Accounting and analytical provision of enterprise risk management in the conditions of the state of war: identification, assessment, measurement and display of risks

DOI:

https://doi.org/10.15587/1729-4061.2023.282644Keywords:

enterprise risk management process, accounting and analytical support for enterprise risk management, classification of enterprise risks, analytical and applied support for risk representation in accounting, analytical matrix for risk impact assessmentAbstract

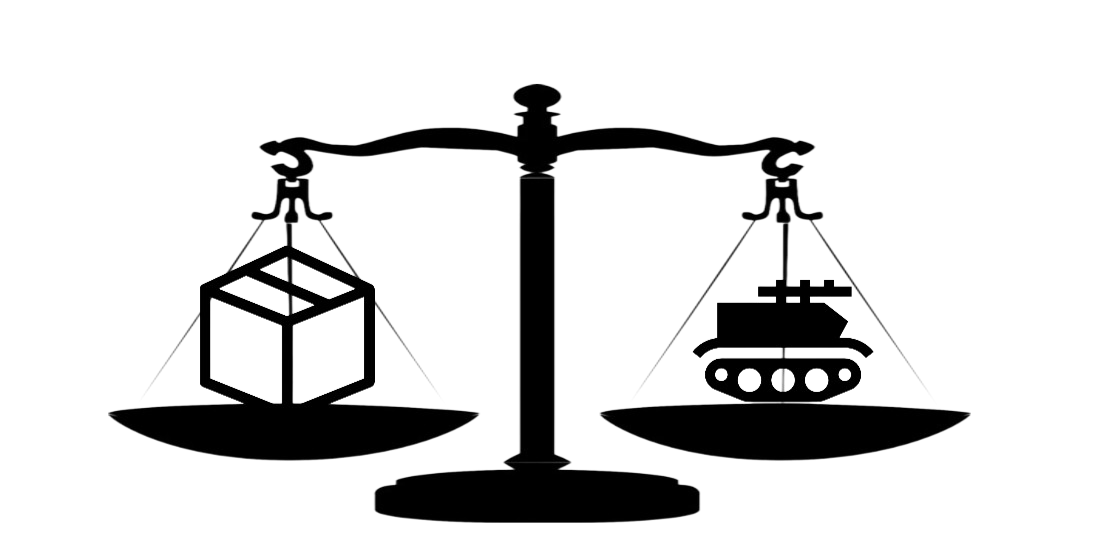

The research is dedicated to the current issue of improving the accounting and analytical support for enterprise risk management in conditions of a military state. It analyzes the processes of risk identification, assessment, measurement, and representation in financial reporting, taking into account International Accounting Standards and qualitative assessments.

A conceptual approach is proposed to enhance the enterprise risk management process through the detailed implementation of three blocks of analytical procedures: research and identification, risk assessment, analysis, and neutralization, which involves its integration into the accounting and analytical support system for enterprise risk management. Based on the analysis of reporting of Ukrainian enterprises, the most common risks arising in modern conditions are identified. A classification of risks by their origin is proposed, allowing for the systematization of various types of reserves, provisions, and funds that are formed to reflect risk events in accordance with accounting standards. The analytical and applied support for risk representation in accounting is improved through the development of an analytical matrix of risk impact on events in reporting. It enables the consolidation of information on the likelihood and significance of risks in a unified format and establishes the appropriateness of reflecting reserves and provisions in accounting. The research results have practical significance and can be utilized by enterprises to enhance their risk management systems and effectively represent risk events in financial reporting, which will contribute to risk reduction and minimizing losses for enterprises in conditions of a military state

References

- Atamas, P. Y., Atamas, O. P., Kramarenko, H. O. (2016). Rol bukhhalterskoho obliku v upravlinni ryzykamy pidpryiemnytstva. Akademichnyi ohliad, 1 (44), 60–69. Available at: https://acadrev.duan.edu.ua/images/stories/files/2016-1/8.pdf

- Gnilitska, L. V. (2014). Informatsiyne zabezpechennya rizikami pidpriemnitskoi' diyalnosti: oblikovy aspect. Ekonomichni innovatsiyi, 57, 88–100. Available at: http://nbuv.gov.ua/UJRN/ecinn_2014_57_12

- Druri, K. (2017). Upravlencheskiy uchet dlya biznes-resheniy. Moscow: YUNITI-DANA, 655.

- Derun, I. (2016). Risk identification in the company’s accounting system. Economic Annals-ХХI, 159 (5-6), 97–100. doi: https://doi.org/10.21003/ea.v159-21

- Junkes, M. B., Tereso, A. P., Afonso, P. S. L. P. (2015). The Importance of Risk Assessment in the Context of Investment Project Management: A Case Study. Procedia Computer Science, 64, 902–910. doi: https://doi.org/10.1016/j.procs.2015.08.606

- Soin, K., Collier, P. (2013). Risk and risk management in management accounting and control. Management Accounting Research, 24 (2), 82–87. doi: https://doi.org/10.1016/j.mar.2013.04.003

- Gatzert, N., Martin, M. (2015). Determinants and Value of Enterprise Risk Management: Empirical Evidence From the Literature. Risk Management and Insurance Review, 18 (1), 29–53. doi: https://doi.org/10.1111/rmir.12028

- Drábková, Z., Pech, M. (2022). Comparison of creative accounting risks in small enterprises: the different branches perspective. E+M Ekonomie a Management, 25 (1), 113–129. doi: https://doi.org/10.15240/tul/001/2022-1-007

- Deaconu, A., Crisan, S., Buiga, A. (2016). Value allocation – contribution and risk to the reliability of financial reporting. E+M Ekonomie a Management, 19 (2), 105–119. doi: https://doi.org/10.15240/tul/001/2016-2-007

- Sunder, S. (2015). Risk in Accounting. Abacus, 51 (4), 536–548. doi: https://doi.org/10.1111/abac.12060

- Nichita, M. (2015). Regression Model for Risk Reporting in Financial Statements of Accounting Services Entities. SEA - Practical Application of Sciences, 3 (2), 101–107. Available at: https://seaopenresearch.eu/Journals/articles/SPAS_8_14.pdf

- Karpushenko, M. (2019). Financial risks management. Visnyk Khmelnytskoho natsionalnoho universytetu, 2, 110–113. Available at: http://journals.khnu.km.ua/vestnik/wp-content/uploads/2021/01/23-15.pdf

- Karpushenko, M., Filatova, I. (2021). Features of risk reflection in integrated reporting. Herald of Khmelnytskyi National University, 2, 211–214. doi: https://doi.org/10.31891/2307-5740-2021-292-2-36

- Chebanova, N., Orlova, V., Revutska, L., Karpushenko, M. (2019). Identification, Measurement and Reflection of Risks in Accounting. SHS Web of Conferences, 67, 01001. doi: https://doi.org/10.1051/shsconf/20196701001

- Mizhnarodnyi standart bukhhalterskoho obliku 37 (MSBO 37). Zabezpechennia, umovni zoboviazannia ta umovni aktyvy. Available at: https://zakon.rada.gov.ua/laws/show/929_051#Text

- Momot, T., Karpushenko, M., Sobolieva, H., Lytovchenko, O., Filatova, I. (2021). Compiling invest-oriented integrated reporting: advantages, standards, recommendations. Eastern-European Journal of Enterprise Technologies, 3 (13 (111)), 47–54. doi: https://doi.org/10.15587/1729-4061.2021.235905

- Mizhnarodnyi standart bukhhalterskoho obliku 8 (MSBO 8). Oblikovi polityky, zminy v oblikovykh otsinkakh ta pomylky. Available at: https://zakon.rada.gov.ua/laws/show/929_020#Text

- Mizhnarodnyi standart bukhhalterskoho obliku 1 (MSBO 1). Podannia finansovoi zvitnosti. Available at: https://zakon.rada.gov.ua/laws/show/929_013#Text

- Pro suttievist u bukhhalterskomu obliku i zvitnosti. Lyst vid 29.07.2003 N 04230-108. Ministerstvo finansiv Ukrainy. Available at: https://ips.ligazakon.net/document/MF03268

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Maria Karpushenko, Tetiana Momot, Yuliia Mizik, Galyna Shapoval, Oleg Karpushenko

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.