A comparative study of fintech payment services adoption among malaysian and indonesian fresh graduates: through the lens of UTAUT theory

DOI:

https://doi.org/10.15587/1729-4061.2022.265662Keywords:

performance expectancy, effort expectancy, social influence, Fintech, national culture, trustAbstract

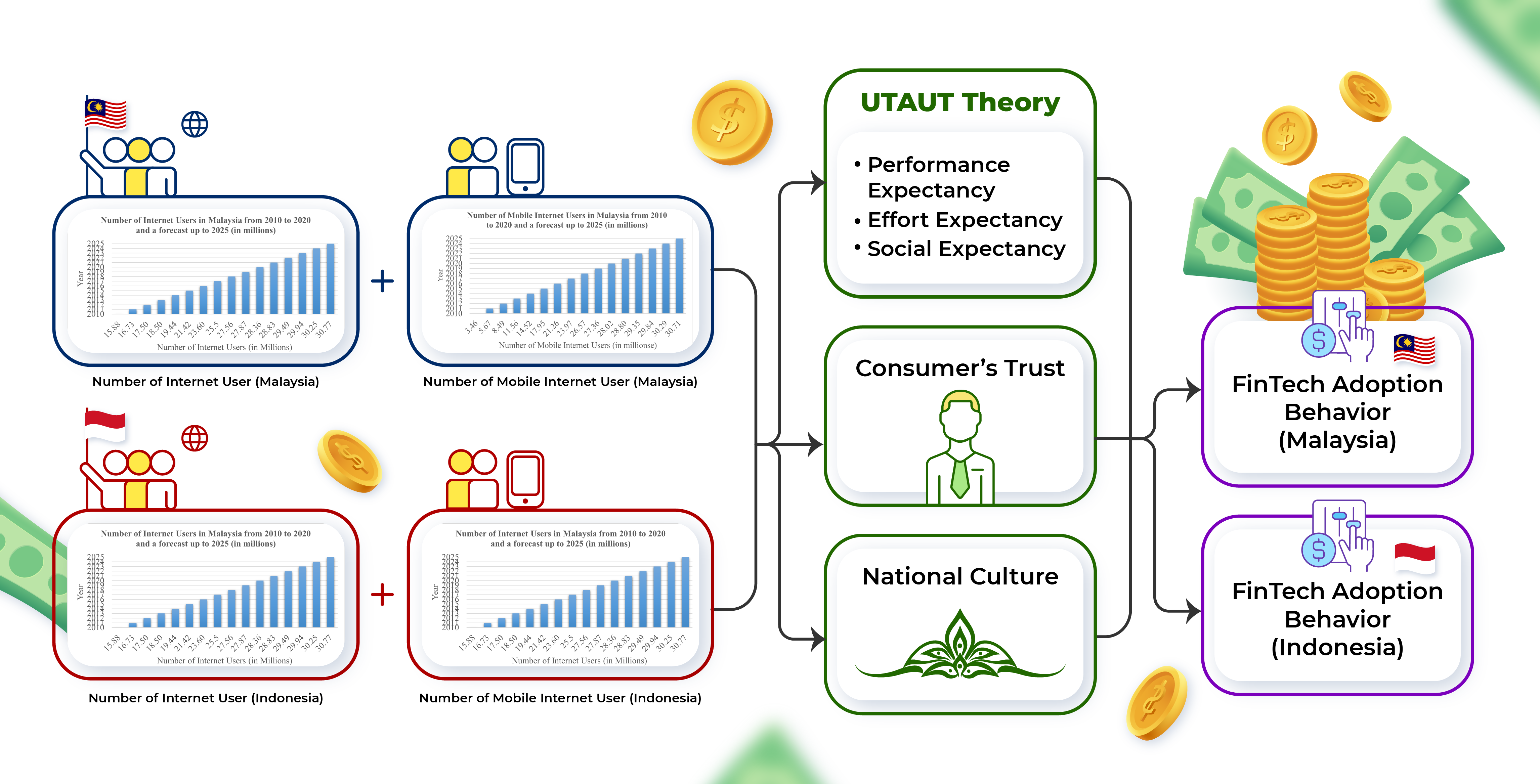

The Covid-19 pandemic had changed the business model in various industries. Companies have switched to digital business processes in order to survive in this challenging situation. Financial Technology (Fintech), especially digital payment services, has become the most preferred solution for handling financial transactions in conditions of limited mobility and interaction. The phenomenal emergence of Fintech has captured the attention of the world and the Asian region, including Malaysia and Indonesia. Despite various benefits offered by Fintech, the adoption rate is still relatively low, especially for IT-savvy groups of fresh graduates in both countries. This comparative study aims to analyze the adoption of Fintech payment services in Malaysia and Indonesia using the UTAUT theory approach.

The research measures the relationships between performance expectancy, effort expectancy, social influence, consumers’ trust, and national culture with the adoption of Fintech. Each indicator of national culture, such as individualism, power distance, uncertainty avoidance, masculinity and long-term orientation, was measured to see its relationship with the adoption rate.

The quantitative method was employed, and the data were collected via an online survey of a total of 486 respondents. Using multivariate regression analysis, 57.9 % behavioral adoption of Fintech payment services both in Malaysia and Indonesia was explained through performance expectancy, effort expectancy, social influence, customer trust and national culture. The study revealed that performance expectancy and the cultural factor individualism had the highest effect on the decision to adopt digital payment services. This study contributes to the Fintech ecosystem in both countries by providing some recommendations to Fintech providers, financial institutions, and governments in policy making. It is also expected that the research will support the government’s goal to become a cashless society as a strategy to increase financial inclusion.

References

- Mwiya, B., Chikumbi, F., Shikaputo, C., Kabala, E., Kaulung’ombe, B., Siachinji, B. (2017). Examining Factors Influencing E-Banking Adoption: Evidence from Bank Customers in Zambia. American Journal of Industrial and Business Management, 7 (6), 741–759. doi: https://doi.org/10.4236/ajibm.2017.76053

- Müller, J. (2021). Malaysia: number of internet users 2010–2025. Statista.com. Available at: https://www.statista.com/statistics/553752/number-of-internet-users-in-malaysia/

- We Are Social & Hootsuite (2021).

- Blohm, I., Leimeister, J. M., Krcmar, H. (2013). Crowdsourcing: How to Benefit from (Too) Many Great Ideas. MIS Quarterly Executive, 12, 199–211.

- Fintech Shows Strong Growth Momentum in Malaysia (2021). Fintech News Malaysia. Available at: https://fintechnews.my/29891/various/fintech-shows-strong-growth-momentum-in-malaysia/

- Kurniasari, F., Gunardi, A., Putri, F. P., Firmansyah, A. (2021). The role of financial technology to increase financial inclusion in Indonesia. International Journal of Data and Network Science, 5, 391–400. doi: https://doi.org/10.5267/j.ijdns.2021.5.004

- The global findex database 2021: measuring financial inclusion around the world (2021). World Bank.

- Dorfleitner, G., Hornuf, L., Schmitt, M., Weber, M. (2016). The Fintech Market in Germany. SSRN Electronic Journal. doi: https://doi.org/10.2139/ssrn.2885931

- Indonesia Fintech Report and Map (2020). Fintech Singapore. Available at: https://fintechnews.sg/45513/indonesia/indonesia-fintech-report-and-map-2020/

- Quarterly Bulletin 2021 (2021). Bank Negara Malaysia Publisher. Available at: https://www.bnm.gov.my/quarterly-bulletin-2021

- Asosiasi Penyelenggara Jasa Internet Indonesia. Laporan Survei Internet APJII and Indonesia Survey Center 2019 – 2020 (Q2) (2021). Available at: https://apjii.or.id/content/read/39/521/Hasil-Survei-Internet-APJII-2019-2020-Q2

- Statista. Malaysia: Statistics & Facts. Available at: https://www.statista.com/map/asia/malaysia/

- Ahmad, S., Tajul Urus, S., Syed Mustapha Nazri, S. N. F. (2021). Technology Acceptance of Financial Technology (Fintech) for Payment Services Among Employed Fresh Graduates. Asia-Pacific Management Accounting Journal, 16 (2), 27–58. doi: https://doi.org/10.24191/apmaj.v16i2-02

- Mathews, M. S. (2020). Trust fresh graduates to deliver. New Straits Times. Available at: https://www.nst.com.my/opinion/letters/2020/02/568669/trust-fresh-graduates-deliver

- Zhang, Y., Li, H., Hai, M., Li, J., Li, A. (2017). Determinants of loan funded successful in online P2P Lending. Procedia Computer Science, 122, 896–901. doi: https://doi.org/10.1016/j.procs.2017.11.452

- Minkov, M. (2013). The concept of culture in cross-cultural analysis: The science and art of comparing the world's modern societies and their cultures. SAGE Publications, 9–18.

- Venkatesh, Morris, Davis, Davis (2003). User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly, 27 (3), 425. doi: https://doi.org/10.2307/30036540

- Chikondi Daka, G., Phiri, J. (2019). Factors Driving the Adoption of E-banking Services Based on the UTAUT Model. International Journal of Business and Management, 14 (6), 43. doi: https://doi.org/10.5539/ijbm.v14n6p43

- Davis, F. D. (1993). User acceptance of information technology: system characteristics, user perceptions and behavioral impacts. International Journal of Man-Machine Studies, 38 (3), 475–487. doi: https://doi.org/10.1006/imms.1993.1022

- Kurniasari, F., Abd Hamid, N., Qinghui, C. (2020). The Effect of Perceived Usefulness, Perceived Ease of Use, Trust, Attitude and Satisfaction Into Continuance of Intention in Using Alipay, Management & Accounting Review, 19 (2). Available at: https://mar.uitm.edu.my/index.php/19-2/12-cv19n02/46-vol-19-2-article-7

- Hofstede-Insights. Available at: https://www.hofstede-insights.com/

- Lee, J.-H., Song, C.-H. (2013). Effects of trust and perceived risk on user acceptance of a new technology service. Social Behavior and Personality: An International Journal, 41 (4), 587–597. doi: https://doi.org/10.2224/sbp.2013.41.4.587

- Arpaci, I. (2016). Understanding and predicting students’ intention to use mobile cloud storage services, Computing Human Behavior, 58, 150–157. doi: https://doi.org/10.1016/j.chb.2015.12.067

- Malaquias, F. F., Hwang, Y. (2016). Trust in mobile banking under conditions of information asymmetry. Information Development, 32 (5), 1600–1612. doi: https://doi.org/10.1177/0266666915616164

- Pavlou, P. A., Gefen, D. (2004). Building Effective Online Marketplaces with Institution-Based Trust. Information Systems Research, 15 (1), 37–59. doi: https://doi.org/10.1287/isre.1040.0015

- Abd Hamid, N., Kurniasari, F., Hakimah, A. M. T., Fairuz, T. E., Nor, H. M. S., Morazah, M. A., Nurshamimi, S. (2018). A comparative study of Malaysian and Indonesian students’ entrepreneurial characteristics and career choices resulting from the digital economy. International Journal of Supply Chain Management, 7 (5), 250–258.

- Li, Y., Huang, J. (2009). Applying theory of perceived risk and technology acceptance model in the online shopping channel. World Academy of Science, Engineering and Technology, 9–12.

- Schierz, P. G., Schilke, O., Wirtz, B. W. (2010). Understanding consumer acceptance of mobile payment services: An empirical analysis. Electronic Commerce Research and Applications, 9 (3), 209–216. doi: https://doi.org/10.1016/j.elerap.2009.07.005

- Davidson, S., Wilson, T. (2008). Submission to the Review of the National Innovation System.

- Williams, R. (2008). Keywords: A vocabulary of culture and society, London: London Fontana Press.

- Nunnaly, J. (1978). Psychometric Theory. New York: McGraw-Hill, 64–65.

- Sekaran, U., Bougie, R. J. (2016). Research methods for business: A skill building approach. WileyPLUS Learning Space Card.

- Maureen Nelloh, L. A., Santoso, A. S., Slamet, M. W. (2019). Will Users Keep Using Mobile Payment? It Depends on Trust and Cognitive Perspectives. Procedia Computer Science, 161, 1156–1164. doi: https://doi.org/10.1016/j.procs.2019.11.228

- Hasan, R. (2021). Factors affecting adoption of Fintech in Bangladesh. International Journal of Science and Business, 5 (9), 156–164.

- Wiradinata, T. (2018). Mobile Payment Services Adoption: The Role of Perceived Technology Risk. 2018 International Conference on Orange Technologies (ICOT). doi: https://doi.org/10.1109/icot.2018.8705859

- Alwi, S., Salleh, M. N. M., Razak, S. E. A., Naim, N. (2019). Consumer acceptance and adoption towards payment-type fintech services from Malaysian perspective. International Journal of Advanced Science and Technology, 28 (15), 148–163.

- Chong, T.-P., William Choo, K.-S., Yip, Y.-S., Chan, P.-Y., Julian Teh, H.-L., Ng, S.-S. (2019). An adoption of Fintech service in Malaysia. Southeast Asia Journal of Contemporary Business, Economics and Law, 18 (5), 134–147.

- Aji, H. M., Berakon, I., Riza, A. F. (2020). The effects of subjective norm and knowledge about riba on intention to use e-money in Indonesia. Journal of Islamic Marketing, 12 (6), 1180–1196. doi: https://doi.org/10.1108/jima-10-2019-0203

- Kalinić, Z., Liébana-Cabanillas, F. J., Muñoz-Leiva, F., Marinković, V. (2019). The moderating impact of gender on the acceptance of peer-to-peer mobile payment systems. International Journal of Bank Marketing, 38 (1), 138–158. doi: https://doi.org/10.1108/ijbm-01-2019-0012

- Graužinienė, S., Kuizinienė, D. (2021). Research on factors identification in FinTech acceptance: Lithuania context. Applied Economics: Systematic Research, 14 (1), 41–57. doi: https://doi.org/10.7220/aesr.2335.8742.2020.14.1.3

- Setiawan, B., Nugraha, D. P., Irawan, A., Nathan, R. J., Zoltan, Z. (2021). User Innovativeness and Fintech Adoption in Indonesia. Journal of Open Innovation: Technology, Market, and Complexity, 7 (3). doi: https://doi.org/10.3390/joitmc7030188

- Kurniasari, F., Urus, S. B. T., Utomo, P., Abd Hamid, N. B., Jimmy, S. Y., & Othman, I. W. Determinant Factors of Adoption of Fintech Payment Services in Indonesia using the UTAUT Approach. https://apmaj.uitm.edu.my/index.php/current/18-cv17n1/135-av17n1-4

- Rabaai, A. (2021). An Investigation into the Acceptance of Mobile Wallets in the FinTech Era: An Empirical Study from Kuwait. International Journal of Business Information Systems, 1 (1), 1. doi: https://doi.org/10.1504/ijbis.2021.10038422

- Tohang, V., Ramadhan, A. S., Djajadiningrat, V. (2021). An Empirical Study on Customer Acceptance of FinTech 3.0 in Private Banking. 2021 International Conference on Information Management and Technology (ICIMTech). doi: https://doi.org/10.1109/icimtech53080.2021.9535074

- Handarkho, Y. D., Harjoseputro, Y., Samodra, J. E., Irianto, A. B. P. (2021). Understanding proximity mobile payment continuance usage in Indonesia from a habit perspective. Journal of Asia Business Studies, 15 (3), 420–440. doi: https://doi.org/10.1108/jabs-02-2020-0046

- Sankaran, R., Chakraborty, S. (2022). Factors Impacting Mobile Banking in India: Empirical Approach Extending UTAUT2 with Perceived Value and Trust. IIM Kozhikode Society & Management Review, 11 (1), 7–24. doi: https://doi.org/10.1177/2277975220975219

- Gunadil, W., Lie, F., Susanto, M. (2020). Factors contributing to the adoption of Fintech in Indonesia. Psychology and Education Journal, 57 (9), 284–291.

- Malaysia. Hofstede Insights. Available at: https://www.hofstede-insights.com/country/malaysia/

- Tajul Urus, S., Mohamed, I. S. (2021). A Flourishing Fintech Ecosystem: Conceptualization and Governing Issues in Malaysia. Business and Economic Research, 11 (3), 106–131. doi: https://doi.org/10.5296/ber.v11i3.18729

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Sharina Tajul Urus, Florentina Kurniasari, Sharifah Nazatul Faiza Syed Mustapha Nazri, Prio Utomo, Intan Waheedah Othman, So Yohanes Jimmy, Nadiah Abd Hamid

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.