Research of the factor segment content of economic security management in the conditions of geopolitical transformations

DOI:

https://doi.org/10.15587/2706-5448.2022.271798Keywords:

shadow economy, geopolitical security, state structures, mergers and acquisitions, macroeconomics, management system, economic reformAbstract

The object of research is management system of the country's economic security and the consequences of the influence of the shadow economy on it. Research is carried out on the example of Ukraine, as a country with a fairly high level of shadow processes in business.

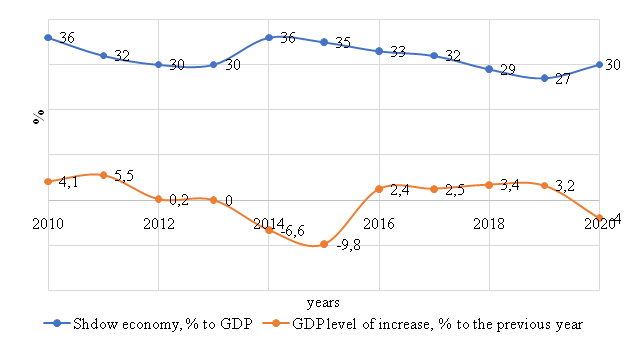

Shadow incomes and agreements are currently one of the main problems of the management system of income distribution and redistribution. The global scale of the economy and the deregulation of international mergers and acquisitions take shadow capital beyond individual countries, giving them global importance for the economic security of different countries. An analysis of the influence of the shadow economy on all stages of merger and acquisition agreements in Ukraine was carried out. The negative effects of shadowing on attracting foreign and national investments, which reduces the effectiveness of the country’s economic security management system, were analyzed. The article presents a comparative analysis of the dynamics of economic development indices of the country and the level of the shadow economy.

In the process of the research methods of analysis and synthesis, methods of logical design, tabular and graphical methods of data presentation are used. Correlation-regression analysis was used to study the relationship between the indicators of the shadow economy and the level of economic security of the state.

On the basis of statistical indicators, the comparison of indicators of development of shadow economy and separate indicators of economic security of Ukraine is carried out. Correlation-regression analysis was used to study the relationship between the indicators of the illegal economy and the level of economic security of the state in the conditions of geopolitical transformation. The results of the calculations showed that for most indices of economic security and the level of the shadow economy there is a direct relationship. The established dependencies can be the basis for determining the key vectors of the state policy of counteracting the development of the shadow economy and tools for influencing the most sensitive indicators of Ukraine’s economic development.

The research conducted in this article can be useful for scientists who research economic security management systems, for government institutions with the aim of forming an economic security program. The methodology can be used to determine investment priorities based on the analysis of the impact of the illegal economy on the economic security of society.

Supporting Agency

- Presentation of research in the form of publication through financial support in the form of a grant from SUES (Support to Ukrainian Editorial Staff).

References

- Kovac, D., Vukovic, V., Kleut, N., Podobnik, B. (2016). To Invest or Not to Invest, That Is the Question: Analysis of Firm Behavior under Anticipated Shocks. PLOS ONE, 11 (8), e0158782. doi: https://doi.org/10.1371/journal.pone.0158782

- Ritter, J. R., Signori, A., Vismara, S. (2013). Economies of scope and IPO activity in Europe. Handbook of Research on IPOs, 11–34. doi: https://doi.org/10.4337/9781781955376.00008

- The Next Normal Emerging stronger from the coronavirus pandemic (2021). Available at: https://www.mckinsey.com/featured-insights/coronavirus-leading-through-the-crisis

- Carbonara, G., Caiazza, R. (2009). Mergers and acquisitions: Causes and effects. The Journal of American Academy of Business, Cambridge, 14 (2), 188–194.

- Verkhovnaia Rada priniala zakon, otkryvaiushchii granitcy dlia biznesa (2019). Available at: https://biz.liga.net/all/all/novosti/vr-prinyala-zakonoproekt-otkryvayuschiy-granitsy-dlya-biznes

- Moschieri, C., Campa, J. M. (2014). New trends in mergers and acquisitions: Idiosyncrasies of the European market. Journal of Business Research, 67 (7), 1478–1485. doi: https://doi.org/10.1016/j.jbusres.2013.07.018

- Del Bo, C. D., Ferraris, M., Florio, M. (2017). Governments in the market for corporate control: Evidence from M& A deals involving state-owned enterprises. Journal of Comparative Economics, 45 (1), 89–109. doi: https://doi.org/10.1016/j.jce.2016.11.006

- Aiello, R. J., Watkins, M. D. (2000). The fine art of friendly acquisition. Harvard business review, 78 (6), 100–107.

- Campa, J. M., Moschieri, C. (2008). The European M&A industry: Trends, patterns and shortcomings. IESE Business School, University of Navarra.

- Nyborg, K. G., Östberg, P. (2014). Money and liquidity in financial markets. Journal of Financial Economics, 112 (1), 30–52. doi: https://doi.org/10.1016/j.jfineco.2013.12.003

- Andrieș, A. M., Vîrlan, C. A. (2017). Risk arbitrage in emerging Europe: are cross-border mergers and acquisition deals more risky? Economic Research-Ekonomska Istraživanja, 30 (1), 1367–1389. doi: https://doi.org/10.1080/1331677x.2017.1355259

- Firstbrook, C. (2007). Transnational mergers and acquisitions: how to beat the odds of disaster. Journal of Business Strategy, 28 (1), 53–56. doi: https://doi.org/10.1108/02756660710723215

- Broihanne, M. H., Merli, M., Roger, P. (2014). Overconfidence, risk perception and the risk-taking behavior of finance professionals. Finance Research Letters, 11 (2), 64–73. doi: https://doi.org/10.1016/j.frl.2013.11.002

- Delpini, D., Battiston, S., Caldarelli, G., Riccaboni, M. (2019). Systemic risk from investment similarities. PLOS ONE, 14 (5), e0217141. doi: https://doi.org/10.1371/journal.pone.0217141

- Huyghebaert, N., Luypaert, M. (2013). Value creation and division of gains in horizontal acquisitions in Europe: the role of industry conditions. Applied Economics, 45 (14), 1819–1833. doi: https://doi.org/10.1080/00036846.2011.639739

- Koster, H. (2021). Mergers and Acquisitions in the Netherlands: Do Listed Companies Need Better Defences? International Company and Commercial Law Review, 2021 (3), 166–176.

- Defrancq, C., Huyghebaert, N., Luypaert, M. (2016). Influence of family ownership on the industry-diversifying nature of a firm’s M&A strategy: Empirical evidence from Continental Europe. Journal of Family Business Strategy, 7 (4), 210–226. doi: https://doi.org/10.1016/j.jfbs.2016.11.002

- Defrancq, C., Huyghebaert, N., Luypaert, M. (2020). Influence of acquirer boards on M&A value creation: Evidence from Continental Europe. Journal of International Financial Management & Accounting, 32 (1), 21–62. doi: https://doi.org/10.1111/jifm.12124

- Kalinin, O., Gonchar, V., Simanavičienė, Ž. (2019). Risk management of the investment marketing on diversified enterprises. Economics. Ecology. Socium, 3 (4), 35–44. doi: https://doi.org/10.31520/2616-7107/2019.3.4-5

- Demirkan, S., Radhakrishnan, S., Urcan, O. (2011). Discretionary Accruals Quality, Cost of Capital, and Diversification. Journal of Accounting, Auditing & Finance, 27 (4), 496–526. doi: https://doi.org/10.1177/0148558x11409162

- Hopkin, P. (2012). Fundamentals of risk management: understanding evaluating and implementing effective risk management. Institute of Risk Management.

- John, A., Lawton, T., Meadows, M. (2018). Managing cross-border M&A: Three approaches to takeovers in Europe. The Routledge Companion to European Business. Routledge, 282–294. doi: https://doi.org/10.4324/9781315397306-23

- World bank (2021) Doing Business. Available at: https://archive.doingbusiness.org/en/data/exploretopics/getting-credit

- Pro vnesennia zmin do deiakykh zakonodavchykh aktiv Ukrainy shchodo stymuliuvannia investytsiinoi diialnosti v Ukraini (2019). Zakon Ukrainy No. 132-IX. 20.09.2019. Available at: https://zakon.rada.gov.ua/laws/show/132-20#Text

- Pro vnesennia zmin do Mytnoho kodeksu Ukrainy shchodo deiakykh pytan funktsionuvannia avtoryzovanykh ekonomichnykh operatoriv (2019). Zakon Ukrainy No. 141-IX. 02.10.2019. Available at: https://zakon.rada.gov.ua/laws/show/141-IX#Text

- Pro vnesennia zmin do Zakonu Ukrainy «Pro budivelni normy» shchodo udoskonalennia normuvannia u budivnytstvi (2019). Zakon Ukrainy No. 156-IX. 03.10.2019. Available at: https://zakon.rada.gov.ua/laws/show/156-20#Text

- Lowinski, F., Schiereck, D., Thomas, T. W. (2004). The Effect of Cross-Border Acquisitions on Shareholder Wealth – Evidence from Switzerland. Review of Quantitative Finance and Accounting, 22 (4), 315–330. doi: https://doi.org/10.1023/b:requ.0000032601.84464.52

- 2021 was a blowout year for M&A (2022). KPMG. Available at: https://inventure.com.ua/analytics/investments/2021-god-stal-rekordnym-dlya-mirovogo-rynka-manda

- Křížová, Z., Sedláček, J., Hýblová, E. (2014). Mergers and Acquisitions in the Selected Countries of Central and Eastern Europe. Proceedings of the 11th International Scientific Conference on European Financial Systems, 351–358.

- Liu, Y. (2022). Credit Resource Availability and Innovation Output: Evidence from Chinese Industrial Enterprises. Journal of Applied Finance & Banking, 12 (1), 1–26. doi: https://doi.org/10.47260/jafb/1211

- Mateev, M. (2017). Is the M&A announcement effect different across Europe? More evidences from continental Europe and the UK. Research in International Business and Finance, 40, 190–216. doi: https://doi.org/10.1016/j.ribaf.2017.02.001

- Van der Klip, B., Habermehl, M. (2021). Public Mergers and Acquisitions in the Netherlands: Overview Other Regulatory Restrictions. Thomson reuters. Available at: https://uk.practicallaw.thomsonreuters.com/3-502-0666?transitionType=Default&contextData=(sc.Default)&firstPage=true

- Verheij, D. (2019). Performance of high-tech country and sector cross border M&A acitivities in Europe.

- Pandey, G., Sidharth, O. (2021). The Impact of Covid-19 on Merger and Acquisition. Issue 6 Int'l JL Mgmt. & Human., 4, 213.

- Tinova ekonomika. Zahalni tendentsii 2020 (2021). Ministerstvo ekonomiky. Departament stratehichnoho planuvannia ta makroekonomichnoho prohnozuvannia.

- Schmid, A. S., Sánchez, C. M., Goldberg, S. R. (2011). M& A today: Great challenges, but great opportunities. Journal of Corporate Accounting & Finance, 23 (2), 3–8. doi: https://doi.org/10.1002/jcaf.21731

- Wan, W. P., Hoskisson, R. E., Short, J. C., Yiu, D. W. (2010). Resource-Based Theory and Corporate Diversification. Journal of Management, 37 (5), 1335–1368. doi: https://doi.org/10.1177/0149206310391804

- Kazmierska-Jozwiak, B. (2014). Activity of Central Eastern Europe Countries on Mergers and Acquisitions Market. Social Sciences, 83 (1), 72–79. doi: https://doi.org/10.5755/j01.ss.83.1.6864

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Oleksandr Kalinin, Viktoriya Gonchar, Zaneta Simanaviciene

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.