Assessing the impact of fiscal freedom and the rule of law upon output growth in some Central and Eastern European countries

DOI:

https://doi.org/10.15587/2706-5448.2025.322824Keywords:

institutes and institutions, institutional support, output growth, Central and Eastern European countries, UkraineAbstract

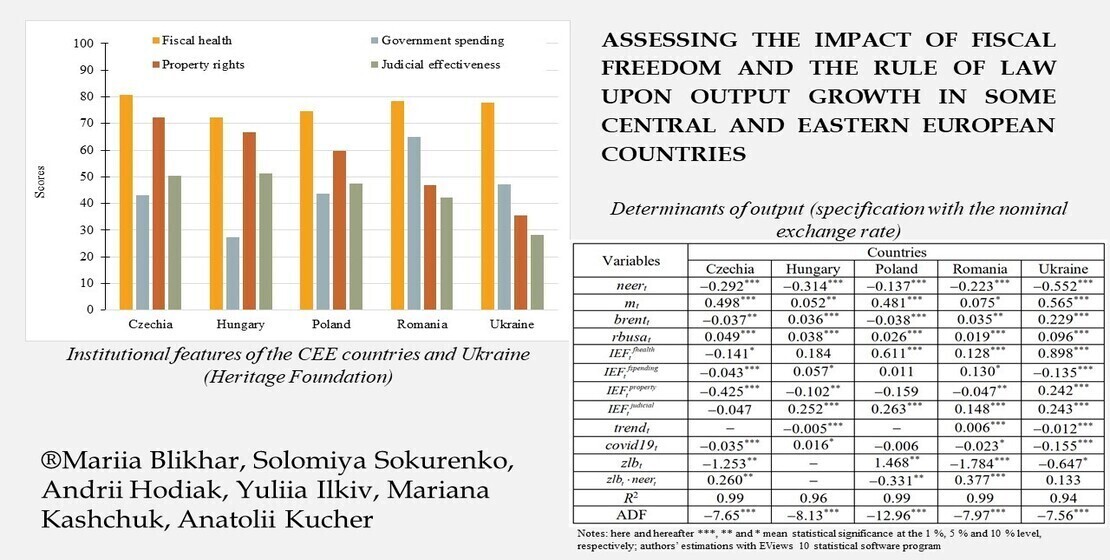

The object of the study was selected to be several countries of Central and Eastern Europe (Poland, Romania, the Czech Republic, Hungary) and Ukraine, where one of the problem areas is the dependence of economic growth on fiscal freedom and the rule of law.

To study this functional relationship, it is possible to use empirical estimates for quarterly data from 2010 to 2022 using the GMM method. The empirical estimates obtained for individual countries show significant differences in the impact of fiscal freedom and the rule of law on income. This allows to better understand the specifics of fiscal policy and institutional transformation in the selected countries. There are several main results. First, improving the financial situation is favorable for economic growth in Poland, Romania, and Ukraine, but unfavorable in the Czech Republic (there is no effect in Hungary). Second, it was found that lower government spending is beneficial for economic growth only in Romania and Hungary (to a lesser extent). At the same time, for the Czech Republic and Ukraine, an increase in government spending is preferable. Third, the protection of property rights encourages economic growth only in Ukraine. The inverse relationship for Central and Eastern European countries may mean that administrative guarantees in the area of property rights are much stricter than the achieved income level would suggest. Fourth, the efficiency of the judicial system is found to encourage economic growth in 4 out of 5 countries except the Czech Republic.

The paper confirms the findings of other studies for Central and Eastern European countries and Ukraine that currency devaluation in nominal and real terms hinders economic growth. Money emission and interest rate increases in the US are favorable for economic growth in all countries. The consequences for economic growth of the increase in global crude oil prices, the COVID-19 pandemic and the period of extremely low interest rates (ZLB) in 2010–2020 differ across countries.

References

- Hussain, M., Haque, M. (2016). Impact of Economic Freedom on the Growth Rate: A Panel Data Analysis. Economies, 4 (2), 5. https://doi.org/10.3390/economies4020005

- Cebula, R. J. (2011). Economic Growth, Ten Forms of Economic Freedom, and Political Stability: An Empirical Study Using Panel Data, 2003–2007. The Journal of Private Enterprise, 26 (2), 6181.

- Cebula, R. J., Mixon, F. G. (2012). The Impact of Fiscal and Other Economic Freedoms on Economic Growth: An Empirical Analysis. International Advances in Economic Research, 18 (2), 139–149. https://doi.org/10.1007/s11294-012-9348-1

- Lorizio, M., Gurrieri, A. R. (2014). Efficiency of Justice and Economic Systems. Procedia Economics and Finance, 17, 104–112. https://doi.org/10.1016/s2212-5671(14)00884-3

- Al–Katout, F., Bakir, A. (2019). The Impact of Economic Freedom on Economic Growth. International Journal of Business and Economics Research, 8 (6), 469–477. https://doi.org/10.11648/j.ijber.20190806.27

- Özyilmaz, A. (2022). The role of economic freedoms in economic growth. Journal of Management and Economics Design, 20 (3), 59–74.

- Rapsikevicius, J., Bruneckiene, J., Lukauskas, M., Mikalonis, S. (2021). The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries. Sustainability, 13 (4), 2380. https://doi.org/10.3390/su13042380

- Ahmed, S., Mushtaq, M., Fahlevi, M., Aljuaid, M., Saniuk, S. (2023). Decomposed and composed effects of economic freedom on economic growth in south Asia. Heliyon, 9 (2), e13478. https://doi.org/10.1016/j.heliyon.2023.e13478

- Gorlach, V. I., le Roux, P. (2015). The Impact of Economic Freedom on Economic Growth in the SADC: An Individual Component Analysis. Studies in Economics and Econometrics, 39 (2), 41–63. https://doi.org/10.1080/10800379.2015.12097280

- Bernardelli, M., Próchniak, M., Witkowski, B. (2021). Time stability of the impact of institutions on economic growth and real convergence of the EU countries: implications from the hidden Markov models analysis. Equilibrium. Quarterly Journal of Economics and Economic Policy, 16 (2), 285–323. https://doi.org/10.24136/eq.2021.011

- Bayar, Y. (2016). Impact of openness and economic freedom on economic growth in the transition economies of the European Union. South-Eastern Europe Journal of Economics, 1, 719.

- Emini, E. (2021). The impact of economic freedom on growth prospects of Southeast European countries. Economic Vision, 8 (15/16), 51–59.

- Reichel, R. (2022). Economic growth, economic freedom and the elasticity of substitution. Studies in Economics and International Finance, 2 (2), 195203.

- Thuy, D. T. B.; Nguyen, A. T., Hens, L. (Eds.) (2022). Impacts of Economic Freedom on Economic Growth in Developing Countries. Global Changes and Sustainable Development in Asian Emerging Market Economies. Vol. 1. Cham: Springer Nature Switzerland AG, 35–44. https://doi.org/10.1007/978-3-030-81435-9_3

- Carlsson, P., Lundström, S. (2002). Economic freedom and growth: Decomposing the effects. Public Choice, 112 (3-4), 335–344. https://doi.org/10.1023/a:1019968525415

- Miller, T., Kim, A. B., Roberts, J. M., Tyrrell, P. (2022). 2022 Index of Economic Freedom. Washington: The Heritage Foundation.

- Berggren, N. (2003). The Benefits of Economic Freedom: A Survey. The Independent Review, VIII (2), 193–211.

- Chemin, M. (2007). The Impact of the Judiciary on Economic Activity: Evidence from India. CIRPEE Cahier de recherche/Working Paper, 07-24. CIRPEE. Montreal: University of Quebec at Montreal.

- Ramos-Maqueda, M., Chen, D. (2021). The Role of Justice in Development: The Data Revolution. Policy Research Working Paper Series, 9720. Washington: The World Bank. https://doi.org/10.1596/1813-9450-9720

- Boudreaux, C. J. (2017). Institutional quality and innovation: some cross-country evidence. Journal of Entrepreneurship and Public Policy, 6 (1), 26–40. https://doi.org/10.1108/jepp-04-2016-0015

- Barro, R. J. (1989). The Ricardian Approach to Budget Deficits. Journal of Economic Perspectives, 3 (2), 37–54. https://doi.org/10.1257/jep.3.2.37

- Naape, B. (2021). The Interplay Between Economic Freedom and Tax Revenue Performance: Panel Evidence from SADC. Journal of Economics, Business, & Accountancy Ventura, 24 (2), 195–204. https://doi.org/10.14414/jebav.v24i2.2757

- Dawson, J. W. (2003). Causality in the freedom-growth relationship. European Journal of Political Economy, 19 (3), 479–495. https://doi.org/10.1016/s0176-2680(03)00009-0

- Deseau, A., Levai, A., Schmiegelow, M. (2019). Access to Justice and Economic Development: Evidence from an International Panel Dataset. LIDAM Discussion Papers, 2019009. Louvain: Université Catholique de Louvain.

- Nguyen, T. A. N., Luong, T. T. H. (2021). Fiscal Policy, Institutional Quality, and Public Debt: Evidence from Transition Countries. Sustainability, 13 (19), 10706. https://doi.org/10.3390/su131910706

- Feld, L. P., Voigt, S. (2003). Economic Growth and Judicial Independence: Cross Country Evidence Using a New Set of Indicators. CESifo Working Paper, 906. Munich: Münchner Gesellschaft zur Förderung der Wirtschaftswissenschaft. https://doi.org/10.2139/ssrn.395403

- Laeven, L., Majnoni, G. (2005). Does judicial efficiency lower the cost of credit? Journal of Banking & Finance, 29 (7), 1791–1812. https://doi.org/10.1016/j.jbankfin.2004.06.036

- Şaşmaz, M. Ü., Sağdiç, E. N. (2020). The effect of government effectiveness and rule of law on economic growth: The case of European Union transition economies. İşletme Fakültesi Dergisi, 21 (1), 203217. https://doi.org/10.24889/ifede.729490

- Derbel, H., Abdelkafi, R., Chkir, A. (2011). The Effects of Economic Freedom Components on Economic Growth: An Analysis with A Threshold Model. Journal of Politics and Law, 4 (2), 49–60. https://doi.org/10.5539/jpl.v4n2p49

- Rode, M., Coll, S. (2011). Economic freedom and growth. Which policies matter the most? Constitutional Political Economy, 23 (2), 95–133. https://doi.org/10.1007/s10602-011-9116-x

- Alexandrakis, C., Livanis, G. (2013). Economic Freedom and Economic Performance in Latin America: A Panel Data Analysis. Review of Development Economics, 17 (1), 34–48. https://doi.org/10.1111/rode.12013

- Akin, C. S., Aytun, C., Aktakas, B. G. (2014). The impact of economic freedom upon economic growth: An application on different income groups. Asian Economic and Financial Review, 4 (8), 10241039. Available at: https://archive.aessweb.com/index.php/5002/article/view/1233

- Kovačević, S., Borović, Z. (2014). Economic Freedom and Economic Performance in Former Socialist Countries – Panel Approach. Proceedings of the Faculty of Economics in East Sarajevo, 9, 1926. https://doi.org/10.7251/zrefis1409019k

- Ivanović, V., Stanišić, N. (2017). Monetary freedom and economic growth in New European Union Member States. Economic Research-Ekonomska Istraživanja, 30 (1), 453–463. https://doi.org/10.1080/1331677x.2017.1305803

- Kapás, J., Czeglédi, P. (2017). Institutions and policies of economic freedom: different effects on income and growth. Economia Politica, 34 (2), 259–282. https://doi.org/10.1007/s40888-017-0063-5

- Xhepa, S. (2017). Economic freedom and growth: exploring statistical significance of the relationship in the Balkan economies. Economicus, 16, 519.

- Recuero, L. H., González, R. P. (2019). Economic growth, institutional quality and financial development in middle-income countries. Documentos de Trabajo, 1937. Madrid: Banco de España. https://doi.org/10.2139/ssrn.3489866

- Kapopoulos, P., Rizos, A. (2021). Judicial Efficiency and Economic Growth: Evidence based on EU data. MPRA Paper, 107861. Munich: University Library of Munich.

- D’Agostino, E., De Benedetto, M. A., Sobbrio, G. (2022). Does the economic freedom hinder the underground economy? Evidence from a cross-country analysis. Economia Politica, 40 (1), 319–341. https://doi.org/10.1007/s40888-022-00288-2

- Bajrami, R., Gashi, A., Ukshini, K., Rexha, D. (2022). Impact of the government size on economic growth in the Western Balkan countries. Journal of Governance and Regulation, 11 (1), 55–63. https://doi.org/10.22495/jgrv11i1art6

- D’Apice, V., Fiordelisi, F., Puopoloet, G. W. (2020). Judicial Efficiency and Lending Quality. CSEF Working Papers, 588. Naples: University of Naples.

- Esposito, G., Lanau, S., Pompeet, S. (2014). Judicial System Reform in Italy – A Key to Growth. IMF Working Paper, WP/14/32. Washington: International Monetary Fund. https://doi.org/10.5089/9781475573022.001

- Blikhar, M., Golynska, M., Shandra, B., Matviienko, O., Svyshcho, V. (2021). Rule of Low as Factor of Investments in Ukraine. International Journal of Economics and Business Administration, IX (1), 199–210. https://doi.org/10.35808/ijeba/667

- Ramoni-Perazzi, J., Romero, H. (2022). Exchange rate volatility, corruption, and economic growth. Heliyon, 8 (12), e12328. https://doi.org/10.1016/j.heliyon.2022.e12328

- Vega-Gordillo, M., Alvarez-Arce, J. A. (2003). Economic growth and freedom: A causality study. Cato Journal, 23 (2), 199–215.

- Farr, W. K., Lord, R. A., Wolfenbarger, L. J. (1998). Economic Freedom, Political Freedom and Economic Well-Being: A Causality Analysis. Cato Journal, 18 (2), 247262.

- Gouider, A., Nouira, R., Saafi, S. (2022). Re-Exploring the Nexus Between Economic Freedom and Growth: Is There a Threshold Effect? Journal of Economic Development, 47 (3), 147167.

- Bergh, A., Bjørnskov, C. (2021). Does economic freedom boost growth for everyone? Kyklos, 74 (2), 170–186. https://doi.org/10.1111/kykl.12262

- IMF. International Financial Statistics database. Available at: https://data.imf.org

- IMF. Primary Commodity Prices database. Available at: https://www.imf.org/en/Research/commodity-prices

- Afonso, A., Jalles, J. T. (2012). Revisiting Fiscal Sustainability: Panel Cointegration and Structural Breaks in OECD Countries. ECB Working Paper Series, 1465. Frankfurt: European Central Bank. https://doi.org/10.2139/ssrn.2128484

- Hsing, Y. (2016). Is Real Depreciation Expansionary? The Case of the Slovak Republic. Applied Econometrics and International Development, 16 (2), 55–62.

- Hsing, Y. (2016). Is real depreciation expansionary? The case of the Czech Republic. Theoretical and Applied Economics, XXIII (3), 93–100.

- Bahmani-Oskooee, M., Kutan, A. M. (2008). Are devaluations contractionary in emerging economies of Eastern Europe? Economic Change and Restructuring, 41 (1), 61–74. https://doi.org/10.1007/s10644-008-9041-9

- Hatmanu, M., Cautisanu, C., Ifrim, M. (2020). The Impact of Interest Rate, Exchange Rate and European Business Climate on Economic Growth in Romania: An ARDL Approach with Structural Breaks. Sustainability, 12 (7), 2798. https://doi.org/10.3390/su12072798

- Haug, A., Jędrzejowicz, T., Sznajderska, A. (2013). Combining monetary and fiscal policy in an SVAR for a small open economy. NBP Working Papers, 168. Warsaw: National Bank of Poland. https://doi.org/10.2139/ssrn.2369254

- Hsing, Y. (2019). Does the Mundell-Fleming Model Apply to Poland? Theoretical and Applied Economics, XXVI (4 (621)), 265272.

- Simionescu, M., Balcerzak, A., Bilan, Y., Kotásková, A. (2018). The impact of money on output in Czech Republic and Romania. Journal of Business Economics and Management, 19 (1), 20–41. https://doi.org/10.3846/jbem.2018.1480

- Škare, M., Benazić, M., Tomić, D. (2016). On the neutrality of money in CEE (EU member) states: A panel cointegration analysis. Acta Oeconomica, 66 (3), 393–418. https://doi.org/10.1556/032.2016.66.3.2

- Shevchuk, V. (2022). Price and output effects of long-term exchange rate changes: Central and Eastern European countries in 2002–2019. Entrepreneurial Business and Economics Review, 10 (3), 37–50. https://doi.org/10.15678/eber.2022.100303

- di Giovanni, J., Shambaugh, J. C. (2008). The impact of foreign interest rates on the economy: The role of the exchange rate regime. Journal of International Economics, 74 (2), 341–361. https://doi.org/10.1016/j.jinteco.2007.09.002

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Mariia Blikhar, Solomiya Sokurenko, Andrii Hodiak, Yuliia Ilkiv, Mariana Kashchuk, Anatolii Kucher

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.