Assessment of high-tech export dynamics and the impact of its cyclicality on GDP and the country’s production reserves

DOI:

https://doi.org/10.15587/2706-5448.2025.329470Keywords:

high-tech, high-tech products, export, production reserves, mathematical modeling, dynamic indicators, cyclicalityAbstract

The object of this research is the dynamics of high-tech exports and their impact on GDP and production reserves. The instability of high-tech exports can hinder long-term economic growth, particularly in economies where technological sectors play a crucial role in national competitiveness.

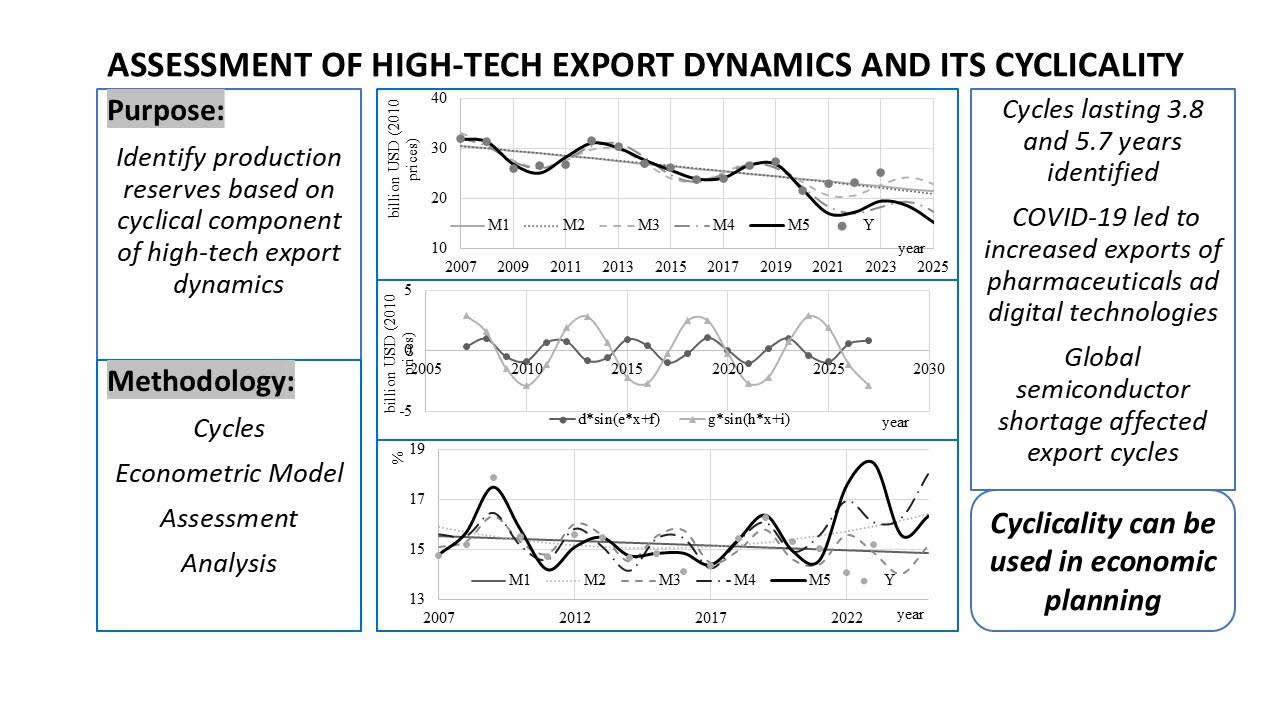

To address these issues, the research employs an econometric approach that integrates both linear and cyclical components to analyze the structural dynamics of high-tech exports. As a result, the research identifies two dominant economic cycles, lasting 3.8 and 5.7 years respectively, which significantly influence overall export trends. This is attributed to the nature of high-tech industries, where product innovation cycles, shifts in global demand, and technological progress contribute to periodic fluctuations in export volumes.

The proposed econometric model offers a more accurate assessment of production reserves by identifying periods of economic acceleration and deceleration. This is achieved through the model's ability to isolate cyclical components, enabling strategic adjustments in industrial planning, investment policy, and innovation-driven growth. For instance, based on the identified cycles, companies can better align product launch schedules, reconfigure production capacity during demand slowdowns, and optimize export contract volumes during peak growth periods. Compared to conventional forecasting methods, this approach provides a more comprehensive understanding of high-tech export dynamics, enhancing economic stability and industrial resilience.

The research also holds practical significance. Specifically, the implementation of adaptive budgetary and industrial strategies that are attuned to cyclical dynamics can reduce the risks of overproduction, shortages, or price volatility. In post-war Ukraine, the findings may facilitate the development of strategic policies aimed at the recovery and modernization of the industrial sector. Given limited resources and the urgent need for innovative reconstruction strategies, the proposed model could serve as a foundation for crisis-responsive planning and the rationalization of investments in priority industries.

References

- Porter, M. (1990). Competitive Advantage of Nations. Competitive Intelligence Review, 1 (1), 14–14. https://doi.org/10.1002/cir.3880010112

- Belov, A., Svistun, L., Ptashchenko, L., Popova, Y., Mammadov, E. M.; Onyshchenko, V., Mammadova, G., Sivitska, S., Gasimov, A. (Eds.) (2023). Analysis of High-Tech Trends in the Context of Management Tasks of State’s Scientific and Technical Development. Proceedings of the 4th International Conference on Building Innovations. ICBI 2022. Lecture Notes in Civil Engineering. Vol. 299. Cham: Springer, 845–864. https://doi.org/10.1007/978-3-031-17385-1_72

- Heyets, V. (2023). Economic profile formation of strategically important types of industrial activity in Ukraine (retrospective view). Economy of Ukraine, 66 (8 (741), 3–27. https://doi.org/10.15407/economyukr.2023.08.003

- Hatzichronoglou, T. (1997). Revision of the High-Technology Sector and Product Classification. Paris: OECD. https://doi.org/10.1787/050148678127

- Ross, A. (2017). The Industries of the Future. New York, London, Toronto, Sydney, New Delhi: Simon & Schuster, 320.

- OECD Taxonomy of Economic Activities Based on R&D Intensity (2016). OECD Science, Technology and Industry Working Papers 2016/04. Vol. 2016/04. https://doi.org/10.1787/5jlv73sqqp8r-en

- Molnárová, Z., Reiter, M. (2022). Technology, demand, and productivity: What an industry model tells us about business cycles. Journal of Economic Dynamics and Control, 134, 104272. https://doi.org/10.1016/j.jedc.2021.104272

- Yang, B., Zhu, S. (2022). Public funds in high-tech industries: A blessing or a curse. Socio-Economic Planning Sciences, 83, 101037. https://doi.org/10.1016/j.seps.2021.101037

- Shcherbak, V., Bryzhan, I., Chevhanova, V., Svistun, L., Hryhoryeva, O. (2020). Impact of forced migration on the sustainable development of rural territories. Global Journal of Environmental Science and Management, 6 (4), 481–496. https://doi.org/10.22034/gjesm.2020.04.05

- Özsoy, S., Ergüzel, O. Ş., Ersoy, A. Y., Saygılı, M. (2021). The impact of digitalization on export of high technology products: A panel data approach. The Journal of International Trade & Economic Development, 31 (2), 277–298. https://doi.org/10.1080/09638199.2021.1965645

- Rivlin, P. (Ed.) (2010). Globalization and High Technology. The Israeli Economy from the Foundation of the State through the 21st Century. Cambridge: Cambridge University Press, 94–117.

- Marukawa, T. (2013). Japan’s High-Technology Trade with China and Its Export Control. Journal of East Asian Studies, 13 (3), 483–501. https://doi.org/10.1017/s1598240800008316

- Ustabaş, A., Ersin, Ö. Ö. (2016). The Effects of R& D and High Technology Exports on Economic Growth: A Comparative Cointegration Analysis for Turkey and South Korea. International Conference on Eurasian Economies 2016. https://doi.org/10.36880/c07.01475

- Ege, A., Ege, A. Y. (2017). The Turkish economy and the challenge of technology: a trade perspective. New Perspectives on Turkey, 57, 31–60. https://doi.org/10.1017/npt.2017.28

- Garces, E. J., Adriatico, C. G. (2019). Correlates of High Technology Exports Performance in the Philippines. Open Journal of Social Sciences, 7 (5), 215–226. https://doi.org/10.4236/jss.2019.75018

- Srholec, M. (2007). High-Tech Exports from Developing Countries: A Symptom of Technology Spurts or Statistical Illusion? Review of World Economics, 143 (2), 227–255. https://doi.org/10.1007/s10290-007-0106-z

- Kabaklarli, E., Duran, M. S., Üçler, Y. T. (2018). High-technology exports and economic growth: panel data analysis for selected OECD countries. Forum Sci. Oeconomia. Wydawnictwo Naukowe Akademii WSB. Economic Growth, Innovations and Lobbying, 6 (2), 47–60.

- Şahin, L., Kutluay Şahin, D. (2021). The Relationship Between High-Tech Export and Economic Growth: A Panel Data Approach for Selected Countries. Gaziantep University Journal of Social Sciences, 20 (1), 22–31. https://doi.org/10.21547/jss.719642

- Ersin, Ö., Ustabaş, A., Acar, T. (2022). The nonlinear effects of high technology exports, R&D and patents on economic growth: a panel threshold approach to 35 OECD countries. Romanian Journal of Economic Forecasting, 25, 26–44.

- Siddiqui, A. A. (2022). Technology Intensive Exports and Growth of Asian Economies. The Indian Economic Journal, 70 (2), 229–248. https://doi.org/10.1177/00194662221082205

- Bottega, A., Romero, J. P. (2021). Innovation, export performance and trade elasticities across different sectors. Structural Change and Economic Dynamics, 58, 174–184. https://doi.org/10.1016/j.strueco.2021.05.008

- Sandu, S., Ciocanel, B. (2014). Impact of R&D and Innovation on High-tech Export. Procedia Economics and Finance, 15, 80–90. https://doi.org/10.1016/s2212-5671(14)00450-x

- Love, J. H., Ganotakis, P. (2013). Learning by exporting: Lessons from high-technology SMEs. International Business Review, 22 (1), 1–17. https://doi.org/10.1016/j.ibusrev.2012.01.006

- Wu, J., Ma, Z., Zhuo, S. (2017). Enhancing national innovative capacity: The impact of high-tech international trade and inward foreign direct investment. International Business Review, 26 (3), 502–514. https://doi.org/10.1016/j.ibusrev.2016.11.001

- Mandelman, F. S., Rabanal, P., Rubio-Ramírez, J. F., Vilán, D. (2011). Investment-specific technology shocks and international business cycles: An empirical assessment. Review of Economic Dynamics, 14 (1), 136–155. https://doi.org/10.1016/j.red.2010.08.001

- Gupta, R., Ma, J., Risse, M., Wohar, M. E. (2018). Common business cycles and volatilities in US states and MSAs: The role of economic uncertainty. Journal of Macroeconomics, 57, 317–337. https://doi.org/10.1016/j.jmacro.2018.06.009

- Li, J., Ren, Z., Wang, Z. (2008). Response of nonlinear random business cycle model with time delay state feedback. Physica A: Statistical Mechanics and Its Applications, 387 (23), 5844–5851. https://doi.org/10.1016/j.physa.2008.06.017

- Yang, M. (2020). Remeasuring and decomposing stochastic trends in business cycles. Research in Economics, 74 (4), 354–362. https://doi.org/10.1016/j.rie.2020.10.006

- Breitung, J., Eickmeier, S. (2015). Analyzing business cycle asymmetries in a multi-level factor model. Economics Letters, 127, 31–34. https://doi.org/10.1016/j.econlet.2014.12.001

- Yan, C., Huang, K. X. D. (2020). Financial cycle and business cycle: An empirical analysis based on the data from the U.S. Economic Modelling, 93, 693–701. https://doi.org/10.1016/j.econmod.2020.01.018

- Berger, T., Richter, J., Wong, B. (2022). A unified approach for jointly estimating the business and financial cycle, and the role of financial factors. Journal of Economic Dynamics and Control, 136, 104315. https://doi.org/10.1016/j.jedc.2022.104315

- Franke, R. (2022). An empirical test of a fundamental Harrod-Kaldor business cycle model. Structural Change and Economic Dynamics, 60, 1–14. https://doi.org/10.1016/j.strueco.2021.11.001

- Heiberger, C., Maußner, A. (2020). Perturbation solution and welfare costs of business cycles in DSGE models. Journal of Economic Dynamics and Control, 113, 103819. https://doi.org/10.1016/j.jedc.2019.103819

- Lin, Y. C. (2021). Business cycle fluctuations in Taiwan – A Bayesian DSGE analysis. Journal of Macroeconomics, 70, 103349. https://doi.org/10.1016/j.jmacro.2021.103349

- Belov, A. (2023). A new approach to the analysis of the high-tech exports dynamics (on the example of the Czech Republic). Socio-Economic Problems and the State, 28 (1), 53–65. https://doi.org/10.33108/sepd2023.01.053

- Belov, A., Nikolenko, I. (2024). Analysis of cyclicity in the dynamics of high-tech exports in Mexico. Current issues in modern science, 9 (27). https://doi.org/10.52058/2786-6300-2024-9(27)-56-68

- Preview. World Development Indicators. DataBank. Available at: https://databank.worldbank.org/reports.aspx?source=2&series=TX.VAL.TECH.CD&country= Last accessed: 31.08.2020

- The United States of America Annual and Monthly Inflation Tables. Available at: https://www.statbureau.org/en/united-states/inflation-tables Last accessed: 23.12.2021

- Popular Indicators. World Development Indicators. DataBank. Available at: https://databank.worldbank.org/indicator/NY.GDP.MKTP.CD/1ff4a498/Popular-Indicators Last accessed: 10.02.2025

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Petro Makarenko, Oleksandr Belov, Andrii Makarenko, Lуudmyla Svystun

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.