Development of a mechanism for managing the level of investment in R&D of city-forming enterprises (by the example of the metallurgical industry)

DOI:

https://doi.org/10.15587/1729-4061.2024.304718Keywords:

investment level, R&D, metallurgical industry, enterprise managementAbstract

The object of the study is investment in R&D of enterprises. The problem of developing a mechanism for managing the level of R&D investment at industrial enterprises has been solved. The results are obtained:

– gradation of R&D investment levels at enterprises based on the application of the beta coefficient calculation methodology adapted to the R&D sphere;

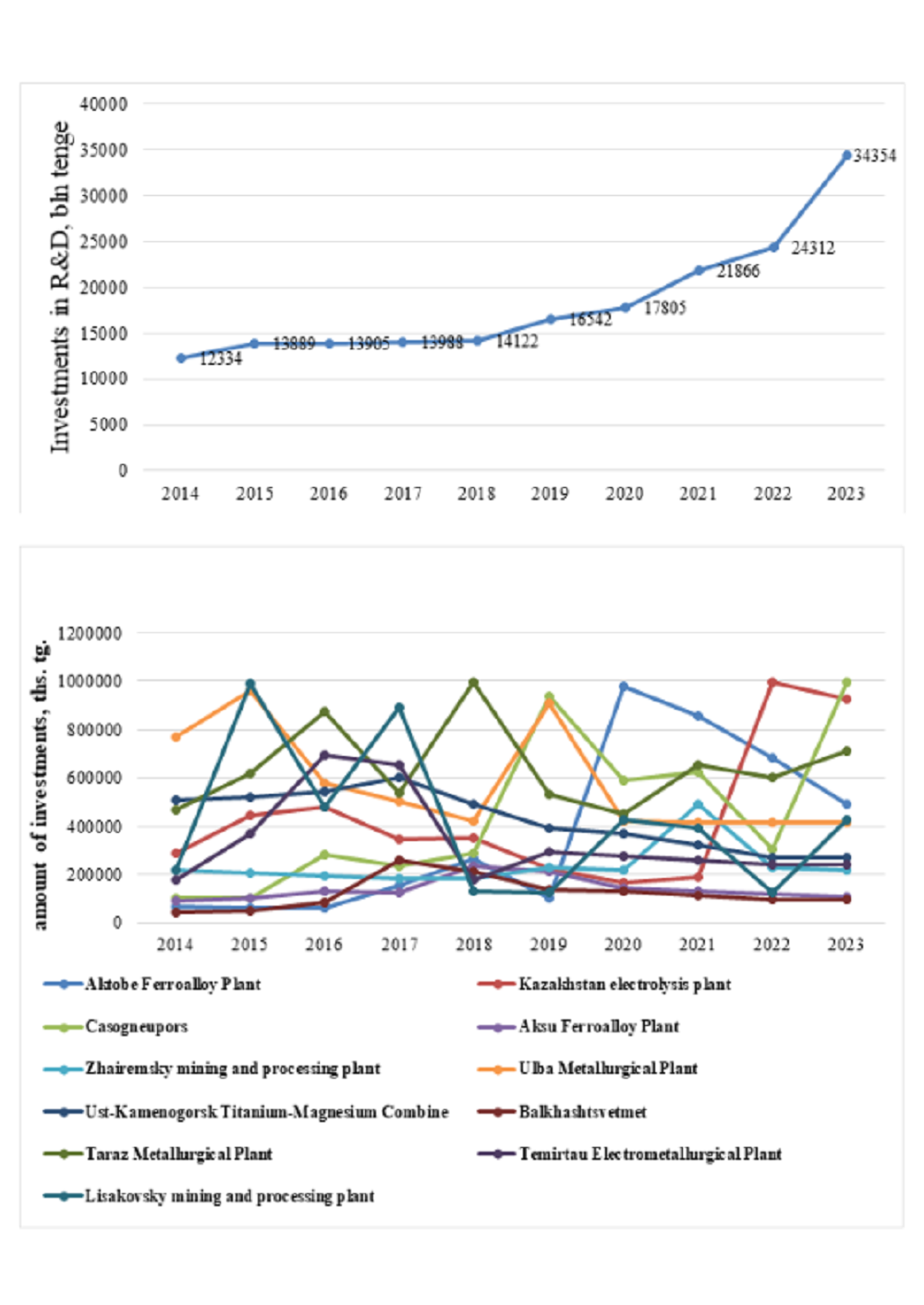

– distribution of city-forming enterprises of the metallurgical industry by R&D investment levels: high level – 27 % of surveyed enterprises, average – 18 %, low – 55 %, critical – 0 %;

– development of a matrix based on the comparison of the level of R&D investment and the level of sales volumes of the enterprise's products calculated according to one algorithm. For each cell of the matrix, management decisions of strategic nature are proposed to increase the level of R&D investment.

The results obtained are explained by the assumption of a linear relationship between the size of R&D investment of a particular enterprise over time and aggregate industry R&D investment (as a benchmark). The tendency of R&D investment growth in the industry, regularity of R&D investments of the surveyed enterprises were confirmed, time series of R&D investment both at the evaluated enterprise and in the industry as a whole were processed using trend smoothing.

The features of the obtained results lie in the application of comparable coefficients (investments in R&D), as well as in the application of the developed assessment in the management of the enterprise.

The practical significance of this study results is the possibility of applying the obtained conclusions and recommendations to increase the level of R&D investment of large industrial enterprises in the volume, scope and conditions corresponding to the developing economy

References

- PCT. Yearly Review (2022). WIPO. Available at: https://digitizare.biblioteca.ct.ro/wp-content/uploads/wipo-pub-901-2022-en-patent-cooperation-treaty-yearly-review-2022.pdf

- Consolidated Reader-Friendly Edition of the Treaty on European Union (TEU) and the Treaty on the Functioning of the European Union (TFEU) as amended by the Treaty of Lisbon. Available at: http://en.euabc.com/upload/books/lisbon-treaty-3edition.pdf

- KNOEMA. Available at: https://knoema.com/atlas

- Sternberg, R. J., Lubart, T. I. (1998). The Concept of Creativity: Prospects and Paradigms. Handbook of Creativity, 3–15. https://doi.org/10.1017/cbo9780511807916.003

- Barro, R. J., Sala-i-Martin, X. (2004). Economic Growth. Cambridge, London: The MIT Press, 654. Available at: http://piketty.pse.ens.fr/files/BarroSalaIMartin2004.pdf

- Business Research and Development and Innovation: 2015. National Science Foundation. Available at: https://ncses.nsf.gov/pubs/nsf18313/

- Frascati Manual 2015. Guidelines for Collecting and Reporting Data on Research and Experimental Development. Available at: https://www.oecd.org/sti/frascati-manual-2015-9789264239012-en.htm

- Yin, X., Qi, L., Ji, J., Zhou, J. (2023). How does innovation spirit affect R&D investment and innovation performance? The moderating role of business environment. Journal of Innovation & Knowledge, 8 (3), 100398. https://doi.org/10.1016/j.jik.2023.100398

- Gavrysh, O. A., Karpenko, I. O. (2023). Innovation as imperative for competitiveness of transnational corporations in global markets. Economic Synergy, 1, 136–150. https://doi.org/10.53920/es-2023-1-11

- Frolova, N. (2021). Tax incentives for R&D in the context of the development of fiscal space. Finance of Ukraine, 10, 81–97. https://doi.org/10.33763/finukr2021.10.081

- Parast, M. M. (2020). The impact of R&D investment on mitigating supply chain disruptions: Empirical evidence from U.S. firms. International Journal of Production Economics, 227, 107671. https://doi.org/10.1016/j.ijpe.2020.107671

- Weeder, D. (2018). The impact of corporate governance provisions on R&D intensity: a closer look at corporate governance in an international perspective. Uppsala University. Available at: http://urn.kb.se/resolve?urn=urn:nbn:se:uu:diva-357789

- Lee, J., Wang, J. (2021). More Investment Less Profit? An R&D Investment Conundrum of a Financially Constrained Firm in a Supply Chain. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3879197

- Coad, A., Segarra-Blasco, A., Teruel, M. (2020). A bit of basic, a bit of applied? R&D strategies and firm performance. The Journal of Technology Transfer, 46 (6), 1758–1783. https://doi.org/10.1007/s10961-020-09826-1

- Moldabekova, A., Sabyr, N., Zhidebekkyzy, A. (2020). The assessment a relationship between science and socio-economic development of the country (on the example of Kazakhstan). The Economy: Strategy and Practice, 15 (3), 157–170. https://doi.org/10.51176/jesp/issue_3_t12

- The World Bank Research Program, 2005-2007. Abstracts of Current Studies. https://doi.org/10.1596/978-0-8213-7405-4

- Henri, J.-F., Wouters, M. (2020). Interdependence of management control practices for product innovation: The influence of environmental unpredictability. Accounting, Organizations and Society, 86, 101073. https://doi.org/10.1016/j.aos.2019.101073

- Slusarczyk, B., Gorka, M., Wozniak, A. (2022). Value based concept of project management on enterprises. Economics and Finance, 10 (1), 37–53. https://doi.org/10.51586/2754-6209.2021.10.1.37.53

- Industry statistics. Investments statistics. Bureau of National statistics of Agency for Strategic planning and reforms of the Republic of Kazakhstan. Available at: https://stat.gov.kz/en/industries/business-statistics/stat-invest/

- Ren, J, Wang, H. (2023). Mathematical Methods in Data Science. Elsevier. https://doi.org/10.1016/c2022-0-00156-2

- Hunady, J., Pisar, P. (2020). Business Spending on Research and Development and its Relationship to Invention and Innovation. In: Proceedings of the ENTRENOVA. Enterprise Research Innovation Conference. IRENET. Zagreb, 542–552. Available at: https://www.econstor.eu/bitstream/10419/224720/1/51-ENT-2020-Hunady-542-552.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Saltanat Yessengaliyeva, Assel Tapalova, Assel Melekova, Nurkhat Ibadildin, Gaukhar Kairliyeva, Serik Serikbayev, Kanbibi Nursapina

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.