Improving the approach to assessing the impact of financial market digitalization on the rationality of financial decisions

DOI:

https://doi.org/10.15587/2706-5448.2025.331165Keywords:

digital finance, digital resilience, simulation modeling, digital transformation, financial literacyAbstract

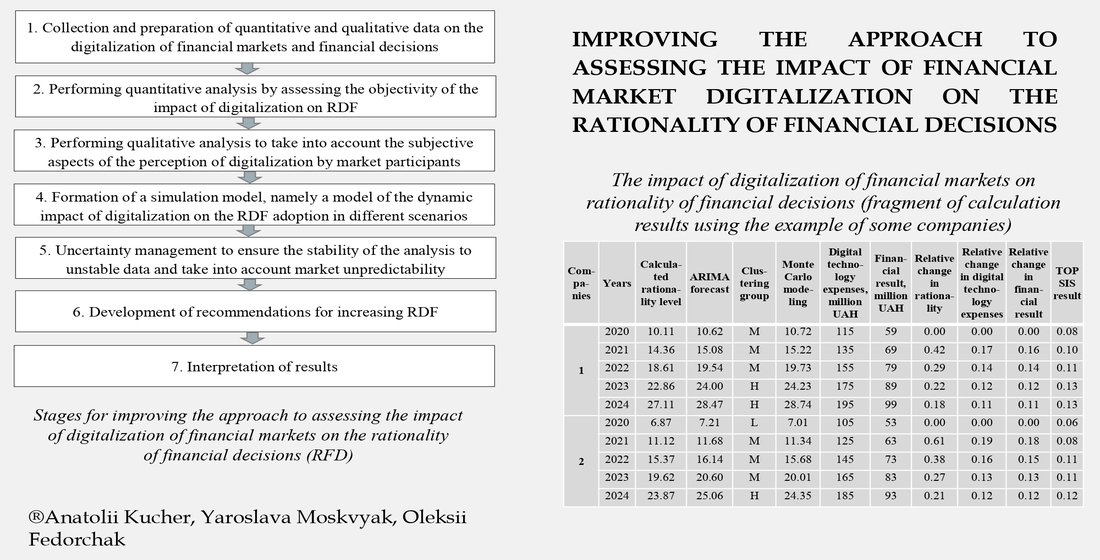

The object of research is the process of assessing the impact of digital transformations on the rationality of financial decisions (RFD) in the context of the functioning of modern financial markets.

The problem being solved is to specify a scientifically sound approach to the integrated analysis of quantitative, qualitative and simulation characteristics, which allow for accurate determination of the effectiveness of digital technologies in the processes of financial decision-making, taking into account uncertainty, data limitations, behavioral factors and the level of digital literacy.

It is proven that the growth of spending on digital technologies is closely correlated with the growth of the RDF level, which is confirmed by the results of multi-criteria analysis, ARIMA forecasting, Monte Carlo modeling and clustering. The effectiveness of the use of hybrid simulation models that combine system dynamics with an agent approach is determined, and indicators of digital sustainability of companies are also proposed.

The recommendations developed to improve the approach to assessing the impact of digitalization of financial markets on RDF can be used by financial institutions, regulatory authorities and the corporate sector to assess the effectiveness of digitalization, increase the validity of financial strategies, reduce the level of risk, adapt to martial law conditions and strengthen competitiveness in the digital environment.

References

- Regulator inertia is leaving Australia lagging other countries as crypto flourishes (2024). The Australian. Available at: https://www.theaustralian.com.au/commentary/regulator-inertia-is-leaving-australia-lagging-other-countries-as-crypto-flourishes/news-story/eb87a8a9edf000f7540b13de01d74dc4

- Barr, M. S. (2025). Deepfakes and the AI Arms Race in Bank Cybersecurity. Available at: https://www.bis.org/review/r250428f.pdf

- Grossman, S. J., Stiglitz, J. E. (1980). On the Impossibility of Informationally Efficient Markets. The American Economic Review, 70 (3), 393–408. Available at: https://www.jstor.org/stable/1805228

- Easley, D., O’hara, M. (2010). Microstructure and Ambiguity. The Journal of Finance, 65 (5), 1817–1846. https://doi.org/10.1111/j.1540-6261.2010.01595.x

- Blume, L., Easley, D., Kleinberg, J., Kleinberg, R., Tardos, E. (2011). Network formation in the presence of contagious risk. Proceedings of the 12th ACM Conference on Electronic Commerce, 1–10. https://doi.org/10.1145/1993574.1993576

- Kniaz, S. V. (2015). The essence of ecological-economic, tourist, eco-informational systems and their interrelations between them. Actual Problems of Economics, 9, 280–285. Available at: http://nbuv.gov.ua/UJRN/ape_2015_9_37

- Kniaz, S. V. (2015). Transfer potential for innovative development of industrial and trade organizations. Actual Problems of Economics, 7, 57–64.

- Kniaz, S. V., Heorhiadi, N. H. (2016). Structure, possibilities and prospects of the development of virtual economy and creative industries. Actual Problems of Economics, 9, 346–351.

- Digitalisation and Finance (2018). OECD Publishing. Available at: https://www.oecd.org/content/dam/oecd/en/publications/reports/2018/01/financial-markets-insurance-and-pensions-2018_9225d1bb/0021e92e-en.pdf

- Samuel, J. (2018). Information Token Driven Machine Learning for Electronic Markets: Performance Effects in Behavioral Financial Big Data Analytics. Journal of Information Systems and Technology Management, 14 (3), 371–384. https://doi.org/10.4301/s1807-17752017000300005

- Samuel, J., Holowczak, R., Pelaez, A. (2020). The Effects of Technology Driven Information Categories on Performance in Electronic Trading Markets. arXiv preprint arXiv:2002.10593. https://doi.org/10.48550/arXiv.2002.10593

- Hilbert, M., Darmon, D. (2020). How Complexity and Uncertainty Grew with Algorithmic Trading. Entropy, 22 (5), 499. https://doi.org/10.3390/e22050499

- Biancotti, C., Ciocca, P. (2021). Financial Markets and Social Media: Lessons From Information Security. Carnegie Endowment for International Peace. Available at: https://carnegieendowment.org/2021/11/02/financial-markets-and-social-media-lessons-from-information-security-pub-85686

- Koskelainen, T., Kalmi, P., Scornavacca, E., Vartiainen, T. (2023). Financial literacy in the digital age – A research agenda. Journal of Consumer Affairs, 57 (1), 507–528. https://doi.org/10.1111/joca.12510

- Hangl, C., Ortner, M. (2022). Does transaction atmosphere influence the decision-making behaviour of investors? ACRN Journal of Finance and Risk Perspectives, 11 (1), 55–78. https://doi.org/10.35944/jofrp.2022.11.1.004

- Upravitelev, A. A. (2022). Bounded Rationality of Decision-Making by Online Microfinance Organizations’ Consumers. Financial Journal, 14 (4), 134–147. https://doi.org/10.31107/2075-1990-2022-4-134-147

- Outouzzalt, A., Elouidani, R., El Moutaouakil, L., Fettahi, I. (2023). Behavioral Biases Affecting Decision-Making in the Financial Market. SHS Web of Conferences, 175, 01055. https://doi.org/10.1051/shsconf/202317501055

- Sujenthirai, A. P. N., Bandara, R., Senevirathne, W. A. R. (2023). Impact of financial literacy and investment skills on investors’ behaviour in colombo stock exchange – mediating role of digital literacy. Journal of Accountancy & Finance, 9 (2), 313–341. https://doi.org/10.57075/jaf922206

- Danylyshyn, V., Synytsia, S. (2023). Digitalization in the financial services market: essence and significance for the economy of Ukraine in today’s conditions. Transformational Economy, 3 (3), 16–20. https://doi.org/10.32782/2786-8141/2023-3-3

- Tardaskina, T. (2025). The digital model of development of socio-economic systems of Ukraine. Journal of Innovations and Sustainability, 9 (1), 5. https://doi.org/10.51599/is.2025.09.01.05

- Kniaz, S., Heorhiadi, N., Kucher, L., Tyrkalo, Y., Bovsunivska, A. (2023). Development of a customer service system in electronic commerce. Business Management, 33 (2). https://doi.org/10.58861/tae.bm.2023.2.04

- Shpak, N., Seliuchenko, N., Dvulit, Z., Kniaz, S., Kucher, L. (2023). Assessment of the impact of macroeconomic crises and war on the activities of JSC “Ukrzaliznytsia”. Financial and Credit Activity Problems of Theory and Practice, 6 (53), 260–272. https://doi.org/10.55643/fcaptp.6.53.2023.4177

- Liu, P., Dwarakanath, K., Vyetrenko, S. S., Balch, T. (2024). Limited or Biased: Modeling Subrational Human Investors in Financial Markets. Journal of Behavioral Finance, 1–24. https://doi.org/10.1080/15427560.2024.2371837

- Zhou, Y., Ni, Y., Gan, Y., Yin, Z., Liu, X., Zhang, J., et al. (2024). Are large language models rational investors? A study on detecting and reducing the financial bias in LLMs. arXiv preprint arXiv:2402.12713. https://doi.org/10.48550/arXiv.2402.12713

- Puzyrova, P. (2024). Transformation of the financial system to ensure economic security and national interests in the context of digitalisation. Journal of Innovations and Sustainability, 8 (4), 12. https://doi.org/10.51599/is.2024.08.04.12

- Hrosul, V., Kruhlova, O., Kolesnyk, A. (2023). Digitalization of the agricultural sector: the impact of ICT on the development of enterprises in Ukraine. Agricultural and Resource Economics: International Scientific E-Journal, 9 (4), 119–140. https://doi.org/10.51599/are.2023.09.04.06

- Zhu, Z. (2024). The Impact of Investor Expectation on the Financial Decision-Making. Highlights in Business, Economics and Management, 34, 102–107. https://doi.org/10.54097/nf8m2446

- Kniaz, S., Brych, V., Heorhiadi, N., Shevchenko, S., Dzvonyk, R., Skrynkovskyy, R. (2024). Enhancing the Informativeness of Managing Mentoring Activities based on Simulation Modeling. 2024 14th International Conference on Advanced Computer Information Technologies (ACIT), 8, 384–388. https://doi.org/10.1109/acit62333.2024.10712547

- Kniaz, S., Brych, V., Heorhiadi, N., Shevchenko, S., Dzvonyk, R., Skrynkovskyy, R. (2024). Informational-Reflective Management of Mentoring Activities Development in the Enterprise. 2024 14th International Conference on Advanced Computer Information Technologies (ACIT), 13, 389–392. https://doi.org/10.1109/acit62333.2024.10712601

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Anatolii Kucher, Yaroslava Moskvyak, Oleksii Fedorchak

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.