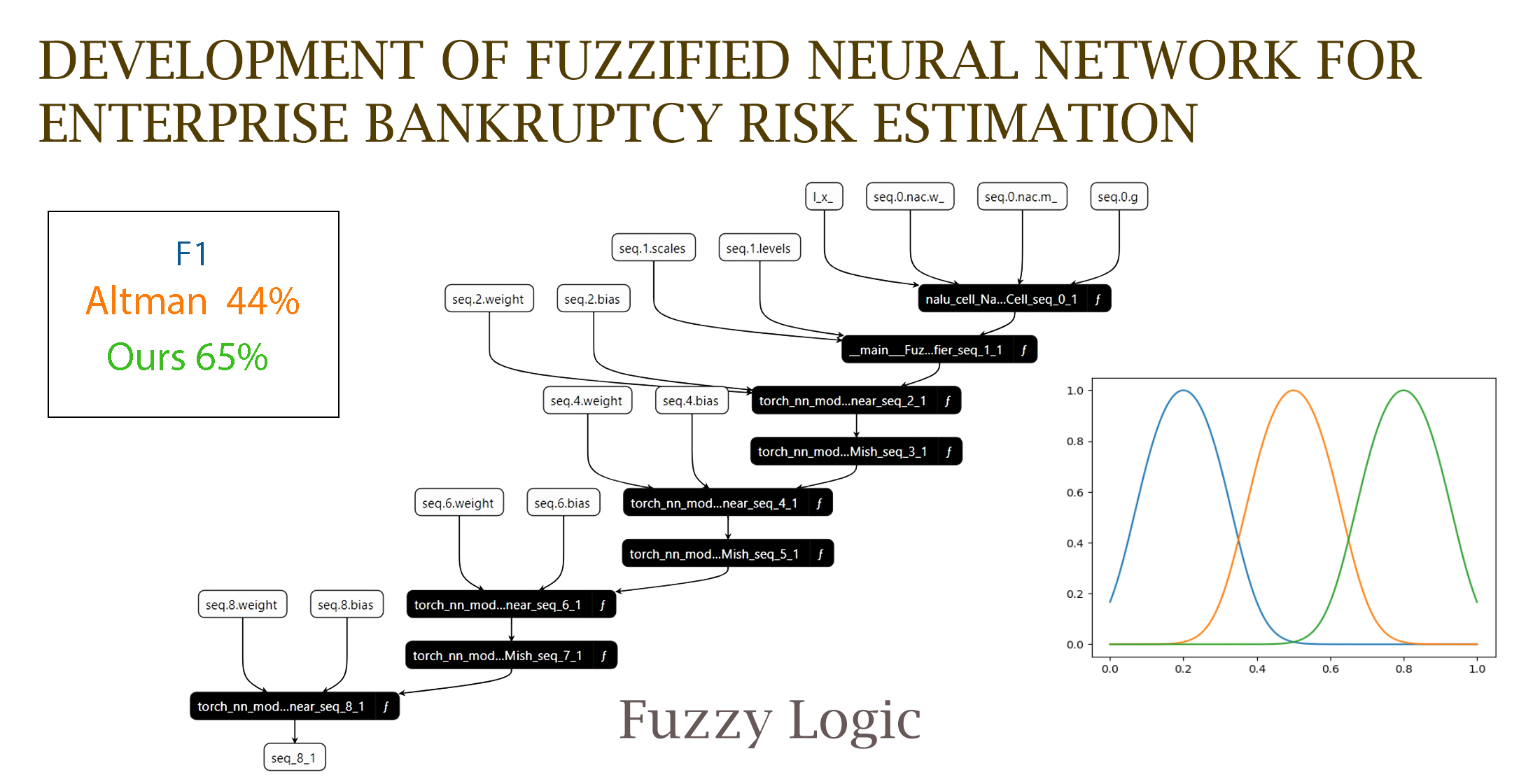

Development of fuzzified neural network for enterprise bankruptcy risk estimation

DOI:

https://doi.org/10.15587/2706-5448.2024.306873Keywords:

statistical model, bankruptcy risk assessment, neural arithmetic, machine learningAbstract

The object of this study is the assessment of the level of enterprise bankruptcy risk. It is a critical component in assessing the financial condition of an enterprise, and also serves as an indicator that allows the management team to reduce potential risks and develop their own strategies to strengthen the financial condition of the enterprise. One of the most challenging aspects of bankruptcy forecasting is the complex financial situations of bankrupt companies. By accurately predicting the risk of bankruptcy, businesses can take preventive measures to mitigate financial difficulties and ensure long-term sustainability. Previous methods, such as Altman's Z-score, are not accurate enough, as presented in the study. The paper investigates a modern approach to bankruptcy prediction based on a neural network with complex neural elements, namely neural arithmetic logic units (NALUs) and a custom phasing layer. This layer can process complex raw numerical values, such as financial indicators relevant to the analysis of a company's bankruptcy. Compared to Altman's Z-score, the developed method demonstrates a better F1 score in bankruptcy classification (48 %). On the raw data, the neural network demonstrates an improvement in the F1 score by about 40 % compared to the classical multilayer perceptron (MLP) with linear layers and nonlinear activation functions. A modern replacement for ReLU called Mish was used, which achieves better generalization. It was also assumed that the addition of new neural elements, which provide the neural network with arithmetic capabilities, contributes to the performance of processing non-normalized input data. This work highlights the importance of using advanced neural network architectures to improve the accuracy and reliability of forecasting in financial risk assessment. Using the parameters presented in the study, managers of enterprises will be able to more accurately assess the risk of bankruptcy.

References

- Long, Y. (2022). Early Warning Analysis of Company’s Financial Risk based on Fuzzy Evaluation Method. Proceedings of the International Conference on Big Data Economy and Digital Management. doi: https://doi.org/10.5220/0011207900003440

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23 (4), 589–609. doi: https://doi.org/10.1111/j.1540-6261.1968.tb00843.x

- Trask, A., Hill, F., Reed, S. E., Rae, J., Dyer, C., Blunsom, P. (2018). Neural arithmetic logic units. Advances in neural information processing systems, 31.

- Chibisova, I. (2012). Methods of estimation and prognostication of bankruptcy of enterprises. Naukovi pratsi Kirovohradskoho natsionalnoho tekhnichnoho universytetu, 22 (2), 389–394.

- Eisenbeis, R. A. (1977). Pitfalls in the application of discriminant analysis in business, finance, and economics. The Journal of Finance, 32 (3), 875–900. doi: https://doi.org/10.1111/j.1540-6261.1977.tb01995.x

- Premachandra, I. M., Bhabra, G. S., Sueyoshi, T. (2009). DEA as a tool for bankruptcy assessment: A comparative study with logistic regression technique. European Journal of Operational Research, 193 (2), 412–424. doi: https://doi.org/10.1016/j.ejor.2007.11.036

- Mihalovič, M. (2016). Performance Comparison of Multiple Discriminant Analysis and Logit Models in Bankruptcy Prediction. Economics & Sociology, 9 (4), 101–118. doi: https://doi.org/10.14254/2071-789x.2016/9-4/6

- Misra, D. (2019). Mish: A self regularized non-monotonic activation function. arXiv:1908.08681. doi: https://doi.org/10.48550/arXiv.1908.08681

- Brownlee, J. (2020). A Gentle Introduction to the Rectified Linear Unit (ReLU). Machine Learning Mastery. Available at: https://machinelearningmastery.com/rectified-linear-activation-function-for-deep-learning-neural-networks

- Ohlson, J. A. (1980). Financial Ratios and the Probabilistic Prediction of Bankruptcy. Journal of Accounting Research, 18 (1), 109–131. doi: https://doi.org/10.2307/2490395

- Ahn, H., Kim, K. (2009). Bankruptcy prediction modeling with hybrid case-based reasoning and genetic algorithms approach. Applied Soft Computing, 9 (2), 599–607. doi: https://doi.org/10.1016/j.asoc.2008.08.002

- US Company Bankruptcy Prediction Dataset. Utkarsh Singh. Available at: https://www.kaggle.com/datasets/utkarshx27/american-companies-bankruptcy-prediction-dataset

- Shulakov, V., Sinkovskyi, А., Tryus, Y. (2023). Information technology for generating synthetic medical data based on neural networks. Actual problems of medical, biological physics and computer science. Vinnytsia: Edelweiss, 76–82.

- Sola, J., Sevilla, J. (1997). Importance of input data normalization for the application of neural networks to complex industrial problems. IEEE Transactions on Nuclear Science, 44 (3), 1464–1468. doi: https://doi.org/10.1109/23.589532

- Nedosekin, A. O. (2008). Business risk assessment on the basis of fuzzy data. Audit and Financial Analysis, 4, 68–72.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Artem Sinkovskyi, Volodymyr Shulakov

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.