Theoretical foundations and practice of the actions of governments and central banks in the conditions of war: historical excursion and Ukrainian experience

DOI:

https://doi.org/10.15587/2706-5448.2023.278349Keywords:

state expenditures, financing of budget expenditures, ensuring the country's defense capability, Ukrainian financing experienceAbstract

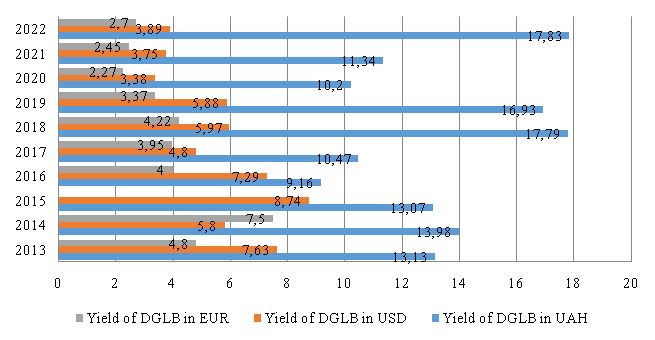

The object of research is the current global experience of regulating the financial sector and financing the costs of military actions of countries that were at war. This experience is compared in the work with those measures that were used by the government of Ukraine during the russian-Ukrainian war. In the conditions of war, the problem of financing war expenditures and balancing the budget for uninterrupted implementation of social payments is particularly acute. A sharp imbalance of the country's budget in the direction of financing military expenses and a drop in GDP, as a result of military operations on the territory of the country where military aggression is taking place, requires adequate actions of both regulatory and investment nature from the government and regulators. The timeliness and adequacy of such actions is a practical and scientific dilemma, the solution of which lies partly in the world's historical experience. The work proves that the actions of the Ukrainian government and the National Bank of Ukraine during the active phase of military aggression on the part of russia fully correspond to modern theoretical and methodological achievements in the organization of financing the defense expenditures of belligerent countries. Ukraine is using almost the entire arsenal of possible financing options: reducing non-military spending, increasing government borrowing, and issuing money. The study of the role of expenditures to fill the budget demonstrated the reduction of the role of taxes as a lever for financing the growing expenditures of states on defense. Coordinated actions of the Government of Ukraine and the National Bank of Ukraine prevented a sharp outflow of foreign capital from the country and preserved the purchasing power of the national currency. This is explained by the timely application of historical experience, tools of the classic Lucas-Stokey model with skillful manipulation of government debt rates in order to interest investors in long-term investment in government debt securities, and unprecedented financial assistance from foreign partners.

References

- Bohdan, T. (2022). Voienni finansy: shcho povynna robyty derzhava? LB.ua. Available at: https://lb.ua/blog/tetiana_bohdan/523270_voienni_finansi_shcho_povinna_robiti.html Last accessed: 16.12.2022

- Hall, G. J., Sargent, T. J. (2022). Three world wars: Fiscal–monetary consequences. Proceedings of the National Academy of Sciences, 119 (18). doi: https://doi.org/10.1073/pnas.2200349119

- Kotyk, Yu. V. (2016). Opodatkuvannia naselennia URSR u 1941–1945 rr. Ukrainskyi selianyn, 16, 86–89.

- Fedorov, M. (2022). Kak Sberbank rabotal v gody Velikoi Otechestvennoi voiny i vosstanavlival stranu posle nee. Drugoi gorod. Available at: https://drugoigorod.ru/sberbank-during-the-great-patriotic-war/ Last accessed: 05.01.2023

- Blokada Nimechchyny (1939-1945). Wikipedia. Available at: https://uk.wikipedia.org/wiki/%D0%91%D0%BB%D0%BE%D0%BA%D0%B0%D0%B4%D0%B0_%D0%9D%D1%96%D0%BC%D0%B5%D1%87%D1%87%D0%B8%D0%BD%D0%B8_(1939%E2%80%941945) Last accessed: 05.01.2023

- Reikhsbank. Wikipedia. Available at: https://uk.wikipedia.org/wiki/%D0%A0%D0%B0%D0%B9%D1%85%D1%81%D0%B1%D0%B0%D0%BD%D0%BA Last accessed: 05.01.2023

- Hroshova systema Nimechchyny: rozvytok ta suchasnyi stan (2011). MAUP. Available at: http://osvita.dream.net.ua/vnz/reports/bank/21028/ Last accessed: 05.01.2023

- Hall, G. J., Sapgent, T. J. (2020). Debt and Taxes in Eight U.S. Wars and Two Insurrections. NBER Working Paper Series. Working Paper 27115. Cambridge. doi: https://doi.org/10.3386/w27115

- Zvit pro finansovu stabilnist (2022). Natsionalnyi bank Ukrainy. Available at: https://bank.gov.ua/admin_uploads/article/FSR_2022-H1.pdf?v=4 Last accessed: 16.12.2022

- Statystyka Natsionalnoho banku. Available at: https://bank.gov.ua/ua/statistic/nbustatistic

- Makroekonomichni pokaznyky. Natsionalnyi bank Ukrainy. Available at: https://bank.gov.ua/ua/statistic/sector-financial#2fs Last accessed: 16.12.2022

- Arbuzov, S. H., Kolobov, Yu. V., Mishchenko, V. I., Naumenkova, S. V. (2011). Bankivska entsyklopediia. Kyiv: Tsentr naukovykh doslidzhen Natsionalnoho banku Ukrainy: Znannia, 264.

- Informatsiia shchodo umov vypusku oblihatsii vnutrishnikh derzhavnykh pozyk, yaki znakhodiatsia v obihu stanom na 1 hrudnia 2022 roku (2022). Ministerstvo finansiv Ukrainy. Available at: https://mof.gov.ua/uk/ovdp-shho-perebuvajut-v-obigu Last accessed: 22.12.2022

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Natalia Shvets, Viktoriia Rudevska

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.