. The primary research results are thematically examined while also considering the secondary sources. Eliminating financial and liquidity constraints was listed as a goal of financial literacy. Findings garnered revealed that financial, liquidity and credit restrictions are the primary causes of business failures in Hatfield. The lack of financial resources for new businesses in Hatfield, as revealed, prompted several liquidity issues in Hatfield, and further lowers the growth rate of Hatfield businesses. It was discovered that Hatfield's entrepreneurs usually experienced premature failure due to inadequate financial education and training. Impliedly, Hatfield business owners possessed poor cash management, defaulting on loan payments due to lack of financial education. Conversely, only few entrepreneurs and business owners in Hatfield, South Africa possess financial literacy competence with the necessary skills needed to better analyze their financial statements appropriately and increase profitability of their business. The practical implication of this finding is that, most entrepreneurs have high possibility to experience premature business liquidity when they have low or no financial literacy.

References

- Akoh, E. I. (2023). Social entrepreneurship as a tool for sustainable development in the townships in KwaZulu-Natal province. doi: https://doi.org/10.51415/10321/4826

- Anwar, M., Shah, S. Z. A. (2020). Entrepreneurial orientation and generic competitive strategies for emerging SMEs: Financial and nonfinancial performance perspective. Journal of Public Affairs, 21 (1). doi: https://doi.org/10.1002/pa.2125

- Urbano, D., Audretsch, D., Aparicio, S., Noguera, M. (2019). Does entrepreneurial activity matter for economic growth in developing countries? The role of the institutional environment. International Entrepreneurship and Management Journal, 16 (3), 1065–1099. doi: https://doi.org/10.1007/s11365-019-00621-5

- Igwe, P. A., Odunukan, K., Rahman, M., Rugara, D. G., Ochinanwata, C. (2020). How entrepreneurship ecosystem influences the development of frugal innovation and informal entrepreneurship. Thunderbird International Business Review, 62 (5), 475–488. doi: https://doi.org/10.1002/tie.22157

- Cantner, U., Cunningham, J. A., Lehmann, E. E., Menter, M. (2020). Entrepreneurial ecosystems: a dynamic lifecycle model. Small Business Economics, 57 (1), 407–423. doi: https://doi.org/10.1007/s11187-020-00316-0

- Adeola, O., Gyimah, P., Appiah, K. O., Lussier, R. N. (2021). Can critical success factors of small businesses in emerging markets advance UN Sustainable Development Goals? World Journal of Entrepreneurship, Management and Sustainable Development, 17 (1), 85–105. doi: https://doi.org/10.1108/wjemsd-09-2019-0072

- Burlea-Schiopoiu, A., Mihai, L. S. (2019). An Integrated Framework on the Sustainability of SMEs. Sustainability, 11 (21), 6026. doi: https://doi.org/10.3390/su11216026

- Guerrero, M., Liñán, F., Cáceres-Carrasco, F. R. (2020). The influence of ecosystems on the entrepreneurship process: a comparison across developed and developing economies. Small Business Economics, 57 (4), 1733–1759. doi: https://doi.org/10.1007/s11187-020-00392-2

- Liguori, E. W., Pittz, T. G. (2020). Strategies for small business: Surviving and thriving in the era of COVID-19. Journal of the International Council for Small Business, 1 (2), 106–110. doi: https://doi.org/10.1080/26437015.2020.1779538

- Foucrier, T., Wiek, A. (2019). A Process-Oriented Framework of Competencies for Sustainability Entrepreneurship. Sustainability, 11 (24), 7250. doi: https://doi.org/10.3390/su11247250

- Wadesango, N., Tinarwo, N., Sitcha, L., Machingambi, S. (2019). The impact of cash flow management on the profitability and sustainability of small to medium-sized enterprises. International Journal of Entrepreneurship, 23 (3), 1–19.

- Zeidy, I. A. (2020). The economic impact of covid-19 on micro, small, and medium enterprises (MSMEs) in Africa and policy options for mitigation. Common Market for Eastern and Southern Africa. Nairobi, 16.

- Bakhtiari, S., Breunig, R., Magnani, L., Zhang, J. (2020). Financial Constraints and Small and Medium Enterprises: A Review. Economic Record, 96 (315), 506–523. doi: https://doi.org/10.1111/1475-4932.12560

- Chirume, E., Kaseke, N. (2020). Impact of COVID-19 on small and medium-sized enterprises (SMEs) in Chinhoyi, Zimbabwe. International Journal of Business, Economics, and Law, 23 (1), 101–110.

- Madzikanda, B., Li, C., Dabuo, F. T. (2021). Barriers to development of entrepreneurial ecosystems and economic performance in Southern Africa. African Journal of Science, Technology, Innovation and Development, 14 (4), 936–946. doi: https://doi.org/10.1080/20421338.2021.1918316

- Chiappini, R., Montmartin, B., Pommet, S., Demaria, S. (2022). Can direct innovation subsidies relax SMEs’ financial constraints? Research Policy, 51 (5), 104493. doi: https://doi.org/10.1016/j.respol.2022.104493

- Rens, V., Iwu, C. G., Tengeh, R. K., Esambe, E. E. (2021). SMEs, Economic Growth, and Business Incubation Conundrum in South Africa. A Literature Appraisal. Journal of Management and Research, 8 (2), 214–251. doi: https://doi.org/10.29145/jmr/82/08

- Demirel, P., Danisman, G. O. (2019). Eco‐innovation and firm growth in the circular economy: Evidence from European small‐ and medium‐sized enterprises. Business Strategy and the Environment, 28 (8), 1608–1618. doi: https://doi.org/10.1002/bse.2336

- Neumeyer, X., Santos, S. C., Morris, M. H. (2021). Overcoming Barriers to Technology Adoption When Fostering Entrepreneurship Among the Poor: The Role of Technology and Digital Literacy. IEEE Transactions on Engineering Management, 68 (6), 1605–1618. doi: https://doi.org/10.1109/tem.2020.2989740

- Islam, M. A., Igwe, P. A., Rahman, M., Saif, A. N. M. (2021). Remote working challenges and solutions: insights from SMEs in Bangladesh during the COVID-19 pandemic. International Journal of Quality and Innovation, 5 (2), 119–140. doi: https://doi.org/10.1504/ijqi.2021.117186

- Pu, G., Qamruzzaman, Md., Mehta, A. M., Naqvi, F. N., Karim, S. (2021). Innovative Finance, Technological Adaptation and SMEs Sustainability: The Mediating Role of Government Support during COVID-19 Pandemic. Sustainability, 13 (16), 9218. doi: https://doi.org/10.3390/su13169218

- Menne, F., Surya, B., Yusuf, M., Suriani, S., Ruslan, M., Iskandar, I. (2022). Optimizing the Financial Performance of SMEs Based on Sharia Economy: Perspective of Economic Business Sustainability and Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 8 (1), 18. doi: https://doi.org/10.3390/joitmc8010018

- Van Song, N., Mai, T. T. H., Thuan, T. D., Van Tien, D., Phuong, N. T. M., Van Ha, T. et al. (2022). SME financing role in developing business environment and economic growth: empirical evidences from technical SMEs in Vietnam. Environmental Science and Pollution Research, 29 (35), 53540–53552. doi: https://doi.org/10.1007/s11356-022-19528-w

- Lyons, A. C., Kass‐Hanna, J. (2021). A methodological overview to defining and measuring «digital» financial literacy. Financial planning review, 4 (2). doi: https://doi.org/10.1002/cfp2.1113

- Kiyabo, K., Isaga, N. (2020). Entrepreneurial orientation, competitive advantage, and SMEs’ performance: application of firm growth and personal wealth measures. Journal of Innovation and Entrepreneurship, 9 (1). doi: https://doi.org/10.1186/s13731-020-00123-7

- Prasanna, R., Jayasundara, J., Naradda Gamage, S. K., Ekanayake, E., Rajapakshe, P., Abeyrathne, G. (2019). Sustainability of SMEs in the Competition: A Systemic Review on Technological Challenges and SME Performance. Journal of Open Innovation: Technology, Market, and Complexity, 5 (4), 100. doi: https://doi.org/10.3390/joitmc5040100

- Cueto, L. J., Frisnedi, A. F. D., Collera, R. B., Batac, K. I. T., Agaton, C. B. (2022). Digital Innovations in MSMEs during Economic Disruptions: Experiences and Challenges of Young Entrepreneurs. Administrative Sciences, 12 (1), 8. doi: https://doi.org/10.3390/admsci12010008

- Wolf, T., Kuttner, M., Feldbauer-Durstmüller, B., Mitter, C. (2020). What we know about management accountants’ changing identities and roles – a systematic literature review. Journal of Accounting & Organizational Change, 16 (3), 311–347. doi: https://doi.org/10.1108/jaoc-02-2019-0025

- Usama, K. M., Yusoff, W. F. (2019). The impact of financial literacy on business performance. International Journal of Research and Innovation in Social Science, 3 (10), 84–91.

- Balen, J., Nojeem, L., Bitala, W., Junta, U., Browndi, I. (2023). Essential Determinants for Assessing the Strategic Agility Framework in Small and Medium-sized Enterprises (SMEs). European Journal of Scientific and Applied Sciences, 10 (2023), 2124–2129.

- Klein, V. B., Todesco, J. L. (2021). COVID‐19 crisis and SMEs responses: The role of digital transformation. Knowledge and Process Management, 28 (2), 117–133. doi: https://doi.org/10.1002/kpm.1660

- Cooper, D. R., Schindler, P. S., Cooper, D. R., Schindler, P. S. (2012). Business research methods. McGraw-Hill Irwin.

- Saunders, M., Lewis, P., Thornhill, A. (2012). Research Methods for Business Students. Pearson Education Limited.

- Krippendorff, K. (2019). Content analysis: An introduction to its methodology. Sage publications. doi: https://doi.org/10.4135/9781071878781

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Eugine Nkwinika, Olawale Olufemi Akinrinde

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.