The implementation of accounting information systems on the stock return and financial performance based on information technology (IT)

DOI:

https://doi.org/10.15587/1729-4061.2023.289424Keywords:

accounting information systems, stock return, financial performance, data capture, data processingAbstract

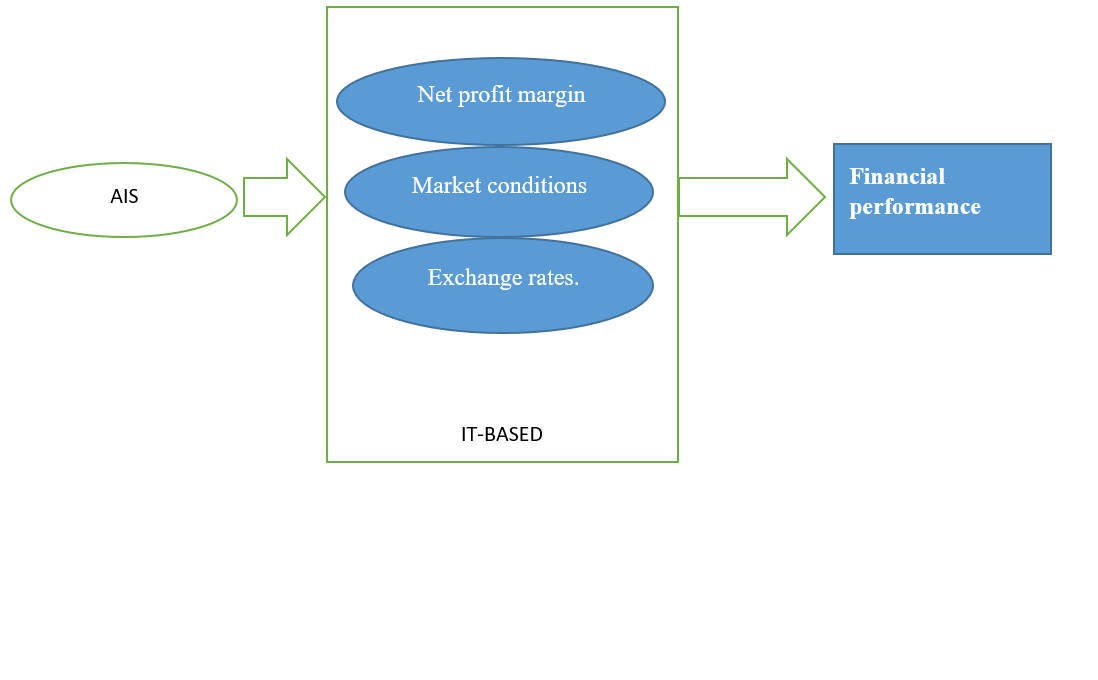

This study investigates the influence of Accounting Information Systems (AIS) on stock return and financial performance. When it comes to organizations, AIS play a crucial part in the process of acquiring, processing, and communicating financial information. The efficient functioning of AIS has the potential to impact stock returns and overall financial performance, making it an essential area of research. The study employs a comprehensive analysis of relevant literature, empirical data, and statistical techniques to examine the relationship between AIS and stock return as well as financial performance. The findings of this study aim to provide insights into the extent to which AIS influences stock return and financial performance. A positive relationship between a well-functioning AIS and stock return is expected, given the importance of accurate and timely financial information in investors' decision-making process. Financial performance parameters including profitability, efficiency, and liquidity are all expected to benefit from a robust AIS. There are major practical and theoretical ramifications of this study. Companies may benefit from better decisions on AIS improvements, maintenance, and rollout if they have a firm grasp of how AIS affects stock performance and overall financial results. According to the data, the efficacy of the accounting information system based on IT has a P value of –0.009, while its t value is equal to 0.027. According to the findings, the return on assets (ROA) has a P value that is equal to –0.592, while its t value is equal to 0.13. Further, AIS's significance in evaluating a firm's financial health and making investment decisions may be better understood. As a result of analyzing how Accounting Information Systems affect stock return and financial performance, this study adds to the current body of information. The results will enhance our understanding of the role of AIS in shaping investment outcomes and financial success.

References

- Al-Wattar, Y. M. A., Almagtome, A. H., Al-Shafeay, K. M. (2019). The role of integrating hotel sustainability reporting practices into an Accounting Information System to enhance Hotel Financial Performance: Evidence from Iraq. African Journal of Hospitality, Tourism and Leisure, 8 (5), 1–16. Available at: https://www.ajhtl.com/uploads/7/1/6/3/7163688/article_25_vol_8_5__2019_iraq.pdf

- Wang, T., Wang, Y., McLeod, A. (2018). Do health information technology investments impact hospital financial performance and productivity? International Journal of Accounting Information Systems, 28, 1–13. doi: https://doi.org/10.1016/j.accinf.2017.12.002

- Khaghaany, M., Kbelah, S., Almagtome, A. (2019). Value relevance of sustainability reporting under an accounting information system: Evidence from the tourism industry. African Journal of Hospitality, Tourism and Leisure, 8, 1–12. Available at: https://www.ajhtl.com/uploads/7/1/6/3/7163688/article_16_special_edition_cut_2019_iraq.pdf

- Knudsen, D.-R. (2020). Elusive boundaries, power relations, and knowledge production: A systematic review of the literature on digitalization in accounting. International Journal of Accounting Information Systems, 36, 100441. doi: https://doi.org/10.1016/j.accinf.2019.100441

- Santosa, P. W. (2019). Financial Performance, Exchange Rate and Stock Return: Evidence from Manufacturing Sector. Jurnal Manajemen Teknologi, 18 (3), 205–217. doi: https://doi.org/10.12695/jmt.2019.18.3.5

- Almagsoosi, L., Abadi, M. T. E., Hasan, H. F., Sharaf, H. K. (2022). Effect of the Volatility of the Crypto Currency and Its Effect on the Market Returns. Industrial Engineering & Management Systems, 21 (2), 238–243. doi: https://doi.org/10.7232/iems.2022.21.2.238

- Alyaseri, N. H. A. (2021). Optimization of the challenges facing the Iraqi economy based on the values of returns in 2000-2020. Economic Annals-ХХI, 194 (11-12), 4–12. doi: https://doi.org/10.21003/ea.v194-01

- Aly, N. H. A., Abbas, I. K., Askar, W. I. (2022). Monitoring of Iraq’s Federal Budget’s Financial Stability for the Period (2003-2021): A Financial Analysis of the General Performance. Industrial Engineering & Management Systems, 21 (4), 557–564. doi: https://doi.org/10.7232/iems.2022.21.4.557

- Ashham, M., Sharaf, H. K., Salman, K., Salman, S. (2017). Simulation of heat transfer in a heat exchanger tube with inclined vortex rings inserts. International Journal of Applied Engineering Research, 12 (20), 9605–9613. Available at: https://www.ripublication.com/ijaer17/ijaerv12n20_48.pdf

- Hadi, A. H., Ali, M. N., Al-shiblawi, G. A. K., Flayyih, H. H., Talab, H. R. (2023). The Effects of Information Technology Adoption on the Financial Reporting: Moderating Role of Audit Risk. International Journal of Economics and Finance Studies, 15 (1), 47–63. Available at: https://agbioforum.org/sobiad.org/menuscript/index.php/ijefs/article/view/1399/315

- Mouhmmd, L. T., Rahima, M. A., Mohammed, A. M., Hasan, H. F., Alwan, A. S., Sharaf, H. K. (2023). The effect of firm type on the relationship between accounting quality and trade credit in listed firms. Corporate and Business Strategy Review, 4 (2), 175–183. doi: https://doi.org/10.22495/cbsrv4i2art16

- Raheemah, S. H., Fadheel, K. I., Hassan, Q. H., Aned, A. M., Turki Al-Taie, A. A., Sharaf, H. K. (2021). Numerical Analysis of the Crack Inspections Using Hybrid Approach for the Application the Circular Cantilever Rods. Pertanika Journal of Science and Technology, 29 (2). doi: https://doi.org/10.47836/pjst.29.2.22

- Salman, S., Sharaf, H. K., Hussein, A. F., Khalaf, N. J., Abbas, M. K., Aned, A. M. et al. (2022). Optimization of raw material properties of natural starch by food glue based on dry heat method. Food Science and Technology, 42. doi: https://doi.org/10.1590/fst.78121

- Sharaf, H. K., Alyousif, S., Khalaf, N. J., Hussein, A. F., Abbas, M. K. (2022). Development of bracket for cross arm structure in transmission tower: Experimental and numerical analysis. New Materials, Compounds and Applications, 6 (3), 257–275. Available at: http://www.jomardpublishing.com/UploadFiles/Files/journals/NMCA/V6N3/SharafHS.pdf

- Subhi, K. A., Hussein, E. K., Al-Hamadani, H. R. D., Sharaf, H. K. (2022). Investigation of the mechanical performance of the composite prosthetic keel based on the static load: a computational analysis. Eastern-European Journal of Enterprise Technologies, 3 (7 (117)), 22–30. doi: https://doi.org/10.15587/1729-4061.2022.256943

- Al-Fahad, I. O. B., Sharaf, H. kadhim, Bachache, L. N., Bachache, N. K. (2023). Identifying the mechanism of the fatigue behavior of the composite shaft subjected to variable load. Eastern-European Journal of Enterprise Technologies, 3 (7 (123)), 37–44. doi: https://doi.org/10.15587/1729-4061.2023.283078

- Abdullah, Y. M., Aziz, G. S., Sharaf, H. K. (2023). Simulate the Rheological Behaviour of the Solar Collector by Using Computational Fluid Dynamic Approach. CFD Letters, 15 (9), 175–182. doi: https://doi.org/10.37934/cfdl.15.9.175182

- Riyadh, H. A., Al-Shmam, M. A., Huang, H. H., Gunawan, B., Alfaiza, S. A. (2020). The analysis of green accounting cost impact on corporations financial performance. International Journal of Energy Economics and Policy, 10 (6), 421–426. doi: https://doi.org/10.32479/ijeep.9238

- Alshehhi, A., Nobanee, H., Khare, N. (2018). The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability, 10 (2), 494. doi: https://doi.org/10.3390/su10020494

- Soto-Acosta, P., Popa, S., Martinez-Conesa, I. (2018). Information technology, knowledge management and environmental dynamism as drivers of innovation ambidexterity: a study in SMEs. Journal of Knowledge Management, 22 (4), 824–849. doi: https://doi.org/10.1108/jkm-10-2017-0448

- Devi, S., Warasniasih, N. M. S., Masdiantini, P. R. (2020). The Impact of COVID-19 Pandemic on the Financial Performance of Firms on the Indonesia Stock Exchange. Journal of Economics, Business, & Accountancy Ventura, 23 (2). doi: https://doi.org/10.14414/jebav.v23i2.2313

- Kokina, J., Blanchette, S. (2019). Early evidence of digital labor in accounting: Innovation with Robotic Process Automation. International Journal of Accounting Information Systems, 35, 100431. doi: https://doi.org/10.1016/j.accinf.2019.100431

- Li, H., No, W. G., Wang, T. (2018). SEC’s cybersecurity disclosure guidance and disclosed cybersecurity risk factors. International Journal of Accounting Information Systems, 30, 40–55. doi: https://doi.org/10.1016/j.accinf.2018.06.003

- Egbunike, C. F., Okerekeoti, C. U. (2018). Macroeconomic factors, firm characteristics and financial performance. Asian Journal of Accounting Research, 3 (2), 142–168. doi: https://doi.org/10.1108/ajar-09-2018-0029

- Duan, H. K., Vasarhelyi, M. A., Codesso, M., Alzamil, Z. (2023). Enhancing the government accounting information systems using social media information: An application of text mining and machine learning. International Journal of Accounting Information Systems, 48, 100600. doi: https://doi.org/10.1016/j.accinf.2022.100600

- Salman, M. D., Alwan, S. A., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Sharaf, H. K. et al. (2023). The Impact of Engineering Anxiety on Students: A Comprehensive Study In the fields of Sport, economics, and teaching methods. Revista iberoamericana de psicología del ejercicio y el deporte, 18 (3), 326–329. Available at: https://www.riped-online.com/articles/the-impact-of-engineering-anxiety-on-students-a-comprehensive-study-in-the-fields-of-sport-economics-and-teaching-methods-98708.html

- Alwan, S. A., Jawad, K. K., Alyaseri, N. H. A., Subhi, K. A., Hussein, E. K., Aned, A. M. et al. (2023). The Psychological Effects of Perfectionism on Sport, economic and Engineering Students. Revista iberoamericana de psicología del ejercicio y el deporte, 18 (3), 330–333. Available at: https://www.riped-online.com/abstract/the-psychological-effects-of-perfectionism-on-sport-economic-and-engineering-students-98715.html

- Alyaseri, N. H. A., Salman, M. D., Maseer, R. W., Hussein, E. K., Subhi, K. A., Alwan, S. A. et al. (2023). Exploring the Modeling of Socio-Technical Systems in the Fields of Sport, Engineering and Economics. Revista iberoamericana de psicología del ejercicio y el deporte, 18 (3), 338–341. Available at: https://dialnet.unirioja.es/servlet/articulo?codigo=9087565

- Jawad, K. K., Alyaseri, N. H. A., Alwan, S. A., Hussein, E. K., Subhi, K. A., Sharaf, H. K. et al. (2023). Contingency in Engineering Problem Solving Understanding its Role and Implications: Focusing on the sports Machine. Revista iberoamericana de psicología del ejercicio y el deporte, 18 (3), 334–337. Available at: https://www.riped-online.com/articles/contingency-in-engineering-problem-solving-understanding-its-role-and-implications-focusing-on-the-sports-machine-98716.html

- Al-Fahad, I. O. B., Hassan, A. D., Faisal, B. M., Sharaf, H. kadhim. (2023). Identification of regularities in the behavior of a glass fiber-reinforced polyester composite of the impact test based on ASTM D256 standard. Eastern-European Journal of Enterprise Technologies, 4 (7 (124)), 63–71. doi: https://doi.org/10.15587/1729-4061.2023.286541

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Rajaa Ali Abed, Ahlam Hameed Kareem, Ali Khazaal Jabbar, Jasim Gshayyish zwaid, Hussein Falah Hasan

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.