Statistical analysis of global debt in the world economy

DOI:

https://doi.org/10.15587/2706-5448.2024.310351Keywords:

global debt, global macroeconomic indicators, Multiple Analysis of Variance, Pearson’s correlation, Spearman’s rank correlationAbstract

The object of research is global debt (or world debt) in the world economy. Today, the problem of global debt (or global indebtedness) is extremely acute in the world economy. The global debt indicator is the largest in all history of the world economy and has already amounted to 315 trillion USD in 2024. The interdependence of the global debt and the main macroeconomic indicators were investigated in this paper. The main world macroeconomic indicators (GDP, inflation, imports, exports, economic growth) and world population are treated as global in this publication. The forecasting of the global debt index was also carried out until 2035 in the world economy.

Statistical analysis methods were used in this research. All research results were obtained through the Statgraphics Centurion statistical package. This package made it possible to carry out the Multiple Analysis of Variance procedure and forecasting through the ARIMA (1,0,0) model.

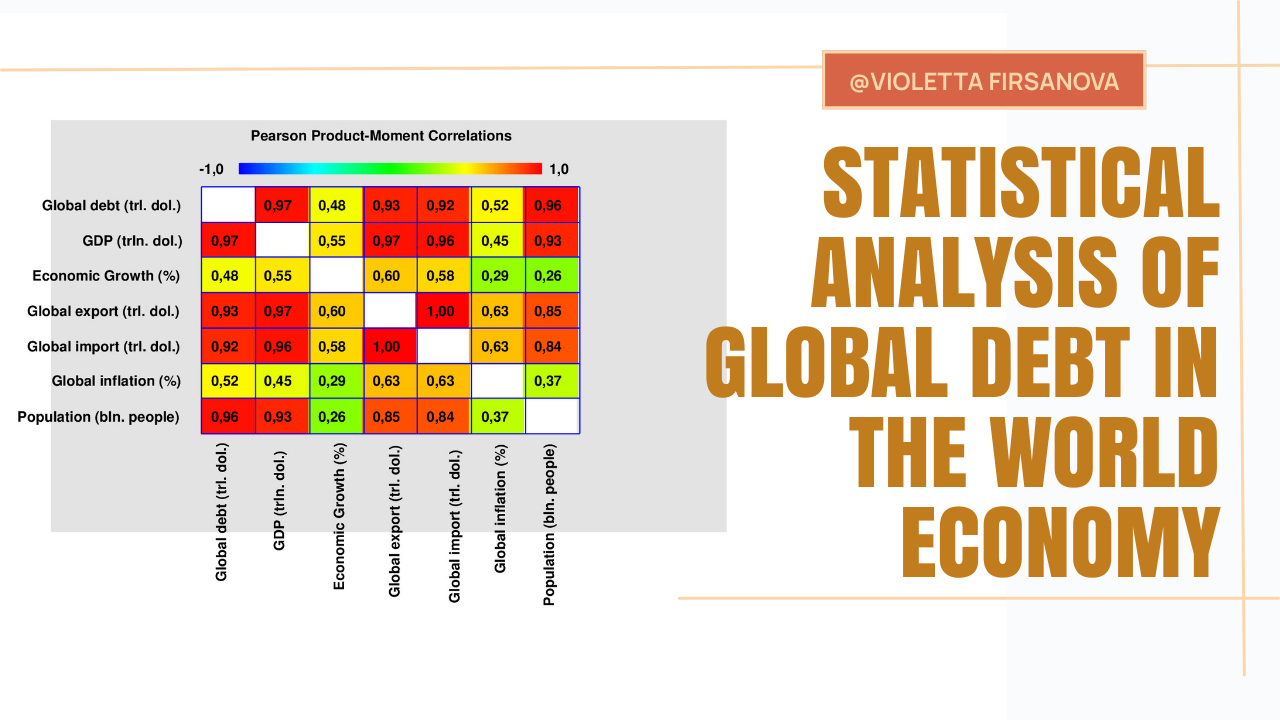

During applying the Multiple Analysis of Variance procedure, this publication included the results of Pearson’s correlation, Spearman’s rank correlation and analysis of covariance. Pearson’s correlation made possible to reveal which global macroeconomic indicators the global debt has very strong and weak connections. Spearman’s rank correlation also demonstrates the interdependence of global debt and global macroeconomic indicators. Covariance analysis gave results that differ from the above methods. In turn, the ARIMA model was used to forecast the global debt until 2035 in this research.

The essence of the research results is that global debt has the closest relationships with such global macroeconomic indicators as global GDP, global exports and global imports and world population. Global debt is moderately correlated with such global macroeconomic indicators as global inflation and global economic growth. The ARIMA model predicts an increase of global debt by 2035, rather than a decrease, and, accordingly, these global macroeconomic indicators as interdependent from the debt.

In practice, these results can be used to implement appropriate economic policies to balance the main macroeconomic indicators in the economy in order to reduce the indebtedness of states that, in turn, affects on the global debt.

References

- Fiscal Monitor (2023). On the Path to Policy Normalization. Available at: https://www.imf.org/en/Publications/FM/Issues/2023/04/03/fiscal-monitor-april-2023

- Global Sovereign Debt Monitor (2024). Available at: https://erlassjahr.de/en/aktionsbox/global-sovereign-debt-monitor-2021/

- Lutsyshyn, Z., Bortnik, A. (1998). Ekonomiko-matematychna model upravlinnia derzhavnym borhom. Visnyk NBU, 7, 23–25.

- Stavytskyy, A., Bilychenko, M. (2018). Modeling the impact of public debt on the economic growth worldwide. Bulletin of Taras Shevchenko National University of Kyiv Economics, 197, 49–59. https://doi.org/10.17721/1728-2667.2018/197-2/8

- Checherita-Westphal, C., Rother, P. (2012). The impact of high government debt on economic growth and its channels: An empirical investigation for the euro area. European Economic Review, 56 (7), 1392–1405. https://doi.org/10.1016/j.euroecorev.2012.06.007

- Hansen, B. E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics, 93 (2), 345–368. https://doi.org/10.1016/s0304-4076(99)00025-1

- Golikov, A. P., Galajda, O. E., Hanova, E. V. (2011). Reshenie zadach po ekonomiko-matematicheskomu modelirovaniiu mirokhoziaistvennykh protcessov v Microsoft Excel i Statistica. Kharkiv: KhNU im. V. N. Karazina, 46.

- Ponomarenko, V. S., Maliarets', L. M. (2009). Multivariate analysis of the socio-economic systems. Kharkiv: KhNEU, 388.

- Global Debt Database. International Monetary Fund. Available at: https://www.imf.org/external/datamapper/datasets/GDD

- Economy. The World Bank. Available at: https://datatopics.worldbank.org/world-development-indicators/themes/economy.html#featured-indicators_1

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Violetta Firsanova

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.