Дослідження процедури LSTM-SARIMA для прогнозування базової інфляції

DOI:

https://doi.org/10.15587/2706-5448.2024.301209Ключові слова:

метод динамічного викривлення часу, кластеризація, K-Means, рекурентна нейронна мережа, машинне навчання, базова інфляціяАнотація

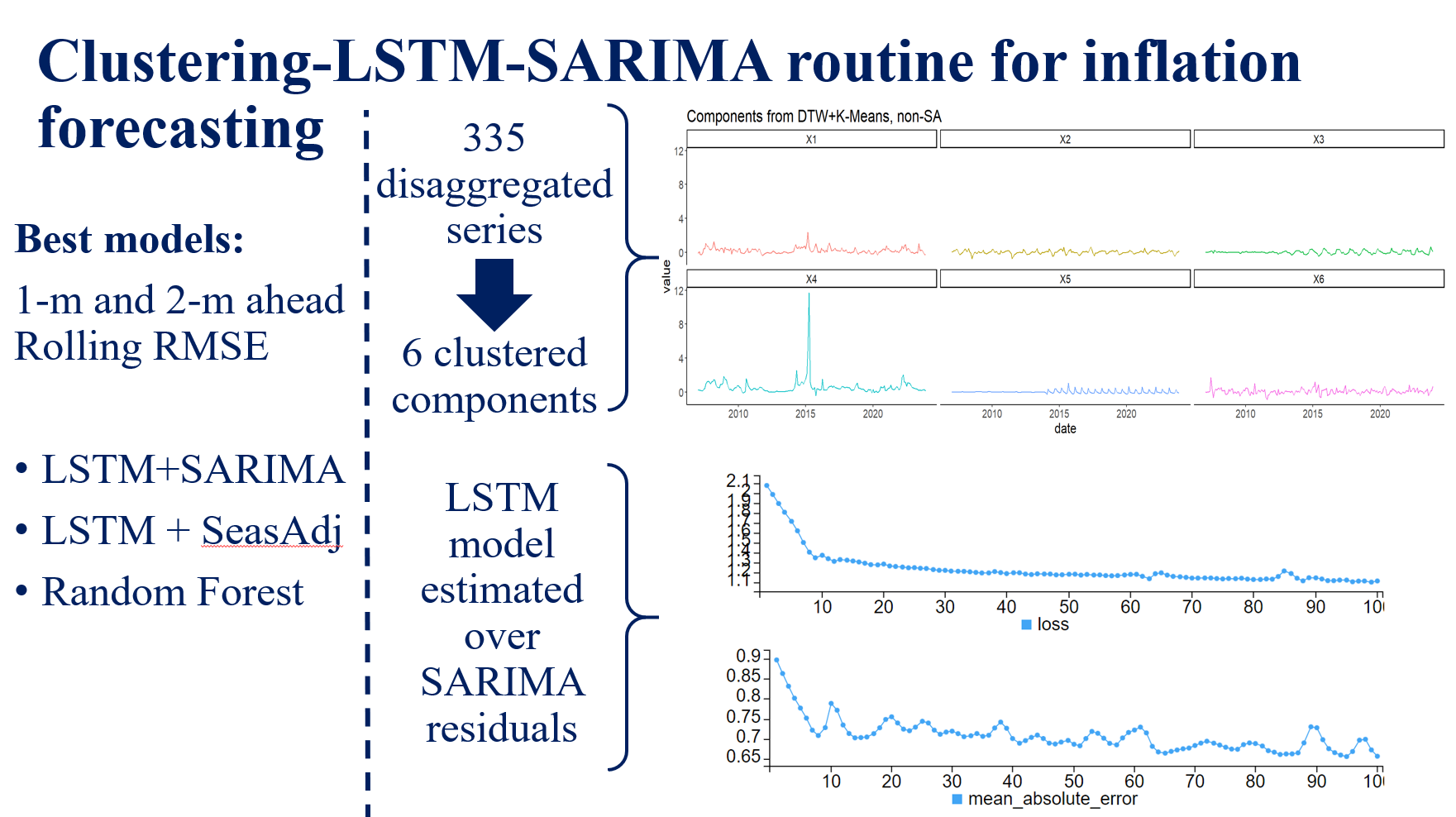

Об’єктом дослідження є прогнозування базової інфляції. У роботі досліджується ефективність нової моделі під час прогнозування базової інфляції. Вона об’єднує понад 300 компонентів у 6 за схожістю їх динаміки за допомогою оновленого алгоритму DTW, налаштованого на місячні часові ряди, та алгоритму K-Means для групування. Надалі модель SARIMA виділяє лінійні та сезонні компоненти, за якими слідує модель LSTM, котра пояснює нелінійності та взаємозалежності. Це вирішує проблему високоякісного прогнозування інфляції на дизагрегованому датасеті. У той час як стандартні та традиційні економетричні методи зосереджені на обмежених наборах даних, які складаються лише з кількох змінних, запропонована методологія здатна охопити більшу частину волатильності, що містить більше інформації. Модель порівнюється з великою кількістю інших моделей, простих, таких як Random Walk і SARIMA, до моделей ML, таких як XGBoost, Random Forest і простий LSTM. Незважаючи на те, що всі моделі Data Science демонструють пристойну продуктивність, процедура DTW+K-Means+SARIMA+LSTM дає найкращий RMSE прогнозів на 1 місяць і на 2 місяці вперед, що підтверджує високу якість запропонованої прогнозної моделі та є рішенням для ключової проблеми, описаної в цій роботі. Це пояснюється здатністю моделі враховувати як лінійні/сезонні патерни даних за допомогою частини SARIMA, так і нелінійні та взаємозалежні з використанням підходу LSTM. Моделі підігнані для випадку України, оскільки вони оцінені на відповідних даних і можуть активно використовуватися для подальшого прогнозування інфляції.

Посилання

- Krukovets, D. (2023). Updated DTW+K-Means approach with LSTM and ARIMA-type models for Core Inflation forecasting. Bulletin of Taras Shevchenko National University of Kyiv. Series: Physics and Mathematics, 2, 214–225. doi: https://doi.org/10.17721/1812-5409.2023/2.38

- Huwiler, M., Kaufmann, D. (2013). Combining disaggregate forecasts for inflation: The SNB’s ARIMA model. Swiss National Bank Economic Studies, 7.

- Mondal, P., Shit, L., Goswami, S. (2014). Study of Effectiveness of Time Series Modeling (Arima) in Forecasting Stock Prices. International Journal of Computer Science, Engineering and Applications, 4 (2), 13–29. doi: https://doi.org/10.5121/ijcsea.2014.4202

- Anggraeni, W., Andri, K. B., Sumaryanto, Mahananto, F. (2017). The Performance of ARIMAX Model and Vector Autoregressive (VAR) Model in Forecasting Strategic Commodity Price in Indonesia. Procedia Computer Science, 124, 189–196. doi: https://doi.org/10.1016/j.procs.2017.12.146

- Medeiros, M. C., Vasconcelos, G. F. R., Veiga, Á., Zilberman, E. (2019). Forecasting Inflation in a Data-Rich Environment: The Benefits of Machine Learning Methods. Journal of Business & Economic Statistics, 39 (1), 98–119. doi: https://doi.org/10.1080/07350015.2019.1637745

- Profatska, N. (2021). Standard quality report state statistical observation «changes in prices (tariffs) for consumer goods (services)» 2.06.01.01. State Statistics Service of Ukraine, 1–11.

- Krukovets, D., Verchenko, O. (2019). Short-Run Forecasting of Core Inflation in Ukraine: a Combined ARMA Approach. Visnyk of the National Bank of Ukraine, 248, 11–20. doi: https://doi.org/10.26531/vnbu2019.248.02

- Shapovalenko, N. (2021). A Suite of Models for CPI Forecasting. Visnyk of the National Bank of Ukraine, 252, 4–36. doi: https://doi.org/10.26531/vnbu2021.252.01

- Almosova, A., Andresen, N. (2019). Nonlinear Inflation Forecasting with Recurrent Neural Networks. European Central Bank (ECB), 1–45.

- Longo, L., Riccaboni, M., Rungi, A. (2022). A neural network ensemble approach for GDP forecasting. Journal of Economic Dynamics and Control, 134, 104278. doi: https://doi.org/10.1016/j.jedc.2021.104278

- Siami-Namini, S., Tavakoli, N., Siami Namin, A. (2018). A Comparison of ARIMA and LSTM in Forecasting Time Series. 2018 17th IEEE International Conference on Machine Learning and Applications (ICMLA). doi: https://doi.org/10.1109/icmla.2018.00227

- Hyndman, R. J., Khandakar, Y. (2008). Automatic Time Series Forecasting: The Forecast Package for R. Journal of Statistical Software, 27 (3). doi: https://doi.org/10.18637/jss.v027.i03

- Fan, G.-F., Zhang, L.-Z., Yu, M., Hong, W.-C., Dong, S.-Q. (2022). Applications of random forest in multivariable response surface for short-term load forecasting. International Journal of Electrical Power & Energy Systems, 139, 108073. doi: https://doi.org/10.1016/j.ijepes.2022.108073

- Kumar, M., Thenmozhi, M. (2014). Forecasting stock index returns using ARIMA-SVM, ARIMA-ANN, and ARIMA-random forest hybrid models. International Journal of Banking, Accounting and Finance, 5 (3), 284. doi: https://doi.org/10.1504/ijbaaf.2014.064307

##submission.downloads##

Опубліковано

Як цитувати

Номер

Розділ

Ліцензія

Авторське право (c) 2024 Dmytro Krukovets

Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License.

Закріплення та умови передачі авторських прав (ідентифікація авторства) здійснюється у Ліцензійному договорі. Зокрема, автори залишають за собою право на авторство свого рукопису та передають журналу право першої публікації цієї роботи на умовах ліцензії Creative Commons CC BY. При цьому вони мають право укладати самостійно додаткові угоди, що стосуються неексклюзивного поширення роботи у тому вигляді, в якому вона була опублікована цим журналом, але за умови збереження посилання на першу публікацію статті в цьому журналі.