Удосконалення підходу до оцінювання впливу діджиталізації фінансових ринків на раціональність фінансових рішень

DOI:

https://doi.org/10.15587/2706-5448.2025.331165Ключові слова:

цифрові фінанси, цифрова стійкість, імітаційне моделювання, цифрова трансформація, фінансова грамотністьАнотація

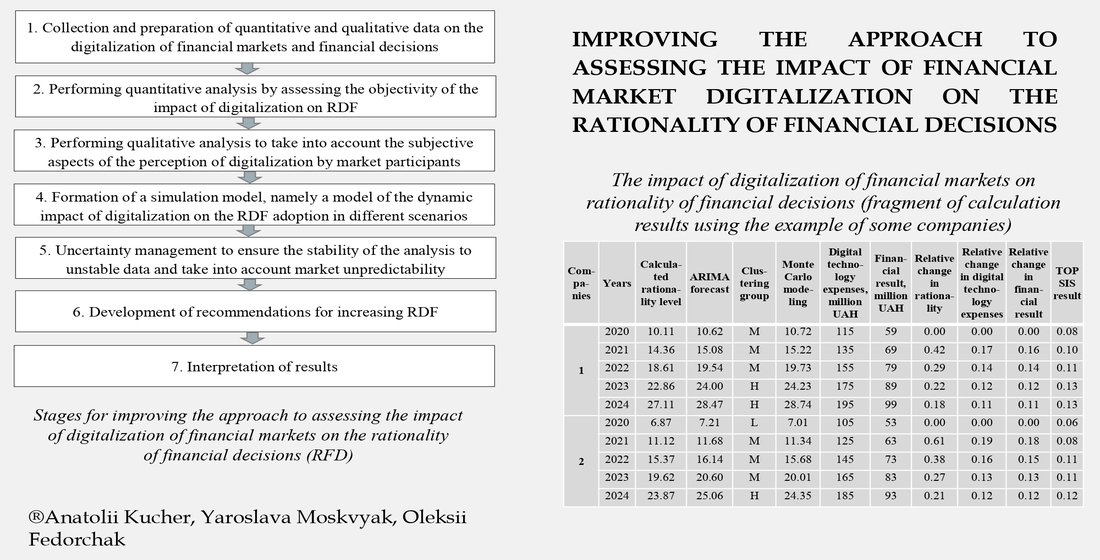

Об’єктом дослідження є процес оцінювання впливу цифрових трансформацій на раціональність фінансових рішень (РФР) у контексті функціонування сучасних фінансових ринків.

Проблема, яка вирішувалась, полягає в конкретизації науково обґрунтованого підходу до інтегрованого аналізу кількісних, якісних та імітаційних характеристик, що дозволяють точно визначати ефективність цифрових технологій у процесах ухвалення фінансових рішень з урахуванням невизначеності, обмежень даних, поведінкових чинників та рівня цифрової грамотності.

Доведено, що зростання витрат на цифрові технології тісно корелює зі зростанням рівня РФР, що підтверджено результатами багатокритеріального аналізу, ARIMA-прогнозування, моделювання Монте-Карло та кластеризації. Визначено ефективність застосування гібридних імітаційних моделей, що поєднують системну динаміку з агентним підходом, а також запропоновано індикатори цифрової стійкості компаній.

Сформовані рекомендації з удосконалення підходу до оцінювання впливу діджиталізації фінансових ринків на РФР можуть бути використані фінансовими установами, регуляторними органами та корпоративним сектором для оцінювання ефективності цифровізації. А також для підвищення обґрунтованості фінансових стратегій, зниження рівня ризику, адаптації до умов воєнного стану та посилення конкурентоспроможності в цифровому середовищі.

Посилання

- Regulator inertia is leaving Australia lagging other countries as crypto flourishes (2024). The Australian. Available at: https://www.theaustralian.com.au/commentary/regulator-inertia-is-leaving-australia-lagging-other-countries-as-crypto-flourishes/news-story/eb87a8a9edf000f7540b13de01d74dc4

- Barr, M. S. (2025). Deepfakes and the AI Arms Race in Bank Cybersecurity. Available at: https://www.bis.org/review/r250428f.pdf

- Grossman, S. J., Stiglitz, J. E. (1980). On the Impossibility of Informationally Efficient Markets. The American Economic Review, 70 (3), 393–408. Available at: https://www.jstor.org/stable/1805228

- Easley, D., O’hara, M. (2010). Microstructure and Ambiguity. The Journal of Finance, 65 (5), 1817–1846. https://doi.org/10.1111/j.1540-6261.2010.01595.x

- Blume, L., Easley, D., Kleinberg, J., Kleinberg, R., Tardos, E. (2011). Network formation in the presence of contagious risk. Proceedings of the 12th ACM Conference on Electronic Commerce, 1–10. https://doi.org/10.1145/1993574.1993576

- Kniaz, S. V. (2015). The essence of ecological-economic, tourist, eco-informational systems and their interrelations between them. Actual Problems of Economics, 9, 280–285. Available at: http://nbuv.gov.ua/UJRN/ape_2015_9_37

- Kniaz, S. V. (2015). Transfer potential for innovative development of industrial and trade organizations. Actual Problems of Economics, 7, 57–64.

- Kniaz, S. V., Heorhiadi, N. H. (2016). Structure, possibilities and prospects of the development of virtual economy and creative industries. Actual Problems of Economics, 9, 346–351.

- Digitalisation and Finance (2018). OECD Publishing. Available at: https://www.oecd.org/content/dam/oecd/en/publications/reports/2018/01/financial-markets-insurance-and-pensions-2018_9225d1bb/0021e92e-en.pdf

- Samuel, J. (2018). Information Token Driven Machine Learning for Electronic Markets: Performance Effects in Behavioral Financial Big Data Analytics. Journal of Information Systems and Technology Management, 14 (3), 371–384. https://doi.org/10.4301/s1807-17752017000300005

- Samuel, J., Holowczak, R., Pelaez, A. (2020). The Effects of Technology Driven Information Categories on Performance in Electronic Trading Markets. arXiv preprint arXiv:2002.10593. https://doi.org/10.48550/arXiv.2002.10593

- Hilbert, M., Darmon, D. (2020). How Complexity and Uncertainty Grew with Algorithmic Trading. Entropy, 22 (5), 499. https://doi.org/10.3390/e22050499

- Biancotti, C., Ciocca, P. (2021). Financial Markets and Social Media: Lessons From Information Security. Carnegie Endowment for International Peace. Available at: https://carnegieendowment.org/2021/11/02/financial-markets-and-social-media-lessons-from-information-security-pub-85686

- Koskelainen, T., Kalmi, P., Scornavacca, E., Vartiainen, T. (2023). Financial literacy in the digital age – A research agenda. Journal of Consumer Affairs, 57 (1), 507–528. https://doi.org/10.1111/joca.12510

- Hangl, C., Ortner, M. (2022). Does transaction atmosphere influence the decision-making behaviour of investors? ACRN Journal of Finance and Risk Perspectives, 11 (1), 55–78. https://doi.org/10.35944/jofrp.2022.11.1.004

- Upravitelev, A. A. (2022). Bounded Rationality of Decision-Making by Online Microfinance Organizations’ Consumers. Financial Journal, 14 (4), 134–147. https://doi.org/10.31107/2075-1990-2022-4-134-147

- Outouzzalt, A., Elouidani, R., El Moutaouakil, L., Fettahi, I. (2023). Behavioral Biases Affecting Decision-Making in the Financial Market. SHS Web of Conferences, 175, 01055. https://doi.org/10.1051/shsconf/202317501055

- Sujenthirai, A. P. N., Bandara, R., Senevirathne, W. A. R. (2023). Impact of financial literacy and investment skills on investors’ behaviour in colombo stock exchange – mediating role of digital literacy. Journal of Accountancy & Finance, 9 (2), 313–341. https://doi.org/10.57075/jaf922206

- Danylyshyn, V., Synytsia, S. (2023). Digitalization in the financial services market: essence and significance for the economy of Ukraine in today’s conditions. Transformational Economy, 3 (3), 16–20. https://doi.org/10.32782/2786-8141/2023-3-3

- Tardaskina, T. (2025). The digital model of development of socio-economic systems of Ukraine. Journal of Innovations and Sustainability, 9 (1), 5. https://doi.org/10.51599/is.2025.09.01.05

- Kniaz, S., Heorhiadi, N., Kucher, L., Tyrkalo, Y., Bovsunivska, A. (2023). Development of a customer service system in electronic commerce. Business Management, 33 (2). https://doi.org/10.58861/tae.bm.2023.2.04

- Shpak, N., Seliuchenko, N., Dvulit, Z., Kniaz, S., Kucher, L. (2023). Assessment of the impact of macroeconomic crises and war on the activities of JSC “Ukrzaliznytsia”. Financial and Credit Activity Problems of Theory and Practice, 6 (53), 260–272. https://doi.org/10.55643/fcaptp.6.53.2023.4177

- Liu, P., Dwarakanath, K., Vyetrenko, S. S., Balch, T. (2024). Limited or Biased: Modeling Subrational Human Investors in Financial Markets. Journal of Behavioral Finance, 1–24. https://doi.org/10.1080/15427560.2024.2371837

- Zhou, Y., Ni, Y., Gan, Y., Yin, Z., Liu, X., Zhang, J., et al. (2024). Are large language models rational investors? A study on detecting and reducing the financial bias in LLMs. arXiv preprint arXiv:2402.12713. https://doi.org/10.48550/arXiv.2402.12713

- Puzyrova, P. (2024). Transformation of the financial system to ensure economic security and national interests in the context of digitalisation. Journal of Innovations and Sustainability, 8 (4), 12. https://doi.org/10.51599/is.2024.08.04.12

- Hrosul, V., Kruhlova, O., Kolesnyk, A. (2023). Digitalization of the agricultural sector: the impact of ICT on the development of enterprises in Ukraine. Agricultural and Resource Economics: International Scientific E-Journal, 9 (4), 119–140. https://doi.org/10.51599/are.2023.09.04.06

- Zhu, Z. (2024). The Impact of Investor Expectation on the Financial Decision-Making. Highlights in Business, Economics and Management, 34, 102–107. https://doi.org/10.54097/nf8m2446

- Kniaz, S., Brych, V., Heorhiadi, N., Shevchenko, S., Dzvonyk, R., Skrynkovskyy, R. (2024). Enhancing the Informativeness of Managing Mentoring Activities based on Simulation Modeling. 2024 14th International Conference on Advanced Computer Information Technologies (ACIT), 8, 384–388. https://doi.org/10.1109/acit62333.2024.10712547

- Kniaz, S., Brych, V., Heorhiadi, N., Shevchenko, S., Dzvonyk, R., Skrynkovskyy, R. (2024). Informational-Reflective Management of Mentoring Activities Development in the Enterprise. 2024 14th International Conference on Advanced Computer Information Technologies (ACIT), 13, 389–392. https://doi.org/10.1109/acit62333.2024.10712601

##submission.downloads##

Опубліковано

Як цитувати

Номер

Розділ

Ліцензія

Авторське право (c) 2025 Anatolii Kucher, Yaroslava Moskvyak, Oleksii Fedorchak

Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License.

Закріплення та умови передачі авторських прав (ідентифікація авторства) здійснюється у Ліцензійному договорі. Зокрема, автори залишають за собою право на авторство свого рукопису та передають журналу право першої публікації цієї роботи на умовах ліцензії Creative Commons CC BY. При цьому вони мають право укладати самостійно додаткові угоди, що стосуються неексклюзивного поширення роботи у тому вигляді, в якому вона була опублікована цим журналом, але за умови збереження посилання на першу публікацію статті в цьому журналі.