Devising ways to improve the financial and tax mechanisms for overcoming the socio-economic crisis caused by martial law

DOI:

https://doi.org/10.15587/1729-4061.2022.268376Keywords:

financial and tax mechanism, socio-economic crisis, digital transformation, financial and legal regulation, social policyAbstract

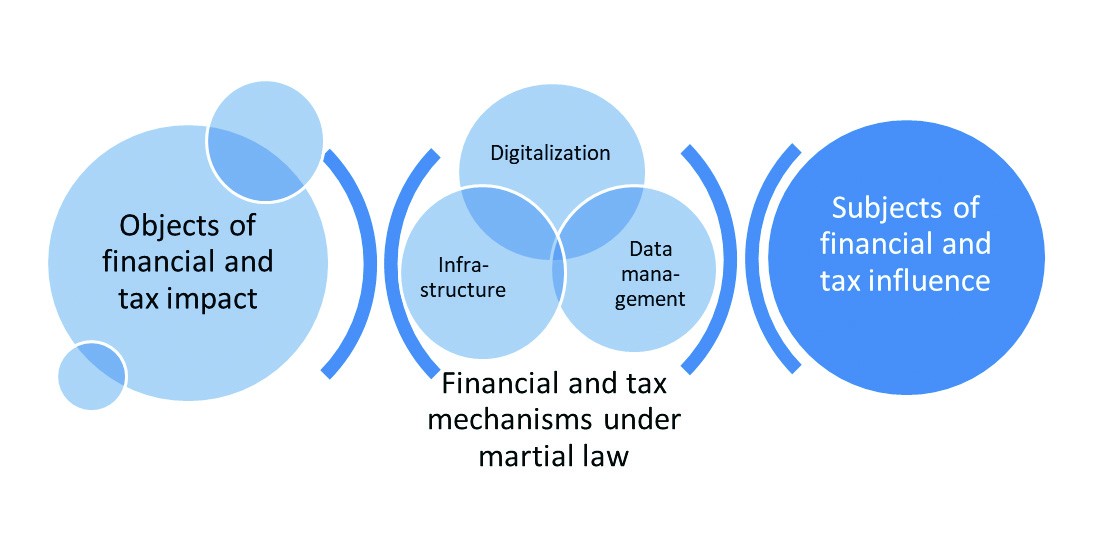

The object of this study is the process of improving financial and tax mechanisms to overcome the socio-economic crisis caused by martial law in Ukraine in the context of digital transformation. During the study, the problem of non-compliance of the existing financial and tax mechanisms with the requirements of digital transformation and the peculiarities of the functioning of the financial sphere under martial law was solved. The key elements of financial and tax mechanisms that should be primarily revised in order to overcome the socio-economic crisis have been clarified. The shortcomings of the functioning of financial and tax mechanisms for overcoming the socio-economic crisis are highlighted. The results of a survey of experts on the proposed factors influencing the effectiveness of such mechanisms were analyzed using the Kendall's concordance coefficient. The most significant factors that formed the basis for the developed directions for improving the financial and tax mechanisms for overcoming the socio-economic crisis have been established. The peculiarities and distinctive features of the results obtained are unanimous consideration of the requirements of digital transformation and the peculiarities of the functioning of the financial sphere under martial law. The financial and tax mechanisms improved on the basis of digital technology are based on the declared principles of G20 digital financial inclusion. The most significant factors of influence were the infrastructure of financial and tax mechanisms; legal and regulatory framework for digitalization; combating digital fraud; adaptation of foreign experience in the use of digital technologies to the national environment. The results can be used in the practical activities of the financial authorities of Ukraine in order to overcome the socio-economic crisis under martial law

References

- Dmytryk, O. O., Kostenko, Y. O., Monaienko, A. O., Riadinska, V. O., Soldatenko, O. V. (2020). State Legal Forms of Interaction with Debt Obligations and State Losses. Journal of Advanced Research in Law and Economics, 11 (2), 342. doi: https://doi.org/10.14505/jarle.v11.2(48).07

- Stratehiya rozvytku finansovoho sektoru Ukrainy do 2025 roku. Available at: https://bank.gov.ua/admin_uploads/article/Strategy_FS_2025.pdf?v=4

- Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 on electronic identification and trust services for electronic transactions in the internal market and repealing Directive 1999/93/EC. Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=uriserv%3AOJ.L_.2014.257.01.0073.01.ENG

- Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 on the protection of natural persons with regard to the processing of personal data and on the free movement of such data, and repealing Directive 95/46/EC (General Data Protection Regulation). Available at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32016R0679

- Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC. Available at: https://eur-lex.europa.eu/legal-content/%20EN/TXT/?uri=CELEX%3A32015L2366

- Yaroshenko, O. M., Sliusar, A. M., Sereda, O. H., Zakrynytska, V. O. (2019). Legal relation: The issues of delineation (on the basis of the civil law of Ukraine). Asia Life Sciences: The Asian International Journal of Life Sciences, 21 (2), 719–734.

- Yaroshenko, O. M., Inshyn, M. I., Vapnyarchuk, N. M., Yakovlyev, O. A., Sereda, O. H. (2022). Non-compete agreement in Ukraine. Informatologia, 55 (1-2), 1–13. doi: https://doi.org/10.32914/i.55.1-2.1

- Kraus, K., Kraus, N., Pochenchuk, G. (2022). Institutional aspects and digitalization of financial inclusion in the national economy. Innovation and Sustainability, 2, 18–28. doi: https://doi.org/10.31649/ins.2022.2.18.28

- Demianyshyn, V. (2017). Tax mechanism of budget revenues formation: the conceptual foundations of theory and modernization trends. World of Finance, 2 (51), 84–96. doi: https://doi.org/10.35774/sf2017.02.084

- Dmytrenko, E. S. (2022). Improvement of financial legislation in the conditions of digitalization of the financial system of Ukraine – the need for today. Kyiv Law Journal, 1, 111–116. doi: https://doi.org/10.32782/klj/2022.1.17

- Bechko, P., Bechko, V., Lisa, N., Ptashnyk, S. (2021). Tax management in the tax administration system. Ekonomika Ta Derzhava, 11, 79. doi: https://doi.org/10.32702/2306-6806.2021.11.79

- Honcharov, Yu. V., Shtuler, I. Y., Ovechkina, O. A., Shtan, M. V. (2020). Digitization as a means of implementing changes in the transitive model of power-property-labor relations in Ukraine. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 5, 170–175. doi: https://doi.org/10.33271/nvngu/2021-5/170

- Sova, O., Radzivilov, H., Shyshatskyi, A., Shvets, P., Tkachenko, V., Nevhad, S. et al. (2022). Development of a method to improve the reliability of assessing the condition of the monitoring object in special-purpose information systems. Eastern-European Journal of Enterprise Technologies, 2 (3 (116)), 6–14. doi: https://doi.org/10.15587/1729-4061.2022.254122

- Dunayev, I., Kud, A., Latynin, M., Kosenko, A., Kosenko, V., Kobzev, I. (2021). Improving methods for evaluating the results of digitizing public corporations. Eastern-European Journal of Enterprise Technologies, 6 (13 (114)), 17–28. doi: https://doi.org/10.15587/1729-4061.2021.248122

- Al-Busaidi, K. A., Al-Muharrami, S. (2020). Beyond profitability: ICT investments and financial institutions performance measures in developing economies. Journal of Enterprise Information Management, 34 (3), 900–921. doi: https://doi.org/10.1108/jeim-09-2019-0250

- Baber, W. W., Ojala, A., Martinez, R. (2019). Effectuation logic in digital business model transformation. Journal of Small Business and Enterprise Development, 26 (6/7), 811–830. doi: https://doi.org/10.1108/jsbed-04-2019-0139

- Wrede, M., Velamuri, V. K., Dauth, T. (2020). Top managers in the digital age: Exploring the role and practices of top managers in firms’ digital transformation. Managerial and Decision Economics, 41 (8), 1549–1567. doi: https://doi.org/10.1002/mde.3202

- Baptista, J., Stein, M.-K., Klein, S., Watson-Manheim, M. B., Lee, J. (2020). Digital work and organisational transformation: Emergent Digital/Human work configurations in modern organisations. The Journal of Strategic Information Systems, 29 (2), 101618. doi: https://doi.org/10.1016/j.jsis.2020.101618

- Chanias, S., Myers, M. D., Hess, T. (2019). Digital transformation strategy making in pre-digital organizations: The case of a financial services provider. The Journal of Strategic Information Systems, 28 (1), 17–33. doi: https://doi.org/10.1016/j.jsis.2018.11.003

- Ozili, P. K. (2018). Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review, 18 (4), 329–340. doi: https://doi.org/10.1016/j.bir.2017.12.003

- Iefymenko, T. I. (2020). Fiscal Regulation of National Economies' Sustainable Growth. Nauka ta innovacii, 16 (5), 21–38. doi: https://doi.org/10.15407/scin16.05.021

- Dmytryk, O. O., Tokareva, K. O., Kolisnyk, A. S. (2021). Tsyfrovi tekhnolohiyi ta yikh vplyv na publichnu finansovu diyalnist. Kontseptsiia «Industriya 4.0»: problemy vprovadzhennia i okremi pravovi aspekty yii realizatsiyi v Ukraini. Kharkiv: NDI prav. zabezp. innovats. rozvytku NAPrN Ukrainy, 63–94. Available at: https://ndipzir.org.ua/wp-content/uploads/2022/02/monografiya-industriya_2021.pdf

- Gnatenko, K. V., Yaroshenko, O. M., Inshyn, M. I., Vapnyarchuk, N. M., Sereda, O. H. (2021). Targeted and Effective Use of State and Non-State Social Funds. International Journal of Criminology and Sociology, 9, 2861–2869. Available at: https://www.lifescienceglobal.com/pms/index.php/ijcs/article/view/8069

- Korol, V., Dmytryk, O., Karpenko, O., Riadinska, V., Basiuk, O., Kobylnik, D. et al. (2022). Elaboration of recommendations on the development of the state internal audit system when applying the digital technologies. Eastern-European Journal of Enterprise Technologies, 1 (13 (115)), 39–48. doi: https://doi.org/10.15587/1729-4061.2022.252424

- Yahelska, K., Tropina, V., Khomutenko, A., Petlenko, Y., Lantukh, K., Kryhan, Y. (2021). Comparative Analysis of Methods for Forecasting Budget Indicators. Studies of Applied Economics, 39 (3). doi: https://doi.org/10.25115/eea.v39i3.4521

- Dmytryk, O., Tokarieva, K. (2021). Current trends in budget and legal regulation. Law and Innovations, 4 (36), 91–97. doi: https://doi.org/10.37772/2518-1718-2021-4(36)-13

- Dmytryk, O. O., Kotenko, A. M., Smychok, Y. M. (2019). Influence of principles of tax legislation on business management in Ukraine. Financial and Credit Activity Problems of Theory and Practice, 1 (28), 105–113. doi: https://doi.org/10.18371/fcaptp.v1i28.163685

- G20 High Level Principles for Digital Financial Inclusion. Available at: https://www.gpfi.org/sites/gpfi/files/documents/G20-HLP-Summary_0.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Olga Dmytryk, Olena Sereda, Katerina Tokarieva, Mushfik Damirchyiev, Iliana Zinovatna

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.