The formation of strategic portfolio of the development of risk management in telecommunications enterprises during martial law and post-war conditions

DOI:

https://doi.org/10.15587/2706-5448.2022.270860Keywords:

risk, strategy, risk management, strategic approach, analysis, evaluation, economic security of telecommunications enterprisesAbstract

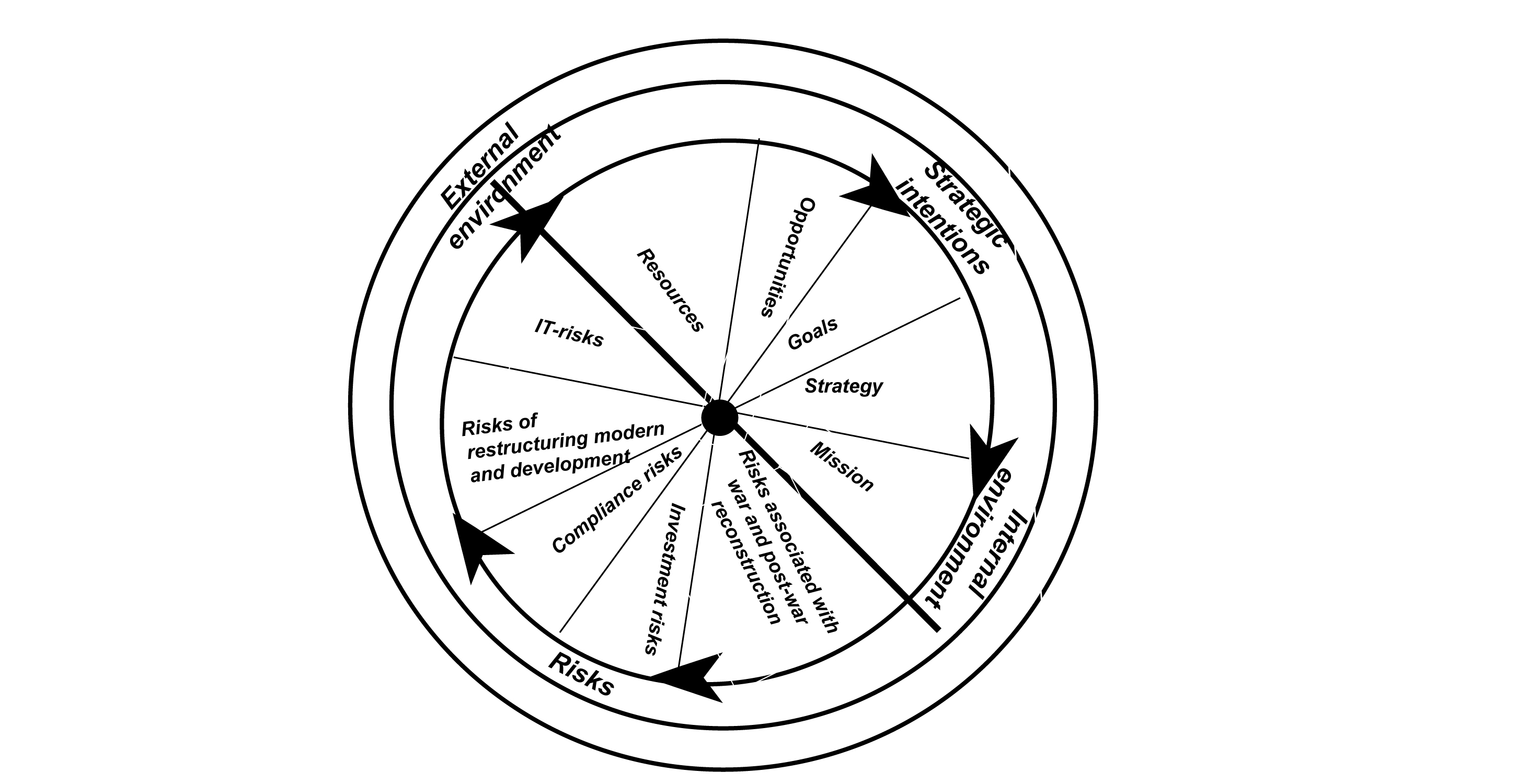

The object of research is the processes of interaction of components of the strategic portfolio of development of telecommunications enterprises, which are subject to the principles of economic security and highlight risk management measures, in terms of overcoming the negative consequences of any changes, conflicts, crises, management problems, and stresses from external influences on the development of telecommunications enterprises. One of the most problematic areas is to determine the actual risks of strategic development of telecommunications enterprises caused by threats and challenges due to the war in Ukraine, which resulted in the destruction of infrastructure, reconstruction works, demining, migration of personnel, reduced solvency of the population, investment risks. This requires an adequate response to preserve positions or minimize destruction. At the same time, an important task is the formation of strategic imperatives for the economic security of telecommunications enterprises. In addition, it is important not only to establish a list of such components, but also to substantiate the principles of ensuring the organisational and managerial stability and competitiveness of the telecommunications enterprise by forming a strategic portfolio for the development of risk management in conditions of instability and uncertainty during martial law and post-war conditions and the dynamism of the external environment.

In the course of the study, methods of detailed analysis of the current state of the problem, based on information search and methods of empirical research (observation, comparison) were used. As well as the method of synthesis and structural-genetic method (extraction from a complex phenomenon of such elements that significantly affect the rest of the research object, in the case of sustainable development tools). At the same time different sources of information, databases, secondary sources of information, company websites and analytical reports were used. As well as primary sources - interviews of company representatives.

The scientific and practical value of the study lies in the formation of the theoretical and methodological foundations of strategic risk management aimed at avoiding or reducing them and at the same time ensuring the desired level of economic security of the telecommunications enterprise. This will allow clearly building the management process in the risk management system in the long term and ensuring the desired level of economic security of the telecommunications enterprise.

This allows a reasonable approach to building a business, contributes to the improvement of strategic plans through the relationship with risk management, namely:

– possibility of in-depth goal setting to achieve the ultimate goal;

– development of the least risky strategic set and an effective system of performance indicators;

– improving the efficiency of risk management;

– adaptation to changes in the external and internal environment;

– increasing the flexibility of the business model.

References

- Minfin: Zvit «Shvydka otsinka zavdanoi shkody ta potreb na vidnovlennia Ukrainy» nadaie vysnovky shchodo vtrat Ukrainy vid viiny z rosiieiu z 24 liutoho do 1 chervnia ta okresliuie potreby krainy u rekonstruktsii ta vidnovlenni (2022). Available at: https://www.kmu.gov.ua/news/uriad-ukrainy-ievropeiska-komisiia-ta-svitovyi-bank-prezentuvaly-zvit-shvydka-otsinka-zavdanoi-shkody-ta-potreb-na-vidnovlennia

- Rappa, M. (2001). Business Models on the Web. Available at: https://fse.blogs.usj.edu.lb/wp-content/blogs.dir/31/files/2011/08/Rappa-Business-Models-on-the-Web.pdf

- Nielsen, C., Lund, M. (2018). Building scalable business models. MIT Sloan Management Review, 59, 65–69. Available at: https://dun-net.dk/media/125194/bm-scalability-wp.pdf

- Pysar, N., Fediunin, S., Vynogradova, О., Chornii, V. (2020). Assessment of the consequences of military conflicts and hybrid warfare for the socio-economic development of Ukraine. Economic Annals-ХХI, 181 (1-2), 18–27. doi: https://doi.org/10.21003/ea.v181-02

- Kyivstar vidnovyv mobilnyi i fiksovanyi zv’iazok u riadi naselenykh punktiv na pivdni i skhodi Ukrainy (2022). Available at: https://hub.kyivstar.ua/news/kyyivstar-vidnovyv-mobilnyj-i-fiksovanyj-zv-yazok-u-ryadi-naselenyh-punktiv-na-pivdni-i-shodi-ukrayiny/

- Ohliad tsyfrovoi transformatsii ekonomiky Ukrainy v umovakh viiny (2022). Available at: https://niss.gov.ua/news/komentari-ekspertiv/ohlyad-tsyfrovoyi-transformatsiyi-ekonomiky-ukrayiny-v-umovakh-viyny

- Pro vnesennia zmin do deiakykh zakoniv Ukrainy shchodo nevidkladnykh zakhodiv posylennia spromozhnostei iz kiberzakhystu derzhavnykh informatsiinykh resursiv ta obiektiv krytychnoi informatsiinoi infrastruktury (2022). Proekt Zakonu No. 8087. 29.09.2022. Available at: https://itd.rada.gov.ua/billInfo/Bills/Card/40553

- Shvydanenko, H. O., Boichenko, K. S. (2015). Rozvytok pidpryiemstva: stratehichni namiry, ryzyky ta efektyvnist. Kyiv: KNEU, 231. Available at: https://core.ac.uk/download/pdf/197268893.pdf

- Davis, J. (2003). Sherman Kent's final thoughts on analysis B policy maker relations. The Sherman Kent Center for Intelligence Analysis. Occasional Papers, 2 (3), 43–44.

- Slywotzky, A. (2008). Turning Strategic Risk into Growth Opportunities. Harvard Business Review, 78–88.

- Reports: 2022 Telecommunications Risk Factor Survey (2022). Available at: https://www.bdo.global/en-gb/insights/global-industries/technology-media-entertainment-and-telecommunications/2022-telecommunications-risk-factor-survey

- Shcho take komplaiens-ryzyky ta yak nymy keruvaty (2022). Visnyk MSFZ, 7. Available at: https://msfz.ligazakon.ua/ua/magazine_article/FZ001573

- Ross, S. A. (2004). Compensation, Incentives, and the Duality of Risk Aversion and Riskiness. The Journal of Finance, 59 (1), 207–225. doi: https://doi.org/10.1111/j.1540-6261.2004.00631.x

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Olena Vynogradova, Nadiia Pysar, Alina Zakharzhevska

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.