The influence of information technology (IT) on firm profitability and stock returns

DOI:

https://doi.org/10.15587/1729-4061.2023.286212Keywords:

IT, firm profitability, stock returns, return on assets, return on equityAbstract

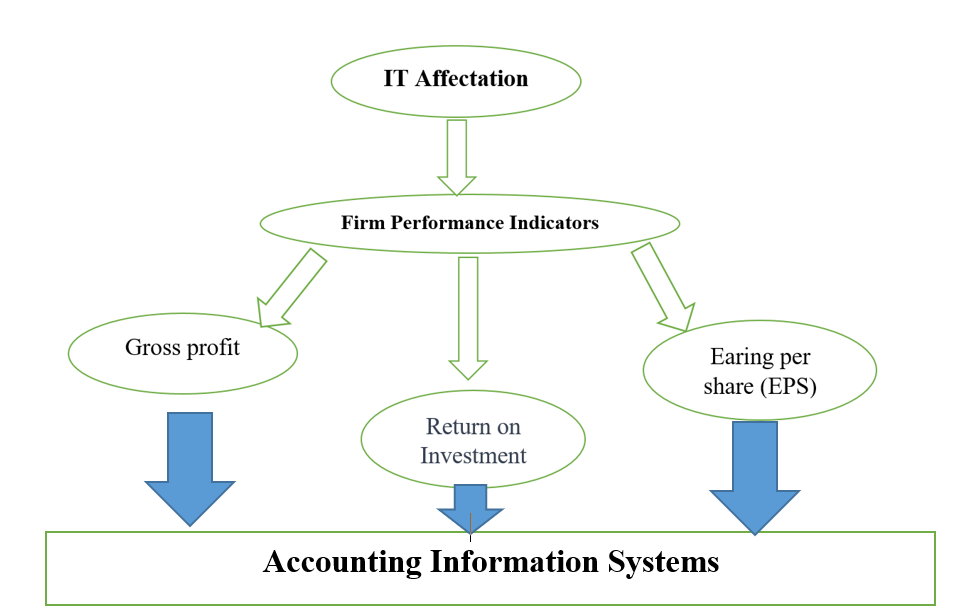

This research study examines the impact of information technology on firm profitability and stock returns. Using a comprehensive dataset of firms across various industries, this research employs rigorous statistical analysis techniques to investigate the relationship between IT investments, firm profitability metrics, and stock returns. The study focuses at how IT investments affect financial performance measures including return on assets (ROA) and return on equity (ROE), with P-values of 0.34 and 0.12, respectively. Furthermore, the study investigates the influence of IT on stock returns, taking into account market capitalization, industry trends, and macroeconomic variables. This study's conclusions center on the beneficial association between IT investments and corporate profitability. The T-value for the IT investment has risen to 6.5. The analysis reveals that firms that strategically leverage IT investments tend to experience higher profitability metrics. Additionally, the research demonstrates the impact of IT on stock returns, highlighting the significance of IT as a driver of firm value and investor confidence. Moreover, this study delves into the mechanisms through which IT investments contribute to firm profitability and stock returns. It investigates the mediating role of factors such as process innovation, customer relationship management, and supply chain optimization, which facilitate the translation of IT investments into improved financial performance. The implications of this research are significant for both practitioners and policymakers. The findings provide valuable insights for firms seeking to enhance their profitability and create shareholder value through strategic IT investments. Additionally, policymakers can use these findings to formulate policies and initiatives that promote the adoption and effective utilization of IT in businesses across various sectors

References

- Chege, S. M., Wang, D., Suntu, S. L. (2019). Impact of information technology innovation on firm performance in Kenya. Information Technology for Development, 26 (2), 316–345. doi: https://doi.org/10.1080/02681102.2019.1573717

- Khuntia, J., Saldanha, T. J. V., Mithas, S., Sambamurthy, V. (2018). Information Technology and Sustainability: Evidence from an Emerging Economy. Production and Operations Management, 27 (4), 756–773. doi: https://doi.org/10.1111/poms.12822

- Gao, M., Huang, J. (2019). Informing the Market: The Effect of Modern Information Technologies on Information Production. The Review of Financial Studies, 33 (4), 1367–1411. doi: https://doi.org/10.1093/rfs/hhz100

- Chen, Y.-C., Hung, M., Wang, Y. (2018). The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. Journal of Accounting and Economics, 65 (1), 169–190. doi: https://doi.org/10.1016/j.jacceco.2017.11.009

- Chae, H.-C., Koh, C. E., Park, K. O. (2018). Information technology capability and firm performance: Role of industry. Information & Management, 55 (5), 525–546. doi: https://doi.org/10.1016/j.im.2017.10.001

- Hirshleifer, D., Hsu, P.-H., Li, D. (2017). Innovative Originality, Profitability, and Stock Returns. The Review of Financial Studies, 31 (7), 2553–2605. doi: https://doi.org/10.1093/rfs/hhx101

- Benitez, J., Ray, G., Henseler, J. (2018). Impact of Information Technology Infrastructure Flexibility on Mergers and Acquisitions. MIS Quarterly, 42 (1), 25–43. doi: https://doi.org/10.25300/misq/2018/13245

- Al-Wattar, Y. M. A., Almagtome, A. H., Al-Shafeay, K. M. (2019). The role of integrating hotel sustainability reporting practices into an Accounting Information System to enhance Hotel Financial Performance: Evidence from Iraq. African Journal of Hospitality, Tourism and Leisure, 8 (5), 1–16. Available at: https://www.ajhtl.com/uploads/7/1/6/3/7163688/article_25_vol_8_5__2019_iraq.pdf

- Saeidi, P., Saeidi, S. P., Sofian, S., Saeidi, S. P., Nilashi, M., Mardani, A. (2019). The impact of enterprise risk management on competitive advantage by moderating role of information technology. Computer Standards & Interfaces, 63, 67–82. doi: https://doi.org/10.1016/j.csi.2018.11.009

- Khaghaany, M., Kbelah, S., Almagtome, A. (2019). Value relevance of sustainability reporting under an accounting information system: Evidence from the tourism industry. African Journal of Hospitality, Tourism and Leisure, 8, 1–12. Available at: https://www.ajhtl.com/uploads/7/1/6/3/7163688/article_16_special_edition_cut_2019_iraq.pdf

- Sharaf, H. K., Ishak, M. R., Sapuan, S. M., Yidris, N. (2020). Conceptual design of the cross-arm for the application in the transmission towers by using TRIZ–morphological chart–ANP methods. Journal of Materials Research and Technology, 9 (4), 9182–9188. doi: https://doi.org/10.1016/j.jmrt.2020.05.129

- Aydiner, A. S., Tatoglu, E., Bayraktar, E., Zaim, S. (2019). Information system capabilities and firm performance: Opening the black box through decision-making performance and business-process performance. International Journal of Information Management, 47, 168–182. doi: https://doi.org/10.1016/j.ijinfomgt.2018.12.015

- Oláh, J., Karmazin, G., Pető, K., Popp, J. (2017). Information technology developments of logistics service providers in Hungary. International Journal of Logistics Research and Applications, 21 (3), 332–344. doi: https://doi.org/10.1080/13675567.2017.1393506

- Devi, S., Warasniasih, N. M. S., Masdiantini, P. R. (2020). The Impact of COVID-19 Pandemic on the Financial Performance of Firms on the Indonesia Stock Exchange. Journal of Economics, Business, & Accountancy Ventura, 23 (2). doi: https://doi.org/10.14414/jebav.v23i2.2313

- Chuang, S.-P., Huang, S.-J. (2016). The Effect of Environmental Corporate Social Responsibility on Environmental Performance and Business Competitiveness: The Mediation of Green Information Technology Capital. Journal of Business Ethics, 150 (4), 991–1009. doi: https://doi.org/10.1007/s10551-016-3167-x

- Sharaf, H. K., Salman, S., Abdulateef, M. H., Magizov, R. R., Troitskii, V. I., Mahmoud, Z. H. et al. (2021). Role of initial stored energy on hydrogen microalloying of ZrCoAl(Nb) bulk metallic glasses. Applied Physics A, 127 (1). doi: https://doi.org/10.1007/s00339-020-04191-0

- Sharaf, H. K., Ishak, M. R., Sapuan, S. M., Yidris, N., Fattahi, A. (2020). Experimental and numerical investigation of the mechanical behavior of full-scale wooden cross arm in the transmission towers in terms of load-deflection test. Journal of Materials Research and Technology, 9 (4), 7937–7946. doi: https://doi.org/10.1016/j.jmrt.2020.04.069

- Bodhanwala, S., Bodhanwala, R. (2018). Does corporate sustainability impact firm profitability? Evidence from India. Management Decision, 56 (8), 1734–1747. doi: https://doi.org/10.1108/md-04-2017-0381

- Sharaf, H. K., Salman, S., Dindarloo, M. H., Kondrashchenko, V. I., Davidyants, A. A., Kuznetsov, S. V. (2021). The effects of the viscosity and density on the natural frequency of the cylindrical nanoshells conveying viscous fluid. The European Physical Journal Plus, 136 (1). doi: https://doi.org/10.1140/epjp/s13360-020-01026-y

- Salman, S., Sharaf, H. K., Hussein, A. F., Khalaf, N. J., Abbas, M. K., Aned, A. M. et al. (2022). Optimization of raw material properties of natural starch by food glue based on dry heat method. Food Science and Technology, 42. doi: https://doi.org/10.1590/fst.78121

- Almagsoosi, L., Abadi, M. T. E., Hasan, H. F., Sharaf, H. K. (2022). Effect of the Volatility of the Crypto Currency and Its Effect on the Market Returns. Industrial Engineering & Management Systems, 21 (2), 238–243. doi: https://doi.org/10.7232/iems.2022.21.2.238

- Sharaf, H. K., Alyousif, S., Khalaf, N. J., Hussein, A. F., Abbas, M. K. (2022). Development of bracket for cross arm structure in transmission tower: Experimental and numerical analysis. New Materials, Compounds and Applications, 6 (3), 257–275. Available at: http://jomardpublishing.com/UploadFiles/Files/journals/NMCA/V6N3/SharafHS.pdf

- Raheemah, S. H., Fadheel, K. I., Hassan, Q. H., Aned, A. M., Turki Al-Taie, A. A., Sharaf, H. K. (2021). Numerical Analysis of the Crack Inspections Using Hybrid Approach for the Application the Circular Cantilever Rods. Pertanika Journal of Science and Technology, 29 (2). doi: https://doi.org/10.47836/pjst.29.2.22

- Kraus, S., Durst, S., Ferreira, J. J., Veiga, P., Kailer, N., Weinmann, A. (2022). Digital transformation in business and management research: An overview of the current status quo. International Journal of Information Management, 63, 102466. doi: https://doi.org/10.1016/j.ijinfomgt.2021.102466

- Hadjielias, E., Christofi, M., Tarba, S. (2022). Contextualizing small business resilience during the COVID-19 pandemic: evidence from small business owner-managers. Small Business Economics, 59 (4), 1351–1380. doi: https://doi.org/10.1007/s11187-021-00588-0

- Falahuddin, F., Fuadi, F., Munandar, M., Juanda, R., Nur Ilham, R. (2022). Increasing business supporting capacity in msmes business group tempe bungong nanggroe kerupuk in syamtalira aron district, utara aceh regency. Irpitage Journal, 2 (2), 65–68. doi: https://doi.org/10.54443/irpitage.v2i2.313

- Mardikaningsih, R., Azizah, E. I., Putri, N. N., Alfan, M. N., Rudiansyah, M. M. D. H. (2022). Business Survival: Competence of Micro, Small and Medium Enterprises. Journal of Social Science Studies (JOS3), 2 (1), 1–4. doi: https://doi.org/10.56348/jos3.v2i1.21

- Sun, T., Zhang, W.-W., Dinca, M. S., Raza, M. (2021). Determining the impact of Covid-19 on the business norms and performance of SMEs in China. Economic Research-Ekonomska Istraživanja, 35 (1), 2234–2253. doi: https://doi.org/10.1080/1331677x.2021.1937261

- Talab, H. R., Flayyih, H. H. (2023). An Empirical Study to Measure the Impact of Information Technology Governance Under the Control Objectives for Information and Related Technologies on Financial Performance. International Journal of Professional Business Review, 8 (4), e01382. doi: https://doi.org/10.26668/businessreview/2023.v8i4.1382

- Al-Taee, S. H. H., Flayyih, H. H. (2023). Impact of the electronic internal auditing based on IT governance to reduce auditing risk. Corporate Governance and Organizational Behavior Review, 7 (1), 94–100. doi: https://doi.org/10.22495/cgobrv7i1p9

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Ali Hussein Hadi, Ghassan Rashad Abdulhameed, Yasir Sahib Malik, Hakeem Hammood Flayyih

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.