Application of probabilistic and stochastic models and data mining for forecasting the contingent of old age pension recipients in the context of systemic uncertainty

DOI:

https://doi.org/10.15587/2706-5448.2024.313960Keywords:

Bayesian network, uncertainty, pension reform, data mining, probability-statistical models, pension recipientsAbstract

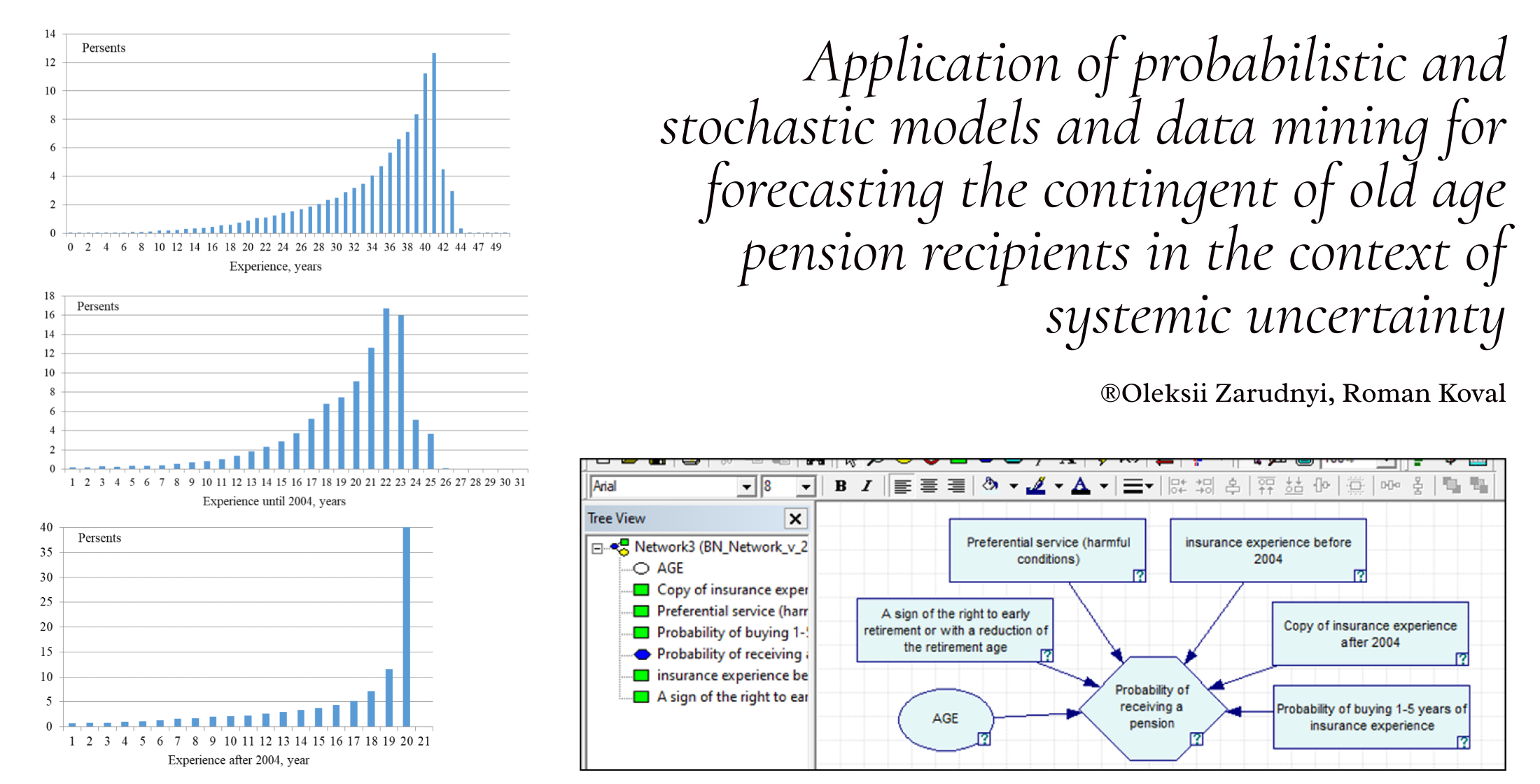

The object of the research is mathematical models for forecasting the contingent of pension recipients in conditions of uncertainty caused by both the reform of the pension system and the impact of armed aggression. Based on the study of statistical information on the structure and dynamics of the contingent of pension recipients, an approach to uncovering systemic uncertainty in the task of forecasting the contingent of pensioners is proposed. This work is part of a study of the application of data mining methods of intellectual data analysis and mathematical modeling in information technology intended for use in the pension system. The main focus of this work is on forecasting the dynamics of the contingent of pension recipients by age, in particular, forecasting the number of newly appointed pensions. The difficulty of forecasting the contingent of pension recipients, in particular by age, is connected with the fact that it is necessary to ensure the representativeness and variability of data sets. In addition, it should be taken into account that a significant number of factors must be included in the model in accordance with the requirements of regulatory documents. Another problematic issue is that the time series of the investigated indicators, such as data on the insurance experience of insured persons (based on the results of a sample survey), may contain significant (more than 40 %) gaps that can be filled only on the basis of primary (paper) documents. Therefore, the input data sets are formed with assumptions about the probability of the accumulation of insurance experience in various groups of insured persons. The paper proposes an analytical toolkit based on the use of probabilistic and statistical models in the form of Bayesian networks, intended for use in specialized decision-making support systems of the Ukrainian pension system. In the course of the study, a number of numerical experiments were carried out, in which the correctness of the proposed method was investigated. The proposals presented in the paper will improve the stability of the pension system of Ukraine, including through a more accurate definition of the dynamics of the contingent of pension recipients and, accordingly, the costs of pension payments. The proposed models and methods can be used as part of decision-making support systems of state and public administration bodies to analyze the results of reforming the pension system.

References

- Zelenko, V. (2023). Reformuvannia pensiinoi systemy Ukrainy u svitli yevropeiskykh standartiv. Lviv: LNU im. Ivana Franka, 202.

- Ministerka sotsialnoi polityky Maryna Lazebna: pro pensiinu reformu i zaprovadzhennia nakopychuvalnoi systemy (2021). Available at: https://www.msp.gov.ua/news/20328.html

- U Minsotspolityky spodivaiutsia zapustyty reformu solidarnoi pensiinoi systemy u lypni 2025 roku (2024). Available at: https://www.ukrinform.ua/rubric-society/3910430-u-minsocpolitiki-spodivautsa-zapustiti-reformu-solidarnoi-pensijnoi-sistemi-u-lipni-2025-roku.html

- Korporatyvnyi nederzhavnyi pensiinyi fond Natsionalnoho banku Ukrainy. Available at: https://knpf.bank.gov.ua

- Lypko, N. (2023). Analysis of the current state of the pension system in Ukraine and the search for the ways to reform IT. Economy and Society, 51. https://doi.org/10.32782/2524-0072/2023-51-44

- Maibutnie pensiinoi systemy Ukrainy: adekvatnist, okhoplennia ta stiikist (2019). Budapesht: Mizhnarodna orhanizatsiia pratsi, 90. Available at: https://www.ilo.org/uk/publications/maybutnye-pensiynoyi-systemy-ukrayiny-adekvatnist-okhoplennya-ta-stiykist

- Metodyka provedennia aktuarnykh rozrakhunkiv u systemi zahalnooboviazkovoho derzhavnoho pensiinoho strakhuvannia (2004). Postanova Kabinetu Ministriv Ukrainy No. 1677. 16.12.2004. Available at: https://www.kmu.gov.ua/npas/10301286

- Pro zatverdzhennia Poriadku provedennia aktuarnykh rozrakhunkiv u systemi zahalnooboviazkovoho derzhavnoho pensiinoho strakhuvannia (2005). Postanova pravlinnia Pensiinoho Fondu Ukrainy No. 12-1. 18.07.2005. Available at: https://zakon.rada.gov.ua/laws/show/z0840-05#Text

- Telichko, N. A. (2013). Actuarial methods to ensure of the pension systems financial sustainability. Visnyk Skhidnoukrainskoho nats. un-tu imeni Volodymyra Dalia, 3 (192), 164–171.

- Romanchuk, N. N. (2017). Tax-benefit model: methodological aspects of implementation. Ekonomika i suspilstvo, 11, 588–592.

- Modeling Pension Reform: The World Bank's Pension Reform Options Simulation Toolkit (2010). World Bank Pension Reform Primer Series, World Bank PROST Model. Available at: http://hdl.handle.net/10986/11074

- Pensions at a Glance 2021: OECD and G20 Indicators (2020). Paris: OECD Publishing, 224. https://doi.org/10.1787/ca401ebd-en

- Pensions Schemes and Projection Models in EU-25 Member States (2007). Occasional Papers, 35, 377. Available at: https://ec.europa.eu/economy_finance/publications/pages/publication10173_en.pdf

- Sze, M. (1993). The Process of Pension Forecasting. Journal of actuarial practice, 1 (1), 31–50. Available at: https://core.ac.uk/download/pdf/127444889.pdf

- Trukhan, S. V., Bidiuk, P. I. (2015). Methods of building mathematical models ofactuarial processes. Eastern-European Journal of Enterprise Technologies, 1 (4 (73)), 27–35. https://doi.org/10.15587/1729-4061.2015.36486

- Pro zahalnooboviazkove derzhavne pensiine strakhuvannia (2003). Zakon Ukrainy No. 1058-IV. 09.07.2003. Available at: https://zakon.rada.gov.ua/laws/show/1058-15#Text

- Ofitsinyi sait Pensiinoho fondu Ukrainy. Available at: https://www.pfu.gov.ua/statystyka/

- Stratehiia demohrafichnoho rozvytku Ukrainy na period do 2040 roku. Available at: https://www.msp.gov.ua/projects/870/

- Derzhavna sluzhba statystyky Ukrainy. Available at: http://www.ukrstat.gov.ua/

- Zvit pro robotu ta vykonannia biudzhetu Pensiinoho fondu Ukrainy u 2023 rotsi. Available at: https://www.kmu.gov.ua/storage/app/sites/1/17-civik-2018/zvit2023/zvit_PFU_2023_.pdf

- Zghurovskyi, M. Z., Pankratova, N. D. (2007). Osnovy systemnoho analizu. Kyiv: Vydavnycha hrupa BHV, 544.

- Zgurovsky, M. Z., Zaychenko, Y. P. (2016). The Fundamentals of Computational Intelligence: System Approach. Springer International Publishing, 375. https://doi.org/10.1007/978-3-319-35162-9

- Andreica, M., Popescu, М. E., Micu, D., Albu, E. (2016). Adaptive management procedural model for support of economic organizations. Proc of 10th International Management Conference «Challenges of Modern Management», 295–301.

- Dobrescu, E. (2017). Modelling an Emergent Economy and Parameter Instability Problem. Journal for Economic Forecasting of Institute for Economic Forecasting, 2, 5–28. Available at: https://ideas.repec.org/a/rjr/romjef/vy2017i2p5-28.html

- Bidyuk, P., Tymoshchuk, O., Kovalenko, A., Korshevnyuk, L. (2022). Systems and Methods for Decision Support. Kyiv: Polytechnika Publisher at the National Technical University of Ukraine «Igor Sikorsky KPI», 610.

- Zgurovsky, M. Z., Bidyuk, P. I., Terentiev, O. M., Prosyankina-Zharova, T. I. (2015). Bayesian Networks in Decision Support Systems. Kyiv: Edelweiss, 300.

- Holsapple, C. W., Winston, A. B. (1996). Decision Support Systems. Saint Paul: West Publishing Company, 850.

- Turban, E., Aronson, J. E. (2001). Decision Support Systems. New Jersey: Prentice Hall, 865.

- Borra, S., Dey, N., Bhattacharyya, S., Bouhlel, M. S. (2019). Intelligent decision support systems, Intelligent Decision Support Systems: Applications in Signal Processing. Berlin, Boston: De Gruyter, 183. https://doi.org/10.1515/9783110621105

- Alasiri, M. M., Salameh, A. A. (2020). The impact of business intelligence (BI) and decision support systems (DSS): exploratory study. International Journal of Management, 11 (5), 1001–1016.

- Friedman, N., Linial, M., Nachman, I., Pe’er, D. (2000). Using Bayesian Networks to Analyze Expression Data. Journal of Computational Biology, 7 (3-4), 601–620. https://doi.org/10.1089/106652700750050961

- Heckerman, D. (1997). Bayesian Networks for Data Mining. Data Mining and Knowledge Discovery, 1, 79–119. https://doi.org/10.1023/a:1009730122752

- Тrofimchuk, О., Bidyuk, P., Коzshukhivska, О., Коzshukhivskyy, А. (2015). Probabilistic and statistical uncertainty Decision Support Systems. Visnyk of Lviv Polytechnic National University, 826, 237–248.

- Gelman, A., Carlin, J. B., Stern, H. S., Rubin, D. B. (2000). Bayesian Data Analysis. New York: Chapman and Hall, CRC Press, 670.

- Jensen, F. V., Nielsen, Th. D. (2007). Bayesian Networks and Decision Graphs. New York: Springer, 457. https://doi.org/10.1007/978-0-387-68282-2

- Jilani, T., Najamuddin, M. (2014). A Review Adaptive Bayesian modeling for time series forecasting. Journal of Applied Environmental and Biological Sciences, 4 (7S), 99–106.

- Mani, S., McDermott, S., Valtorta, M. (1997). MENTOR: A bayesian model for prediction of mental retardation in newborns. Research in Developmental Disabilities, 18 (5), 303–318. https://doi.org/10.1016/s0891-4222(97)00012-7

- Gembarski, P. C., Plappert, S., Lachmayer, R. (2021). Making design decisions under uncertainties: probabilistic reasoning and robust product design. Journal of Intelligent Information Systems, 57 (3), 563–581. https://doi.org/10.1007/s10844-021-00665-6

- Bidyuk, P., Prosyankina-Zharova, T., Terentiev, O.; Hu, Z., Petoukhov, S., Dychka, I., He, M. (Eds.) (2019). Modelling Nonlinear Nonstationary Processes in Macroeconomy and Finances. Advances in Computer Science for Engineering and Education. ICCSEEA 2018. Advances in Intelligent Systems and Computing. Cham: Springer, 754, 735–745. Available at: http://doi.org/10.1007/978-3-319-91008-6_72

- GeNIe 2.0. Available at: https://genie.updatestar.com/en#google_vignette

- Brocklebank, J. C., Dickey, D. A. (2003). SAS System for Forecasting Time Series. Cary N C. SAS Institute Inc., 418.

- SAS Visual Analytics. SAS Institute. Available at: https://www.sas.com/ru_ua/software/visual-analytics.html

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Oleksii Zarudnyi, Roman Koval

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.