Methodical aspects of analysis and risk management of an insurance company

DOI:

https://doi.org/10.15587/2706-5448.2024.314391Keywords:

insurance company risks, PEST analysis, SWOT analysis, forecasting, insolvency risk factorAbstract

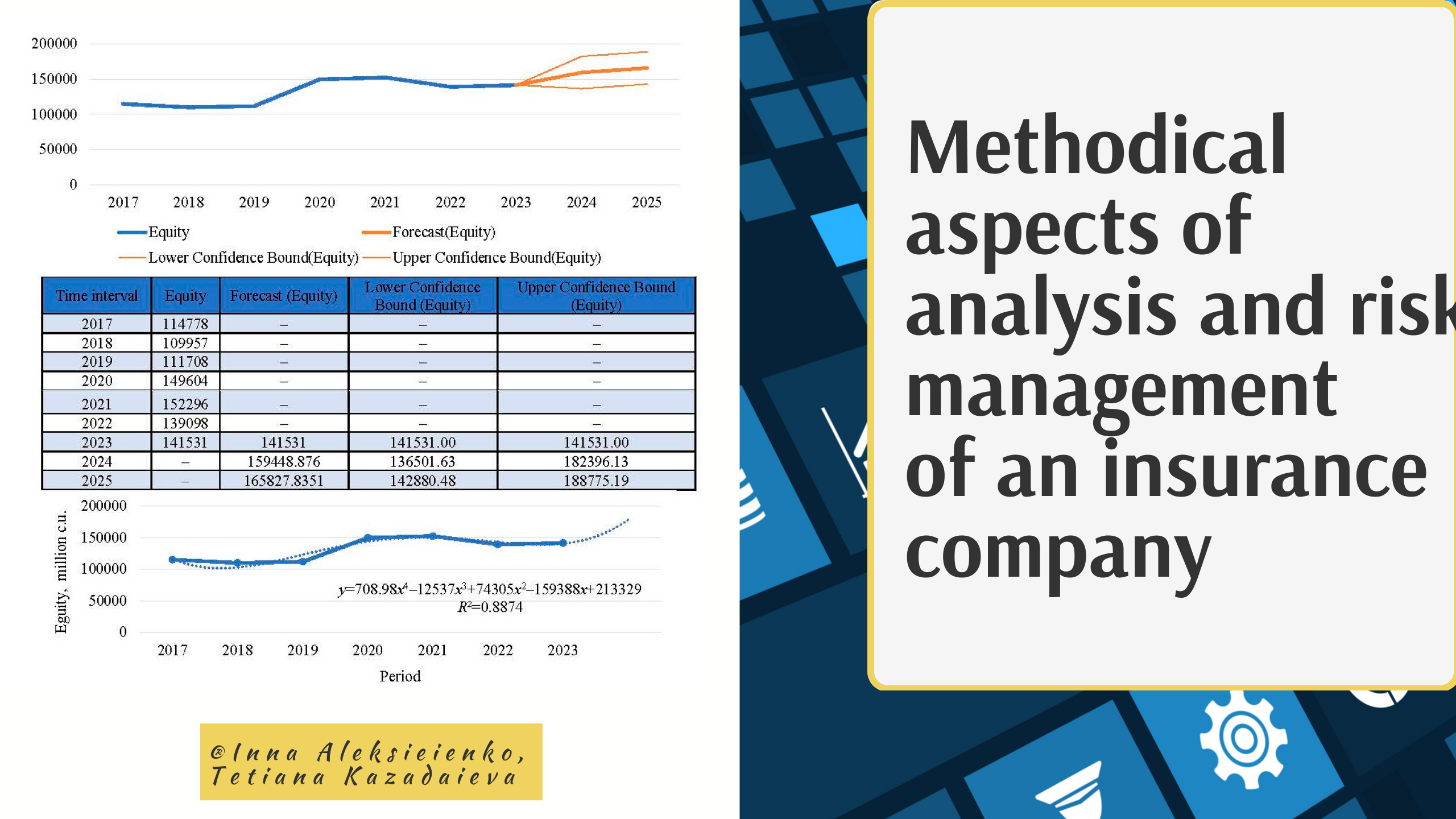

The object of research is the risks of the insurance company. The paper is devoted to the study of the risks of the insurance company, which generate threats to the level of its solvency. The general state of economic development in general and the insurance market in particular determine the operating conditions of any insurer. The insurance company's ability to regulate such conditions is limited, but the formation of a stable state of the internal environment creates opportunities to adapt to threats from the external environment. Timely detection of potential risks in the activities of the insurer, provision of reserves to cover possible losses related to risks, enable companies to overcome the consequences of risks with minimal losses. The methodical basis for evaluating potential risks in the insurance company's activities is strategic analysis methods, such as PEST and SWOT analysis. Their results give an idea of the state of threats in the external environment and the potential opportunities of the insurer's internal reserves. The methods of economic-mathematical modeling and forecasting make it possible to assess the current state of the company and investigate its behavior under the influence of external and internal factors. The basis of the forecast model of risk analysis of an insurance company is formed by the coefficient of risk of loss of solvency, calculated according to the key parameters of the assessment of its financial condition. The reliability of the forecast of the possible risk of loss of the insurer's solvency is ensured by constructing a trend line and forming a forecast sheet in the MS Excel software environment. The forecast sheet forms the probabilities of the values of the indicators with a distinction between optimistic and pessimistic levels of the forecast. Using the trend line and finding the value of the coefficient of determination (R2), the probability of realizing the forecast of growth or reduction in the value of each individual parameter of the model is determined. The practical significance of the obtained results lies in the possibility of increasing the efficiency of the use of available resources and reserves in the process of risk management. The proposed methodical approach can be used to assess the impact of risks in the insurer's activities, which will increase the accuracy of the obtained results.

References

- Poradova, M., Kollar, B. (2020). Methods of Earnings and Risks Management in Insurance Companies. Proceedings of the Fifth International Conference on Economic and Business Management (FEBM 2020). https://doi.org/10.2991/aebmr.k.201211.063

- Bosch-Príncep, M., Devolder, P., Domínguez-Fabián, I. (2002) Risk analysis in asset-liability management for pension fund. Belgian Actuarial Bulletin, 2 (1), 80–91. Available at: https://www.researchgate.net/profile/Manuela-Bosch-Princep/publication/251762240_Risk_analysis_in_asset-liability_management_for_pension_fund/links/5419bb9e0cf2218008bf9e0e/Risk-analysis-in-asset-liability-management-for-pension-fund.pdf

- Dluhopolskyi, O., Khroponiuk, D. (2022). Current problems and development prospects of the mortgage market of Ukraine. Innovation and Sustainability, 1, 118–126. https://doi.org/10.31649/ins.2023.1.118.126

- Kolinets, L., Panukhnyk, O., Krupka, A., Zarichna, N., Lavrov, R., Khroponiuk, D. (2023). Financial and Institutional Aspects of Insurance Market Development Under Conditions of Pandemic 2020–2021 and War 2022–2023: Case Of Ukrainian Insurance Companies. Financial and Credit Activity Problems of Theory and Practice, 5 (52), 97–110. https://doi.org/10.55643/fcaptp.5.52.2023.4158

- Vladyka, Y., Shubina, I. (2023). Insurance Risk Management of the Insurer (According to the Materials of the Insurance Company «USG»). Economy and Society, 55. https://doi.org/10.32782/2524-0072/2023-55-12

- Rud, I. Yu., Tkachenko, M., Kramarenko, A. (2019). Methods of risk management in insurance company. Ekonomika ta upravlinnia pidpryiemstvamy, 3 (71), 21–26. Available at: http://www.psae-jrnl.nau.in.ua/journal/3_71_2_2019_ukr/3.pdf

- Podra, O. P., Petryshyn, N. Ya. (2020) Theoretical and methodological aspects of insurance companies risk management. Menedzhment ta pidpryiemnytstvo v Ukraini: etapy stanovlennia ta problemy rozvytku, 2 (2), 70–78.

- Aleksandrova, M. M., Boiar, D. S. (2021). Mistse strakhovoho rynku v ekonomitsi Ukrainy. Available at: https://conf.ztu.edu.ua/wp-content/uploads/2021/11/254.pdf

- Hranovska, I., Yaremenko, L., Malyshko, V. (2023). The current state and problems of the development of the insurance market under the conditions of marital state. Black Sea Economic Studies, 81, 167–172. https://doi.org/10.32782/bses.81-26

- Prystupa, L. A., Kharchuk, O. B. (2017). Conceptual base of the insurance company’s competitiveness in the modern market environment. Ekonomika ta suspilstvo, 13, 1201–1206. Available at: https://economyandsociety.in.ua/journals/13_ukr/201.pdf

- Bodnar, O., Khorenzhenko, V., Tatarenkova, Y. (2020). Functioning of the insurance market of Ukraine in the conditions of the COVID-19 pandemic. Efektyvna Ekonomika, 10. https://doi.org/10.32702/2307-2105-2020.10.67

- Finansova zvitnist. PAT «SK «Krayina». Available at: https://krayina.com/page/finansova-zvitnist

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Inna Aleksieienko, Tetiana Kazadaieva

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.