Evidence of the negative relationship between transaction costs and economic performance in G7+BRICS countries

DOI:

https://doi.org/10.15587/2706-5448.2022.267896Keywords:

institutions, transaction costs, economic performance, composite indicators, G7 and BRICS countriesAbstract

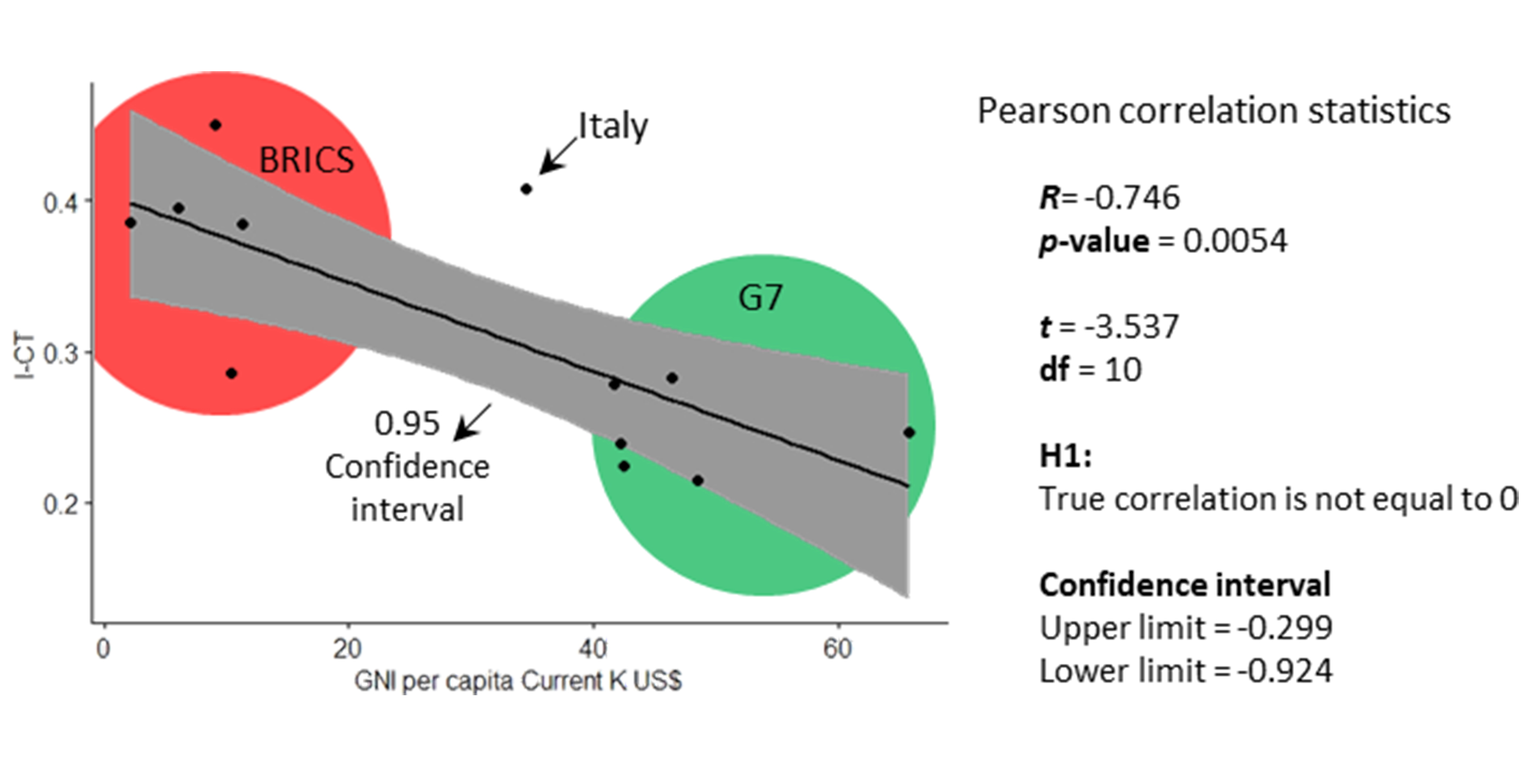

The object of this research is the relationship between Transaction Costs and economic performance. Weak or unreliable institutions open space for corruption, generating a negative externality, increasing the economy's Transaction Costs, inhibiting doing business, and reducing economic growth. Although there is a broad debate about the negative relationship between Transaction Costs and economic performance, little is known about this relationship's strength and significance. This gap occurs because most Transaction Costs estimates are performed at the microeconomic level. Besides, the few estimates of countries' Transaction Costs at the national level are from different periods, which make any analysis unfeasible. The objective of this research is twofold. First, to introduce a comparative index of the Transaction Costs of the countries. Second, to analyze the relationship between the Transaction Costs Index and economic performance. The robustness analysis reveals that the Transaction Costs Index is reliable because the countries' average variation in the ranking is relatively low (1.5 positions), serving as an alternative to the Transaction Costs estimates. The research results show a significant (p-value=0.0054), strong, and negative (R=–0.746) correlation between the Transaction Costs Index and the Gross National Income per capita of G7+BRICS countries. BRICS countries and Italy have lower economic performance, and higher scores on the Transaction Costs Index, suggesting that these countries' institutions are more inefficient than other G7 countries. These results reinforce the current understanding of the negative relationship between Transaction Costs and countries' economic performance. Understanding the effects of Transaction Costs on business activity and, consequently, on economic performance is extremely important for governments to promote adjustments in the regulatory environment that encourage business activity.

Supporting Agency

- This work was funded by the National Council for Scientific and Technological Development (CNPq): Productivity Scholarship 311922/2021-0 and Junior Postdoctoral Scholarship 151518/2022-0. Presentation of research in the form of publication through financial support in the form of a grant from SUES (Support to Ukrainian Editorial Staff).

References

- Williamson, O. E. (1985). The economic institutions of capitalism. Firms, markets, relational contracting. New York: Free Press, 450.

- Djankov, S., Hart, O., McLiesh, C., Shleifer, A. (2008). Debt Enforcement around the World. Journal of Political Economy, 116 (6), 1105–1149. doi: https://doi.org/10.1086/595015

- Breen, M., Gillanders, R. (2012). Corruption, institutions and regulation. Economics of Governance, 13 (3), 263–285. doi: https://doi.org/10.1007/s10101-012-0111-0

- Hartwell, C. A., Michael, B. (2015). A helping hand: examining the effect of foreign banks on the business environment. International Journal of Emerging Markets, 10 (4), 875–895. doi: https://doi.org/10.1108/ijoem-03-2014-0034

- Wallis, J. J., North, D. (1986). Measuring the transaction sector in the American economy, 1870–1970. Long-term factors in American economic growth. University of Chicago Press, 95–162.

- Allen, M. M. C., Aldred, M. L. (2013). Business regulation, inward foreign direct investment, and economic growth in the new European Union member states. Critical Perspectives on International Business, 9 (3), 301–321. doi: https://doi.org/10.1108/17422041311330431

- Wang, N. (2007). Measuring transaction costs: diverging approaches, contending practices. Division of Labour & Transaction Costs, 2 (2), 111–146. doi: https://doi.org/10.1142/s0219871107000324

- Dollery, B., Leong, W. H. (1998). Measuring the Transaction sector in the Australian economy, 1911–1991. Australian Economic History Review, 38 (3), 207–231. doi: https://doi.org/10.1111/1467-8446.00031

- Sulejewicz, A., Graca, P. (2005). Measuring the transaction sector in the Polish economy, 1996–2002. 9th Annual Conference of the International Society for New Institutional Economics. Barcelona, 22–25.

- North, D. C. (1992). Transaction costs, institutions, and economic performance. San Francisco: ICS Press, 13–15.

- North, D. (1990). Institutions, institutional change and economic performance. New York: Cambridge University Press, 159.

- Coase, R. H. (1937). The Nature of the Firm. Economica, 4 (16), 386–405. doi: https://doi.org/10.1111/j.1468-0335.1937.tb00002.x

- Coase, R. (1960). The problem of social cost. Classic papers in natural resource economics. London: Palgrave Macmillan, 87–137.

- Williamson, O. (1999). Public and private bureaucracies: a transaction cost economics perspectives. Journal of Law, Economics, and Organization, 15 (1), 306–342. doi: https://doi.org/10.1093/jleo/15.1.306

- Doshi, R., Kelley, J. G., Simmons, B. A. (2019). The Power of Ranking: The Ease of Doing Business Indicator and Global Regulatory Behavior. International Organization, 73 (3), 611–643. doi: https://doi.org/10.1017/s0020818319000158

- Karama, D. (2014). Ease of Doing Business: Emphasis on Corruption and Rule of Law. University Library of Munich.

- Mehrabani, F., Basirat, M., Abdollahi, F. (2016). Examining the effects of doing business on Iran and MENA countries’ economic growth. International Journal of Islamic and Middle Eastern Finance and Management, 9 (1), 2–23. doi: https://doi.org/10.1108/imefm-07-2014-0066

- Asongu, S., Odhiambo, N. (2019). Doing business and inclusive human development in Sub-Saharan Africa. African Journal of Economic and Management Studies, 10 (1), 2–16. doi: https://doi.org/10.1108/ajems-05-2018-0132

- Tan, K. G., Amri, M., Merdikawati, N. (2018). A new index to measure ease of doing business at the sub-national level. Cross Cultural & Strategic Management, 25 (3), 515–537. doi: https://doi.org/10.1108/ccsm-01-2017-0009

- Tan, K. G., Gopalan, S., Nguyen, W. (2018). Measuring ease of doing business in India’s sub-national economies: a novel index. South Asian Journal of Business Studies, 7 (3), 242–264. doi: https://doi.org/10.1108/sajbs-02-2018-0010

- Hörisch, J., Kollat, J., Brieger, S. A. (2016). What influences environmental entrepreneurship? A multilevel analysis of the determinants of entrepreneurs’ environmental orientation. Small Business Economics, 48 (1), 47–69. doi: https://doi.org/10.1007/s11187-016-9765-2

- Nardo, M., Saisana, M., Saltelli, A., Tarantola, S. (2005). Tools for composite indicators building. European Comission, Ispra, 15 (1), 19–20.

- Correa Machado, A. M., Ekel, P. I., Libório, M. P. (2022). Goal-based participatory weighting scheme: balancing objectivity and subjectivity in the construction of composite indicators. Quality & Quantity. doi: https://doi.org/10.1007/s11135-022-01546-y

- Kuc-Czarnecka, M., Lo Piano, S., Saltelli, A. (2020). Quantitative Storytelling in the Making of a Composite Indicator. Social Indicators Research, 149 (3), 775–802. doi: https://doi.org/10.1007/s11205-020-02276-0

- Libório, M. P., da Silva Martinuci, O., Machado, A. M. C., Machado-Coelho, T. M., Laudares, S., Bernardes, P. (2020). Principal component analysis applied to multidimensional social indicators longitudinal studies: limitations and possibilities. GeoJournal, 87 (3), 1453–1468. doi: https://doi.org/10.1007/s10708-020-10322-0

- Libório, M. P., Martinuci, O. da S., Laudares, S., Lyrio, R. de M., Machado, A. M. C., Bernardes, P., Ekel, P. (2020). Measuring Intra-Urban Inequality with Structural Equation Modeling: A Theory-Grounded Indicator. Sustainability, 12 (20), 8610. doi: https://doi.org/10.3390/su12208610

- Karagiannis, R., Karagiannis, G. (2020). Constructing composite indicators with Shannon entropy: The case of Human Development Index. Socio-Economic Planning Sciences, 70, 100701. doi: https://doi.org/10.1016/j.seps.2019.03.007

- Liborio, M. P., Ekel, P. Y., De Mello Lyrio, R., Bernardes, P., Soares, G. L., Machado-Coelho, T. M. (2020). Structural Equation Modeling Applied to Internet Consumption Forecast in Brazil. IEEE Access, 8, 161816–161824. doi: https://doi.org/10.1109/access.2020.3016286

- Patrick, R., Shaw, A., Freeman, A., Henderson-Wilson, C., Lawson, J., Davison, M., Capetola, T., Lee, C. K. F. (2019). Human Wellbeing and the Health of the Environment: Local Indicators that Balance the Scales. Social Indicators Research, 146 (3), 651–667. doi: https://doi.org/10.1007/s11205-019-02140-w

- Libório, M. P., Ekel, P. I., Lyrio, R. de M., Bernardes, P., Soares, G. L., Machado-Coelho, T. M. (2020). Expand or Oversize? Planning Internet Access Network in a Demand Growth Scenario. Journal of Network and Systems Management, 28 (4), 1820–1838. doi: https://doi.org/10.1007/s10922-020-09561-w

- Gómez-Limón, J., Arriaza, M., Guerrero-Baena, M. (2020). Building a Composite Indicator to Measure Environmental Sustainability Using Alternative Weighting Methods. Sustainability, 12 (11), 4398. doi: https://doi.org/10.3390/su12114398

- Pinheiro-Alves, R., Zambujal-Oliveira, J. (2012). The Ease of Doing Business Index as a tool for investment location decisions. Economics Letters, 117 (1), 66–70. doi: https://doi.org/10.1016/j.econlet.2012.04.026

- Corcoran, A., Gillanders, R. (2014). Foreign direct investment and the ease of doing business. Review of World Economics, 151 (1), 103–126. doi: https://doi.org/10.1007/s10290-014-0194-5

- Ruiz, F., Cabello, J. M., Pérez-Gladish, B. (2018). Building Ease-of-Doing-Business synthetic indicators using a double reference point approach. Technological Forecasting and Social Change, 131, 130–140. doi: https://doi.org/10.1016/j.techfore.2017.06.005

- Bucher, S. (2018). The Global Competitiveness Index As an Indicator of Sustainable Development. Herald of the Russian Academy of Sciences, 88 (1), 44–57. doi: https://doi.org/10.1134/s1019331618010082

- Fattore, M. (2018). Non-aggregated indicators of environmental sustainability. Śląski Przegląd Statystyczny, 16 (22), 7–22.

- Barragán-Ocaña, A., Reyes-Ruiz, G., Olmos-Peña, S., Gómez-Viquez, H. (2019). Approach to the identification of an alternative technological innovation index. Scientometrics, 122 (1), 23–45. doi: https://doi.org/10.1007/s11192-019-03292-9

- Freudenberg, M. (2003). Composite indicators of country performance: a critical assessment. OECD Science, Technology and Industry Working Paper. doi: http://doi.org/10.1787/405566708255

- Grupp, H., Schubert, T. (2010). Review and new evidence on composite innovation indicators for evaluating national performance. Research Policy, 39 (1), 67–78. doi: https://doi.org/10.1016/j.respol.2009.10.002

- El Gibari, S., Gómez, T., Ruiz, F. (2018). Building composite indicators using multicriteria methods: a review. Journal of Business Economics, 89 (1), 1–24. doi: https://doi.org/10.1007/s11573-018-0902-z

- Djankov, S. (2016). The Doing Business project: how it started: correspondence. Journal of Economic Perspectives, 30 (1), 247–248. doi: http://doi.org/10.1257/jep.30.1.247

- Doing Business report 2019 (2020). World Bank. Available at: https://www.doingbusiness.org/content/dam/doingBusiness/media/Annual-Reports/English/DB2019-report_web-version.pdf

- Bernardes, P., Ekel, P. I., Rezende, S. F. L., Pereira Júnior, J. G., dos Santos, A. C. G., da Costa, M. A. R. et. al. (2021). Cost of doing business index in Latin America. Quality & Quantity, 56 (4), 2233–2252. doi: https://doi.org/10.1007/s11135-021-01221-8

- Ekel, P., Bernardes, P., Vale, G. M. V., Libório, M. P. (2022). South American business environment cost index: reforms for Brazil. International Journal of Business Environment, 13 (2), 212–233. doi: https://doi.org/10.1504/ijbe.2022.121973

- Libório, M. P., da Silva, L. M. L., Ekel, P. I., Figueiredo, L. R., Bernardes, P. (2022). Consensus-Based Sub-Indicator Weighting Approach: Constructing Composite Indicators Compatible with Expert Opinion. Social Indicators Research. doi: https://doi.org/10.1007/s11205-022-02989-4

- Libório, M. (2020). Cost of doing business index in Latin America. Mendeley Data, 1. doi: http://doi.org/10.17632/b3yvn2pph9.1

- Dealing with Construction Permits Methodology (2019). World Bank. Available at: https://www.doingbusiness.org/en/methodology/dealing-with-construction-permits

- Djankov, S., La Porta, R., Lopez-de-Silanes, F., Shleifer, A. (2003). Courts: the Lex Mundi Project. The Quarterly Journal of Economics, 118 (2), 453–517. doi: http://doi.org/10.1162/003355303321675437

- Geginat, C., Ramalho, R. (2018). Electricity connections and firm performance in 183 countries. Energy Economics, 76, 344–366. doi: https://doi.org/10.1016/j.eneco.2018.08.034

- Djankov, S., Ganser, T., McLiesh, C., Ramalho, R., Shleifer, A. (2010). The Effect of Corporate Taxes on Investment and Entrepreneurship. American Economic Journal: Macroeconomics, 2 (3), 31–64. doi: https://doi.org/10.1257/mac.2.3.31

- Registering Property Methodology (2019). World Bank https://www.doingbusiness.org/en/methodology/registering-property

- Djankov, S. (2009). The Regulation of Entry: A Survey. The World Bank Research Observer, 24 (2), 183–203. doi: https://doi.org/10.1093/wbro/lkp005

- Djankov, S., Freund, C., Pham, C. S. (2010). Trading on Time. Review of Economics and Statistics, 92 (1), 166–173. doi: https://doi.org/10.1162/rest.2009.11498

- Cinelli, M., Spada, M., Kim, W., Zhang, Y., Burgherr, P. (2020). MCDA Index Tool: an interactive software to develop indices and rankings. Environment Systems and Decisions, 41 (1), 82–109. doi: https://doi.org/10.1007/s10669-020-09784-x

- Pearson, K. (1901). LIII. On lines and planes of closest fit to systems of points in space. The London, Edinburgh, and Dublin Philosophical Magazine and Journal of Science, 2 (11), 559–572. doi: https://doi.org/10.1080/14786440109462720

- Oppong, F. B., Agbedra, S. Y. (2016). Assessing univariate and multivariate normality. A guide for non-statisticians. Math. Theory Modeling, 6 (2), 26–33.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Petr Ekel, Patrícia Bernardes, Sandro Laudares, Matheus Pereira Libório

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.