Exploring ways to construction of a business bootstrapping model to equip emerging micro business in the first year of operation in South Africa

DOI:

https://doi.org/10.15587/2706-5448.2023.286001Keywords:

accessibility of capital, Business model, skills deficiency, competitiveness, financial management, business management, marketingAbstract

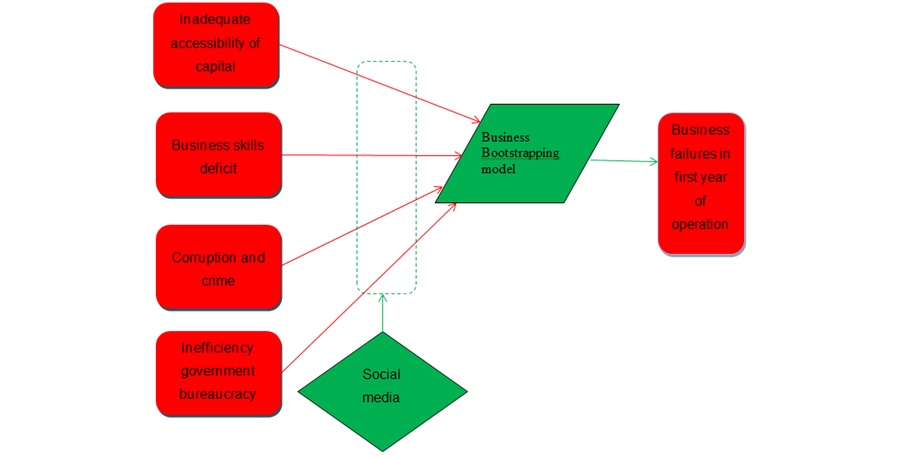

In South Africa, the small, medium, and micro businesses (SMMEs) sector contributes between 52 and 57 percent of the GDP. In the coming years, it is expected that the SMME sector would provide 90 percent of the GDP and employment in South Africa. Due to barriers that prevent potential growth, more than 50 % of businesses in South Africa fail during the first five years of operation. The study examined enterprises in their first year of operation in South Africa and identified the lack of business skills and an insufficient supply of financing as contributing factors. The investigation revealed existing concepts such as Financial bootstrapping and Balance Score Card, both of which are crucial for South African enterprises during their first year of operation. A mixed research approach was chosen for the study in order to answer the research questions. The phenomenological (qualitative) and positivist (quantitative) philosophical paradigms were adopted with a determination to achieve a thorough understanding of the strength and direction of the relationship between a business skills deficit and competitiveness of businesses in the first year in South Africa and, furthermore, the development of the Business Bootstrapping Model. The study's data collection tools included semi-structured interviews and questionnaires. In relation to the data that were gathered for the study, content analysis was utilized as an analytical technique to analyse qualitative data, while SPSS was used to analyse responses to questionnaires for a quantitative study. The availability of capital and the lack of adequate financial resources to manage account receivables were found to be major hindrances to a business' sustainability in its first year of operation. Research gaps were filled by combining empirical investigations and conclusions, and this information was then used to construct the business bootstrapping model. In its initial year of operation, the business Bootstrapping Model included three elements: finance, marketing, and corporate governance. Owners of small businesses can begin generating capital using the Business Bootstrapping Model's financial component, which is a key factor in eradicating financial and liquidity obstacles. The Business Bootstrapping Model also equips business owners with the ability to plan and manage daily operations, including developing short-term financial policies for the business. Furthermore, assists in measurement capabilities for the business’s current financial performance, financial position, and anticipated future business plan. As well as providing an overview of the company's revenues and costs from operating and non-operating activities over time. Business owners are provided with the marketing skills necessary for brand positioning, preventing pricing discrimination, and getting pertinent, hard-to-get customer information and insights on social media through the marketing components of the Business Bootstrapping Model.

Supporting Agency

- Presentation of research in the form of publication through financial support in the form of a grant «Scientific Developments Applicable to the Reconstruction of Ukraine» from the publisher TECHNOLOGY CENTER PC (Kharkiv, Ukraine).

References

- Tsatsenko, N. (2020). SME development, economic growth and structural change: evidence from Ghana and South Africa. Journal of Agriculture and Environment, 2 (14).

- Masuku, B., Nzewi, O. (2021). The South African informal sector’s socio-economic exclusion from basic service provisions: A critique of Buffalo City Metropolitan Municipality’s approach to the informal sector. Journal of Energy in Southern Africa, 32 (2), 59–71. doi: https://doi.org/10.17159/2413-3051/2021/v32i2a5856

- Mhlanga, D., Ndhlovu, E. (2021). Socio-economic and Political Challenges in Zimbabwe and the Development Implications for Southern Africa. Journal of African Foreign Affairs, 8 (2), 75–98. doi: https://doi.org/10.31920/2056-5658/2021/v8n2a5

- Bushe, B. (2019). The causes and impact of business failure among small to micro and medium enterprises in South Africa. Africa’s Public Service Delivery and Performance Review, 7 (1). doi: https://doi.org/10.4102/apsdpr.v7i1.210

- Rogerson, C. M., Rogerson, J. M. (2020). COVID-19 tourism impacts in South Africa: government and industry responses. GeoJournal of Tourism and Geosites, 31 (3), 1083–1091. doi: https://doi.org/10.30892/gtg.31321-544

- Li, J., Fleury, M. T. L. (2019). Overcoming the liability of outsidership for emerging market MNEs: A capability-building perspective. Journal of International Business Studies, 51 (1), 23–37. doi: https://doi.org/10.1057/s41267-019-00291-z

- Mukherjee, D., Makarius, E. E., Stevens, C. E. (2021). A reputation transfer perspective on the internationalization of emerging market firms. Journal of Business Research, 123, 568–579. doi: https://doi.org/10.1016/j.jbusres.2020.10.026

- Portia Msomi, M., Ngibe, M., Loraine Bingwa, L. (2020). The integration of Management Accounting Practices as an innovative strategy towards sustaining small businesses operating in eThekwini metropolitan, South Africa. Problems and Perspectives in Management, 18 (3), 268–281. doi: https://doi.org/10.21511/ppm.18(3).2020.23

- Msomi, T., Olarewaju, O. (2021). Evaluation of access to finance, market and viability of small and medium-sized enterprises in South Africa. Problems and Perspectives in Management, 19 (1), 281–289. doi: https://doi.org/10.21511/ppm.19(1).2021.24

- Khan, M. A. (2022). Barriers constraining the growth of and potential solutions for emerging entrepreneurial SMEs. Asia Pacific Journal of Innovation and Entrepreneurship, 16 (1), 38–50. doi: https://doi.org/10.1108/apjie-01-2022-0002

- Mapuranga, M., Tafadzwa Maziriri, E., Fritz Rukuni, T. (2021). A Hand to Mouth Existence: Hurdles Emanating from the COVID 19 Pandemic for Women Survivalist Entrepreneurs in Johannesburg, South Africa. African Journal of Gender, Society and Development (Formerly Journal of Gender, Information and Development in Africa), 10 (3), 113–140. doi: https://doi.org/10.31920/2634-3622/2021/v10n3a6

- Ogujiuba, K. K., Olamide, E., Agholor, A. I., Boshoff, E., Semosa, P. (2022). Impact of Government Support, Business Style, and Entrepreneurial Sustainability on Business Location of SMEs in South Africa’s Mpumalanga Province. Administrative Sciences, 12 (3), 117. doi: https://doi.org/10.3390/admsci12030117

- Zulu, B., Ngwenya, T., Zondi, B. (2023). An Evaluation of the Factors that Impact the Sustainability of Maritime SMMES in the Kwazulu-Natal Province. African Journal of Inter/Multidisciplinary Studies, 5 (1), 1–14. doi: https://doi.org/10.51415/ajims.v5i1.1040

- Liu, L., Zhang, J. Z., He, W., Li, W. (2021). Mitigating information asymmetry in inventory pledge financing through the Internet of things and blockchain. Journal of Enterprise Information Management, 34 (5), 1429–1451. doi: https://doi.org/10.1108/jeim-12-2020-0510

- Thathsarani, U. S., Jianguo, W. (2022). Do Digital Finance and the Technology Acceptance Model Strengthen Financial Inclusion and SME Performance? Information, 13 (8), 390. doi: https://doi.org/10.3390/info13080390

- Nkwinika, S. E. R., Mashau, P. (2020). Evaluating the financial challenges affecting the competitiveness of small businesses in South Africa. Gender and Behaviour, 18 (1), 15151–15162.

- Khatri, P., Kothari, H., Paliwal, L. R. (2023). Impact of Covid-19 on Digitalization Aspect on India’s MSMEs. From Industry 4.0 to Industry 5.0: Mapping the Transitions. Cham: Springer Nature Switzerland, 135–151. doi: https://doi.org/10.1007/978-3-031-28314-7_13

- Neumeyer, X., Santos, S. C., Morris, M. H. (2021). Overcoming Barriers to Technology Adoption When Fostering Entrepreneurship Among the Poor: The Role of Technology and Digital Literacy. IEEE Transactions on Engineering Management, 68 (6), 1605–1618. doi: https://doi.org/10.1109/tem.2020.2989740

- Horváth, D., Szabó, R. Zs. (2019). Driving forces and barriers of Industry 4.0: Do multinational and small and medium-sized companies have equal opportunities? Technological Forecasting and Social Change, 146, 119–132. doi: https://doi.org/10.1016/j.techfore.2019.05.021

- Fitriasari, F. (2020). How do Small and Medium Enterprise (SME) survive the COVID-19 outbreak? Jurnal Inovasi Ekonomi, 5 (2). doi: https://doi.org/10.22219/jiko.v5i3.11838

- Öndas, V., Akpinar, M. (2021). Understanding high-tech startup failures and their prevention. Conference: RENT Research in Entrepreneurship and Small Business. At: Turku, Finland. Available at: https://www.researchgate.net/publication/357163683_Understanding_High-Tech_Startup_Failures_and_their_Prevention

- Burchi, A., Włodarczyk, B., Szturo, M., Martelli, D. (2021). The Effects of Financial Literacy on Sustainable Entrepreneurship. Sustainability, 13 (9), 5070. doi: https://doi.org/10.3390/su13095070

- Redjeki, F., Affandi, A. (2021). Utilization of Digital Marketing for MSME Players as Value Creation for Customers during the COVID-19 Pandemic. International Journal of Science and Society, 3 (1), 40–55. doi: https://doi.org/10.54783/ijsoc.v3i1.264

- Fachrurazi, F., Zarkasi, Z., Maulida, S., Hanis, R., Yusuf, M. (2022). Ingcreasing micro small medium enteprises activity entrepreneurial capacity in the field of digital marketing. Jurnal Ekonomi, 11 (3), 1653–1660.

- Chirapanda, S. (2020). Identification of success factors for sustainability in family businesses: Case study method and exploratory research in Japan. Journal of Family Business Management, 10 (1), 58–75. doi: https://doi.org/10.1108/jfbm-05-2019-0030

- Adeola, O., Gyimah, P., Appiah, K. O., Lussier, R. N. (2021). Can critical success factors of small businesses in emerging markets advance UN Sustainable Development Goals? World Journal of Entrepreneurship, Management and Sustainable Development, 17 (1), 85–105. doi: https://doi.org/10.1108/wjemsd-09-2019-0072

- Mosweu, O., Ngoepe, M. (2019). Skills and competencies for authenticating digital records to support audit process in Botswana public sector. African Journal of Library, Archives & Information Science, 29 (1), 17–28.

- Assaad, R., El-adaway, I. H. (2020). Enhancing the Knowledge of Construction Business Failure: A Social Network Analysis Approach. Journal of Construction Engineering and Management, 146 (6). doi: https://doi.org/10.1061/(asce)co.1943-7862.0001831

- Jobo, D., Phyllis, C. (2020). Entrepreneurial risk management challenges within the maritime SMEs sub-sector of South Africa. Academy of Entrepreneurship Journal, 26, 1–18.

- Nkwinika, S. E. R. (2019). Toward the construction of a business bootstrapping model to equip emerging micro business in the first year of operation in South Africa.

- Maurud, S., Børøsund, E., Moen, A. (2022). Gender and ethnicity's influence on first-year nursing students' educational motivation and career expectations: A cross-sectional study. Nursing Open, 9 (3), 1667–1678. doi: https://doi.org/10.1002/nop2.1191

- Baha, R., Levy, A., Hasnaoui, A. (2023). Capital structure and default risk of small and medium enterprises: evidence from Algeria. The Journal of Risk Finance, 24 (4), 523–536. doi: https://doi.org/10.1108/jrf-04-2023-0105

- Al Issa, H.-E. (2020). The impact of improvisation and financial bootstrapping strategies on business performance. EuroMed Journal of Business, 16 (2), 171–194. doi: https://doi.org/10.1108/emjb-03-2020-0022

- Salau, A. N. (2022). Financial Bootstrapping and Organizational Performance: A Study of Some Selected SMEs in Oyo State. IRE Journals, 5 (8), 192–202.

- Jusufovska, S., Krasniqi, A. (2019). Strategy orientation and financial bootstrapping in small firms: A quantitative study about how strategy. Academy of Management Perspectives, 24 (3), 11–24. Available at: https://researchportal.hkr.se/ws/portalfiles/portal/35213747/FULLTEXT01.pdf

- Eklund, M. A. (2020). Future Prospects in Balanced Scorecard Research: Sustainability Perspective. Indonesian Journal of Sustainability Accounting and Management, 4 (2), 192–213. doi: https://doi.org/10.28992/ijsam.v4i2.263

- Kaplan, R. S., Norton, D. P. (1996). Strategic learning & the balanced scorecard. Strategy & Leadership, 24 (5), 18–24. doi: https://doi.org/10.1108/eb054566

- Elhamma, A. (2023). The relationship between organisational decentralisation, balanced scorecard and its perceived benefits in Moroccan SMEs. International Journal of Accounting, Auditing and Performance Evaluation, 19 (2), 185–202. doi: https://doi.org/10.1504/ijaape.2023.132384

- Feroze, B., Nafees, B., Ahmad, N., Zahid, M. (2022). Implementation of balanced scorecard and financial performance of SMEs. Multicultural Education, 8 (3), 309–320.

- Yazdanparast, A., Alhenawi, Y. (2022). Impact of COVID-19 pandemic on household financial decisions: A consumer vulnerability perspective. Journal of Consumer Behaviour, 21 (4), 806–827. doi: https://doi.org/10.1002/cb.2038

- Loewald, C., Faulkner, D., Makrelov, K. (2020). Time consistency and economic growth: A case study of South African macroeconomic policy (No. 842). Economic Research Southern Africa.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Eugine Nkwinika

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.