Expenses of future periods as a separate accounting category – difficulties of application

DOI:

https://doi.org/10.15587/2706-5448.2023.276016Keywords:

expenses of future periods, accounting, accounting policy, current expenses, long-term expensesAbstract

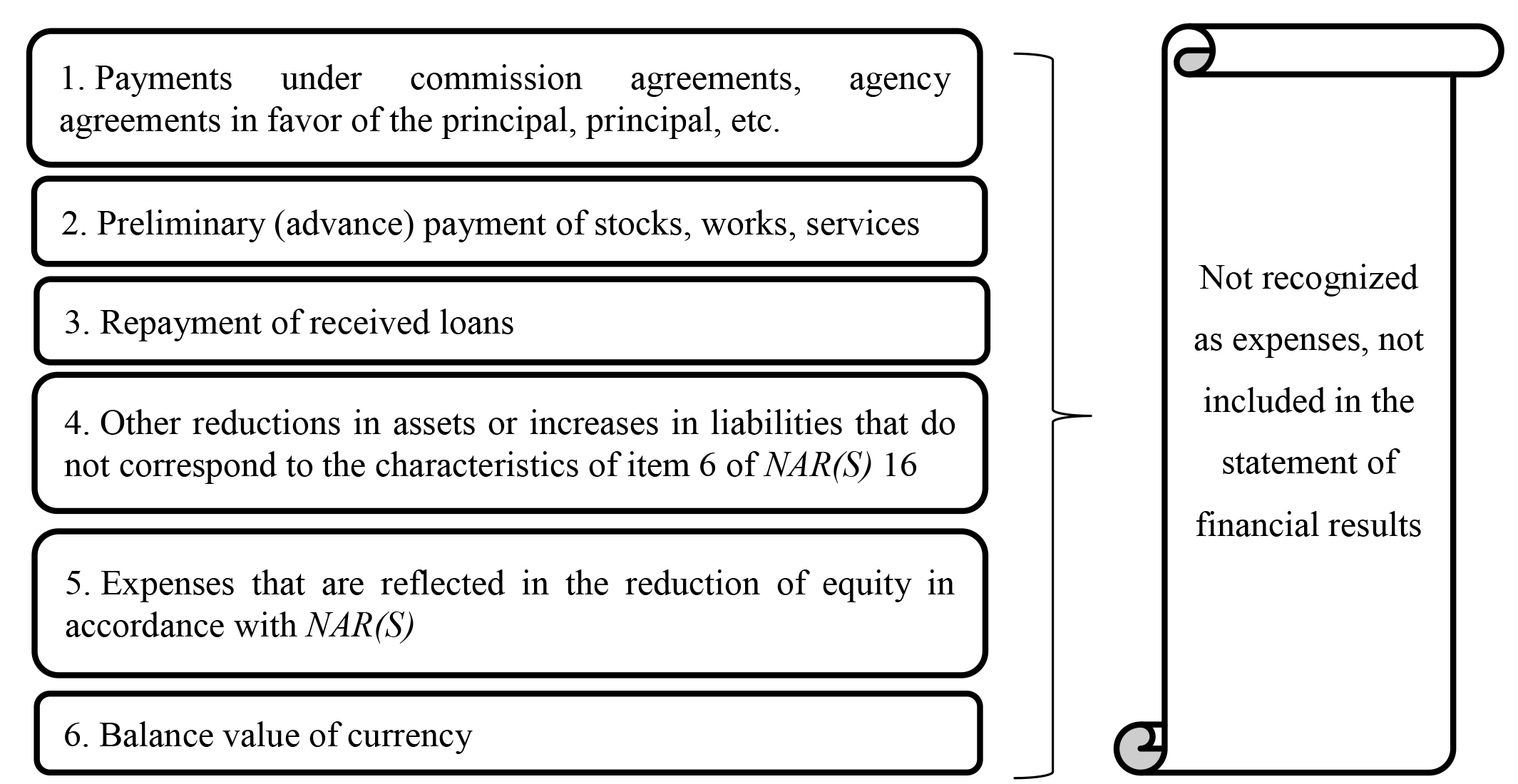

The object of research is the preparation of the procedure for the formation and write-off of the accounting category of expenses of future periods. The difficulty of this issue for practicing accountants is the lack of detailing of their composition, accounting and write-off in regulatory documents. In the national regulations (standards) of accounting (which are the main regulatory document on accounting), there is no definition of this category, as well as its components and the order of their attribution to the expenses of the current period. That is why the criteria for the recognition of expenses were defined, the period of their recognition was determined, and the reasons why some expenses cannot be classified as current expenses in accordance with NAR(S) (National accounting regulations (standards)) were analyzed. The difference between some components of expenses of future periods that are similar in name and expenses that are not included in current expenses according to NAR(S) was clarified. It is also clarified how those expenses of future periods should be reflected, which by all indications can be attributed to this category, however, according to the write-off period, they cannot be credited to account 39 «Expenses of future periods» and entered in the 2nd section of the Balance Sheet «Current assets». In addition, the presence of expenses of future periods as part of separate lines of financial statements according to IFRS (International Financial Reporting Standards) is disclosed. Various options for writing off the expenses of future periods and including them in the composition of the expenses of the current period were also considered. Depending on the time of receipt of income for which these expenses were incurred, it can be carried out in equal parts, proportionally or using other methods.

References

- IAS 38 Intangible Assets (2023). International Financial Reporting Standards (IFRS). Available at: https://www.ifrs.org/issued-standards/list-of-standards/ias-38-intangible-assets/

- Financial Accounting Standards Board (FASB). Available at: https://www.fasb.org/standards

- Smarra, M., Sorrentino, M. (2021). The quality of SOEs’ annual financial statements: A critical analysis of the OECD guidelines. Corporate Governance: Fundamental and Challenging Issues in Scholarly Research. doi: https://doi.org/10.22495/cgfcisrp11

- Vysochan, O. (2022). Accounting of deferred revenue in non-budget non-profit organizations. Economy and Society, 45. doi: https://doi.org/10.32782/2524-0072/2022-45-44

- Kovtunenko, Y. V., Boyarsky, A. D., Zapletniuk, D. K. (2017). Modern approach to the organization of income accounting and expenditures of future periods in the analysis of the financial and economic activity of the enterprise. Ekonomika i suspilstvo, 10, 754–760. Available at: https://economyandsociety.in.ua/journals/10_ukr/128.pdf

- Mel’nyk, E. G. (2011). Accounting and Control of Prepaid Expenses: Theory and Methods. Kyiv. Available at: http://194.44.12.92:8080/jspui/bitstream/123456789/710/1/Мельник.PDF

- Cherednichenko, M. H. (2018). Improvement of income and expenditure control of future periods at agricultural enterprises. Naukovyi visnyk Khersonskoho derzhavnoho universytetu. Seriia: Ekonomichni nauky, 28 (2), 166–169. Available at: https://ej.journal.kspu.edu/index.php/ej/article/view/84/81

- Pro zatverdzhennia Natsionalnoho polozhennia (standartu) bukhhalterskoho obliku 16 «Vytraty» (1999). Nakaz Ministerstva finansiv Ukrainy No. 318. 31.12.1999. Available at: https://zakon.rada.gov.ua/laws/show/z0027-00#Text

- Pro zatverdzhennia Instruktsii pro zastosuvannia Planu rakhunkiv bukhhalterskoho obliku aktyviv, kapitalu, zobov’iazan i hospodarskykh operatsii pidpryiemstv orhanizatsii (1999). Nakaz Ministerstva finansiv Ukrainy No. 291. 30.11.1999. Available at: https://zakon.rada.gov.ua/laws/show/z0893-99#Text

- Pro zatverdzhennia Natsionalnoho polozhennia (standartu) bukhhalterskoho obliku 1 «Vymohy do finansovoi zvitnosti» (1999). Nakaz Ministerstva finansiv Ukrainy No. 318. 31.12.1999. Available at: https://zakon.rada.gov.ua/laws/show/z0027-00#Text

- Pro zatverdzhennia perekladu Taksonomii finansovoi zvitnosti za mizhnarodnymy standartamy finansovoi zvitnosti (2021). Nakaz Ministerstva finansiv Ukrainy No. 595. 12.11.2021. Available at: https://zakon.rada.gov.ua/rada/show/v0595201-21#Text

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Inna Kosata

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.