Development of recurrent neural networks for price forecasting at cryptocurrency exchanges

DOI:

https://doi.org/10.15587/1729-4061.2023.287094Keywords:

machine learning, cryptocurrency exchanges, neural networks, deep learning, price predictionAbstract

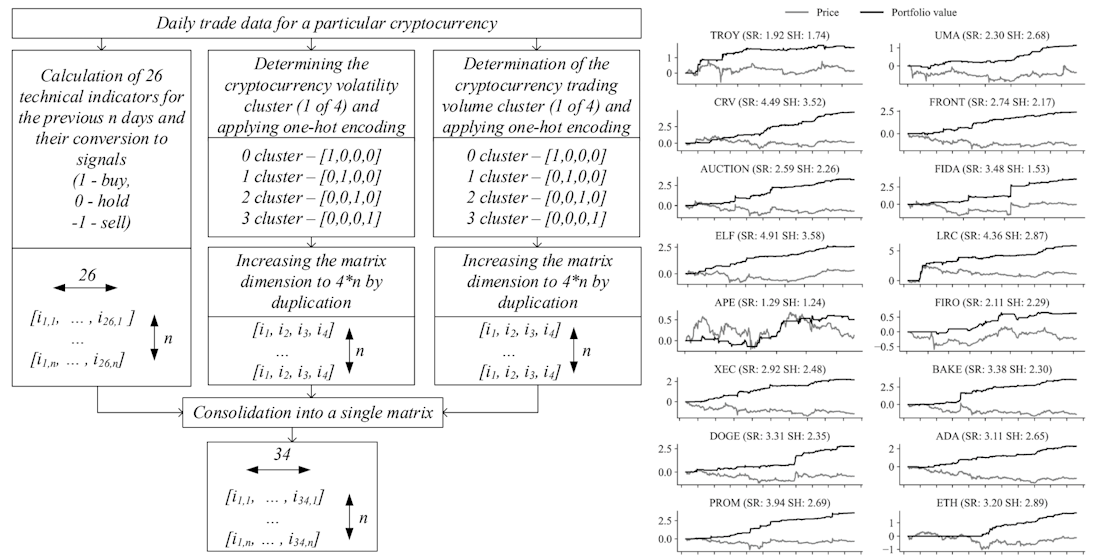

The study focuses on improving the quality of using recurrent neural networks (RNNs) to predict cryptocurrency prices. The formula of the target variable for the model based on the arithmetic mean is developed, which allows us to better take into account the dynamics of cryptocurrency exchanges. The factors affecting this variable were grouped into features based on the volume of daily cryptocurrency trading, the volatility of the relevant prices, and the pre-calculated and selected signals of technical indicators. As part of the study, an algorithm for processing daily data was developed for the model. The results obtained made it possible to create a holistic model for forecasting stock prices. Two recurrent neural networks were trained: one with a long short-term memory (LSTM) and the other with a recurrent gate unit (GRU). To determine the efficiency of the models, the analysis was carried out using two key indicators: the Sortino coefficient, which measures the relative risk/reward for each additional unit of unwanted volatility, and the Sharpe ratio, which measures the return on assets, subtracting the free risk. As a result, it was found that both models have similar results in terms of accuracy (~69 %). Still, the GRU-based model showed significantly better values of the Sortino coefficients (3.13) and Sharpe’s coefficient (2.45), which allows us to conclude that it is effective on cryptocurrency exchanges. At the same time, the LSTM model requires more parameters for training than the GRU model with an identical structure, which leads to a longer training time. The obtained scientific and practical results are aimed at more efficient use of recurrent neural networks in price forecasting on cryptocurrency exchanges

References

- About Crypto wallets. Available at: https://www.liga.net/crypto/ua/wallets

- Cryptocurrencies statistics. Available at: https://coinmarketcap.com

- High Data Growth and Modern Applications Drive New Storage Requirements in Digitally Transformed Enterprises. Available at: https://www.delltechnologies.com/asset/en-us/products/storage/industry-market/h19267-wp-idc-storage-reqs-digital-enterprise.pdf

- Chen, C., Zhao, L., Bian, J., Xing, C., Liu, T.-Y. (2019). Investment Behaviors Can Tell What Inside. Proceedings of the 25th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining. doi: https://doi.org/10.1145/3292500.3330663

- Marques, N. C., Gomes, C. (2010). Maximus-AI: Using Elman Neural Networks for Implementing a SLMR Trading Strategy. Lecture Notes in Computer Science, 579–584. doi: https://doi.org/10.1007/978-3-642-15280-1_55

- Lee, R. S. T. (2020). Chaotic Type-2 Transient-Fuzzy Deep Neuro-Oscillatory Network (CT2TFDNN) for Worldwide Financial Prediction. IEEE Transactions on Fuzzy Systems, 28 (4), 731–745. doi: https://doi.org/10.1109/tfuzz.2019.2914642

- Tran, D. T., Iosifidis, A., Kanniainen, J., Gabbouj, M. (2019). Temporal Attention-Augmented Bilinear Network for Financial Time-Series Data Analysis. IEEE Transactions on Neural Networks and Learning Systems, 30 (5), 1407–1418. doi: https://doi.org/10.1109/tnnls.2018.2869225

- Bao, W., Yue, J., Rao, Y. (2017). A deep learning framework for financial time series using stacked autoencoders and long-short term memory. PLOS ONE, 12 (7), e0180944. doi: https://doi.org/10.1371/journal.pone.0180944

- Achkasova, S. (2020). Implementation the fuzzy modeling technology by means of fuzzyTECH into the process of management the riskiness of business entities activity. Eastern-European Journal of Enterprise Technologies, 5 (3 (107)), 39–54. doi: https://doi.org/10.15587/1729-4061.2020.209836

- Gers, F. A., Schmidhuber, J., Cummins, F. (2000). Learning to Forget: Continual Prediction with LSTM. Neural Computation, 12 (10), 2451–2471. doi: https://doi.org/10.1162/089976600300015015

- Binance API. Available at: https://www.binance.com/en/binance-api

- Development of recurrent neural networks for price forecasting at cryptocurrency exchanges. doi: https://doi.org/10.5281/zenodo.8193302

- Resta, M., Pagnottoni, P., De Giuli, M. E. (2020). Technical Analysis on the Bitcoin Market: Trading Opportunities or Investors’ Pitfall? Risks, 8 (2), 44. doi: https://doi.org/10.3390/risks8020044

- Deng, Y., Bao, F., Kong, Y., Ren, Z., Dai, Q. (2017). Deep Direct Reinforcement Learning for Financial Signal Representation and Trading. IEEE Transactions on Neural Networks and Learning Systems, 28 (3), 653–664. doi: https://doi.org/10.1109/tnnls.2016.2522401

- Wang, J., Wang, J., Fang, W., Niu, H. (2016). Financial Time Series Prediction Using Elman Recurrent Random Neural Networks. Computational Intelligence and Neuroscience, 2016, 1–14. doi: https://doi.org/10.1155/2016/4742515

- Sharpe, W. F. (1966). Mutual Fund Performance. The Journal of Business, 39 (S1), 119. doi: https://doi.org/10.1086/294846

- Sortino, F. A., Price, L. N. (1994). Performance Measurement in a Downside Risk Framework. The Journal of Investing, 3 (3), 59–64. doi: https://doi.org/10.3905/joi.3.3.59

- Lloyd, S. (1982). Least squares quantization in PCM. IEEE Transactions on Information Theory, 28 (2), 129–137. doi: https://doi.org/10.1109/tit.1982.1056489

- Li, Z., Yang, D., Zhao, L., Bian, J., Qin, T., Liu, T.-Y. (2019). Individualized Indicator for All. Proceedings of the 25th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining. doi: https://doi.org/10.1145/3292500.3330833

- Neely, C. J., Rapach, D. E., Tu, J., Zhou, G. (2014). Forecasting the Equity Risk Premium: The Role of Technical Indicators. Management Science, 60 (7), 1772–1791. doi: https://doi.org/10.1287/mnsc.2013.1838

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Viktoriia Tyshchenko, Svitlana Achkasova, Oleksii Naidenko, Serhii Kanyhin, Vlada Karpova

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.