Identifying determinant factors influencing user’s behavioral intention to use Traveloka Paylater

DOI:

https://doi.org/10.15587/1729-4061.2023.275735Keywords:

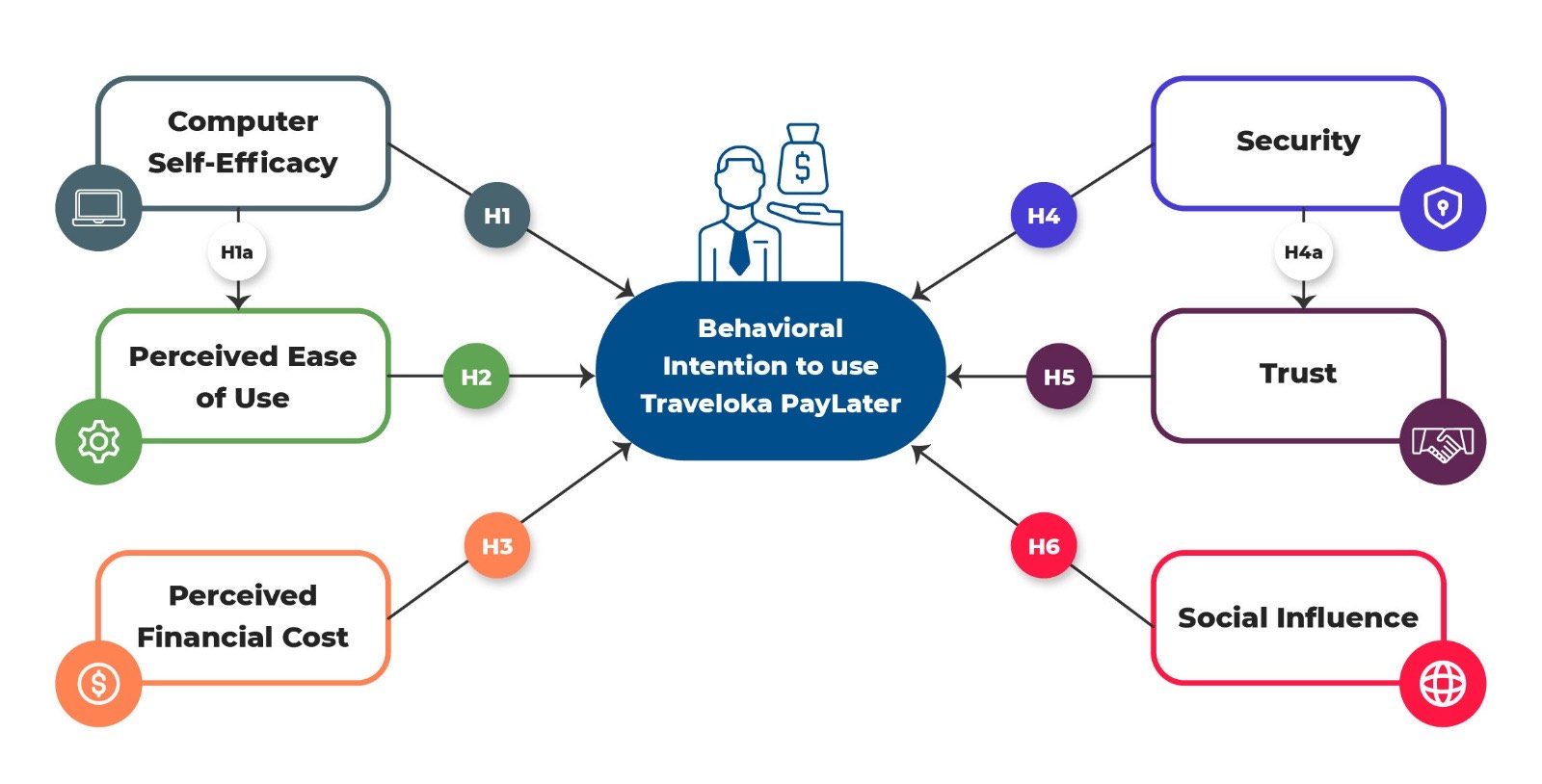

computer self-efficacy, perceived ease of use, financial cost, social influenceAbstract

The paylater payment feature is being widely discussed as an alternative payment system that offers simplicity and flexibility in settling digital business transactions with a 28 % to 38 % growth annually. Despite the popularity of Traveloka apps as the largest travel business platform that has been downloaded more than 100 million times, the number of Traveloka Paylater users is limited to only 8.6 % of the total users. The purpose of this study is to discuss what factors influence a user’s behavioral intention to use Traveloka Paylater.

The study involved 360 Traveloka user respondents over 17 years old who knew the Paylater model of payment but never use Traveloka PayLater.

The research found that computer self-efficacy affects perceived ease of use, security has an effect on trust, and social influence affects the behavioral intention to use Traveloka Paylater. Meanwhile, computer self-efficacy, perceived ease of use, perceived financial costs, security and trust do not have a positive influence on the behavioral intentions to use Traveloka Paylater.

Users with a higher level of computer self-efficacy find it easier to use the services and more trust the platform that has a higher level of security. Social media were proven to have the greatest impact on potential users by encouraging them to use Traveloka Paylater services. Since Traveloka Paylater services also offer some attractive promotions, including discount prices, users won’t mind if there will be extra charges.

The study shows that Traveloka Paylater becomes an attractive digital payment service due to its correlation with the credit system mechanism, which allows buyers to buy now but pay later using an installment plan. Traveloka Paylater shows promising growth since Indonesians are already familiar with the credit system. Since the majority of Traveloka Paylater users are the young generation, this method of payment will create hedonism of impulsive buying.

To extend the number of target users of the older generation, the study revealed the urgency to provide more integrated simple registration methods as well as create attractive live chat features, monitor the system regularly, and work with well-known influencers to increase literacy.

Supporting Agency

- The authors gratefully acknowledge to Universitas Multimedia Nusantara, Indonesia that provided support for this research.

References

- Asosiasi Penyelenggara Jasa Internet Indonesia. Laporan Survei Internet APJII and Indonesia Survey Center 2019–2022 (Q2).

- Kurniasari, F., Riyadi, W. T. (2021). Determinants of Indonesian E-Grocery Shopping Behavior After Covid-19 Pandemic Using the Technology Acceptance Model Approach. United International Journal for Research & Technology (UIJRT), 3 (1), 12–18. Available at: https://uijrt.com/articles/v3/i1/UIJRTV3I10003.pdf

- Layanan Paylater untuk Liburan, Jalan-jalan Dulu Bayar Kemudian (2022). Kompas. Available at: https://travel.kompas.com/read/2022/07/22/181742427/4-layanan-paylater-untuk-liburan-jalan-jalan-dulu-bayar-kemudian?page=all

- Shofa, J. N. (2020). Ini Perbedaan Layanan Paylater dan Kartu Kredit. Available at: https://www.beritasatu.com/digital-life/665965/ini-perbedaan-layanan-paylater-dan-kartu-kredit

- Gharaibeh, M. K., Arshad, M. R., Gharaibeh, N. K. (2018). Using the UTAUT2 Model to Determine Factors Affecting Adoption of Mobile Banking Services: A Qualitative Approach. International Journal of Interactive Mobile Technologies (iJIM), 12 (4), 123–134. doi: https://doi.org/10.3991/ijim.v12i4.8525

- Duke, P., Andy, M., Andrew, C. (2019). Insights into Payments Payment Methods Report 2019 Innovations in the Way We Pay. The Paypers, 144, 1–143.

- Arslan, B. (2015). The influence of credit card usage on impulsive buying. International Journal of Physical and Social Sciences, 5 (7), 235–251.

- Chauhan, M., Shingari, I. (2017). Future of e-Wallets: A Perspective From Under Graduates’. International Journal of Advanced Research in Computer Science and Software Engineering, 7 (8), 146. doi: https://doi.org/10.23956/ijarcsse.v7i8.42

- Kurniasari, F., Gunardi, A., Putri, F. P., Firmansyah, A. (2021). The role of financial technology to increase financial inclusion in Indonesia. International Journal of Data and Network Science, 5, 391–400. doi: https://doi.org/10.5267/j.ijdns.2021.5.004

- Alalwan, A. A., Dwivedi, Y. K., Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37 (3), 99–110. doi: https://doi.org/10.1016/j.ijinfomgt.2017.01.002

- Gulati, S., Nadeau, M.-C., Rajgopal, K. (2015). McKinsey on Payments. McKinsey&Company, 8 (21). Available at: https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/gauging%20the%20disruptive%20potential%20of%20digital%20wallets/gauging%20the%20disruptive%20potential%20of%20digital%20wallets.ashx

- Macedo, I. M. (2017). Predicting the acceptance and use of information and communication technology by older adults: An empirical examination of the revised UTAUT2. Computers in Human Behavior, 75, 935–948. doi: https://doi.org/10.1016/j.chb.2017.06.013

- Nurcahyani, I. (2022). Transformasi Traveloka Dalam Satu Dekade. Antaranews. Available at: https://www.antaranews.com/berita/2756569/transformasi-traveloka-dalam-satu-dekade?#:~:text=Hingga%20saat%20ini%2C%20aplikasi%20Traveloka,populer%20di%20kawasan%20Asia%20Tenggara

- Choshaly, S. H., Tih, S. (2017). The factors associated with the behavioural intention of ecolabelled products. Journal of Social Sciences & Humanities, 25, 196–206.

- Adams, P., Farrell, M., Dalgarno, B., Oczkowski, E. (2017). Household Adoption of Technology: The Case of High-Speed Broadband Adoption in Australia. Technology in Society, 49, 37–47. doi: https://doi.org/10.1016/j.techsoc.2017.03.001

- E-commerce Payments Trends: Indonesia’s e-commerce market trends: Major growth boosted by economic gains (2023). J.P. Morgan Global Payment Trends.

- Kemppainen, K. (2017). Digitalisation: Shaping the retail payment markets while posing new challenges to authorities. Journal of Payments Strategy & Systems, 11 (1), 42–47.

- Ng, D. (2018). Evolution of digital payments: Early learnings from Singapore’s cash-less payment drive. Journal of Payments Strategy & Systems, 11 (4), 306–312.

- Bandura, A. (1977). Self-efficacy: Toward a unifying theory of behavioral change. Psychological Review, 84 (2), 191–215. doi: https://doi.org/10.1037/0033-295x.84.2.191

- Prabhakaran, S., Vasantha, S. (2020). Effect of Social Influence on Intention to Use Mobile Wallet with the Mediating Effect of Promotional Benefits. Journal of Xi’an University of Architecture & Technology, XII (II), 3003–3019.

- Palm, M. (2017). Then press enter: digital payment technology and the history of telephone interface. Cultural Studies, 32 (4), 582–599. doi: https://doi.org/10.1080/09502386.2017.1384034

- Gangwani, R., Cain, A., Collins, A., Cassidy, J. M. (2022). Leveraging Factors of Self-Efficacy and Motivation to Optimize Stroke Recovery. Frontiers in Neurology, 13. doi: https://doi.org/10.3389/fneur.2022.823202

- Ariff, M. S. M., Yeow, S. M., Zakuan, N., Jusoh, A., Bahari, A. Z. (2012). The Effects of Computer Self-Efficacy and Technology Acceptance Model on Behavioral Intention in Internet Banking Systems. Procedia - Social and Behavioral Sciences, 57, 448–452. doi: https://doi.org/10.1016/j.sbspro.2012.09.1210

- Review of buy now pay later arrangements (2018). ASIC.

- McGowan, M. (2017). Afterpay: buy-now pay-later scheme soars in popularity but experts sound warning. Available at: https://www.theguardian.com/australia-news/2017/sep/21/afterpay-buy-now-pay-later-scheme-soars-in-popularity-but-experts-sound-warning

- Mitchell, S., Qadar, S. (2019). Afterpay, PayPal and Zip Pay: The shopping tech making us buy more. Available at:: https://www.abc.net.au/everyday/afterpay-paypal-and-zip-pay-making-us-buy-more/11604216

- Chatterjee, P., Rose, R. L. (2012). Do Payment Mechanisms Change the Way Consumers Perceive Products? Journal of Consumer Research, 38 (6), 1129–1139. doi: https://doi.org/10.1086/661730

- Damghanian, H., Zarei, A., Siahsarani Kojuri, M. A. (2016). Impact of Perceived Security on Trust, Perceived Risk, and Acceptance of Online Banking in Iran. Journal of Internet Commerce, 15 (3), 214–238. doi: https://doi.org/10.1080/15332861.2016.1191052

- Soman, D. (2001). Effects of Payment Mechanism on Spending Behavior: The Role of Rehearsal and Immediacy of Payments. Journal of Consumer Research, 27 (4), 460–474. doi: https://doi.org/10.1086/319621

- Kurniasari, F., Abd Hamid, N., Qinghui, C. (2020). The effect of perceived usefulness, perceived ease of use, trust, attitude and satisfaction into continuance intention in using alipay. Management & Accounting Review, 19 (2).

- Prastiwi, I. E., Fitria, T. N. (2021). Konsep Paylater Online Shopping dalam Pandangan Ekonomi Islam. Jurnal Ilmiah Ekonomi Islam, 7 (1), 425. doi: https://doi.org/10.29040/jiei.v7i1.1458

- Abdullah, F., Ward, R., Ahmed, E. (2016). Investigating the influence of the most commonly used external variables of TAM on students’ Perceived Ease of Use (PEOU) and Perceived Usefulness (PU) of e-portfolios. Computers in Human Behavior, 63, 75–90. doi: https://doi.org/10.1016/j.chb.2016.05.014

- Mwiya, B., Chikumbi, F., Shikaputo, C., Kabala, E., Kaulung’ombe, B., Siachinji, B. (2017). Examining Factors Influencing E-Banking Adoption: Evidence from Bank Customers in Zambia. American Journal of Industrial and Business Management, 07 (06), 741–759. doi: https://doi.org/10.4236/ajibm.2017.76053

- Saprikis, V., Avlogiaris, G., Katarachia, A. (2022). A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information, 13 (1), 30. doi: https://doi.org/10.3390/info13010030

- Chua, E. L., Chiu, J. L., Chiu, C. L. (2020). Factors influencing trust and behavioral intention to use Airbnb service innovation in three ASEAN countries. Asia Pacific Journal of Innovation and Entrepreneurship, 14 (2), 175–188. doi: https://doi.org/10.1108/apjie-12-2019-0095

- Riffai, M. M. M. A., Grant, K., Edgar, D. (2012). Big TAM in Oman: Exploring the promise of on-line banking, its adoption by customers and the challenges of banking in Oman. International Journal of Information Management, 32 (3), 239–250. doi: https://doi.org/10.1016/j.ijinfomgt.2011.11.007

- Agrawal, A. (2018). The Effects of Immediate and Delayed Payments on Consumption Behavior. ETD collection for University of Nebraska - Lincoln. Available at: https://digitalcommons.unl.edu/dissertations/AAI10837673/

- Singh, S., Srivastava, R. K. (2018). Predicting the intention to use mobile banking in India. International Journal of Bank Marketing, 36 (2), 357–378. doi: https://doi.org/10.1108/ijbm-12-2016-0186

- Folkinshteyn, D., Lennon, M. (2016). Braving Bitcoin: A technology acceptance model (TAM) analysis. Journal of Information Technology Case and Application Research, 18 (4), 220–249. doi: https://doi.org/10.1080/15228053.2016.1275242

- Vejačka, M., Štofa, T. (2017). Influence of security and trust on electronic banking adoption in Slovakia. E+M Ekonomie a Management, 20 (4), 135–150. doi: https://doi.org/10.15240/tul/001/2017-4-010

- Cheng, F. M., Phou, S., Phuong, S. (2018). Factors Influencing on Consumer’s Digital Payment Adaptation – A Comparison of Technology Acceptance Model and Brand Knowledge. Proceedings of the 21st Asia-Pacific Conference on Global Business, Economics, Finance & Social Sciences (AP18Taiwan Conference). Taipei.

- Yao, M., Di, H., Zheng, X., Xu, X. (2018). Impact of payment technology innovations on the traditional financial industry: A focus on China. Technological Forecasting and Social Change, 135, 199–207. doi: https://doi.org/10.1016/j.techfore.2017.12.023

- Yap, L., Khoo, G. L. (2022). An Investigation to Examine Factors Influencing University Students’ Behavioral Intention Towards the Acceptance of Brightspace LMS: Using SEM Approach. ACE Official Conference Proceedings. doi: https://doi.org/10.22492/issn.2186-5892.2022.24

- Ho, J. C., Wu, C.-G., Lee, C.-S., Pham, T.-T. T. (2020). Factors affecting the behavioral intention to adopt mobile banking: An international comparison. Technology in Society, 63, 101360. doi: https://doi.org/10.1016/j.techsoc.2020.101360

- Garg, N., Garg, N. (2019). Blockchain Revolutionizing Industry 4.0 (Decentralize Technology for Industries Automation). Global Journal of Enterprise Information System, 11 (4), 70–72.

- Fang, S., Xu, L. D., Zhu, Y., Ahati, J., Pei, H., Yan, J., Liu, Z. (2014). An Integrated System for Regional Environmental Monitoring and Management Based on Internet of Things. IEEE Transactions on Industrial Informatics, 10 (2), 1596–1605. doi: https://doi.org/10.1109/tii.2014.2302638

- Yeboah, A., Owusu-Prempeh, V. (2017). Exploring the Consumer Impulse Buying Behaviour from a Range of Consumer and Product Related Factors. International Journal of Marketing Studies, 9 (2), 146. doi: https://doi.org/10.5539/ijms.v9n2p146

- Hair, J. F., Risher, J. J., Sarstedt, M., Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31 (1), 2–24. doi: https://doi.org/10.1108/ebr-11-2018-0203

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Florentina Kurniasari, Johny Natu Prihanto, Nikolaus Andre

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.