Development and justification of the system methodological approach to assessing the investment business project implementation efficiency under conditions of the external market environment factors impact

DOI:

https://doi.org/10.15587/1729-4061.2023.279621Keywords:

mathematical model, forecasting the effectiveness of a business project, synergistic approach, net present valueAbstract

Evaluating the effectiveness of the implementation of an investment project is a key issue when making management decisions both at the stage of setting up a startup and for expanding an existing business.

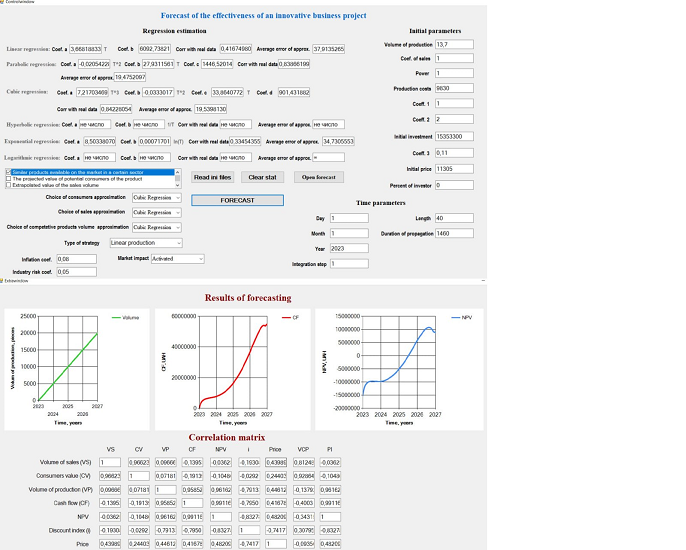

This paper reports a systematic approach to building a mathematical model to solve the task of forecasting the effectiveness of business projects, taking into account the influence of factors of the external economic environment. Proposed factors include the impact of supply and demand on the price of goods, political and industry risks, the volume of commodity supply and sales. In view of this, a method for calculating the political component of the discount coefficient using the Fourier series has been proposed. Using the theory of differential equations, correlation and regression analysis, a mathematical model for forecasting indicators of efficiency of business project implementation taking into account the influence of factors of the external economic environment has been constructed. Based on it, a generalized algorithm for applying a mathematical model to predict the effectiveness of investment projects in various business sectors has been developed.

The results from applying differential equations and variable discount coefficient showed a decrease in NPV by 14 %, and PI by 5.1 %, due to more accurate consideration of the political component in calculating the discount factor. Also, with the influence of supply and demand on the price of goods and nonlinear cash flows, it was found that the payback period does not clearly indicate the effectiveness of the implementation of an investment business project. Determining these factors provides more accurate information to the investor or business owner when forecasting the stability of a business project for making management decisions on its implementation

References

- Dilaver, Ö., Calvert Jump, R., Levine, P. (2018). Agent‐based macroeconomics and dynamic stochastic general equilibrium models: where do we go from here? Journal of Economic Surveys, 32 (4), 1134–1159. doi: https://doi.org/10.1111/joes.12249

- Téllez León, I., Venegas Martínez, F., Rodríguez Nava, A. (2011). Inflation Volatility and Growth in a Stochastic Small Open Economy: A Mixed Jump-Diffusion Approach. Economía Teoría y Práctica, 35. doi: https://doi.org/10.24275/etypuam/ne/352011/tellez

- Vines, D., Wills, S. (2018). The rebuilding macroeconomic theory project: an analytical assessment. Oxford Review of Economic Policy, 34 (1-2), 1–42. doi: https://doi.org/10.1093/oxrep/grx062

- Stiglitz, J. E. (2018). Where modern macroeconomics went wrong. Oxford Review of Economic Policy, 34 (1-2), 70–106. Available at: https://academic.oup.com/oxrep/article/34/1-2/70/4781816

- Blanchard, O. (2018). On the future of macroeconomic models. Oxford Review of Economic Policy, 34 (1-2), 43–54. doi: https://doi.org/10.1093/oxrep/grx045

- Brynjolfsson, E., Jin, W., McElheran, K. (2021). The power of prediction: predictive analytics, workplace complements, and business performance. Business Economics, 56 (4), 217–239. doi: https://doi.org/10.1057/s11369-021-00224-5

- Kuzhda, Т. (2012). Retail sales forecasting with application the multiple regression. Sotsialno-ekonomichni problemy i derzhava, 1 (6), 91–101. Available at: https://elartu.tntu.edu.ua/bitstream/123456789/1716/4/12ktibrm.pdf

- Adams, P. A., Adrian, T., Boyarchenko, N., Giannone, D. (2021). Forecasting macroeconomic risks. International Journal of Forecasting, 37 (3), 1173–1191. doi: https://doi.org/10.1016/j.ijforecast.2021.01.003

- Kumar, V., Garg, M. L. (2018). Predictive Analytics: A Review of Trends and Techniques. International Journal of Computer Applications, 182 (1), 31–37. doi: https://doi.org/10.5120/ijca2018917434

- Maliar, L., Maliar, S., Winant, P. (2021). Deep learning for solving dynamic economic models. Journal of Monetary Economics, 122, 76–101. doi: https://doi.org/10.1016/j.jmoneco.2021.07.004

- Karaca, Y., Baleanu, D. (2022). Evolutionary Mathematical Science, Fractional Modeling and Artificial Intelligence of Nonlinear Dynamics in Complex Systems. Chaos Theory and Applications, 4 (3), 111–118. Available at: https://dergipark.org.tr/en/pub/chaos/issue/73033/1188154

- Swanson, N. R., Xiong, W. (2018). Big data analytics in economics: What have we learned so far, and where should we go from here? Canadian Journal of Economics/Revue Canadienne d’économique, 51 (3), 695–746. doi: https://doi.org/10.1111/caje.12336

- de Resende, C. C., Pereira, A. C. M., Cardoso, R. T. N., de Magalhães, A. R. B. (2017). Investigating market efficiency through a forecasting model based on differential equations. Physica A: Statistical Mechanics and Its Applications, 474, 199–212. doi: https://doi.org/10.1016/j.physa.2017.01.057

- Liu, W. W., Liu, Y., Chan, N. H. (2018). Modeling eBay price using stochastic differential equations. Journal of Forecasting, 38 (1), 63–72. doi: https://doi.org/10.1002/for.2551

- Dipple, S., Choudhary, A., Flamino, J., Szymanski, B. K., Korniss, G. (2020). Using correlated stochastic differential equations to forecast cryptocurrency rates and social media activities. Applied Network Science, 5 (1). doi: https://doi.org/10.1007/s41109-020-00259-1

- Krusell, P., Smith, Jr., A. A. (1998). Income and Wealth Heterogeneity in the Macroeconomy. Journal of Political Economy, 106 (5), 867–896. doi: https://doi.org/10.1086/250034

- Guide to the business plan. Available at: https://www.unido.org/sites/default/files/2008-07/Annex_7_Guide_to_the_Business_Plan_0.pdf

- Watsham, T. J., Parramore, K. (1997). Quantitative Methods in Finance. International Thomson Business Press, 393.

- Dupakova, J., Hurt, J., Stepan, J. (2003). Stochastic Modeling in Economics and Finance. Springer, 386. doi: https://doi.org/10.1007/b101992

- Kabachenko, D. (2015). Improving the assessment effectiveness methods of innovative industrial Leading Ukrainian Companies activity. New Developments in Mining Engineering 2015, 353–361. doi: https://doi.org/10.1201/b19901-62

- Kabachenko, D., Cherkas, O. (2019). Features of enterprises management system in modern business conditions. European journal of economics and management. Management in economic sectors and enterprises. Regional economy, 5 (3), 74–84. Available at: https://eujem.cz/wp-content/uploads/2019/eujem_2019_5_3/13.pdf

- Antomonov, M. Yu. (2018). Matematicheskaya obrabotka i analiz mediko-biologicheskikh dannykh. Kyiv: MITS «Medinform», 579.

- Degtyareva, N. A. (2018). Modeli analiza i prognozirovaniya na osnove vremennykh ryadov. Chelyabinsk: Izd-vo ZAO Biblioteka A. Millera, 160.

- Shchelkalin, V. (2014). “Caterpillar”-SSA and Box-Jenkins hybrid models and methods for time series forecasting. Eastern-European Journal of Enterprise Technologies, 5 (4 (71)), 43–62. doi: https://doi.org/10.15587/1729-4061.2014.28172

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Dmytro Kabachenko, Erik Lapkhanov

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.