Оцінка впливу фіскальної свободи та верховенства права на економічне зростання в деяких країнах Центральної та Східної Європи

DOI:

https://doi.org/10.15587/2706-5448.2025.322824Ключові слова:

інститути та інституції, інституційне забезпечення, економічне зростання, країни Центральної та Східної Європи, УкраїнаАнотація

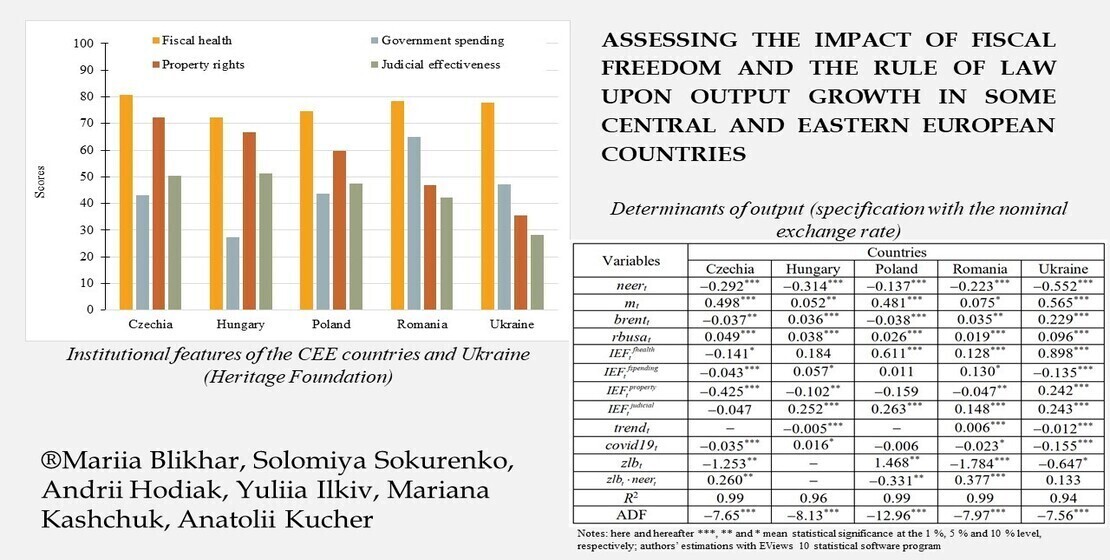

Об’єктом дослідження обрано кілька країн Центральної та Східної Європи (Польща, Румунія, Чехія, Угорщина) та Україну, де одним із проблемних місць є залежність економічного зростання від фіскальної свободи та верховенства права.

Для дослідження такого функціонального зв’язку використовували емпіричні оцінки для квартальних даних 2010–2022 рр. за допомогою методу GMM. Отримані емпіричні оцінки для окремих країн показують значні відмінності щодо впливу фіскальної свободи та верховенства права на дохід. Завдяки цьому можна краще зрозуміти особливості проведення фіскальної політики та інституційних перетворень у обраних країнах. Основних результатів кілька. По-перше, поліпшення фінансового становища є сприятливим для економічного зростання у Польщі, Румунії та Україні, але несприятливим – у Чехії (в Угорщині впливу немає). По-друге, отримано, що менші урядові видатки корисні для економічного зростання лише в Румунії та Угорщині (меншою мірою). Водночас для Чехії та України кращим є збільшення урядових видатків. По-третє, захист майнових прав заохочує економічне зростання лише в Україні. Обернена залежність для країн Центральної та Східної Європи може означати, що адміністративні гарантії у царині майнових прав набагато жорсткіші, ніж це передбачає досягнутий рівень доходу. По-четверте, виявлено, що ефективність судової системи заохочує економічне зростання в 4-х з 5-ти країн, крім Чехії.

Підтверджено висновки з інших досліджень для країн Центральної та Східної Європи та України, що девальвація грошової одиниці у номінальному та реальному вимірах перешкоджає економічному зростанню. Грошова емісія та підвищення процентної ставки у США сприятливі для економічного зростання в усіх країнах. Наслідки для економічного зростання від підвищення світових цін на сиру нафту, пандемії COVID-19 та періоду екстремально нижчих процентних ставок (ZLB) у 2010-2020 рр. відрізняються у розрізі окремих країн.

Посилання

- Hussain, M., Haque, M. (2016). Impact of Economic Freedom on the Growth Rate: A Panel Data Analysis. Economies, 4 (2), 5. https://doi.org/10.3390/economies4020005

- Cebula, R. J. (2011). Economic Growth, Ten Forms of Economic Freedom, and Political Stability: An Empirical Study Using Panel Data, 2003–2007. The Journal of Private Enterprise, 26 (2), 6181.

- Cebula, R. J., Mixon, F. G. (2012). The Impact of Fiscal and Other Economic Freedoms on Economic Growth: An Empirical Analysis. International Advances in Economic Research, 18 (2), 139–149. https://doi.org/10.1007/s11294-012-9348-1

- Lorizio, M., Gurrieri, A. R. (2014). Efficiency of Justice and Economic Systems. Procedia Economics and Finance, 17, 104–112. https://doi.org/10.1016/s2212-5671(14)00884-3

- Al–Katout, F., Bakir, A. (2019). The Impact of Economic Freedom on Economic Growth. International Journal of Business and Economics Research, 8 (6), 469–477. https://doi.org/10.11648/j.ijber.20190806.27

- Özyilmaz, A. (2022). The role of economic freedoms in economic growth. Journal of Management and Economics Design, 20 (3), 59–74.

- Rapsikevicius, J., Bruneckiene, J., Lukauskas, M., Mikalonis, S. (2021). The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries. Sustainability, 13 (4), 2380. https://doi.org/10.3390/su13042380

- Ahmed, S., Mushtaq, M., Fahlevi, M., Aljuaid, M., Saniuk, S. (2023). Decomposed and composed effects of economic freedom on economic growth in south Asia. Heliyon, 9 (2), e13478. https://doi.org/10.1016/j.heliyon.2023.e13478

- Gorlach, V. I., le Roux, P. (2015). The Impact of Economic Freedom on Economic Growth in the SADC: An Individual Component Analysis. Studies in Economics and Econometrics, 39 (2), 41–63. https://doi.org/10.1080/10800379.2015.12097280

- Bernardelli, M., Próchniak, M., Witkowski, B. (2021). Time stability of the impact of institutions on economic growth and real convergence of the EU countries: implications from the hidden Markov models analysis. Equilibrium. Quarterly Journal of Economics and Economic Policy, 16 (2), 285–323. https://doi.org/10.24136/eq.2021.011

- Bayar, Y. (2016). Impact of openness and economic freedom on economic growth in the transition economies of the European Union. South-Eastern Europe Journal of Economics, 1, 719.

- Emini, E. (2021). The impact of economic freedom on growth prospects of Southeast European countries. Economic Vision, 8 (15/16), 51–59.

- Reichel, R. (2022). Economic growth, economic freedom and the elasticity of substitution. Studies in Economics and International Finance, 2 (2), 195203.

- Thuy, D. T. B.; Nguyen, A. T., Hens, L. (Eds.) (2022). Impacts of Economic Freedom on Economic Growth in Developing Countries. Global Changes and Sustainable Development in Asian Emerging Market Economies. Vol. 1. Cham: Springer Nature Switzerland AG, 35–44. https://doi.org/10.1007/978-3-030-81435-9_3

- Carlsson, P., Lundström, S. (2002). Economic freedom and growth: Decomposing the effects. Public Choice, 112 (3-4), 335–344. https://doi.org/10.1023/a:1019968525415

- Miller, T., Kim, A. B., Roberts, J. M., Tyrrell, P. (2022). 2022 Index of Economic Freedom. Washington: The Heritage Foundation.

- Berggren, N. (2003). The Benefits of Economic Freedom: A Survey. The Independent Review, VIII (2), 193–211.

- Chemin, M. (2007). The Impact of the Judiciary on Economic Activity: Evidence from India. CIRPEE Cahier de recherche/Working Paper, 07-24. CIRPEE. Montreal: University of Quebec at Montreal.

- Ramos-Maqueda, M., Chen, D. (2021). The Role of Justice in Development: The Data Revolution. Policy Research Working Paper Series, 9720. Washington: The World Bank. https://doi.org/10.1596/1813-9450-9720

- Boudreaux, C. J. (2017). Institutional quality and innovation: some cross-country evidence. Journal of Entrepreneurship and Public Policy, 6 (1), 26–40. https://doi.org/10.1108/jepp-04-2016-0015

- Barro, R. J. (1989). The Ricardian Approach to Budget Deficits. Journal of Economic Perspectives, 3 (2), 37–54. https://doi.org/10.1257/jep.3.2.37

- Naape, B. (2021). The Interplay Between Economic Freedom and Tax Revenue Performance: Panel Evidence from SADC. Journal of Economics, Business, & Accountancy Ventura, 24 (2), 195–204. https://doi.org/10.14414/jebav.v24i2.2757

- Dawson, J. W. (2003). Causality in the freedom-growth relationship. European Journal of Political Economy, 19 (3), 479–495. https://doi.org/10.1016/s0176-2680(03)00009-0

- Deseau, A., Levai, A., Schmiegelow, M. (2019). Access to Justice and Economic Development: Evidence from an International Panel Dataset. LIDAM Discussion Papers, 2019009. Louvain: Université Catholique de Louvain.

- Nguyen, T. A. N., Luong, T. T. H. (2021). Fiscal Policy, Institutional Quality, and Public Debt: Evidence from Transition Countries. Sustainability, 13 (19), 10706. https://doi.org/10.3390/su131910706

- Feld, L. P., Voigt, S. (2003). Economic Growth and Judicial Independence: Cross Country Evidence Using a New Set of Indicators. CESifo Working Paper, 906. Munich: Münchner Gesellschaft zur Förderung der Wirtschaftswissenschaft. https://doi.org/10.2139/ssrn.395403

- Laeven, L., Majnoni, G. (2005). Does judicial efficiency lower the cost of credit? Journal of Banking & Finance, 29 (7), 1791–1812. https://doi.org/10.1016/j.jbankfin.2004.06.036

- Şaşmaz, M. Ü., Sağdiç, E. N. (2020). The effect of government effectiveness and rule of law on economic growth: The case of European Union transition economies. İşletme Fakültesi Dergisi, 21 (1), 203217. https://doi.org/10.24889/ifede.729490

- Derbel, H., Abdelkafi, R., Chkir, A. (2011). The Effects of Economic Freedom Components on Economic Growth: An Analysis with A Threshold Model. Journal of Politics and Law, 4 (2), 49–60. https://doi.org/10.5539/jpl.v4n2p49

- Rode, M., Coll, S. (2011). Economic freedom and growth. Which policies matter the most? Constitutional Political Economy, 23 (2), 95–133. https://doi.org/10.1007/s10602-011-9116-x

- Alexandrakis, C., Livanis, G. (2013). Economic Freedom and Economic Performance in Latin America: A Panel Data Analysis. Review of Development Economics, 17 (1), 34–48. https://doi.org/10.1111/rode.12013

- Akin, C. S., Aytun, C., Aktakas, B. G. (2014). The impact of economic freedom upon economic growth: An application on different income groups. Asian Economic and Financial Review, 4 (8), 10241039. Available at: https://archive.aessweb.com/index.php/5002/article/view/1233

- Kovačević, S., Borović, Z. (2014). Economic Freedom and Economic Performance in Former Socialist Countries – Panel Approach. Proceedings of the Faculty of Economics in East Sarajevo, 9, 1926. https://doi.org/10.7251/zrefis1409019k

- Ivanović, V., Stanišić, N. (2017). Monetary freedom and economic growth in New European Union Member States. Economic Research-Ekonomska Istraživanja, 30 (1), 453–463. https://doi.org/10.1080/1331677x.2017.1305803

- Kapás, J., Czeglédi, P. (2017). Institutions and policies of economic freedom: different effects on income and growth. Economia Politica, 34 (2), 259–282. https://doi.org/10.1007/s40888-017-0063-5

- Xhepa, S. (2017). Economic freedom and growth: exploring statistical significance of the relationship in the Balkan economies. Economicus, 16, 519.

- Recuero, L. H., González, R. P. (2019). Economic growth, institutional quality and financial development in middle-income countries. Documentos de Trabajo, 1937. Madrid: Banco de España. https://doi.org/10.2139/ssrn.3489866

- Kapopoulos, P., Rizos, A. (2021). Judicial Efficiency and Economic Growth: Evidence based on EU data. MPRA Paper, 107861. Munich: University Library of Munich.

- D’Agostino, E., De Benedetto, M. A., Sobbrio, G. (2022). Does the economic freedom hinder the underground economy? Evidence from a cross-country analysis. Economia Politica, 40 (1), 319–341. https://doi.org/10.1007/s40888-022-00288-2

- Bajrami, R., Gashi, A., Ukshini, K., Rexha, D. (2022). Impact of the government size on economic growth in the Western Balkan countries. Journal of Governance and Regulation, 11 (1), 55–63. https://doi.org/10.22495/jgrv11i1art6

- D’Apice, V., Fiordelisi, F., Puopoloet, G. W. (2020). Judicial Efficiency and Lending Quality. CSEF Working Papers, 588. Naples: University of Naples.

- Esposito, G., Lanau, S., Pompeet, S. (2014). Judicial System Reform in Italy – A Key to Growth. IMF Working Paper, WP/14/32. Washington: International Monetary Fund. https://doi.org/10.5089/9781475573022.001

- Blikhar, M., Golynska, M., Shandra, B., Matviienko, O., Svyshcho, V. (2021). Rule of Low as Factor of Investments in Ukraine. International Journal of Economics and Business Administration, IX (1), 199–210. https://doi.org/10.35808/ijeba/667

- Ramoni-Perazzi, J., Romero, H. (2022). Exchange rate volatility, corruption, and economic growth. Heliyon, 8 (12), e12328. https://doi.org/10.1016/j.heliyon.2022.e12328

- Vega-Gordillo, M., Alvarez-Arce, J. A. (2003). Economic growth and freedom: A causality study. Cato Journal, 23 (2), 199–215.

- Farr, W. K., Lord, R. A., Wolfenbarger, L. J. (1998). Economic Freedom, Political Freedom and Economic Well-Being: A Causality Analysis. Cato Journal, 18 (2), 247262.

- Gouider, A., Nouira, R., Saafi, S. (2022). Re-Exploring the Nexus Between Economic Freedom and Growth: Is There a Threshold Effect? Journal of Economic Development, 47 (3), 147167.

- Bergh, A., Bjørnskov, C. (2021). Does economic freedom boost growth for everyone? Kyklos, 74 (2), 170–186. https://doi.org/10.1111/kykl.12262

- IMF. International Financial Statistics database. Available at: https://data.imf.org

- IMF. Primary Commodity Prices database. Available at: https://www.imf.org/en/Research/commodity-prices

- Afonso, A., Jalles, J. T. (2012). Revisiting Fiscal Sustainability: Panel Cointegration and Structural Breaks in OECD Countries. ECB Working Paper Series, 1465. Frankfurt: European Central Bank. https://doi.org/10.2139/ssrn.2128484

- Hsing, Y. (2016). Is Real Depreciation Expansionary? The Case of the Slovak Republic. Applied Econometrics and International Development, 16 (2), 55–62.

- Hsing, Y. (2016). Is real depreciation expansionary? The case of the Czech Republic. Theoretical and Applied Economics, XXIII (3), 93–100.

- Bahmani-Oskooee, M., Kutan, A. M. (2008). Are devaluations contractionary in emerging economies of Eastern Europe? Economic Change and Restructuring, 41 (1), 61–74. https://doi.org/10.1007/s10644-008-9041-9

- Hatmanu, M., Cautisanu, C., Ifrim, M. (2020). The Impact of Interest Rate, Exchange Rate and European Business Climate on Economic Growth in Romania: An ARDL Approach with Structural Breaks. Sustainability, 12 (7), 2798. https://doi.org/10.3390/su12072798

- Haug, A., Jędrzejowicz, T., Sznajderska, A. (2013). Combining monetary and fiscal policy in an SVAR for a small open economy. NBP Working Papers, 168. Warsaw: National Bank of Poland. https://doi.org/10.2139/ssrn.2369254

- Hsing, Y. (2019). Does the Mundell-Fleming Model Apply to Poland? Theoretical and Applied Economics, XXVI (4 (621)), 265272.

- Simionescu, M., Balcerzak, A., Bilan, Y., Kotásková, A. (2018). The impact of money on output in Czech Republic and Romania. Journal of Business Economics and Management, 19 (1), 20–41. https://doi.org/10.3846/jbem.2018.1480

- Škare, M., Benazić, M., Tomić, D. (2016). On the neutrality of money in CEE (EU member) states: A panel cointegration analysis. Acta Oeconomica, 66 (3), 393–418. https://doi.org/10.1556/032.2016.66.3.2

- Shevchuk, V. (2022). Price and output effects of long-term exchange rate changes: Central and Eastern European countries in 2002–2019. Entrepreneurial Business and Economics Review, 10 (3), 37–50. https://doi.org/10.15678/eber.2022.100303

- di Giovanni, J., Shambaugh, J. C. (2008). The impact of foreign interest rates on the economy: The role of the exchange rate regime. Journal of International Economics, 74 (2), 341–361. https://doi.org/10.1016/j.jinteco.2007.09.002

##submission.downloads##

Опубліковано

Як цитувати

Номер

Розділ

Ліцензія

Авторське право (c) 2025 Mariia Blikhar, Solomiya Sokurenko, Andrii Hodiak, Yuliia Ilkiv, Mariana Kashchuk, Anatolii Kucher

Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License.

Закріплення та умови передачі авторських прав (ідентифікація авторства) здійснюється у Ліцензійному договорі. Зокрема, автори залишають за собою право на авторство свого рукопису та передають журналу право першої публікації цієї роботи на умовах ліцензії Creative Commons CC BY. При цьому вони мають право укладати самостійно додаткові угоди, що стосуються неексклюзивного поширення роботи у тому вигляді, в якому вона була опублікована цим журналом, але за умови збереження посилання на першу публікацію статті в цьому журналі.