Optimization of business processes in investment using automation technology, financial calculations, and risk assessment methods

DOI:

https://doi.org/10.15587/1729-4061.2023.276098Keywords:

business processes in investment, information technology, rate of return, financial calculations, β coefficientAbstract

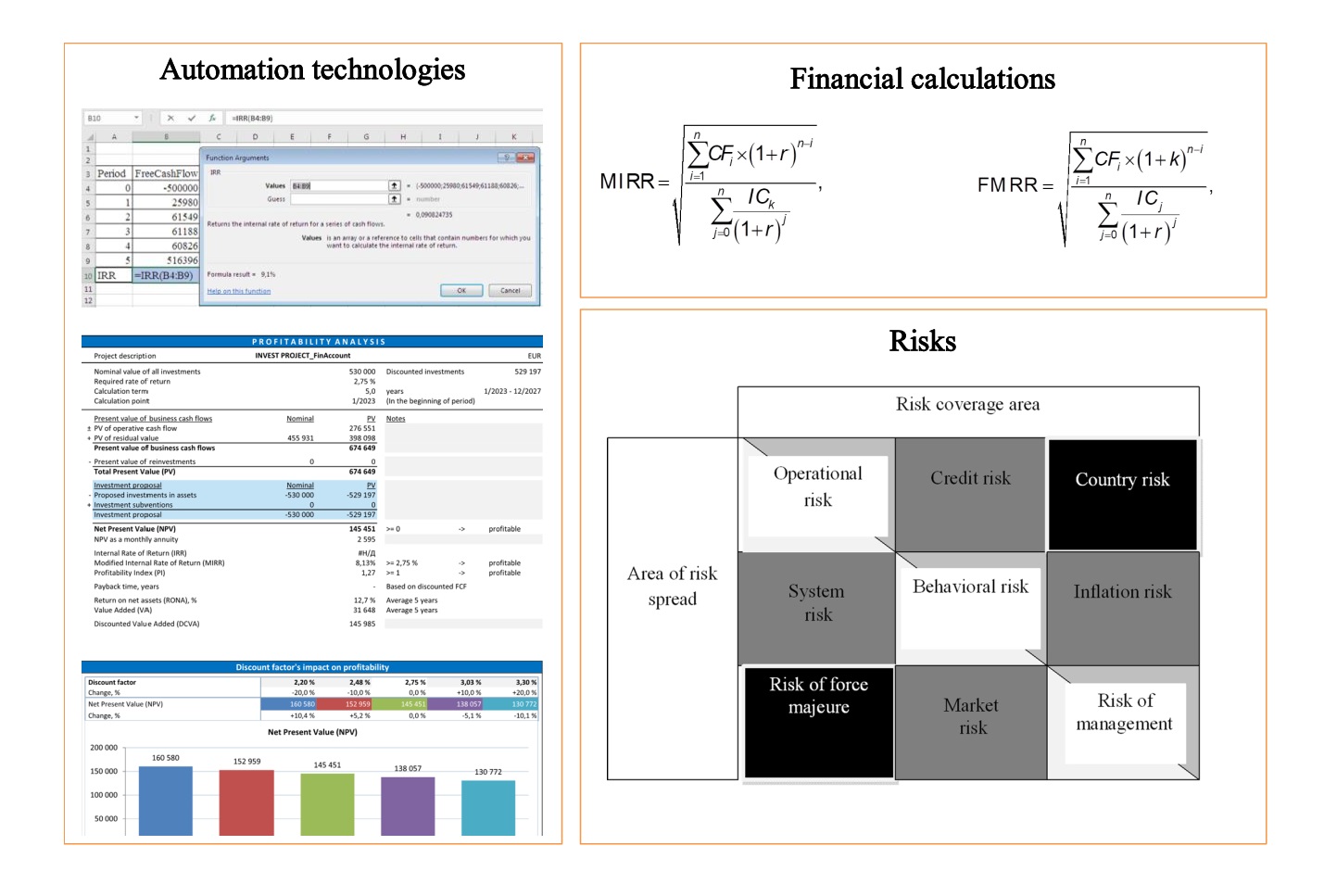

This work considers the optimization and development of business processes in investment. The conditions for the digitalization of the economy actualize the issue of introducing information technologies at all its levels and links. It is proved that information technology is an effective tool for reducing the time for the implementation of individual business processes and in investment. Its use expands the possibilities of exchanging information and its dissemination to the general public, improves the quality of investment tasks and the objectivity of investment decision-making results. Experimental studies have confirmed that the result of its application is the efficiency of obtaining, processing, and analyzing information when making management decisions. The visual content of the results of investment analysis, obtained using automation technologies, facilitates the perception of information, improves the quality of its transmission, and the value of ideas. The continuous development of information technologies in the field of investment is the basis for further scientific and practical research in this area. Based on such considerations, the feasibility of modifying the methodical toolkit of financial calculations in the process of analyzing the effectiveness of investment implementation is justified. Models of the modified internal rate of return on investment and the rate of return on financial management are proposed. Based on their definition, the objectivity of evaluating investments increases, the effectiveness of cash flow management during their implementation is proved. Strengthening the manifestation of crisis phenomena actualize the study of the nature of the occurrence of risks and the degree of their controllability. The approach to assessing investment risks using the β coefficient, the calculation technology, which is a universal tool for assessing the impact of systemic risks at the macro and micro levels, is substantiated.

References

- Hryhorenko, Ye., Shnitser, M. (2022). Yak pislia viyny Ukraina maie vidnovliuvaty ekonomiku ta biznes. Velyke doslidzhennia. Forbes Ukraine. Available at: https://forbes.ua/money/yak-pisslya-viyni-ukraina-mae-vidnovlyuvati-ekonomiku-ta-biznes-velike-doslidzhennya-deloitte-15122022-10501

- Ministerstvo ekonomiky Ukrainy. Available at: https://me.gov.ua/?lang=uk-UA

- Gura, O. L. (2015). The software of the management process of the investment project. Zovnishnia torhivlia: ekonomika, finansy, pravo, 1 (78), 111–120. Available at: http://zt.knute.edu.ua/files/2015/%E2%84%961(78)/uazt_2015_1_14.pdf

- Tkachenko, A., Mamenko, K. (2011). Basis of teoretiko and methodological aspects of automation process acceptance of investment decisions. Humanitarnyi visnyk ZDIA, 46, 260–267. Available at: http://nbuv.gov.ua/UJRN/znpgvzdia_2011_46_24

- Wach, M., Chomiak-Orsa, I. (2021). The application of predictive analysis in decision-making processes on the example of mining company’s investment projects. Procedia Computer Science, 192, 5058–5066. doi: https://doi.org/10.1016/j.procs.2021.09.284

- Kurkov, M. (2019). Tools of artificial intelligence in investment activity at financial markets. Intelekt ХХІ, 2, 93–99. Available at: http://www.intellect21.nuft.org.ua/journal/2019/2019_2/19.pdf

- Liu, X., Yuan, X., Zhang, R., Ye, N. (2022). Risk Assessment and Regulation Algorithm for Financial Technology Platforms in Smart City. Computational Intelligence and Neuroscience, 2022, 1–13. doi: https://doi.org/10.1155/2022/9903364

- Back, C., Morana, S., Spann, M. (2023). When do robo-advisors make us better investors? The impact of social design elements on investor behavior. Journal of Behavioral and Experimental Economics, 103, 101984. doi: https://doi.org/10.1016/j.socec.2023.101984

- Pronoza, P., Kuzenko, T., Sablina, N. (2022). Implementation of strategic tools in the process of financial security management of industrial enterprises in Ukraine. Eastern-European Journal of Enterprise Technologies, 2 (13 (116)), 15–23. doi: https://doi.org/10.15587/1729-4061.2022.254234

- Potyshniak, O., Dobuliak, L., Filippov, V., Malakhovskyi, Y., Lozova, O. (2019). Assessment of the Effectiveness of the Strategic Management System of Investment Activities of Companies. Academy of Strategic Management Journal, 18 (4). Available at: https://www.abacademies.org/articles/assessment-of-the-effectiveness-of-the-strategic-management-system-of-investment-activities-of-companies-8384.html

- Shkvarchuk, L. O., Slav’yuk, R. A. (2017). The evaluation of companies’ investment attractiveness based on сash flow analys. Financial and Credit Activity Problems of Theory and Practice, 1 (22), 158–171. doi: https://doi.org/10.18371/fcaptp.v1i22.109943

- Christersson, M., Vimpari, J., Junnila, S. (2015). Assessment of financial potential of real estate energy efficiency investments–A discounted cash flow approach. Sustainable Cities and Society, 18, 66–73. doi: https://doi.org/10.1016/j.scs.2015.06.002

- Morhachov, I., Khandii, О., Klius, Y., Burko, Y. (2022). Minimumpermissible level of investment efficiencyof Ukrainian business: aspects of the organization of investment company. Financial and credit activity problems of theory and practice. 2 (43), 126–134. doi: https://doi.org/10.55643/fcaptp.2.43.2022.3693

- Mulyani, E., Fitra, H., Honesty, F. F. (2021). Investment Decisions: The Effect of Risk Perceptions and Risk Propensity for Beginner Investors in West Sumatra. Advances in Economics, Business and Management Research, 192, 49–55. Available at: https://www.atlantis-press.com/article/125963968.pdf

- Zhuravlyova, I., Berest, M., Poltinina, O., Lelyuk, S. (2017). Detection of financial risks at macro-, mezo- and microlevels of economy. Economic Annals-ХХI, 165 (5-6), 31–35. doi: https://doi.org/10.21003/ea.v165-07

- Calandro, J. Jr. (2016). Impact investment and risk management: overview and approach. ACRN Oxford Journal of Finance and Risk Perspectives, 5.3, 46–60. Available at: http://www.acrn-journals.eu/resources/jofrp0503d.pdf

- Kostyrko, L., Sieriebriak, K., Sereda, O., Zaitseva, L. (2022). Investment attractiveness of Ukraine as a dominant attraction of foreign direct investment from the European space: analysis, evaluation. Financial and Credit Activity Problems of Theory and Practice, 2(43), 95–106. doi: https://doi.org/10.55643/fcaptp.2.43.2022.3700

- Міністерство фінансів України. Available at: https://bonds.gov.ua/

- Kukhta, P. (2014). Characteristics of MIRR method in evaluation of investment projects' effectiveness. Bulletin of Taras Shevchenko National University of Kyiv Economics, 8 (161), 52–56. doi: https://doi.org/10.17721/1728-2667.2014/161-8/11

- Yankovyi, O., Kozak, Y., Lyzun, M., Lishchynskyy, I., Savelyev, Y., Kuryliak, V. (2022). Investment decision based on analysis of mathematical interrelation between criteria IRR, MIRR, PI. Financial and Credit Activity Problems of Theory and Practice, 5 (46), 171–181. doi: https://doi.org/10.55643/fcaptp.5.46.2022.3857

- Invest for Excel. Available at: https://www.investforexcel.com/

- Prohramni produkty Microsoft 365. Available at: https://templates.office.com/en-us/investment-tracker-tm00414392

- Bondarchuk, M. K., Druhov, O. O., Voloshyn, О. P. (2017). Research on the problemmatics of anti-crisis innovations financing in business structures. Financial and Credit Activity Problems of Theory and Practice, 2 (23), 101–109. doi: https://doi.org/10.18371/fcaptp.v2i23.121394

- Koreniuk, P. I., Chekalova, N. E. (2017). Management of competitiveness of the construction industry in modern conditions. Global and national problems of the economy, 15, 88–97. Available at: http://global-national.in.ua/issue-15-2017/23-vipusk-15-lyutij-2017-r/2737-korenyuk-p-i-chekalova-n-e-upravlinnya-konkurentospromozhnistyu-budivelnoji-galuzi-v-suchasnikh-umovakh

- Bisceglia, M., Scigliuto, I. (2016). The Beta Coefficient of an Unlisted Bank. Procedia - Social and Behavioral Sciences, 235, 638–647. doi: https://doi.org/10.1016/j.sbspro.2016.11.087

- Lamers, M., Present, T., Vander Vennet, R. (2022). European bank profitability: The great convergence? Finance Research Letters, 49, 103088. doi: https://doi.org/10.1016/j.frl.2022.103088

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Pavlo Pronoza, Volodymyr Chernyshov, Yevheniia Malyshko, Inna Aleksieienko

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.