Developing a neuro-flexible mechanism of bankruptcy risk estimation based on conditional parameters

DOI:

https://doi.org/10.15587/2706-5448.2024.309963Keywords:

statistical model, bankruptcy risk estimation, Neural Arithmetic Logic Unit, fuzzifier block, machine learningAbstract

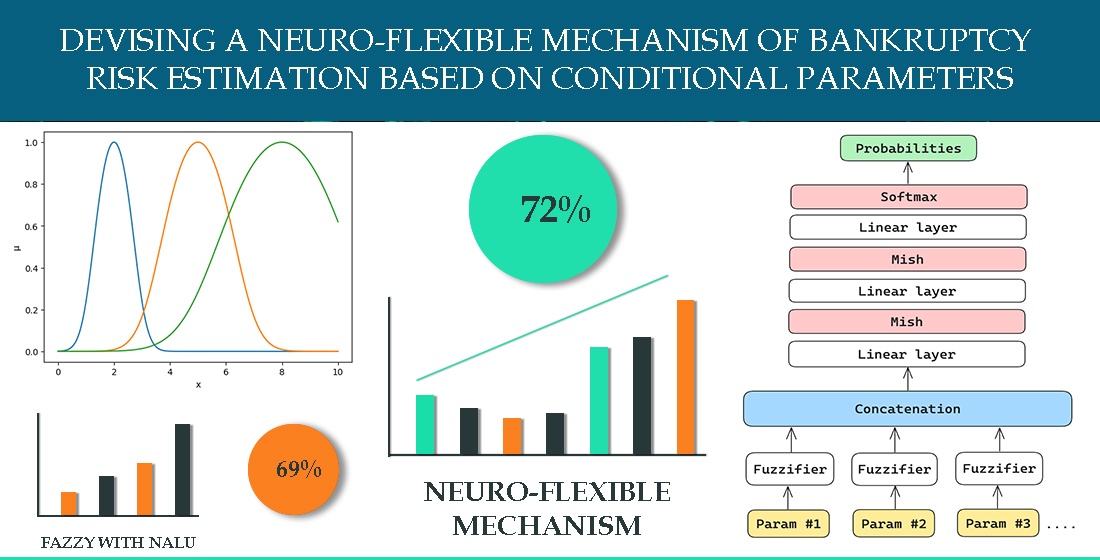

The object of the study is the estimation of the risk of enterprise bankruptcy. The work is aimed at developing a new model for estimating the risk of enterprise bankruptcy. Estimating the risk of bankruptcy is critical to assessing a company’s financial health. It serves as a key indicator that enables management teams to proactively mitigate potential risks and develop strategies to strengthen the company’s financial position over time. It is possible to enhance our prior bankruptcy prediction model by eliminating the Neural Arithmetic Logic Unit (NALU) block and refining the fuzzifier block to assess if the new architecture can effectively simulate approximate arithmetic for discovering complex financial ratios and relationships. The new model uses our bespoke «neuro-flexible» mechanism that incorporates a fuzzifier block as its initial layer, transforming each financial parameter into a fuzzy representation without any NALU blocks down the line. This approach allows the model to process undefined or missing inputs, enhancing its robustness in varied financial scenarios. The fuzzified values are then processed through linear layers with Mish activation, known for superior generalization performance. Key improvements include optimal categorization of raw numbers through embedding vectors and significant acceleration in learning speed. Experiments conducted using PyTorch on an Apple M1 processor demonstrated a substantial average prediction performance of 72 %, indicating the efficacy of the proposed enhancements in bankruptcy estimation. Bankruptcy risk is important for assessing a company’s financial health. It helps management teams reduce risks and strengthen the company’s finances. By predicting bankruptcy risk, companies can take steps to avoid financial problems and stay in business.

References

- Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23 (4), 589–609. https://doi.org/10.1111/j.1540-6261.1968.tb00843.x

- Chibisova, I. (2012). Methods of estimation and prognostication of bankruptcy of enterprises. Naukovi pratsi Kirovohradskoho natsionalnoho tekhnichnoho universytetu, 22 (2), 389–394.

- Eisenbeis, R. A. (1977). Pitfalls in the application of discriminant analysis in business, finance, and economics. The Journal of Finance, 32 (3), 875–900. https://doi.org/10.1111/j.1540-6261.1977.tb01995.x

- Premachandra, I. M., Bhabra, G. S., Sueyoshi, T. (2009). DEA as a tool for bankruptcy assessment: A comparative study with logistic regression technique. European Journal of Operational Research, 193 (2), 412–424. https://doi.org/10.1016/j.ejor.2007.11.036

- Mihalovič, M. (2016). Performance Comparison of Multiple Discriminant Analysis and Logit Models in Bankruptcy Prediction. Economics & Sociology, 9 (4), 101–118. https://doi.org/10.14254/2071-789x.2016/9-4/6

- Sinkovskyi, A., Shulakov, V. (2024). Development of fuzzified neural network for enterprise bankruptcy risk estimation. Information and Control Systems, 3 (2 (77)), 19–22. https://doi.org/10.15587/2706-5448.2024.306873

- Sola, J., Sevilla, J. (1997). Importance of input data normalization for the application of neural networks to complex industrial problems. IEEE Transactions on Nuclear Science, 44 (3), 1464–1468. https://doi.org/10.1109/23.589532

- Trask, A., Hill, F., Reed, S. E., Rae, J., Dyer, C., Blunsom, P. (2018). Neural arithmetic logic units. Advances in neural information processing systems, 31.

- Bengio, Y., Ducharme, R., Vincent, P., Janvin, C. (2003). A neural probabilistic language model. Journal of Machine Learning Research, 3, 1137–1155.

- Misra, D. (2019). Mish: A self regularized non-monotonic activation function. https://doi.org/10.48550/arXiv.1908.08681

- Utkarsh Singh. US Company Bankruptcy Prediction Dataset. Available at: https://www.kaggle.com/datasets/utkarshx27/american-companies-bankruptcy-prediction-dataset

- Kraskov, A., Stögbauer, H., Grassberger, P. (2004). Estimating mutual information. Physical Review E, 69 (6). https://doi.org/10.1103/physreve.69.066138

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Artem Sinkovskyi, Volodymyr Shulakov

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.