Development of financial literacy and fintech adoption on women SMEs business performance in Indonesia

DOI:

https://doi.org/10.15587/1729-4061.2024.312613Keywords:

UTAUT Theory, financial literacy, FinTech adoption, business performanceAbstract

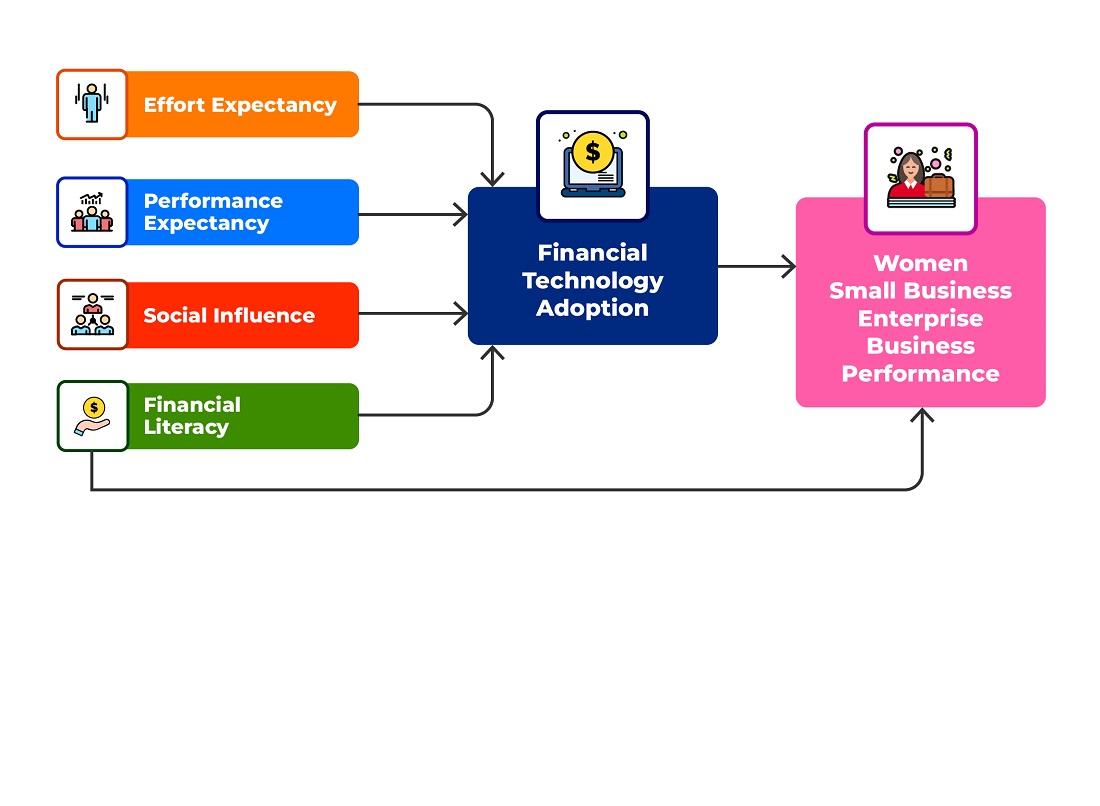

Women-owned small businesses are crucial to the Indonesian economy. Despite this contribution, women entrepreneurs face many challenges when building their businesses, especially getting business loans. Women entrepreneurs adopt less technology and have less financial expertise than men. This study aims to determine financial literacy factors affecting women SMEs' business success and the extent of financial technology (FinTech) use as an alternative funding source to formal financial institutions. The study examines FinTech adoption using the Unified Theory of Acceptance and Use of Technology (UTAUT Theory). This study also examines how FinTech adoption mediates the indirect effect of financial literacy on SME business performance. The study uses a quantitative research approach using a judgmental sample of 270 women entrepreneurs who have previously used FinTech. The data is analyzed with SEM-PLS. According to the study, effort expectancy, performance expectancy, and social influence all have a beneficial impact on FinTech adoption among women-owned small businesses. The survey found that FinTech adoption was a key factor influencing women SMEs' business performance. The findings also indicate that financial literacy has a beneficial effect on business success. The study reveals FinTech adoption as a mediating factor in the association between financial literacy and SMEs business success. As a result, our findings contribute to a better understanding of how digital technology adoption affects SMEs' performance and long-term sustainability. The findings offer insights for entrepreneurs, policymakers, and company owners looking to enhance the survival rate of SMEs by improving operations and harnessing digital technology to promote capital accessibility, FinTech adoption, and financial literacy.

Supporting Agency

- The authors gratefully acknowledge to Universitas Multimedia Nusantara, Indonesia that provided support for this research with the contract No. 0064-RD-LPPM-UMN/P-INT/VI/2024.

References

- Franzke, S., Wu, J., Froese, F. J., Chan, Z. X. (2022). Female entrepreneurship in Asia: a critical review and future directions. Asian Business & Management, 21 (3), 343–372. https://doi.org/10.1057/s41291-022-00186-2

- Khan, R. U., Salamzadeh, Y., Shah, S. Z. A., Hussain, M. (2021). Factors affecting women entrepreneurs’ success: a study of small- and medium-sized enterprises in emerging market of Pakistan. Journal of Innovation and Entrepreneurship, 10 (1). https://doi.org/10.1186/s13731-021-00145-9

- Jasin, M., Anisah, H. U., Fatimah, C. E. A., Azra, F. E. A., Suzanawaty, L., Junaedi, I. W. R. (2024). The role of digital literacy and knowledge management on process innovation in SMEs. International Journal of Data and Network Science, 8 (1), 337–344. https://doi.org/10.5267/j.ijdns.2023.9.020

- Saprikis, V., Avlogiaris, G., Katarachia, A. (2022). A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information, 13 (1), 30. https://doi.org/10.3390/info13010030

- Widagdo, B., Sa’diyah, C. (2023). Business sustainability: Functions of financial behavior, technology, and knowledge. Problems and Perspectives in Management, 21 (1), 120–130. https://doi.org/10.21511/ppm.21(1).2023.11

- Ghosh, P. K., Ghosh, S. K., Chowdhury, S. (2017). Factors hindering women entrepreneurs’ access to institutional finance- an empirical study. Journal of Small Business & Entrepreneurship, 30 (4), 279–291. https://doi.org/10.1080/08276331.2017.1388952

- Babajide, A., Osabuohien, E., Tunji-Olayeni, P., Falola, H., Amodu, L. et al. (2021). Financial literacy, financial capabilities, and sustainable business model practice among small business owners in Nigeria. Journal of Sustainable Finance & Investment, 13 (4), 1670–1692. https://doi.org/10.1080/20430795.2021.1962663

- Keuangan, O. J. (2022). Hasil snlik per kategori 62,42%. Otoritas Jasa Keuang., 2013.

- García-Pérez-de-Lema, D., Ruiz-Palomo, D., Diéguez-Soto, J. (2021). Analysing the roles of CEO’s financial literacy and financial constraints on Spanish SMEs technological innovation. Technology in Society, 64, 101519. https://doi.org/10.1016/j.techsoc.2020.101519

- Agarwal, S., Zhang, J. (2020). FinTech, Lending and Payment Innovation: A Review. Asia-Pacific Journal of Financial Studies, 49 (3), 353–367. https://doi.org/10.1111/ajfs.12294

- Venkatesh, Morris, Davis, Davis (2003). User Acceptance of Information Technology: Toward a Unified View. MIS Quarterly, 27 (3), 425. https://doi.org/10.2307/30036540

- Bullough, A., Guelich, U., Manolova, T. S., Schjoedt, L. (2021). Women’s entrepreneurship and culture: gender role expectations and identities, societal culture, and the entrepreneurial environment. Small Business Economics, 58 (2), 985–996. https://doi.org/10.1007/s11187-020-00429-6

- Ye, J., Kulathunga, K. (2019). How Does Financial Literacy Promote Sustainability in SMEs? A Developing Country Perspective. Sustainability, 11 (10), 2990. https://doi.org/10.3390/su11102990

- Kurniasari, F., Lestari, E. D., Tannady, H. (2023). Pursuing Long-Term Business Performance: Investigating the Effects of Financial and Technological Factors on Digital Adoption to Leverage SME Performance and Business Sustainability – Evidence from Indonesian SMEs in the Traditional Market. Sustainability, 15 (16), 12668. https://doi.org/10.3390/su151612668

- Wen, B., Kurniasari, F., Dwi Lestari, E. (2024). Elucidating drivers of repurchase intention in the e-marketplace through the lens of online trust-building mechanisms. Innovative Marketing, 20 (1), 212–226. https://doi.org/10.21511/im.20(1).2024.18

- Wahyono, Hutahayan, B. (2021). The relationships between market orientation, learning orientation, financial literacy, on the knowledge competence, innovation, and performance of small and medium textile industries in Java and Bali. Asia Pacific Management Review, 26 (1), 39–46. https://doi.org/10.1016/j.apmrv.2020.07.001

- Lontchi, C. B., Yang, B., Shuaib, K. M. (2023). Effect of Financial Technology on SMEs Performance in Cameroon amid COVID-19 Recovery: The Mediating Effect of Financial Literacy. Sustainability, 15 (3), 2171. https://doi.org/10.3390/su15032171

- Llados-Masllorens, J., Ruiz-Dotras, E. (2021). Are women’s entrepreneurial intentions and motivations influenced by financial skills? International Journal of Gender and Entrepreneurship, 14 (1), 69–94. https://doi.org/10.1108/ijge-01-2021-0017

- Henseler, J., Hubona, G., Ray, P. A. (2016). Using PLS path modeling in new technology research: updated guidelines. Industrial Management & Data Systems, 116 (1), 2–20. https://doi.org/10.1108/imds-09-2015-0382

- Ringle, C. M., Sarstedt, M., Mitchell, R., Gudergan, S. P. (2018). Partial least squares structural equation modeling in HRM research. The International Journal of Human Resource Management, 31 (12), 1617–1643. https://doi.org/10.1080/09585192.2017.1416655

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Florentina Kurniasari, Elissa Dwi Lestari

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.