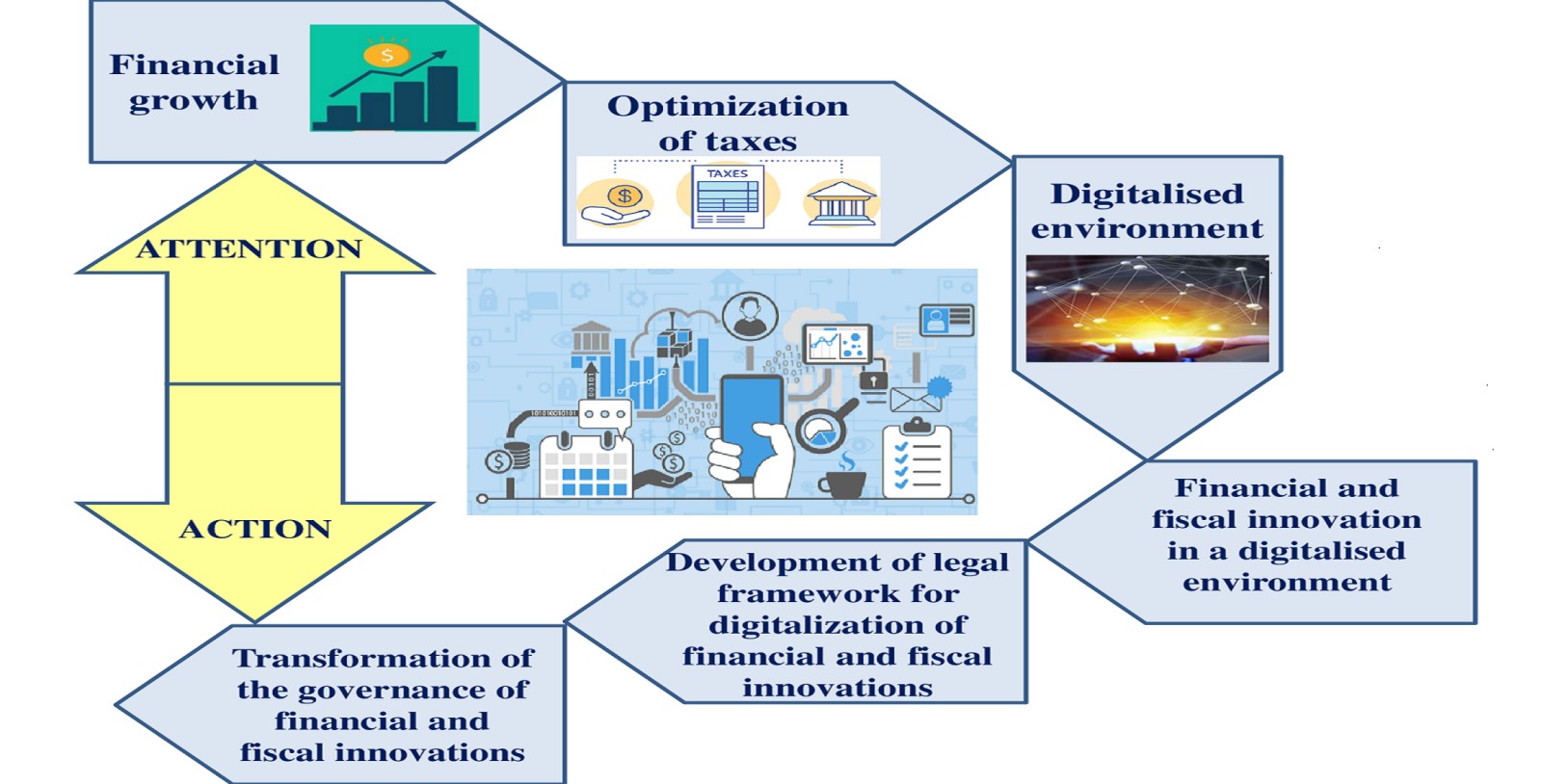

Improving the governance and legal framework for implementing financial and fiscal innovation in a digitalized environment

DOI:

https://doi.org/10.15587/1729-4061.2022.265780Keywords:

financial and tax innovations, financial and tax management, legal regulation, digital technologiesAbstract

This paper considers the organizational and legal support of the processes of digitalization of innovation in the financial and tax sectors. The main prerequisites were identified, and the role of financial and tax innovations in the development of the economy at the macro level was defined. Emphasis is on digital technologies as the main driving force of innovation in the financial and tax sector. The relationship between the concepts of "financial and tax innovations" and "financial engineering" has been established. The main directions of digitalization of the financial and tax sectors are identified. The digital technologies that have the greatest impact on financial and tax innovation are identified, namely: blockchain, Big Data, artificial intelligence, cloud technologies, the Internet of Things. The directions of legal regulation were substantiated and further steps to develop legal support for the digitalization of the financial sector were determined. To this end, the components of legal regulation, institutional regulation, and scientific and methodological regulation of digitalization of the financial sector are detailed. In contrast to numerous studies in the field of legal support and regulation of digitalization of the financial and tax sectors, it has been hypothesized and proved that the greatest effect is achieved with the harmonious interaction of institutional components. The system of management of financial and tax innovations in the context of digitalization has been improved. To this end, the stages of the transformation process of the financial and tax innovation management system in the context of digitalization were detailed and an algorithm for digitalization of the financial sector has been developed. The scope of practical application of the research results is the development of the financial and tax sector through the introduction of digital tools

References

- Ha, L. T. (2022). Effects of digitalization on financialization: Empirical evidence from European countries. Technology in Society, 68, 101851. doi: https://doi.org/10.1016/j.techsoc.2021.101851

- Monkiewicz, J., Monkiewicz, M. (2022). Financial Sector Supervision in Digital Age: Transformation in Progress. Foundations of Management, 14 (1), 25–36. doi: https://doi.org/10.2478/fman-2022-0002

- Pantielieieva, N., Krynytsia, S., Khutorna, M., Potapenko, L. (2018). FinTech, Transformation of Financial Intermediation and Financial Stability. 2018 International Scientific-Practical Conference Problems of Infocommunications. Science and Technology (PIC S&T). doi: https://doi.org/10.1109/infocommst.2018.8632068

- Pantielieieva, N., Khutorna, M., Lytvynenko, O., Potapenko, L. (2020). FinTech, RegTech and Traditional Financial Intermediation: Trends and Threats for Financial Stability. Lecture Notes on Data Engineering and Communications Technologies, 1–21. doi: https://doi.org/10.1007/978-3-030-35649-1_1

- Suryono, R. R., Budi, I., Purwandari, B. (2020). Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information, 11 (12), 590. doi: https://doi.org/10.3390/info11120590

- Ashta, A., Biot-Paquerot, G. (2018). FinTech evolution: Strategic value management issues in a fast changing industry. Strategic Change, 27 (4), 301–311. doi: https://doi.org/10.1002/jsc.2203

- Eyal, I. (2017). Blockchain Technology: Transforming Libertarian Cryptocurrency Dreams to Finance and Banking Realities. Computer, 50 (9), 38–49. doi: https://doi.org/10.1109/mc.2017.3571042

- Stern, C., Makinen, M., Qian, Z. (2017). FinTechs in China – with a special focus on peer to peer lending. Journal of Chinese Economic and Foreign Trade Studies, 10 (3), 215–228. doi: https://doi.org/10.1108/jcefts-06-2017-0015

- Mathur, N., Karre, S. A., Mohan, L. S., Reddy, Y. R. (2018). Analysis of FinTech Mobile App Usability for Geriatric Users in India. Proceedings of the 4th International Conference on Human-Computer Interaction and User Experience in Indonesia, CHIuXiD ’18. doi: https://doi.org/10.1145/3205946.3205947

- Nomakuchi, T. (2018). A Case Study on Fintech in Japan Based on Keystone Strategy. 2018 Portland International Conference on Management of Engineering and Technology (PICMET). doi: https://doi.org/10.23919/picmet.2018.8481745

- Iman, N. (2018). Assessing the dynamics of fintech in Indonesia. Investment Management and Financial Innovations, 15 (4), 296–303. doi: https://doi.org/10.21511/imfi.15(4).2018.24

- Stewart, H., Jürjens, J. (2018). Data security and consumer trust in FinTech innovation in Germany. Information & Computer Security, 26 (1), 109–128. doi: https://doi.org/10.1108/ics-06-2017-0039

- Bakaeva, O. Y., Belikov, E. G., Pokachalova, E. V., Popov, V. V., Razgildieva, M. B. (2018). Implementing the principles of the social state in tax law within the context of the digital economy. The Journal of Social Sciences Research, 3, 61–66. doi: https://doi.org/10.32861/jssr.spi3.61.66

- Grundel, L. P., Nazarova, N. A., Zhuravleva, I. A., Kostin, A. A., Suleymanov, M. D. (2019). Taxation and the Digital Economy: Technologies, Innovations, Prospects. Journal of Advanced Research in Dynamical and Control Systems, 11 (11-SPECIAL ISSUE), 138–145. doi: https://doi.org/10.5373/jardcs/v11sp11/20192940

- Reva, D. M. (2015). Current issues of tax incentive. Pravo ta innovatsiyi, 3 (11), 72–77. Available at: https://ndipzir.org.ua/wp-content/uploads/2015/09/Reva11.pdf

- Mozghovyi, O. M., Musiets, T. V., Rudenko-Sudarieva, L. V. (2015). Mizhnarodni finansy. Kyiv: KNEU, 515.

- Vahnovska, N. A., Ishchuk, L. I., Polishchuk, V. G. (2015). Current tax innovations as a priority component of financial engineering of business processes in Ukraine. Aktualni problemy ekonomiky, 8 (170), 337–342. Available at: https://lib.lntu.edu.ua/sites/default/files/2021-01/ape_2015_8_42%20%281%29.pdf

- Velychkin, V. O., Tymoshenko, M. V. (2019). Finansovyi inzhynirynh. Dnipro: Universytet mytnoi spravy ta finansiv, 124.

- Musiienko, V., Zinchenko, M. (2020). Financial engineering – generator of financial innovations. Market Infrastructure, 39, 346–352. doi: https://doi.org/10.32843/infrastruct39-57

- Furdela, N., Serzhanov, V. (2020). Finansovyi inzhynirynh v umovakh postindustrialnoi ekonomiky. Rozvytok naukovoi dumky postindustrialnoho suspilstva: suchasnyi dyskurs, 1, 103–105. doi: https://doi.org/10.36074/13.11.2020.v1.08

- Rezul'taty issledovaniya mneniya rynka po voprosam razvitiya finansovykh tekhnologiy na 2021–2023 gg. (2020). Doklad Assotsiatsii "FinTekh", 71.

- Al-Ababneh, H. A., Al-Dhaimesh, H., Alshira’h, A. F., Alibraheem, M. H., Mugableh, M. I., Alhosban, A. et. al. (2022). Formation of scientific and methodological aspects of evaluation transformation of targets economic development of countries. Eastern-European Journal of Enterprise Technologies, 3 (13 (117)), 52–66. doi: https://doi.org/10.15587/1729-4061.2022.259677

- Vuković, M. (2020). Towards the digitization of tax administration. Available at: https://www.cef-see.org/files/Digitization_Tax_Administration.pdf

- Yak tsyfrova era transformuie sferu opodatkuvannia (2019). Available at: https://www.ey.com/uk_ua/tax/how-tax-is-transforming-in-the-digital-age

- Strimkyi rozvytok Fintekh i inshurtekha (2017). Available at: https://tbt-broker.com/news/samye-perspektivnye-fintekh-otrasli

- Pantielieieva, N. M. (2017). Financial innovations in the conditions of digitalization of the economics: trends, challenges and threats. Pryazovskyi ekonomichnyi visnyk, 3 (03), 68–73.

- Victorova, N., Vylkova, E., Pokrovskaia, N., Shukhov, F. (2019). Information Technology and Innovation in Taxpayer Registration and Numbering. Proceedings of the 2019 International SPBPU Scientific Conference on Innovations in Digital Economy. doi: https://doi.org/10.1145/3372177.3373349

- Sharmila, S. (2019). Digital Finance With Respect To Financial Inclusion. International Journal of Recent Technology and Engineering (IJRTE), 8 (3), 6321–6326. doi: https://doi.org/10.35940/ijrte.c6013.098319

- Pantielieieva, N., Didkovsky, R. (2020). Modern technologies of data and knowledge processing for the real economic sector: technological, economic and social aspects. Scientific Notes of Taurida National V.I. Vernadsky University. Series: Economy and Management, 31 (4). doi: https://doi.org/10.32838/2523-4803/70-4-49

- Mikhaleva, O. L., Syradoev, D. V., Terekhova, T. A. (2020). Big Data Technology Application in the Taxation Sphere. Lecture Notes in Networks and Systems, 431–436. doi: https://doi.org/10.1007/978-3-030-53277-2_51

- Kontseptsiya rozvytku tsyfrovoi ekonomiky ta suspilstva Ukrainy na 2018-2020 roky (2018). Rozporiadzhennia KMU Ukrainy vid 17 sichnia 2018 r. No. 67-r. Available at: https://zakon.rada.gov.ua/laws/show/67-2018-%D1%80/conv#Text

- Pro skhvalennia Stratehii zdiisnennia tsyfrovoho rozvytku, tsyfrovykh transformatsiy i tsyfrovizatsii systemy upravlinnia derzhavnymy finansamy na period do 2025 roku ta zatverdzhennia planu zakhodiv shchodo yii realizatsiyi (2021). Rozporiadzhennia KMU Ukrainy vid 17 lystopada 2021 r. No. 1467-r. Available at: https://zakon.rada.gov.ua/laws/show/1467-2021-%D1%80#Text

- Kolisnyk, A. (2021). Taxation in the conditions of digitalization of the economy: on the issue of legal regulation. Aktualni problemy hospodarskoi diyalnosti v umovakh rozbudovy ekonomiky Industriyi 4.0. Kharkiv: NDI PZIR NAPrN Ukrainy, 68–75. Available at: https://openarchive.nure.ua/bitstream/document/17622/1/doc11.pdf

- Latkovska, T. A. (2021). Finansovo-pravove rehuliuvannia suspilnykh vidnosyn v umovakh tsyfrovoi transformatsiyi. Finansove pravo v umovakh tsyfrovoi transformatsiyi. Chernivtsi: Tekhnodruk, 45–88. Available at: http://dspace.onua.edu.ua/bitstream/handle/11300/15123/%d0%9c%d0%be%d0%bd%d0%be%d0%b3%d1%80%d0%b0%d1%84%d1%96%d1%8f%20%d0%a4%d1%96%d0%bd%20%d0%bf%d1%80%d0%b0%d0%b2.pdf?sequence=3&isAllowed=y

- Petrenko, N. O., Mashkovska, L. V. (2020). Digitalization of state administrative services in Ukraine: regulatory aspects. Law and Society, 2, 112–119. doi: https://doi.org/10.32842/2078-3736/2020.2-1.18

- Lutsenko, A., Vykluk, М., Skoryk, М., Hromova, Т. (2021). Fiscal regulation concept formation of the Ukraine's economy development. Studies of Applied Economics, 38 (4). doi: https://doi.org/10.25115/eea.v38i4.3997

- Dolganova, Yu. S., Istomina, N. A., Terentieva, M. N. (2019). Approaches to the regulation of the development of digitalization of finance in the regional economy. Proceedings of the 1st International Scientific Conference “Modern Management Trends and the Digital Economy: From Regional Development to Global Economic Growth” (MTDE 2019). doi: https://doi.org/10.2991/mtde-19.2019.51

- Pantielieieva, N. (2022). Digital Transformation of Tax Administration. Traektoriâ Nauki = Path of Science, 8 (1), 3035–3051. doi: https://doi.org/10.22178/pos.78-9

- Koschuk, T. (2019). Ways to improve taxation for digital companies. Finance of Ukraine, 10, 73–88. doi: https://doi.org/10.33763/finukr2019.10.073

- Stratehiya rozvytku fintekhu v Ukraini: stalyi rozvytok innovatsiy, keshles ta fin hramotnist (2019). Kyiv: Natsionalnyi bank Ukrainy, 49.

- Sun, Y., Li, S., Wang, R. (2022). Fintech: from budding to explosion - an overview of the current state of research. Review of Managerial Science. doi: https://doi.org/10.1007/s11846-021-00513-5

- Marszk, A., Lechman, E. (2021). Reshaping financial systems: The role of ICT in the diffusion of financial innovations – Recent evidence from European countries. Technological Forecasting and Social Change, 167, 120683. doi: https://doi.org/10.1016/j.techfore.2021.120683

- Ukraina 2030E − kraina z rozvynutoiu tsyfrovoiu ekonomikoiu. Available at: https://strategy.uifuture.org/kraina-z-rozvinutoyu-cifrovoyu-ekonomikoyu.html

- Tsyfrova adzhenda Ukrainy – 2020 (2016). Available at: https://ucci.org.ua/uploads/files/58e78ee3c3922.pdf

- Ruohomaa, H., Salminen, V. (2019). Ecosystem-Based Development on Managing Digital Transformation. Advances in Human Factors, Business Management and Leadership, 132–140. doi: https://doi.org/10.1007/978-3-030-20154-8_13

- Okolelova, E., Shibaeva, M., Shulgina, L., Efimyev, A., Serebryakova, N. (2020). The model of forming of innovative financing and credit schemes in housing construction and estimation of their financial stability. IOP Conference Series: Materials Science and Engineering, 890 (1), 012194. doi: https://doi.org/10.1088/1757-899x/890/1/012194

- Kuzmenko, H., Yahelska, K., Artyukh, O., Babich, I., Volenshchuk, N., Sulimenko, L. (2021). Improved Methodology of Accounting and Audit of Payments to Employees in Ukraine. Universal Journal of Accounting and Finance, 9 (1), 44–53. doi: https://doi.org/10.13189/ujaf.2021.090105

- Yahelska, K., Tropina, V., Khomutenko, A., Petlenko, Y., Lantukh, K., Kryhan, Y. (2021). Comparative Analysis of Methods for Forecasting Budget Indicators. Studies of Applied Economics, 39 (3). doi: https://doi.org/10.25115/eea.v39i3.4521

- Kolomiiets, P. V. (2020). Systema komplaiens yak element podatkovoi bezpeky Ukrainy. Modern Researches: Progress of the Legislation of Ukraine and Experience of the European Union, 735–750. doi: https://doi.org/10.30525/978-9934-588-43-3/2.9

- Frost, Dzh., Gambakorta, L., Shin, Kh. S. (2021). Ot finansovykh innovatsiy k finansovoy integratsii. Finansy i razvitie, 3, 14–17. Available at: https://www.imf.org/external/russian/pubs/ft/fandd/2021/03/pdf/fd0321r.pdf

- Finansoviy inzhiniring na finansovykh rynkakh (2017). Available at: https://finance-credit.news/osnovyi-finansov-ekonomika/finansovyiy-injiniring-finansovyih-58343.html

- Dmytryk, O. O., Kostenko, Y. O., Monaienko, A. O., Riadinska, V. O., Soldatenko, O. V. (2020). State Legal Forms of Interaction with Debt Obligations and State Losses. Journal of Advanced Research in Law and Economics, 11 (2), 342. doi: https://doi.org/10.14505/jarle.v11.2(48).07

- Korol, V., Dmytryk, O., Karpenko, O., Riadinska, V., Basiuk, O., Kobylnik, D. et. al. (2022). Elaboration of recommendations on the development of the state internal audit system when applying the digital technologies. Eastern-European Journal of Enterprise Technologies, 1 (13 (115)), 39–48. doi: https://doi.org/10.15587/1729-4061.2022.252424

- Yaroshenko, O. M., Sliusar, A. M., Sereda, O. H., Zakrynytska, V. O. (2019). Legal relation: The issues of delineation (on the basis of the civil law of Ukraine). Asia Life Sciences, 21 (2), 719–734.

- Gnatenko, K. V., Yaroshenko, O. M., Inshyn, M. I., Vapnyarchuk, N. M., Sereda, O. H. (2020). Targeted and Effective Use of State and Non-State Social Funds. International Journal of Criminology and Sociology, 9, 2861–2869. Available at: https://www.lifescienceglobal.com/pms/index.php/ijcs/article/view/8069/4319

- Zaitsev, O., Kroitor, V., Isaiev, A., Bilenko, M., Savchenko, A. (2020). Legal nature of invalid transactions. Systematic Reviews in Pharmacy, 11 (11), 533–536. Available at: https://www.sysrevpharm.org/articles/legal-nature-of-invalid-transactions.pdf

- Puchkovska, I. Y., Pecheniy, O. P., Isaiev, A. M. (2020). Ensuring the Fulfillment of Contracts in Civil Law. International Journal of Criminology and Sociology, 9, 3040–3047. Available at: https://www.lifescienceglobal.com/pms/index.php/ijcs/article/view/8089/4339

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Olga Dmytryk, Dmytro Kobylnik, Olena Sereda, Arcen Isaiev, Artem Kotenko

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.