Identifying factors impact on investment in financial services under digital financial ecosystem transformation

DOI:

https://doi.org/10.15587/2706-5448.2025.346108Keywords:

finance, financial ecosystem, financial services, investments, financial technologies, digital transformation, modelingAbstract

The object of research is global investment processes in the financial services sector. The problem is the gaps in the development of analytical tools for assessing and forecasting the volume of global investments in the financial services sector when the role of financial institutions changes in the digital transformation of the financial ecosystem.

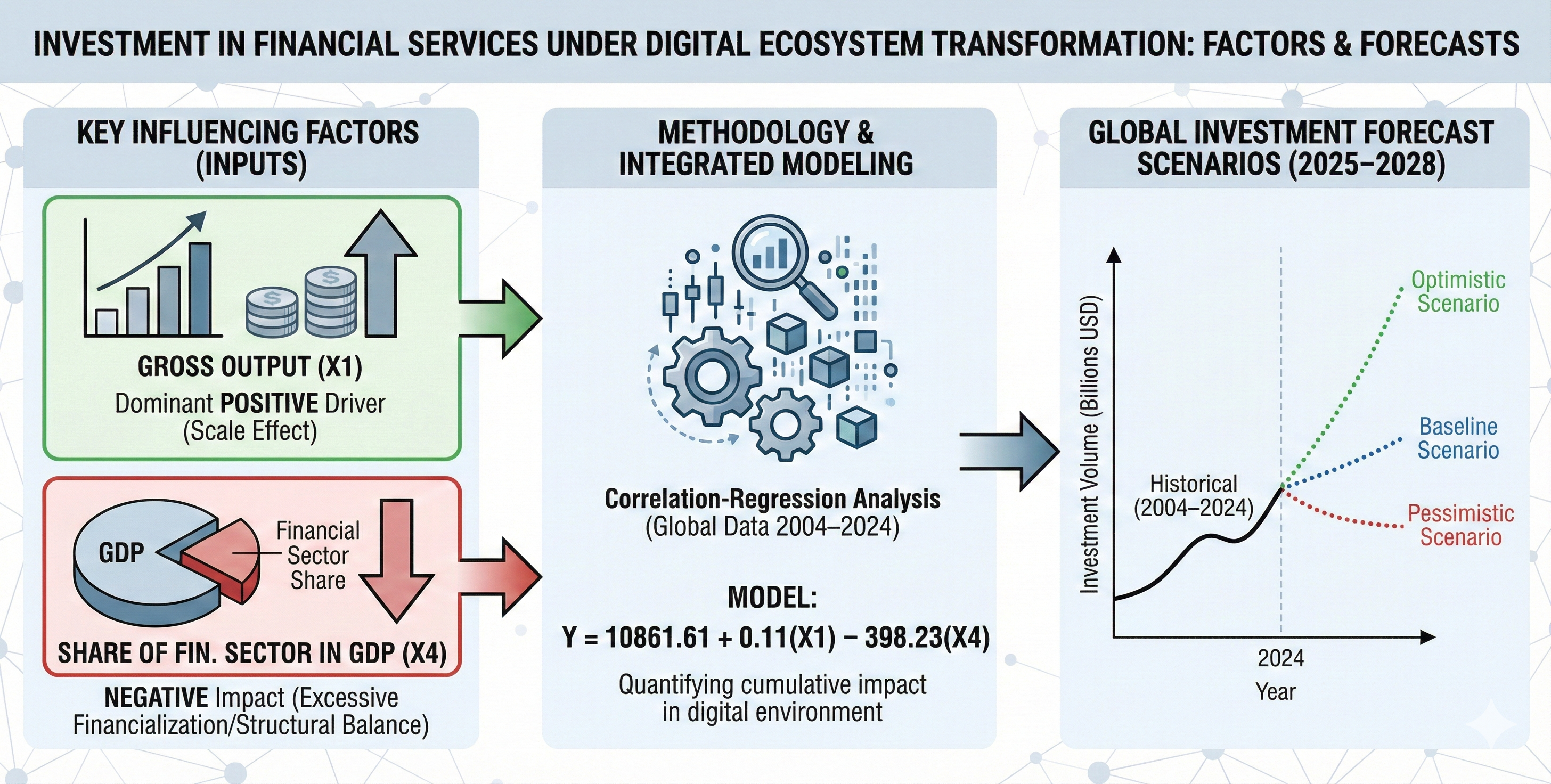

Correlation-regression analysis methods serve as the methodological basis of this research, implemented on the basis of Oxford Economics statistical data. A theoretical analysis of scientific approaches has been conducted to identify potential key factors influencing investments in financial services. A sample of statistical data on the dynamics of the international capital market has been formulated, characterizing changes in indicators of the financial services sector for the period 2004–2024. A correlation analysis has been conducted to identify multicollinearity of the identified factors and the resulting indicator – investments in financial services to assess their density and direction of the relationship. As a result of modeling, a regression equation with high reliability has been obtained. The model showed that gross output (X1) acts as a dominant positive driver of investment activity. In turn, the most significant result is the detection of a statistically significant negative impact of the share of the financial sector in GDP (X4) on total investment in the sector. The main forecast scenarios of the dynamics of global investments in financial services are formulated. The multidirectional impact on the dynamics of investment processes is determined – scale and structural balance within the integrated model. The practical result of its implementation is the application of the proposed toolkit for making investment and regulatory decisions in the medium term by investment funds, fintech companies and financial market regulators.

References

- State of Venture Q1’24 Report (2024). CB Insights. Available at: https://www.cbinsights.com/research/report/venture-trends-q1-2024/

- Crypto losses in Q1’24. (2024). Report prepared by Immunefi. Available at: https://downloads.ctfassets.net/t3wqy70tc3bv/34mVQUo6KAMcKF7rHyRdNM/d6c8710283abad55ec786c56f94eb3d1/Immunefi__Crypto_Losses_in_Q1_2024.pdf

- Arner, D. W., Wang, C. M. L., Buckley, R. P., Zetzsche, D. A. (2025). Building Open Finance: From Policy to Infrastructure. CFTE Academic and Industry Paper Series, Centre for Finance, Technology and Entrepreneurship (CFTE), University of Hong Kong Faculty of Law Research Paper, no. 2025/02, UNSW Law Research Paper, no. 25–10. https://doi.org/10.2139/ssrn.5116657

- Bethune, Z., Sultanum, B., Trachter, N. (2021). An Information-based Theory of Financial Intermediation. The Review of Economic Studies, 89 (5), 2381–2444. https://doi.org/10.1093/restud/rdab092

- Corley, S., Malu, V., Setiadi, A. (2025). Building ecosystems in digital finance for innovation and inclusion. Journal of Digital Banking, 10 (1), 40–53. https://doi.org/10.69554/gete2247

- Kushnir, S. O., Bakuta, O. O. (2023). Investments in cryptocurrency – features, risks and prospects. International Scientific Journal “Internauka”, 6, 23–28. Available at: https://www.inter-nauka.com/issues/2023/6/8784

- Morhachov, I., Ovcharenko, I., Oviechkina, O., Tyshchenko, V., Tyshchenko, O. (2021). Assessment of us banking sector investment attractiveness for minority investors: theoretical-applied aspect. Financial and Credit Activity Problems of Theory and Practice, 3 (38), 56–65. https://doi.org/10.18371/fcaptp.v3i38.237419

- Bondarenko, L., Moroz, N., Zhelizniak, R., Bonetskyy, O. (2022). Fintech market development in the world and in Ukraine. Financial and Credit Activity Problems of Theory and Practice, 6 (41), 121–127. https://doi.org/10.18371/fcaptp.v6i41.251410

- Nieizviestna, О. V., Slobodyanyuk, N. O., Voloshyna, S. V., Gudz, Y. F. (2019). The research of investment capacity of non-banking financial institutions of ukraine during financial and economic crisis. Financial and Credit Activity Problems of Theory and Practice, 3 (30), 375–390. https://doi.org/10.18371/fcaptp.v3i30.179813

- Füss, R., Morkoetter, S., Oliveira, M. (2023). Investing in Your Alumni: Endowments’ Investment Choices in Private Equity. Journal of Financial Services Research, 68 (1), 1–50. https://doi.org/10.1007/s10693-023-00419-1

- Santos, J. A. C., Shao, P. (2022). Investor Diversity and Liquidity in the Secondary Loan Market. Journal of Financial Services Research, 63 (3), 249–272. https://doi.org/10.1007/s10693-022-00377-0

- Purella, S. (2025). Zero-Trust Architecture in Distributed Financial Ecosystems. International Journal of Computing and Engineering, 7 (20), 11–26. https://doi.org/10.47941/ijce.3075

- Tripathi, S., Bhushan, C. (2025). Digital Transformation in Finance: Innovations, Challenges, and Future Trends. Stallion Journal for Multidisciplinary Associated Research Studies, 1 (1), 24–35. https://doi.org/10.55544/sjmars.icmri.5

- Caragea, D., Cojoianu, T., Dobri, M., Hoepner, A., Peia, O., Romelli, D. (2023). Competition and Innovation in the Financial Sector: Evidence from the Rise of FinTech Start-ups. Journal of Financial Services Research, 65 (1), 103–140. https://doi.org/10.1007/s10693-023-00413-7

- Kovalenko, Y., Martynenko, V., Chunytska, I., Didenko, L., Yatsenko, I., Shulha, T. (2022). The newest scientific and methodical approach to assessing the openness of investment financial services markets. Financial and Credit Activity Problems of Theory and Practice, 6 (47), 230–241. https://doi.org/10.55643/fcaptp.6.47.2022.3899

- Harazishvili, Y. M., Nazaraga, I. M. (2012). Investments: an approach to forecasting. Actual Problems of Economics, 9, 213–222. Available at: http://nbuv.gov.ua/UJRN/ape_2012_9_29

- Tokhtamysh, T. O., Yaholnytskyi, O. A., Hranko, K. B. (2020). Analysis of the impact of FinTech development on foreign direct investment. Economic Space, 159, 28–32. https://doi.org/10.32782/2224-6282/159-5

- Zadoia, A. O. (2019). Portfelni investytsii u suchasnomu sviti: empirychna perevirka hipotez. Yevropeiskyi Vektor Ekonomichnoho Rozvytku, 2 (27), 60–69. https://doi.org/10.32342/2074-5362-2019-2-27-6

- Chu, Y., Wei, J. (2023). Fintech Lending and Credit Market Competition. Journal of Financial and Quantitative Analysis, 59 (5), 2199–2225. https://doi.org/10.1017/s0022109023000698

- Buckley, R. P., Arner, D. W., Zetzsche, D. A. (2023). FinTech: Finance, Technology and Regulation. Cambridge: Cambridge University Press. https://doi.org/10.1017/9781009086943

- Alsmadi, A. A., Al-Okaily, M. (2025). Future front of finance: the role of FinTech strategies, competitiveness dynamics and sustainable solutions. Competitiveness Review: An International Business Journal. https://doi.org/10.1108/cr-11-2023-0298

- Nibley, B. (2025). Pros & cons of sector investing. SoFi Learn. Available at: https://www.sofi.com/learn/content/sector-investing-pros-and-cons/

- Importance and components of the financial services sector (2024). Investopedia. Available at: https://www.investopedia.com/ask/answers/030315/what-financial-services-sector.asp

- Emerging Markets Information Service. Available at: https://www.emis.com/pl

- Lyubchyk, L., Galuza, A., Grinberg, G.; Shahbazova, S. N., Sugeno, M., Kacprzyk, J. (Eds.) (2020). Semi-supervised learning to rank with nonlinear preference model. Recent Developments in Fuzzy Logic and Fuzzy Sets: Dedicated to Lotfi A. Zadeh. Cham: Springer International Publishing, 81–103. https://doi.org/10.1007/978-3-030-38893-5_5

- Lyubchyk, L., Grinberg, G., Lubchick, M., Galuza, A., Akhiiezer, O. (2020). Interval Evaluation of Stationary State Probabilities for Markov Set-Chain Models. 2020 10th International Conference on Advanced Computer Information Technologies (ACIT). IEEE, 82–85. https://doi.org/10.1109/acit49673.2020.9208932

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Oleksandr Manoylenko, Svitlana Kuznetsova

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.