Development of an algorithm for assessing the fair value of non-current assets for higher education institutions

DOI:

https://doi.org/10.15587/2706-5448.2024.317652Keywords:

valuation of non-current assets, valuation algorithm, fair value, initial recognition, revaluation, higher education institutionsAbstract

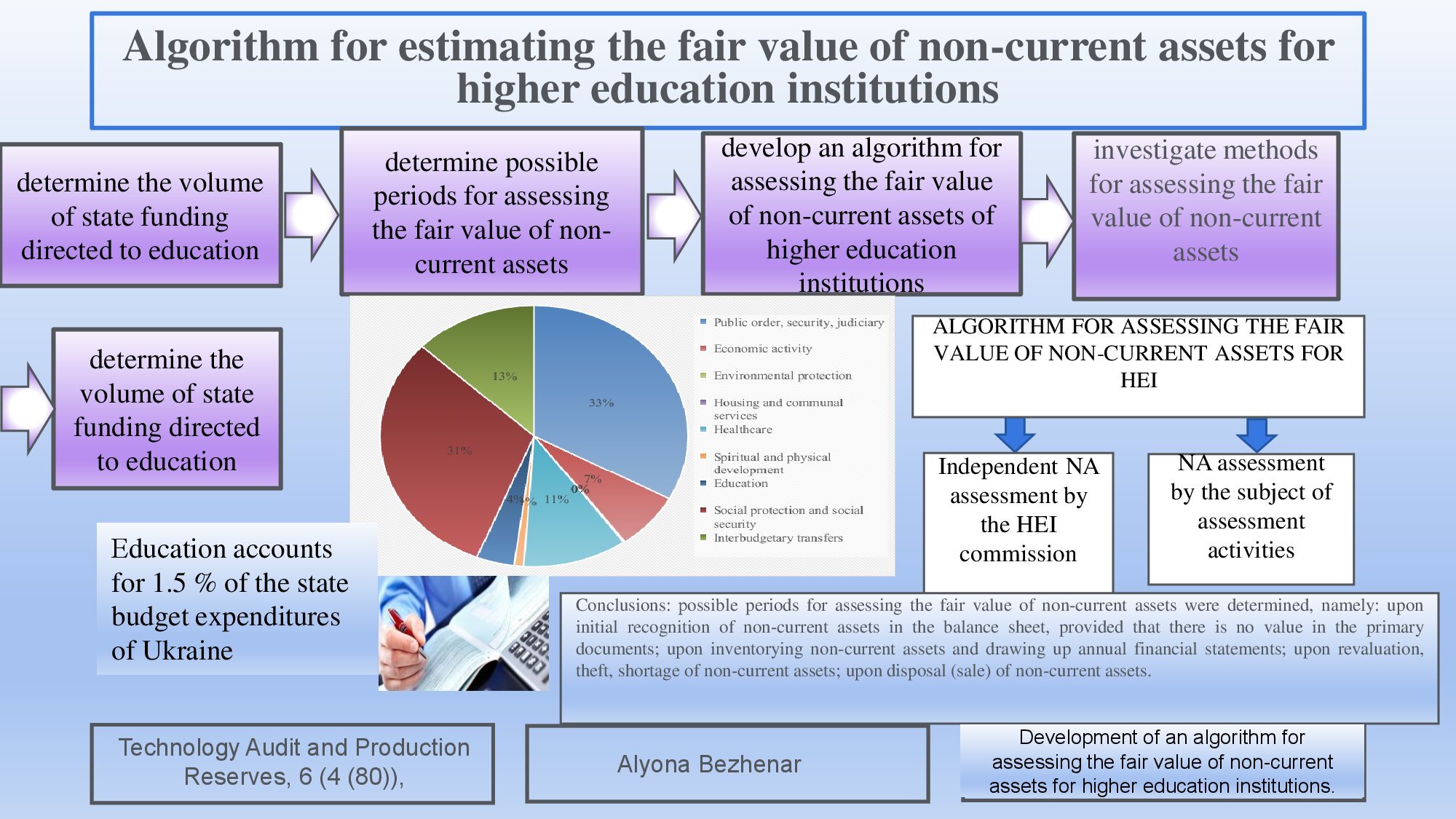

The object of research is the algorithm for assessing the fair value of non-current assets for higher education institutions.

The research problem, which is solved in the course of the work, is the lack of a clear algorithm for assessing the fair value of non-current assets of higher education institutions. There is also no methodological support for assessing the fair value of non-current assets taking into account the industry specifics of higher education institutions.

The work has developed an algorithm for assessing the fair value of non-current assets of higher education institutions, which includes two directions: assessing the fair value of non-current assets independently for higher education institutions; assessment with the help of an assessment entity. The algorithm for assessing the fair value of non-current assets independently by higher education institutions is identified as the main direction, which involves the implementation of the following actions:

– creation of an assessment commission;

– approval of the head’s order for the assessment;

– the presence of an active market;

– the possibility of identifying the object;

– the presence of methodological support for calculating fair value.

The methods of assessing the fair value of non-current assets were investigated, among which: market, cost and income. The market method of assessing the fair value of non-current assets, which is the easiest to apply, was determined as the recommended one for higher education institutions. Its advantages and disadvantages were summarized, among the advantages the market factor of supply and demand for similar objects was highlighted. The structure of the Methodological Provisions for assessing the fair value of non-current assets (NA) was developed according to the following points:

– general provisions;

– criteria for allocating groups of NA subject to assessment;

– criteria for identifying NA;

– the presence of active market conditions;

– methods of assessing fair value;

– requirements for drawing up an Act on the valuation of non-current assets.

References

- Pantelić, M. (2019). Implementation of fair value accounting in Serbia: Empirical research. Ekonomika Preduzeca, 67 (5-6), 345–355. https://doi.org/10.5937/ekopre1906345p

- Arsenijević, A. (2022). Application of the principle of conservatism against the application of the fair value concept: An example of the Serbian capital market. Ekonomika, 68 (1), 93–104. https://doi.org/10.5937/ekonomika2201093a

- Petković, M., Krstić, B., Rađenović, T. (2020). Accounting -based valuation methods of intangible assets: Theorethical overview. Ekonomika, 66 (1), 1–12. https://doi.org/10.5937/ekonomika2001001p

- Lovinska, L. H. (2006). Otsinka v bukhhalterskomu obliku. Kyiv: KNEU, 256.

- Koriahin, M. V. (2018). Otsinka v systemi bukhhalterskoho obliku. Efektyvna ekonomika, 10, 1–4.

- Doroshenko, O. O. (2016). Evaluation in accounting methodology of budgetary institutions: new approaches and innovations. Hlobalni ta natsionalni problemy ekonomiky, 9, 776–780. Available at: http://global-national.in.ua/archive/9-2016/159.pdf

- Cherkashyna, T. V. (2017). Non-financial assets: assessment and classification in the public sector. Prychornomorski ekonomichni studii, 23, 201–206. Available at: http://nbuv.gov.ua/UJRN/bses_2017_23_39

- Pro Derzhavnyi biudzhetu Ukrainy na 2023 rik (2022). Zakon Ukrainy No. 2710-IX. 03.11.2022. Available at: https://index.minfin.com.ua/ua/finance/budget/gov/expense/

- Pro zatverdzhennia Natsionalnoho polozhennia (standart) bukhhalterskoho obliku v derzhavnomu sektori 121 «Osnovni zasoby» (2010). Nakaz Ministerstva finansiv Ukrainy No. 1202. 12.10.2010. Available at: http://zakon2.rada.gov.ua/laws/show/z1017-10

- Pro zatverdzhennia Natsionalnoho polozhennia (standart) bukhhalterskoho obliku v derzhavnomu sektori 122 «Nematerialni aktyvy» (2010). Nakaz Ministerstva finansiv Ukrainy No. 1202. 12.10.2010. Available at: https://zakon.rada.gov.ua/laws/show/z1018-10#Text

- Mizhnarodnyi standart bukhhalterskoho obliku dlia derzhavnoho sektoru 17 «Osnovni zasoby». Available at: https://buhgalter911.com/public/uploads/normativka/Standart_gossektor/%D0%9C%D0%A1%D0%91%D0%9E%D0%94%D0%A1/%D0%9C%D0%A1%D0%91%D0%9E%D0%94%D0%A1_17.pdf

- Pro zatverdzhennia Metodychnykh rekomendatsii z bukhhalterskoho obliku dlia subiektiv derzhavnoho sektoru (2015). Nakaz Ministerstva finansiv Ukrainy No. 11. 23.01.2015. Available at: https://zakon.rada.gov.ua/rada/show/v0011201-15#Text

- Pro otsinku maina, mainovykh prav ta profesiinu otsinochnu diialnist v Ukraini (2001). Zakon Ukrainy No. 2658-III. 12.07.2001. Available at: https://zakon.rada.gov.ua/laws/show/2658-14#Text

- Polozhennia pro inventaryzatsiiu aktyviv ta zoboviazan (2014). Nakaz Ministerstva finansiv Ukrainy No. 879. 02.09.2014. Available at: https://zakon.rada.gov.ua/laws/show/z1365-14#Text

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Alyona Bezhenar

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.