Порівняльне дослідження впровадження фінтех-послуг серед молодих фахівців малайзії та індонезії: через призму теорії UTAUT

DOI:

https://doi.org/10.15587/1729-4061.2022.265662Ключові слова:

очікувані результати, очікувані витрати зусиль, соціальний вплив, фінтех, національна культура, довіраАнотація

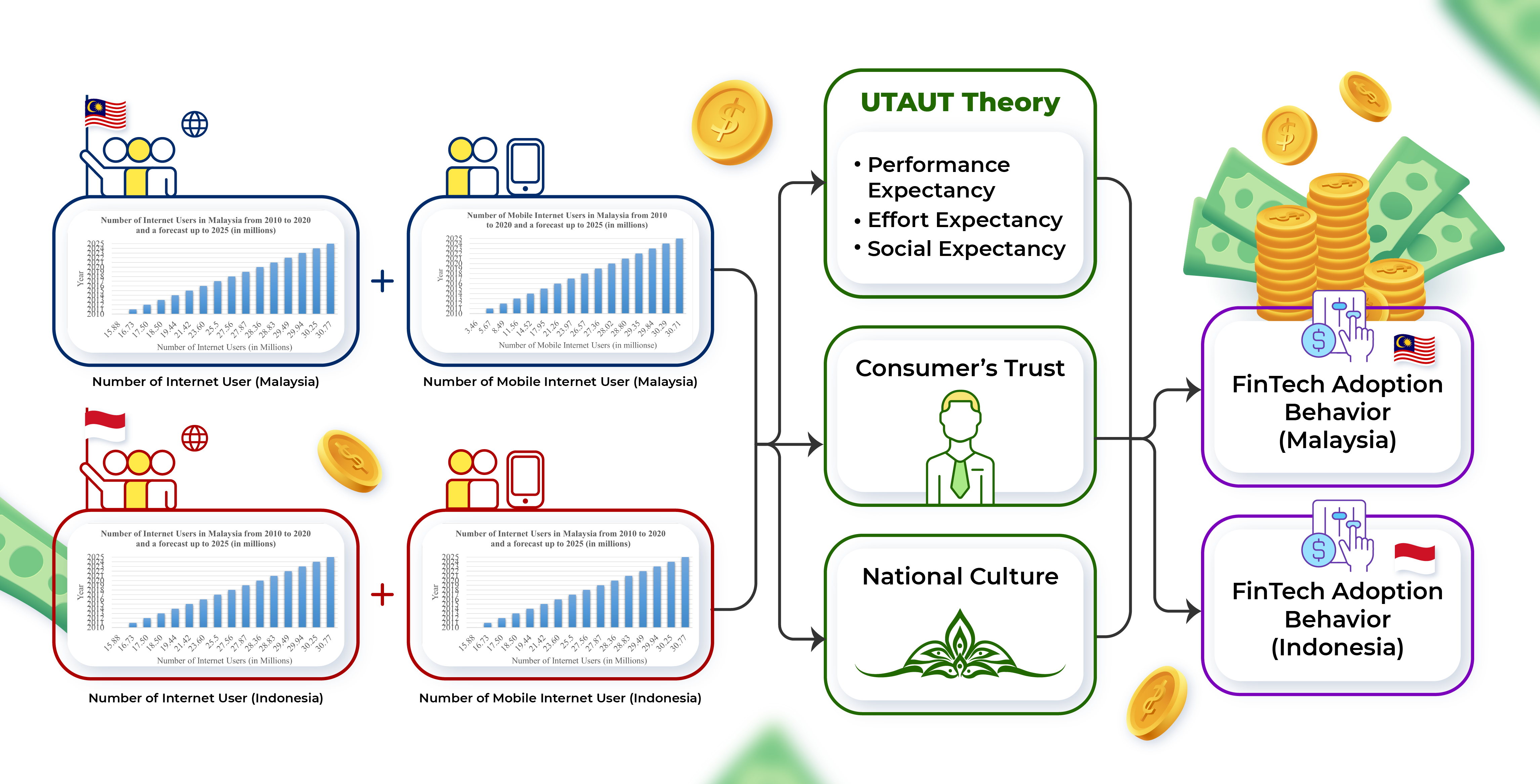

Пандемія Covid-19 змінила модель ділової діяльності у різних галузях. Щоб вистояти у цій непростій ситуації, компанії перейшли на цифрові бізнес-процеси. В умовах обмеженої мобільності та взаємодії, фінансові технології (фінтех), особливо послуги цифрових платежів, стали найкращим рішенням для обробки фінансових операцій. Феноменальна поява фінтеху привернула увагу всього світу та азіатського регіону, включаючи Малайзію та Індонезію. Незважаючи на різні переваги фінтеху, рівень впровадження залишається відносно низьким, особливо серед підкованих в ІТ молодих фахівців в обох країнах. Це порівняльне дослідження спрямоване на аналіз впровадження фінтех-послуг у Малайзії та Індонезії з використанням теорії UTAUT.

Дослідження вимірює взаємозв'язок між очікуваними результатами, очікуваними витратами зусиль, соціальним впливом, довірою клієнтів та національною культурою та впровадженням фінтеху. Виміряне співвідношення кожного показника національної культури, включаючи індивідуалізм, дистанцію влади, неприйняття невизначеності, маскулінність та довгострокову орієнтацію, з рівнем впровадження.

Був використаний кількісний метод, дані були зібрані за допомогою онлайн-опитування 486 респондентів. Використовуючи багатовимірний регресійний аналіз, 57,9 % випадків впровадження фінтех-послуг як у Малайзії, так і в Індонезії пояснювалися очікуваними результатами, очікуваними витратами зусиль, соціальним впливом, довірою клієнтів та національною культурою. Дослідження показало, що очікувані результати та культурний фактор індивідуалізму найбільше впливають на прийняття рішення про впровадження цифрових платіжних послуг. Дане дослідження сприяє розвитку екосистеми фінтеху в обох країнах, надаючи деякі рекомендації постачальникам фінтеху, фінансовим установам та урядам при розробці політики. Також очікується, що дослідження підтримає мету уряду стати безготівковим суспільством в якості стратегії підвищення фінансової інклюзивності.

Посилання

- Mwiya, B., Chikumbi, F., Shikaputo, C., Kabala, E., Kaulung’ombe, B., Siachinji, B. (2017). Examining Factors Influencing E-Banking Adoption: Evidence from Bank Customers in Zambia. American Journal of Industrial and Business Management, 7 (6), 741–759. doi: https://doi.org/10.4236/ajibm.2017.76053

- Müller, J. (2021). Malaysia: number of internet users 2010–2025. Statista.com. Available at: https://www.statista.com/statistics/553752/number-of-internet-users-in-malaysia/

- We Are Social & Hootsuite (2021).

- Blohm, I., Leimeister, J. M., Krcmar, H. (2013). Crowdsourcing: How to Benefit from (Too) Many Great Ideas. MIS Quarterly Executive, 12, 199–211.

- Fintech Shows Strong Growth Momentum in Malaysia (2021). Fintech News Malaysia. Available at: https://fintechnews.my/29891/various/fintech-shows-strong-growth-momentum-in-malaysia/

- Kurniasari, F., Gunardi, A., Putri, F. P., Firmansyah, A. (2021). The role of financial technology to increase financial inclusion in Indonesia. International Journal of Data and Network Science, 5, 391–400. doi: https://doi.org/10.5267/j.ijdns.2021.5.004

- The global findex database 2021: measuring financial inclusion around the world (2021). World Bank.

- Dorfleitner, G., Hornuf, L., Schmitt, M., Weber, M. (2016). The Fintech Market in Germany. SSRN Electronic Journal. doi: https://doi.org/10.2139/ssrn.2885931

- Indonesia Fintech Report and Map (2020). Fintech Singapore. Available at: https://fintechnews.sg/45513/indonesia/indonesia-fintech-report-and-map-2020/

- Quarterly Bulletin 2021 (2021). Bank Negara Malaysia Publisher. Available at: https://www.bnm.gov.my/quarterly-bulletin-2021

- Asosiasi Penyelenggara Jasa Internet Indonesia. Laporan Survei Internet APJII and Indonesia Survey Center 2019 – 2020 (Q2) (2021). Available at: https://apjii.or.id/content/read/39/521/Hasil-Survei-Internet-APJII-2019-2020-Q2

- Statista. Malaysia: Statistics & Facts. Available at: https://www.statista.com/map/asia/malaysia/

- Ahmad, S., Tajul Urus, S., Syed Mustapha Nazri, S. N. F. (2021). Technology Acceptance of Financial Technology (Fintech) for Payment Services Among Employed Fresh Graduates. Asia-Pacific Management Accounting Journal, 16 (2), 27–58. doi: https://doi.org/10.24191/apmaj.v16i2-02

- Mathews, M. S. (2020). Trust fresh graduates to deliver. New Straits Times. Available at: https://www.nst.com.my/opinion/letters/2020/02/568669/trust-fresh-graduates-deliver

- Zhang, Y., Li, H., Hai, M., Li, J., Li, A. (2017). Determinants of loan funded successful in online P2P Lending. Procedia Computer Science, 122, 896–901. doi: https://doi.org/10.1016/j.procs.2017.11.452

- Minkov, M. (2013). The concept of culture in cross-cultural analysis: The science and art of comparing the world's modern societies and their cultures. SAGE Publications, 9–18.

- Venkatesh, Morris, Davis, Davis (2003). User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly, 27 (3), 425. doi: https://doi.org/10.2307/30036540

- Chikondi Daka, G., Phiri, J. (2019). Factors Driving the Adoption of E-banking Services Based on the UTAUT Model. International Journal of Business and Management, 14 (6), 43. doi: https://doi.org/10.5539/ijbm.v14n6p43

- Davis, F. D. (1993). User acceptance of information technology: system characteristics, user perceptions and behavioral impacts. International Journal of Man-Machine Studies, 38 (3), 475–487. doi: https://doi.org/10.1006/imms.1993.1022

- Kurniasari, F., Abd Hamid, N., Qinghui, C. (2020). The Effect of Perceived Usefulness, Perceived Ease of Use, Trust, Attitude and Satisfaction Into Continuance of Intention in Using Alipay, Management & Accounting Review, 19 (2). Available at: https://mar.uitm.edu.my/index.php/19-2/12-cv19n02/46-vol-19-2-article-7

- Hofstede-Insights. Available at: https://www.hofstede-insights.com/

- Lee, J.-H., Song, C.-H. (2013). Effects of trust and perceived risk on user acceptance of a new technology service. Social Behavior and Personality: An International Journal, 41 (4), 587–597. doi: https://doi.org/10.2224/sbp.2013.41.4.587

- Arpaci, I. (2016). Understanding and predicting students’ intention to use mobile cloud storage services, Computing Human Behavior, 58, 150–157. doi: https://doi.org/10.1016/j.chb.2015.12.067

- Malaquias, F. F., Hwang, Y. (2016). Trust in mobile banking under conditions of information asymmetry. Information Development, 32 (5), 1600–1612. doi: https://doi.org/10.1177/0266666915616164

- Pavlou, P. A., Gefen, D. (2004). Building Effective Online Marketplaces with Institution-Based Trust. Information Systems Research, 15 (1), 37–59. doi: https://doi.org/10.1287/isre.1040.0015

- Abd Hamid, N., Kurniasari, F., Hakimah, A. M. T., Fairuz, T. E., Nor, H. M. S., Morazah, M. A., Nurshamimi, S. (2018). A comparative study of Malaysian and Indonesian students’ entrepreneurial characteristics and career choices resulting from the digital economy. International Journal of Supply Chain Management, 7 (5), 250–258.

- Li, Y., Huang, J. (2009). Applying theory of perceived risk and technology acceptance model in the online shopping channel. World Academy of Science, Engineering and Technology, 9–12.

- Schierz, P. G., Schilke, O., Wirtz, B. W. (2010). Understanding consumer acceptance of mobile payment services: An empirical analysis. Electronic Commerce Research and Applications, 9 (3), 209–216. doi: https://doi.org/10.1016/j.elerap.2009.07.005

- Davidson, S., Wilson, T. (2008). Submission to the Review of the National Innovation System.

- Williams, R. (2008). Keywords: A vocabulary of culture and society, London: London Fontana Press.

- Nunnaly, J. (1978). Psychometric Theory. New York: McGraw-Hill, 64–65.

- Sekaran, U., Bougie, R. J. (2016). Research methods for business: A skill building approach. WileyPLUS Learning Space Card.

- Maureen Nelloh, L. A., Santoso, A. S., Slamet, M. W. (2019). Will Users Keep Using Mobile Payment? It Depends on Trust and Cognitive Perspectives. Procedia Computer Science, 161, 1156–1164. doi: https://doi.org/10.1016/j.procs.2019.11.228

- Hasan, R. (2021). Factors affecting adoption of Fintech in Bangladesh. International Journal of Science and Business, 5 (9), 156–164.

- Wiradinata, T. (2018). Mobile Payment Services Adoption: The Role of Perceived Technology Risk. 2018 International Conference on Orange Technologies (ICOT). doi: https://doi.org/10.1109/icot.2018.8705859

- Alwi, S., Salleh, M. N. M., Razak, S. E. A., Naim, N. (2019). Consumer acceptance and adoption towards payment-type fintech services from Malaysian perspective. International Journal of Advanced Science and Technology, 28 (15), 148–163.

- Chong, T.-P., William Choo, K.-S., Yip, Y.-S., Chan, P.-Y., Julian Teh, H.-L., Ng, S.-S. (2019). An adoption of Fintech service in Malaysia. Southeast Asia Journal of Contemporary Business, Economics and Law, 18 (5), 134–147.

- Aji, H. M., Berakon, I., Riza, A. F. (2020). The effects of subjective norm and knowledge about riba on intention to use e-money in Indonesia. Journal of Islamic Marketing, 12 (6), 1180–1196. doi: https://doi.org/10.1108/jima-10-2019-0203

- Kalinić, Z., Liébana-Cabanillas, F. J., Muñoz-Leiva, F., Marinković, V. (2019). The moderating impact of gender on the acceptance of peer-to-peer mobile payment systems. International Journal of Bank Marketing, 38 (1), 138–158. doi: https://doi.org/10.1108/ijbm-01-2019-0012

- Graužinienė, S., Kuizinienė, D. (2021). Research on factors identification in FinTech acceptance: Lithuania context. Applied Economics: Systematic Research, 14 (1), 41–57. doi: https://doi.org/10.7220/aesr.2335.8742.2020.14.1.3

- Setiawan, B., Nugraha, D. P., Irawan, A., Nathan, R. J., Zoltan, Z. (2021). User Innovativeness and Fintech Adoption in Indonesia. Journal of Open Innovation: Technology, Market, and Complexity, 7 (3). doi: https://doi.org/10.3390/joitmc7030188

- Kurniasari, F., Urus, S. B. T., Utomo, P., Abd Hamid, N. B., Jimmy, S. Y., & Othman, I. W. Determinant Factors of Adoption of Fintech Payment Services in Indonesia using the UTAUT Approach. https://apmaj.uitm.edu.my/index.php/current/18-cv17n1/135-av17n1-4

- Rabaai, A. (2021). An Investigation into the Acceptance of Mobile Wallets in the FinTech Era: An Empirical Study from Kuwait. International Journal of Business Information Systems, 1 (1), 1. doi: https://doi.org/10.1504/ijbis.2021.10038422

- Tohang, V., Ramadhan, A. S., Djajadiningrat, V. (2021). An Empirical Study on Customer Acceptance of FinTech 3.0 in Private Banking. 2021 International Conference on Information Management and Technology (ICIMTech). doi: https://doi.org/10.1109/icimtech53080.2021.9535074

- Handarkho, Y. D., Harjoseputro, Y., Samodra, J. E., Irianto, A. B. P. (2021). Understanding proximity mobile payment continuance usage in Indonesia from a habit perspective. Journal of Asia Business Studies, 15 (3), 420–440. doi: https://doi.org/10.1108/jabs-02-2020-0046

- Sankaran, R., Chakraborty, S. (2022). Factors Impacting Mobile Banking in India: Empirical Approach Extending UTAUT2 with Perceived Value and Trust. IIM Kozhikode Society & Management Review, 11 (1), 7–24. doi: https://doi.org/10.1177/2277975220975219

- Gunadil, W., Lie, F., Susanto, M. (2020). Factors contributing to the adoption of Fintech in Indonesia. Psychology and Education Journal, 57 (9), 284–291.

- Malaysia. Hofstede Insights. Available at: https://www.hofstede-insights.com/country/malaysia/

- Tajul Urus, S., Mohamed, I. S. (2021). A Flourishing Fintech Ecosystem: Conceptualization and Governing Issues in Malaysia. Business and Economic Research, 11 (3), 106–131. doi: https://doi.org/10.5296/ber.v11i3.18729

##submission.downloads##

Опубліковано

Як цитувати

Номер

Розділ

Ліцензія

Авторське право (c) 2022 Sharina Tajul Urus, Florentina Kurniasari, Sharifah Nazatul Faiza Syed Mustapha Nazri, Prio Utomo, Intan Waheedah Othman, So Yohanes Jimmy, Nadiah Abd Hamid

Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License.

Закріплення та умови передачі авторських прав (ідентифікація авторства) здійснюється у Ліцензійному договорі. Зокрема, автори залишають за собою право на авторство свого рукопису та передають журналу право першої публікації цієї роботи на умовах ліцензії Creative Commons CC BY. При цьому вони мають право укладати самостійно додаткові угоди, що стосуються неексклюзивного поширення роботи у тому вигляді, в якому вона була опублікована цим журналом, але за умови збереження посилання на першу публікацію статті в цьому журналі.

Ліцензійний договір – це документ, в якому автор гарантує, що володіє усіма авторськими правами на твір (рукопис, статтю, тощо).

Автори, підписуючи Ліцензійний договір з ПП «ТЕХНОЛОГІЧНИЙ ЦЕНТР», мають усі права на подальше використання свого твору за умови посилання на наше видання, в якому твір опублікований. Відповідно до умов Ліцензійного договору, Видавець ПП «ТЕХНОЛОГІЧНИЙ ЦЕНТР» не забирає ваші авторські права та отримує від авторів дозвіл на використання та розповсюдження публікації через світові наукові ресурси (власні електронні ресурси, наукометричні бази даних, репозитарії, бібліотеки тощо).

За відсутності підписаного Ліцензійного договору або за відсутністю вказаних в цьому договорі ідентифікаторів, що дають змогу ідентифікувати особу автора, редакція не має права працювати з рукописом.

Важливо пам’ятати, що існує і інший тип угоди між авторами та видавцями – коли авторські права передаються від авторів до видавця. В такому разі автори втрачають права власності на свій твір та не можуть його використовувати в будь-який спосіб.