Управління ризиками на основі інструментів хеджування в умовах експортно орієнтованої економіки

DOI:

https://doi.org/10.15587/1729-4061.2024.299651Ключові слова:

ризики експортерів металопродукції, хеджування цінового ризику, зовнішня торгівля, металургійна галузьАнотація

Об’єктом дослідження є процес управління ризиками підприємств металургійної галузі як суб’єкта зовнішньоекономічної діяльності. В умовах експортно-орієнтованої економіки важливо мати інструменти завчасного реагування на кризи і виклики, зумовлені різними факторами. Волатильність ринку та світових і внутрішніх цін на ключові продукти і сировину додають невизначеності та спонукають менеджмент до пошуку інструментів захисту своїх фінансових надходжень.

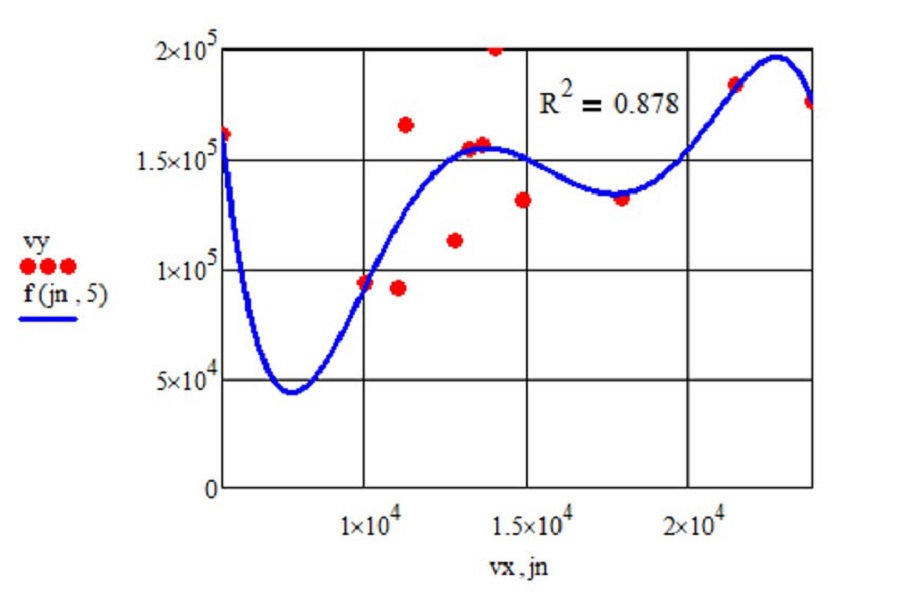

Побудова карти ризиків та застосування математичного інструментарію для прогнозування й мінімізації негативних наслідків від настання ризикових подій сприятимуть ухваленню оптимальних управлінських рішень в операційній діяльності та в процесі ціноутворення.

Інтерпретація циклу управління ризиками для потреб підприємств металургійної галузі дозволить адекватно ідентифікувати ризики, притаманні галузі та розробити заходи щодо гнучкого реагування на кризи і виклики. В ході дослідження було з’ясовано, що підприємства-експортери потребують захисту, насамперед, від цінового ризику, який суттєво зростає в умовах інфляції та через стрибки індексу споживчих цін в окремій країні. В якості інструменту захисту пропонується застосовувати хеджування.

Визначення периметру ризик-хеджування шляхом ризик-орієнтованого відбору індикаторів (зовнішніх та внутрішніх, комерційних та некомерційних ризиків) залежно від певної ситуації на ринку дозволить встановити кореляційний зв’язок між ключовими факторами впливу.

Впровадження циклу ризик-хеджування в практику діяльності підприємств металургійної галузі дозволить забезпечити гнучке управління процедурою ціноутворення на металопродукцію як на внутрішньому ринку, так і під час зовнішньої торгівлі

Посилання

- Nguembi, I. P., Yang, L., Appiah, V. S. (2023). Safety and risk management of Chinese enterprises in Gabon’s mining industry. Heliyon, 9 (10), e20721. https://doi.org/10.1016/j.heliyon.2023.e20721

- Tuo, J., Zhang, F. (2020). Modelling the iron ore price index: A new perspective from a hybrid data reconstructed EEMD-GORU model. Journal of Management Science and Engineering, 5 (3), 212–225. https://doi.org/10.1016/j.jmse.2020.08.003

- Liu, J., Hu, Y., Yan, L.-Z., Chang, C.-P. (2023). Volatility spillover and hedging strategies between the European carbon emissions and energy markets. Energy Strategy Reviews, 46, 101058. https://doi.org/10.1016/j.esr.2023.101058

- Thakur, J., Hesamzadeh, M. R., Date, P., Bunn, D. (2023). Pricing and hedging wind power prediction risk with binary option contracts. Energy Economics, 126, 106960. https://doi.org/10.1016/j.eneco.2023.106960

- Matsumoto, T., Yamada, Y. (2021). Simultaneous hedging strategy for price and volume risks in electricity businesses using energy and weather derivatives. Energy Economics, 95, 105101. https://doi.org/10.1016/j.eneco.2021.105101

- Będowska-Sójka, B., Demir, E., Zaremba, A. (2022). Hedging Geopolitical Risks with Different Asset Classes: A Focus on the Russian Invasion of Ukraine. Finance Research Letters, 50, 103192. https://doi.org/10.1016/j.frl.2022.103192

- Akhtaruzzaman, M., Banerjee, A. K., Le, V.Moussa, F. (2024). Hedging precious metals with impact investing. International Review of Economics & Finance, 89, 651–664. https://doi.org/10.1016/j.iref.2023.07.047

- Abdollahi, H., Fjesme, S. L., Sirnes, E. (2024). Measuring market volatility connectedness to media sentiment. The North American Journal of Economics and Finance, 71, 102091. https://doi.org/10.1016/j.najef.2024.102091

- Nieizviestna, O., Ruban, K. (2023). The impact of the COVID-19 pandemic on the financial activities of mining and metallurgy companies as an example of PJSC «ArcelorMittal Kryviy Rih». Economy and Society, (53). https://doi.org/10.32782/2524-0072/2023-53-24

- Obiednani na vsikh frontakh. Richnyi zvit 2022. Metinvest. Available at: https://metinvestholding.com/ua/ar2022/

- Steel trade and trade policy developments. Available at: https://one.oecd.org/document/DSTI/SC(2022)13/FINAL/en/pdf

- Komentar Natsionalnoho banku shchodo rivnia infliatsii u 2023 rotsi. NBU. Available at: https://bank.gov.ua/ua/news/all/komentar-natsionalnogo-banku-schodo-rivnya-inflyatsiyi-u-2023-rotsi

- GMK Center. Available at: https://gmk.center/ua/news/

- Richnyi zvit 2021. Metinvest. Available at: https://metinvestholding.com/ar2021/pdf/Metinvest_AR2021_UA_all.pdf

- Prokhorova, V., Kovalenko, O., Bozhanova, O., Zakharchyn, H. (2023). The paradigm of emergent qualities of education management as a scientific and technological platform for sustainable development. IOP Conference Series: Earth and Environmental Science, 1150 (1), 012014 https://doi.org/10.1088/1755-1315/1150/1/012014

- Statystyka ta reiestry. Derzhavna mytna sluzhba Ukrainy. Available at: https://customs.gov.ua/statistika-ta-reiestri

- Indeksy. Ministerstvo finansiv Ukrainy. Available at: https://index.minfin.com.ua/ua/economy/gdp/

- Industry of Ukraine 2016-2020 (2021). State Statistics Service of Ukraine. Kyiv. Available at: https://ukrstat.gov.ua/druk/publicat/kat_u/2021/zb/12/zb_prom_16_20.pdf

- Pylypenko, H. M., Prokhorova, V. V., Mrykhina, O. B., Koleshchuk, O. Y., Mushnykova, S. A. (2020). Cost evaluation models of R&D products of industrial enterprises. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 5, 163–170. https://doi.org/10.33271/nvngu/2020-5/163

- Prokhorova, V. V., Yemelyanov, O. Y., Koleshchuk, O. Y., Antonenko, N. S., Zaitseva, A. S. (2023). Information support for management of energy-saving economic development of enterprises. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 6, 175–183. https://doi.org/10.33271/nvngu/2023-6/175

- Abernikhina, I., Toporkova, O., Sokyrynska, І., Shylo, L. (2021). Methodical approaches for assessing the financial stability of insurance companies. Financial and Credit Activity Problems of Theory and Practice, 3 (38), 144–153. https://doi.org/10.18371/fcaptp.v3i38.237437

- Prokhorova, V. V., Yemelyanov, O. Y., Koleshchuk, O. Y., Petrushka, K. I. (2023). Tools for assessing obstacles in implementation of energy saving measures by enterprises. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 1, 160–168. https://doi.org/10.33271/nvngu/2023-1/160

##submission.downloads##

Опубліковано

Як цитувати

Номер

Розділ

Ліцензія

Авторське право (c) 2024 Viktoriia Prokhorova, Iryna Abernikhina, Svitlana Mushnykova, Olena Bozhanova, Olena Toporkova

Ця робота ліцензується відповідно до Creative Commons Attribution 4.0 International License.

Закріплення та умови передачі авторських прав (ідентифікація авторства) здійснюється у Ліцензійному договорі. Зокрема, автори залишають за собою право на авторство свого рукопису та передають журналу право першої публікації цієї роботи на умовах ліцензії Creative Commons CC BY. При цьому вони мають право укладати самостійно додаткові угоди, що стосуються неексклюзивного поширення роботи у тому вигляді, в якому вона була опублікована цим журналом, але за умови збереження посилання на першу публікацію статті в цьому журналі.

Ліцензійний договір – це документ, в якому автор гарантує, що володіє усіма авторськими правами на твір (рукопис, статтю, тощо).

Автори, підписуючи Ліцензійний договір з ПП «ТЕХНОЛОГІЧНИЙ ЦЕНТР», мають усі права на подальше використання свого твору за умови посилання на наше видання, в якому твір опублікований. Відповідно до умов Ліцензійного договору, Видавець ПП «ТЕХНОЛОГІЧНИЙ ЦЕНТР» не забирає ваші авторські права та отримує від авторів дозвіл на використання та розповсюдження публікації через світові наукові ресурси (власні електронні ресурси, наукометричні бази даних, репозитарії, бібліотеки тощо).

За відсутності підписаного Ліцензійного договору або за відсутністю вказаних в цьому договорі ідентифікаторів, що дають змогу ідентифікувати особу автора, редакція не має права працювати з рукописом.

Важливо пам’ятати, що існує і інший тип угоди між авторами та видавцями – коли авторські права передаються від авторів до видавця. В такому разі автори втрачають права власності на свій твір та не можуть його використовувати в будь-який спосіб.