Improving the financing mechanism for the development of local communities based on the use of digital technologies

DOI:

https://doi.org/10.15587/1729-4061.2024.300908Keywords:

financing mechanism for the development of local communities, technical infrastructure of financing, digital technologiesAbstract

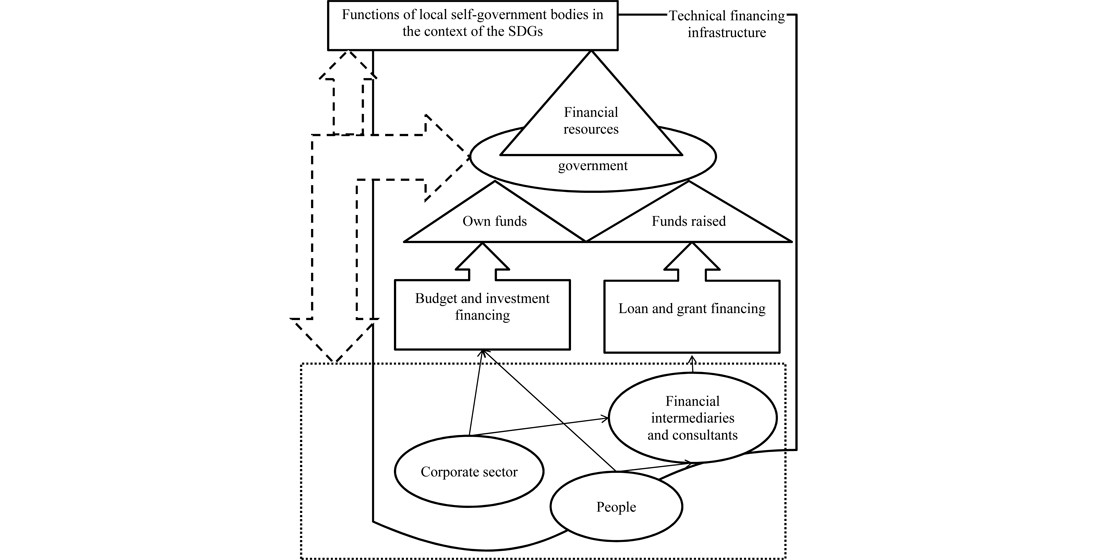

The object of this study is the financing mechanism for the development of local communities. The paper addressed the problem of improving this mechanism under conditions of limited resources through the use of digital technologies. The structure of the mechanism is represented as interconnected subjects, sources, methods, objectives, and technical infrastructure of financing. Local self-government bodies are the managing entity. Factors affecting the availability of financial resources, depending on the financing method, are the volume of resources, the orderliness of legislation and legal models, financial capabilities, and interests of financing entities. They also include legal restrictions on application, requirements of resource holders, their cost and duration of receipt. The crisis was recognized as a significant limiting factor. Identification of factors of accessibility and complexity makes it possible to identify weak points in the entire funding mechanism. The description of the theoretical concept of the financing mechanism due to its universality, the factors of the availability of financial resources and the shortcomings of the technical infrastructure, identified on this basis, made it possible to solve the investigated problem. As a result, directions for improving the financing mechanism for the development of local communities have been determined in terms of technical infrastructure. They consist in creating unified technical systems for managing financing processes and expanding training and support for financing entities. The use of artificial intelligence, big data, blockchain and tokenization technologies for decision-making, forecasting the needs of local communities and the development of crowdfunding is also proposed. Owing to this, it will be possible to achieve practical expectations for improving the effectiveness of the existing financing mechanism, which consists in reducing transaction costs, attracting additional financial resources, increasing public participation and transparency of financial processes

References

- Pike, A., Rodríguez-Pose, A., Tomaney, J. (2007). What Kind of Local and Regional Development and for Whom? Regional Studies, 41 (9), 1253–1269. https://doi.org/10.1080/00343400701543355

- Transforming our world: the 2030 Agenda for Sustainable Development. United Nations. Available at: https://sdgs.un.org/2030agenda

- Report of the World Commission on Environment and Development: Our Common Future. Available at: https://sustainabledevelopment.un.org/content/documents/5987our-common-future.pdf

- Jackson, D. (Ed.) (2021). UNCDF Local Government Finance is Development Finance: UNCDF Local Transformative Finance Investment Agenda. United Nations Capital Development Fund. Available at: https://www.uncdf.org/Download/AdminFileWithFilename?id=16773&cultureId=127&filename=local-government-finance-is-development-financewebpdf

- Romeo, L. (2018). Decentralizing for development: The developmental potential of local autonomy and the limits of politics driven decentralization reforms. Working Papers. Available at: https://ideas.repec.org/p/ess/wpaper/id12486.html

- Hendriks, C. (2018). Municipal financing for sustainable development: A case of South Africa. Local Economy: The Journal of the Local Economy Policy Unit, 33 (7), 757–774. https://doi.org/10.1177/0269094218811799

- Oh, Y., Jeong, S., Shin, H. (2019). A Strategy for a Sustainable Local Government: Are Participatory Governments More Efficient, Effective, and Equitable in the Budget Process? Sustainability, 11 (19), 5312. https://doi.org/10.3390/su11195312

- Singla, A., Shumberger, J., Swindell, D. (2019). Paying for infrastructure in the post-recession era: Exploring the use of alternative funding and financing tools. Journal of Urban Affairs, 43 (4), 526–548. https://doi.org/10.1080/07352166.2019.1660580

- Bulavinets, V., Karpyshyn, N. (2019). Financial potential of territorial communities: modern state and prospects. Світ Фінансів, 4 (61), 96–110. Available at: http://sf.wunu.edu.ua/index.php/sf/article/view/1276/1279

- Prokhorova, V. V., Babichev, A. V., Yukhman, Y. V., Varenko, T. V. (2021). Public-Private Partnership as an Institute of Combined Public and Private Efforts to Solve Socially Important Tasks in Ukraine. THE PROBLEMS OF ECONOMY, 4 (50), 50–55. https://doi.org/10.32983/2222-0712-2021-4-50-55

- Mayer, M. (2019). An Exploratory Look at the Growth and Success of Crowdfunding in the Public Space. State and Local Government Review, 51 (3), 187–196. https://doi.org/10.1177/0160323x20915590

- Baccarne, B., Evens, T., De Marez, L. (2020). Understanding Civic Crowdfunding as a Mechanism for Leveraging Civic Engagement and Urban Innovation. Technology Innovation Management Review, 10 (5), 51–66. https://doi.org/10.22215/timreview/1356

- Van Montfort, K., Siebers, V., De Graaf, F. J. (2020). Civic Crowdfunding in Local Governments: Variables for Success in the Netherlands? Journal of Risk and Financial Management, 14 (1), 8. https://doi.org/10.3390/jrfm14010008

- Sedlitzky, R., Franz, Y. (2019). “What If We All Chip In?” Civic Crowdfunding As Alternative Financing For Urban Development Projects. Built Environment, 45 (1), 26–44. https://doi.org/10.2148/benv.45.1.26

- González-Azcárate, M., Luis Cruz‐Maceín, J., Bardají, I. (2023). Crowdfarming. A public-private crowdfunding campaign to finance sustainable local food systems: a case study of short food supply chains in Madrid. New Medit, 22 (3). https://doi.org/10.30682/nm2303f

- Tsili staloho rozvytku: Shcho treba znaty orhanam mistsevoho samovriaduvannia. UCLG. Available at: https://www.undp.org/sites/g/files/zskgke326/files/migration/ua/SDG_LocalGov_v05.pdf

- Infrastructure Financing for Sustainable Development in Asia and the Pacific (2019). In ESCAP Financing for Development Series. UN. https://doi.org/10.18356/0fb07716-en

- Farvacque-Vitkovic, C. D., Kopanyi, M. (Eds.) (2014). Municipal Finances: A Handbook for Local Governments. The World Bank Group. https://doi.org/10.1596/978-0-8213-9830-2

- Vammalle, C., Bambalaite, I. (2021). Funding and financing of local government public investment. OECD Working Papers on Fiscal Federalism. https://doi.org/10.1787/162d8285-en

- Dokhody mistsevykh biudzhetiv. Biudzhet dlia hromadian. Ministerstvo finansiv Ukrainy. Available at: https://openbudget.gov.ua/national-budget/incomes

- Mistsevyi borh ta mistsevyi harantovanyi borh. Informatsiya shchodo zdiysnennia mistsevoho zapozychennia. Ministerstvo finansiv Ukrainy. Available at: https://mof.gov.ua/uk/miscevij-borg-ta-miscevij-garantovanij-borg

- Perelik derzhavnykh investytsiinykh proiektiv. Ministerstvo ekonomiky Ukrainy. Available at: https://www.me.gov.ua/Documents/Download?id=b64ca58d-c988-4665-8803-72263e01928e

- Monitoring of PPP implementation in Ukraine. Ministry of Economy of Ukraine. Available at: https://www.me.gov.ua/Documents/Detail?lang=en-GB&id=6aab1657-215d-46f8-8d93-46961e76fd6f&title=MonitoringOfPppImplementationInUkraine

- Trebesch, С., Antezza, А., Bushnell, K., Bomprezzi, P., Dyussimbinov, Y. et al. (2023). The Ukraine Support Tracker: Which countries help Ukraine and how? Kiel Working Paper, 2218. Available at: https://www.ifw-kiel.de/fileadmin/Dateiverwaltung/IfW-Publications/fis-import/87bb7b0f-ed26-4240-8979-5e6601aea9e8-KWP_2218_Trebesch_et_al_Ukraine_Support_Tracker.pdf

- Mizhnarodna pidtrymka. Spysok proiektiv ta prohram MTD. Detsentralizatsiya. Available at: https://decentralization.gov.ua/donors

- Dani shchodo nadkhodzhen na spetsialni rakhunky NBU dlia zboru koshtiv. Ofitsiyna fandreizynhova platforma Ukrainy. Available at: https://files.u24.gov.ua/reports/2023-04-14/20230414_Report_MOI.pdf

- Bauer, J. M., Herder, P. M. (2009). Designing Socio-Technical Systems. Philosophy of Technology and Engineering Sciences, 601–630. https://doi.org/10.1016/b978-0-444-51667-1.50026-4

- Ministerstvo rozvytku hromad, terytoriy ta infrastruktury Ukrainy. DREAM. Available at: https://dream.gov.ua/ua

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Serghiy Radynskyy, Vadym Ratynskiy, Nataliia Diachenko, Valentyn Diachenko, Andrii Krupka, Zoryana Lobodina, Halyna Pohrishchuk, Nataliia Dobizha, Svitlana Shpylyk, Vladyslav Bendiuh

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.