Development neuro-fuzzy model to predict the stocks of companies in the electric vehicle industry

DOI:

https://doi.org/10.15587/1729-4061.2023.281138Keywords:

stock price forecasting, correlation of technical indicators, neural network, adaptive neuro-fuzzy inference system, electric vehicle sectorAbstract

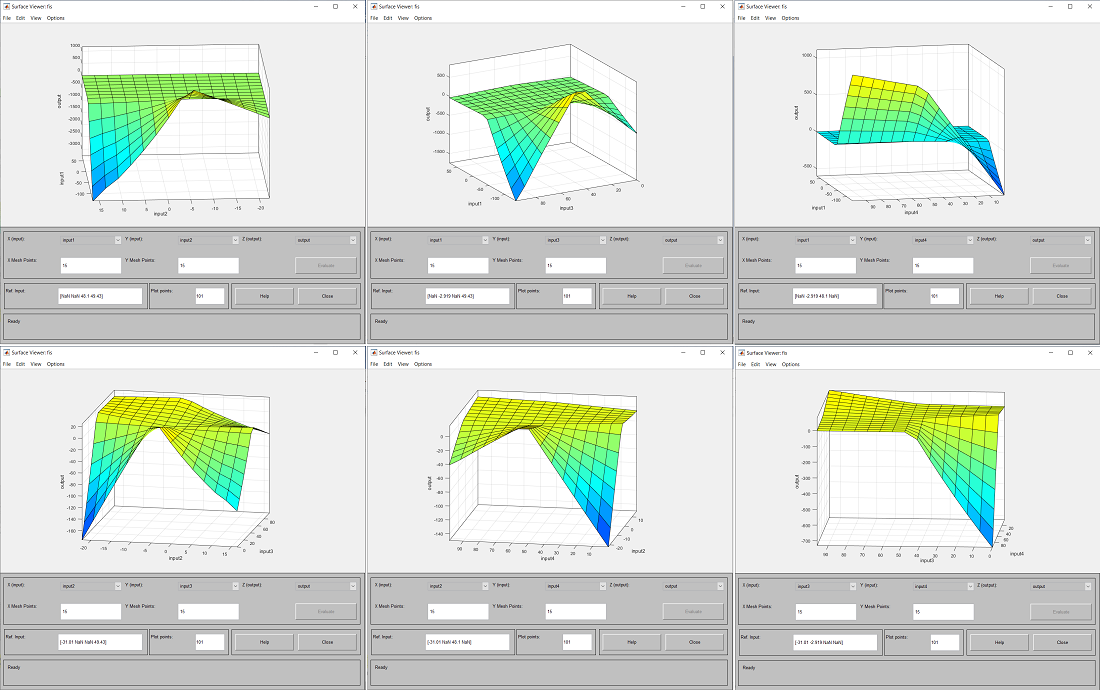

Adaptive neuro-fuzzy inference system (ANFIS) it is a type of neural network that combines the strengths of both fuzzy logic and artificial neural networks. ANFIS is particularly useful in stock trading because it can handle uncertainty and imprecision in the data, which is common in stock market data. In stock trading, ANFIS can be used for a variety of purposes, such as predicting stock prices, identifying profitable trades, and detecting stock market trends. One of the key advantages of using ANFIS for stock trading is that it can handle both linear and non-linear relationships in the data. This is particularly useful in the stock market, where the relationships between different variables are often complex and non-linear. ANFIS can also be updated and retrained as new data becomes available, which allows it to adapt to changing market conditions. Therefore, the main hypothesis of this work is to understand whether it is possible to predict the dynamics of prices for stocks of companies in the electric vehicle (EV) sector using technical analysis indicators. The purpose of this work is to create a model for predicting the prices of companies in the EV sector. The technical analysis indicators were processed by several machine learning models. Linear models generally perform worse than more advanced techniques. Decision trees, whether fine or coarse, tend to yield poorer performance results in terms of RMSE, MSE and MAE. After conducting a data analysis, the ANFIS and Bayesian regularization back propagation Neural Network (BR-BPNN) models were seen to be the most effective. The ANFIS was trained for 2000 epochs which yielded a minimum RMSE of 5.90926

References

- Ma, Y., Mao, R., Lin, Q., Wu, P., Cambria, E. (2023). Multi-source aggregated classification for stock price movement prediction. Information Fusion, 91, 515–528. doi: https://doi.org/10.1016/j.inffus.2022.10.025

- Xu, G. (2022). Deep Learning and Machine Learning Are Being Used to Forecast the Stock Market. Smart Innovation, Systems and Technologies, 597–605. doi: https://doi.org/10.1007/978-981-19-2768-3_58

- Al-Nefaie, A. H., Aldhyani, T. H. H. (2022). Predicting Close Price in Emerging Saudi Stock Exchange: Time Series Models. Electronics, 11 (21), 3443. doi: https://doi.org/10.3390/electronics11213443

- Chen, Q., Robert, C.-Y. (2022). Graph-Based Learning for Stock Movement Prediction with Textual and Relational Data. The Journal of Financial Data Science, 4 (4), 152–166. doi: https://doi.org/10.3905/jfds.2022.1.104

- Shao, B., Li, M., Zhao, Y., Bian, G. (2019). Nickel Price Forecast Based on the LSTM Neural Network Optimized by the Improved PSO Algorithm. Mathematical Problems in Engineering, 2019, 1–15. doi: https://doi.org/10.1155/2019/1934796

- Górna, A., Wieruszewski, M., Szabelska-Beręsewicz, A., Stanula, Z., Adamowicz, K. (2022). Biomass Price Prediction Based on the Example of Poland. Forests, 13 (12), 2179. doi: https://doi.org/10.3390/f13122179

- Sabri, M. S., Khalid, N., Azam, A. H. M., Sarmidi, T. (2022). Impact Analysis of the External Shocks on the Prices of Malaysian Crude Palm Oil: Evidence from a Structural Vector Autoregressive Model. Mathematics, 10 (23), 4599. doi: https://doi.org/10.3390/math10234599

- Javid, I., Ghazali, R., Syed, I., Zulqarnain, M., Husaini, N. A. (2022). Study on the Pakistan stock market using a new stock crisis prediction method. PLOS ONE, 17 (10), e0275022. doi: https://doi.org/10.1371/journal.pone.0275022

- Zhang, Q., Zhang, P., Zhou, F. (2022). Intraday and interday features in the high-frequency data: Pre- and post-Crisis evidence in China’s stock market. Expert Systems with Applications, 209, 118321. doi: https://doi.org/10.1016/j.eswa.2022.118321

- Cheng, C.-H., Tsai, M.-C., Chang, C. (2022). A Time Series Model Based on Deep Learning and Integrated Indicator Selection Method for Forecasting Stock Prices and Evaluating Trading Profits. Systems, 10 (6), 243. doi: https://doi.org/10.3390/systems10060243

- Jiménez-Preciado, A. L., Venegas-Martínez, F., Ramírez-García, A. (2022). Stock Portfolio Optimization with Competitive Advantages (MOAT): A Machine Learning Approach. Mathematics, 10 (23), 4449. doi: https://doi.org/10.3390/math10234449

- Duan, Z., Chen, C., Cheng, D., Liang, Y., Qian, W. (2022). Optimal Action Space Search. Proceedings of the 31st ACM International Conference on Information & Knowledge Management. doi: https://doi.org/10.1145/3511808.3557412

- Thavaneswaran, A., Liang, Y., Das, S., Thulasiram, R. K., Bhanushali, J. (2022). Intelligent Probabilistic Forecasts of VIX and its Volatility using Machine Learning Methods. 2022 IEEE Symposium on Computational Intelligence for Financial Engineering and Economics (CIFEr). doi: https://doi.org/10.1109/cifer52523.2022.9776069

- Zhu, Z., Liu, Z., Jin, G., Zhang, Z., Chen, L., Zhou, J., Zhou, J. (2021). MixSeq: Connecting Macroscopic Time Series Forecasting with Microscopic Time Series Data. Advances in Neural Information Processing Systems, 34, 12904–12916.

- Zhao, A., Gao, J., Guan, H. (2020). Forecasting Model for Stock Market Based on Probabilistic Linguistic Logical Relationship and Distance Measurement. Symmetry, 12 (6), 954. doi: https://doi.org/10.3390/sym12060954

- Almeida, R. L. de, Neves, R. F. (2022). Stock market prediction and portfolio composition using a hybrid approach combined with self-adaptive evolutionary algorithm. Expert Systems with Applications, 204, 117478. doi: https://doi.org/10.1016/j.eswa.2022.117478

- Kumar, G., Singh, U. P., Jain, S. (2021). Hybrid evolutionary intelligent system and hybrid time series econometric model for stock price forecasting. International Journal of Intelligent Systems, 36 (9), 4902–4935. doi: https://doi.org/10.1002/int.22495

- Musaev, A., Grigoriev, D. (2021). Analyzing, Modeling, and Utilizing Observation Series Correlation in Capital Markets. Computation, 9 (8), 88. doi: https://doi.org/10.3390/computation9080088

- Khan, A. H., Cao, X., Katsikis, V. N., Stanimirovic, P., Brajevic, I., Li, S. et al. (2020). Optimal Portfolio Management for Engineering Problems Using Nonconvex Cardinality Constraint: A Computing Perspective. IEEE Access, 8, 57437–57450. doi: https://doi.org/10.1109/access.2020.2982195

- Lin, Y., Lin, Z., Liao, Y., Li, Y., Xu, J., Yan, Y. (2022). Forecasting the realized volatility of stock price index: A hybrid model integrating CEEMDAN and LSTM. Expert Systems with Applications, 206, 117736. doi: https://doi.org/10.1016/j.eswa.2022.117736

- Liu, X., Guo, J., Wang, H., Zhang, F. (2022). Prediction of stock market index based on ISSA-BP neural network. Expert Systems with Applications, 204, 117604. doi: https://doi.org/10.1016/j.eswa.2022.117604

- Aldhyani, T. H. H., Alzahrani, A. (2022). Framework for Predicting and Modeling Stock Market Prices Based on Deep Learning Algorithms. Electronics, 11 (19), 3149. doi: https://doi.org/10.3390/electronics11193149

- Kumar, G., Jain, S., Singh, U. P. (2020). Stock Market Forecasting Using Computational Intelligence: A Survey. Archives of Computational Methods in Engineering, 28 (3), 1069–1101. doi: https://doi.org/10.1007/s11831-020-09413-5

- Devianto, D., Permathasari, P., Yollanda, M., Wirahadi Ahmad, A. (2020). The Model of Artificial Neural Network and Nonparametric MARS Regression for Indonesian Composite Index. IOP Conference Series: Materials Science and Engineering, 846 (1), 012007. doi: https://doi.org/10.1088/1757-899x/846/1/012007

- Pyo, S., Lee, J., Cha, M., Jang, H. (2017). Predictability of machine learning techniques to forecast the trends of market index prices: Hypothesis testing for the Korean stock markets. PLOS ONE, 12 (11), e0188107. doi: https://doi.org/10.1371/journal.pone.0188107

- Verma, P., Dumka, A., Bhardwaj, A., Ashok, A., Kestwal, M. C., Kumar, P. (2021). A Statistical Analysis of Impact of COVID19 on the Global Economy and Stock Index Returns. SN Computer Science, 2 (1). doi: https://doi.org/10.1007/s42979-020-00410-w

- Ampomah, E. K., Nyame, G., Qin, Z., Addo, P. C., Gyamfi, E. O., Gyan, M. (2021). Stock Market Prediction with Gaussian Naïve Bayes Machine Learning Algorithm. Informatica, 45 (2). doi: https://doi.org/10.31449/inf.v45i2.3407

- Ma, Y., Han, R., Wang, W. (2021). Portfolio optimization with return prediction using deep learning and machine learning. Expert Systems with Applications, 165, 113973. doi: https://doi.org/10.1016/j.eswa.2020.113973

- Kamal, S., Sharma, S., Kumar, V., Alshazly, H., Hussein, H. S., Martinetz, T. (2022). Trading Stocks Based on Financial News Using Attention Mechanism. Mathematics, 10 (12), 2001. doi: https://doi.org/10.3390/math10122001

- Chen, Y., Wu, J., Bu, H. (2018). Stock Market Embedding and Prediction: A Deep Learning Method. 2018 15th International Conference on Service Systems and Service Management (ICSSSM). doi: https://doi.org/10.1109/icsssm.2018.8464968

- Guarnieri, M. (2012). Looking back to electric cars. 2012 Third IEEE HISTory of ELectro-Technology CONference (HISTELCON). doi: https://doi.org/10.1109/histelcon.2012.6487583

- Chou, J.-S., Nguyen, N.-M., Chang, C.-P. (2022). Intelligent candlestick forecast system for financial time-series analysis using metaheuristics-optimized multi-output machine learning. Applied Soft Computing, 130, 109642. doi: https://doi.org/10.1016/j.asoc.2022.109642

- Ferdaus, M. M., Chakrabortty, R. K., Ryan, M. J. (2022). Multiobjective Automated Type-2 Parsimonious Learning Machine to Forecast Time-Varying Stock Indices Online. IEEE Transactions on Systems, Man, and Cybernetics: Systems, 52 (5), 2874–2887. doi: https://doi.org/10.1109/tsmc.2021.3061389

- Kamara, A. F., Chen, E., Pan, Z. (2022). An ensemble of a boosted hybrid of deep learning models and technical analysis for forecasting stock prices. Information Sciences, 594, 1–19. doi: https://doi.org/10.1016/j.ins.2022.02.015

- Altarawneh, G. A., Hassanat, A. B., Tarawneh, A. S., Abadleh, A., Alrashidi, M., Alghamdi, M. (2022). Stock Price Forecasting for Jordan Insurance Companies Amid the COVID-19 Pandemic Utilizing Off-the-Shelf Technical Analysis Methods. Economies, 10 (2), 43. doi: https://doi.org/10.3390/economies10020043

- Christy Jackson, J., Prassanna, J., Abdul Quadir, Md., Sivakumar, V. (2021). WITHDRAWN: Stock market analysis and prediction using time series analysis. Materials Today: Proceedings. doi: https://doi.org/10.1016/j.matpr.2020.11.364

- Lee, M.-C., Chang, J.-W., Yeh, S.-C., Chia, T.-L., Liao, J.-S., Chen, X.-M. (2022). Applying attention-based BiLSTM and technical indicators in the design and performance analysis of stock trading strategies. Neural Computing and Applications, 34 (16), 13267–13279. doi: https://doi.org/10.1007/s00521-021-06828-4

- Banik, S., Sharma, N., Mangla, M., Mohanty, S. N., Shitharth, S. (2022). LSTM based decision support system for swing trading in stock market. Knowledge-Based Systems, 239, 107994. doi: https://doi.org/10.1016/j.knosys.2021.107994

- Srivastava, P. R., Zuopeng (Justin) Zhang, Eachempati, P. (2021). Deep Neural Network and Time Series Approach for Finance Systems. Journal of Organizational and End User Computing, 33 (5), 204–226. doi: https://doi.org/10.4018/joeuc.20210901.oa10

- Salkar, T., Shinde, A., Tamhankar, N., Bhagat, N. (2021). Algorithmic Trading using Technical Indicators. 2021 International Conference on Communication Information and Computing Technology (ICCICT). doi: https://doi.org/10.1109/iccict50803.2021.9510135

- Uma, K. S., Naidu, S. (2021). Prediction of Intraday Trend Reversal in Stock Market Index Through Machine Learning Algorithms. Image Processing and Capsule Networks, 331–341. doi: https://doi.org/10.1007/978-3-030-51859-2_30

- Sharipbay, A., Barlybayev, A., Sabyrov, T. (2016). Measure the Usability of Graphical User Interface. Advances in Intelligent Systems and Computing, 1037–1045. doi: https://doi.org/10.1007/978-3-319-31232-3_98

- Omarbekova, A., Sharipbay, A., Barlybaev, A. (2017). Generation of Test Questions from RDF Files Using PYTHON and SPARQL. Journal of Physics: Conference Series, 806, 012009. doi: https://doi.org/10.1088/1742-6596/806/1/012009

- Abdygalievich, A. S., Barlybayev, A., Amanzholovich, K. B. (2019). Quality Evaluation Fuzzy Method of Automated Control Systems on the LMS Example. IEEE Access, 7, 138000–138010. doi: https://doi.org/10.1109/access.2019.2943000

- Abdymanapov, S. A., Muratbekov, M., Altynbek, S., Barlybayev, A. (2021). Fuzzy Expert System of Information Security Risk Assessment on the Example of Analysis Learning Management Systems. IEEE Access, 9, 156556–156565. doi: https://doi.org/10.1109/access.2021.3129488

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Alibek Barlybayev, Lena Zhetkenbay, Didar Karimov, Banu Yergesh

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.