Consideration of the peculiarities of analyzing financial transactions subject to financial monitoring in times of war

DOI:

https://doi.org/10.15587/2706-5448.2023.284222Keywords:

financial monitoring, financial transactions, bank activity, martial law, money laundering, terrorist financingAbstract

The object of the research is the financial transactions that are subject to financial monitoring. Today, financial monitoring is an integral part of the activities of Ukrainian banks, especially during the period of martial law, since it is through banks that the process of laundering proceeds from crime most often occurs.

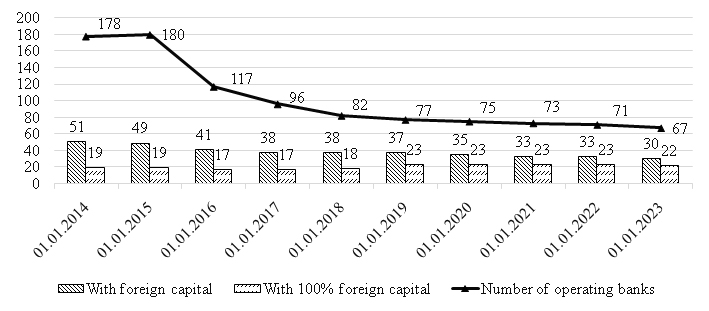

The article discusses the peculiarities of analyzing financial transactions subject to financial monitoring in wartime. In particular, the author outlines the trends in the banking system. Given the current challenges, in particular, martial law in Ukraine, the author analyzes the dynamics of submission by banks of reports on financial transactions subject to financial monitoring, including in terms of financial monitoring features, and investigates the factors that affect their number. A forecast of the volume of reports is made. The author analyzes the recommendations of the State Financial Monitoring Service of Ukraine (SFMS), which contribute to the improvement of customer service processes in banks in order to counteract money laundering and terrorist financing. The authors also provide the main tools used for money laundering, terrorist financing, etc. during the war. The author describes the impact of money laundering and terrorist financing on the financial security of the state.

The military aggression of the russian federation against Ukraine has had a significant impact on money laundering, terrorist financing, and the financing of the proliferation of weapons of mass destruction. Due to untimely/non-operational or inefficient/poor quality analysis and appropriate response of banks to financial transactions that are subject to financial monitoring, this direction in the activities of banks requires special attention. In the current situation, there are new challenges and threats that have signs of criminal acts and fraud:

– financing of war and terrorism/separatism; laundering the proceeds of corruption;

– embezzlement of budget funds and funds of state enterprises;

– laundering of proceeds from crimes related to fraudulent acquisition of funds of citizens and legal entities by deception, including under the guise of assistance to the Armed Forces of Ukraine.

The authors propose to improve the legislative and regulatory acts in the field of financial monitoring and to introduce penalties for bank employees for improper performance of their duties at the legislative level. The authors also focus on the proper automation of processes in banks.

References

- Yehoricheva, S. B. (Ed.) (2014). Orhanizatsiia finansovoho monitorynhu v bankakh. Kyiv: Tsentr uchbovoi literatury, 292. Available at: https://core.ac.uk/download/pdf/300237512.pdf Last accessed: 01.06.2023.

- Yurchuk, N. (2020). Functioning of the financial monitoring system in banking institutions. Norwegian Journal of development of the International Science, 42 (2), 54–62. Available at: https://nor-ijournal.com/wp-content/uploads/2020/09/NJD_43_2.pdf Last accessed: 01.06.2023.

- Telestakova, A. A., Mirzoian, R. A. (2019). Zmist ta znachennia finansovoho monitorynhu za diialnistiu ustanov bankivskoi systemy Ukrainy. Zhurnal skhidnoievropeiskoho prava, 69, 192–199.

- Vnukova, N. M. (2018). Upravlinnia ryzykamy finansovykh ustanov u sferi finansovoho monitorynhu. Naukovi zapysky Natsionalnoho universytetu «Ostrozka akademiia». Seriia «Ekonomika», 8 (36), 64–68.

- Pro zapobihannia ta protydiiu lehalizatsii (vidmyvanniu) dokhodiv, oderzhanykh zlochynnym shliakhom, finansuvanniu teroryzmu ta finansuvanniu rozpovsiudzhennia zbroi masovoho znyshchennia (2019). Zakon Ukrainy No. 361-IX vid 06.12.2019. Available at: https://zakon.rada.gov.ua/laws/show/361-20#Text Last accessed: 01.06.2023.

- Pro zatverdzhennia Polozhennia pro zdiisnennia bankamy finansovoho monitorynhu (2020). Postanova Pravlinnia Natsionalnoho banku Ukrainy No. 65 vid 19.05.2020. Available at: https://zakon.rada.gov.ua/laws/show/v0065500-20#Text Last accessed: 01.06.2023.

- Nahliadova statystyka. Statystychna informatsiia (2023). Natsionalnyi bank Ukrainy. Available at: https://bank.gov.ua/ua/statistic/supervision-statist Last accessed: 01.06.2023.

- Zvit pro finansovu stabilnist (2022). Natsionalnyi bank Ukrainy. Available at: https://bank.gov.ua/admin_uploads/article/FSR_2022-H2.pdf?v=4 Last accessed: 01.06.2023.

- Statystyka (2023). Derzhavna sluzhba finansovoho monitorynhu Ukrainy. Available at: https://fiu.gov.ua/pages/dijalnist/funkcional/statistika-ta-infografika/statistika Last accessed: 01.06.2023.

- Zvit Derzhavnoi sluzhby finansovoho monitorynhu Ukrainy za 2022 rik (2023). Derzhavna sluzhba finansovoho monitorynhu Ukrainy. Available at: https://fiu.gov.ua/assets/userfiles/0350/zvity/zvit2022ukr.pdf Last accessed: 01.06.2023.

- Riven tinovoi ekonomiky mynuloho roku zris do 32%. Minfin. Available at: https://minfin.com.ua/ua/2022/11/01/94863482/ Last accessed: 01.06.2023.

- Pryntsypy pobudovy systemy protydii vidmyvanniu dokhodiv, oderzhanykh zlochynnym shliakhom u bankakh (2018). Natsionalnyi bank Ukrainy. Available at: http://finmonitoring.in.ua/wp-content/uploads/2018/05/principi-pobudovi-sistemi-protidiyi-vidmivannyu-doxodiv-oderzhanix-zlochinnim-shlyaxom-u-bankax.pdf Last accessed: 01.06.2023.

- Pro robotu bankivskoi systemy v period zaprovadzhennia voiennoho stanu (2022). Postanova Pravlinnia Natsionalnoho banku Ukrainy No. 18 vid 24.02.2022. Available at: https://zakon.rada.gov.ua/laws/show/v0018500-22#Text Last accessed: 01.06.2023.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Olha Vovchak, Liubov Yendorenko

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.