Possibilities of integrating artificial intelligence technologies into the system of accounting and analytical support to public sector entitie

DOI:

https://doi.org/10.15587/1729-4061.2024.319051Keywords:

artificial intelligence, cloud technologies, automation, accounting, analysis, public sectorAbstract

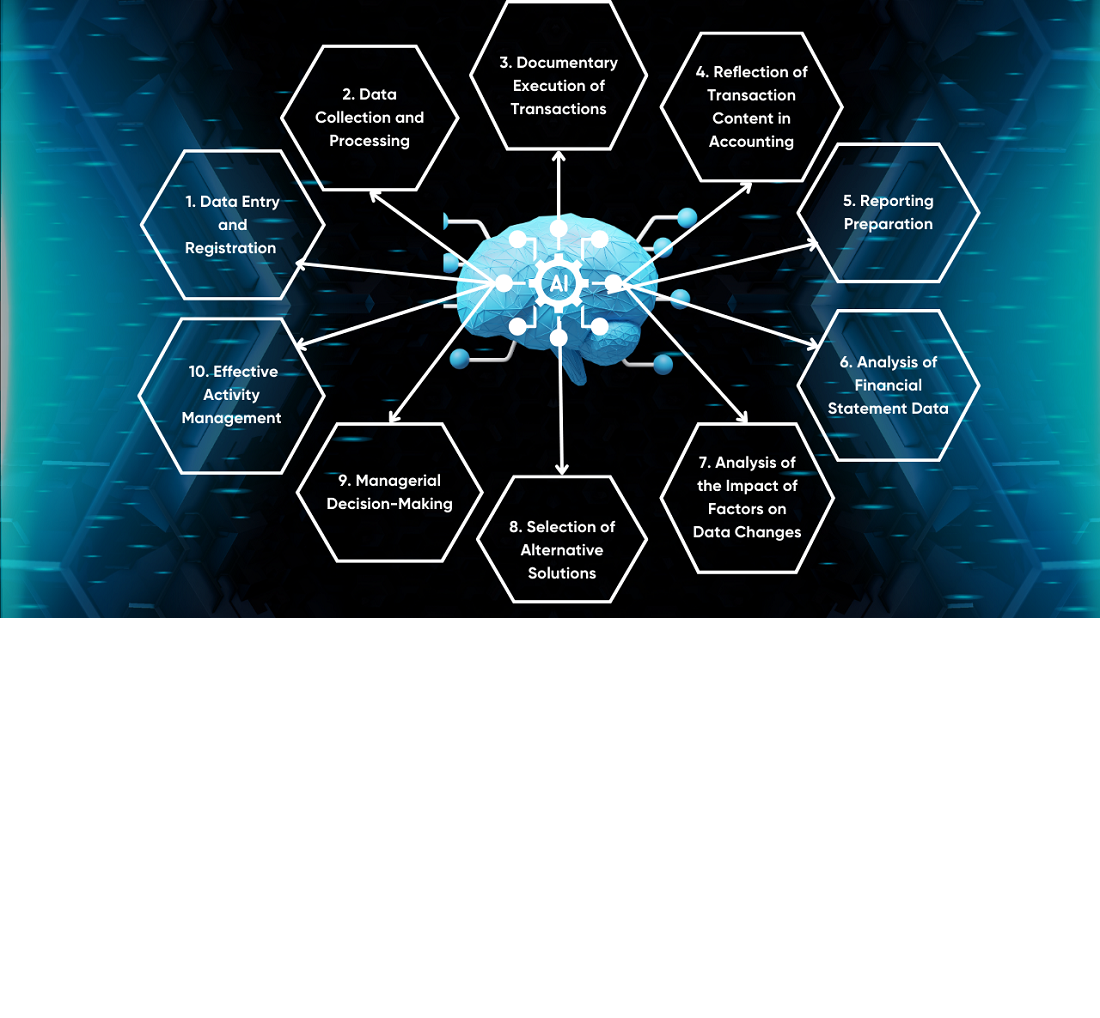

The object of this study is artificial intelligence technologies in the system of accounting and analytical support to public sector entities.

This paper addresses the task related to the possibility of integrating artificial intelligence technologies into the accounting and analytical support system of public sector entities. The key differences between conventional accounting automation and artificial intelligence technologies in the system of accounting and analytical support have been determined. Analysis of investment volumes for the introduction of artificial intelligence, including in the accounting system, was carried out. It was established that according to forecasts for 2025 the amount of investment in the field of artificial intelligence for the automation of accounting and reporting will grow actively: in the USA (USD 45–50 billion), China (USD 30–35 billion), Germany (USD 15–18 billion), Japan (USD 13–15 billion), Great Britain (USD 12–15 billion). Analysis of the characteristics and cost of integrating modern artificial intelligence technologies into the system of accounting and analytical support was carried out. Zoho Books AI cloud technology, which in terms of cost and properties is most suitable for integration into the system of accounting and analytical support of public sector entities, has been identified as recommended. The key factors of the impact of artificial intelligence on the automation of the accounting and analytical support system, which lead to saving time on document processing, reporting and data analysis, have been determined. Based on the calculation results, it was determined that as a result of the integration of Zoho Books AI technology into the accounting and analytical support system, time will be reduced by 2164 hours/year, which will lead to the optimization of public funds

References

- Ubaldi, B., Fevre, E. M. L., Petrucci, E., Marchionni, P., Biancalana, C., Hiltunen, N. et al. (2019).State of the art in the use of emerging technologies in the public sector. Organisation for Economic Co-Operation and Development (OECD). https://doi.org/10.1787/932780bc-en

- Ulnicane, I., Eke, D. O., Knight, W., Ogoh, G., Stahl, B. C. (2021). Good governance as a response to discontents? Déjà vu, or lessons for AI from other emerging technologies. Interdisciplinary Science Reviews, 46 (1-2), 71–93. https://doi.org/10.1080/03080188.2020.1840220

- Androutsopoulou, A., Karacapilidis, N., Loukis, E., Charalabidis, Y. (2019). Transforming the communication between citizens and government through AI-guided chatbots. Government Information Quarterly, 36 (2), 358–367. https://doi.org/10.1016/j.giq.2018.10.001

- Fostolovych, V. (2022). Artificial intelligence in modern business: potential, current trends and prospects of integration in different spheres of economic activity and human life activity. Efektyvna ekonomika, 7. https://doi.org/10.32702/2307-2105.2022.7.4

- AI In Accounting Market Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029). Available at: https://www.mordorintelligence.com/industry-reports/artificial-intelligence-in-accounting-market

- Sun, T. Q., Medaglia, R. (2019). Mapping the challenges of Artificial Intelligence in the public sector: Evidence from public healthcare. Government Information Quarterly, 36 (2), 368–383. https://doi.org/10.1016/j.giq.2018.09.008

- Cao, P. (2023). Research on the impact of artificial intelligence-based e-commerce personalization on traditional accounting methods. International Journal of Intelligent Networks, 4, 193–201. https://doi.org/10.1016/j.ijin.2023.07.004

- Abdullah, A. A. H., Almaqtari, F. A. (2024). The impact of artificial intelligence and Industry 4.0 on transforming accounting and auditing practices. Journal of Open Innovation: Technology, Market, and Complexity, 10 (1), 100218. https://doi.org/10.1016/j.joitmc.2024.100218

- Luthfiani, A. D. (2024). The Artificial Intelligence Revolution in Accounting and Auditing: Opportunities, Challenges, and Future Research Directions. Journal of Applied Business, Taxation and Economics Research, 3 (5), 516–530. https://doi.org/10.54408/jabter.v3i5.290

- Hussin, N. A. K. M., Bukhari, N. A. N. M., Hashim, N. H. A. N., Bahari, S. N. A. S., Ali, M. M. (2024). The Impact of Artificial Intelligence on the Accounting Profession: A Concept Paper. Business Management and Strategy, 15 (1), 34. https://doi.org/10.5296/bms.v15i1.21620

- Norzelan, N. A., Mohamed, I. S., Mohamad, M. (2024). Technology acceptance of artificial intelligence (AI) among heads of finance and accounting units in the shared service industry. Technological Forecasting and Social Change, 198, 123022. https://doi.org/10.1016/j.techfore.2023.123022

- Panda, K. (2024). Artificial Intelligence-based Analysis of Change in Public Finance between US and International Markets. 2024 IEEE International Conference on Computing, Power and Communication Technologies (IC2PCT), 1234–1238. https://doi.org/10.1109/ic2pct60090.2024.10486276

- Furmanchuk, O. (2023). The role of state finance audit in the system of accounting and analytical support of the state funds management system. Economics of Development, 22 (4), 34–42. https://doi.org/10.57111/econ/4.2023.34

- Odonkor, B., Kaggwa, S., Uwaoma, P. U., Hassan, A. O., Farayola, O. A. (2024). The impact of AI on accounting practices: A review: Exploring how artificial intelligence is transforming traditional accounting methods and financial reporting. World Journal of Advanced Research and Reviews, 21 (1), 172–188. https://doi.org/10.30574/wjarr.2024.21.1.2721

- Surya, L. (2019). Artificial intelligence in public sector. Novateur publications international journal of innovations in engineering research and technology, 6 (8), 7–12. Available at: https://www.researchgate.net/profile/Lakshmisri-Surya/publication/349310325_ARTIFICIAL_INTELLIGENCE_IN_PUBLIC_SECTOR/links/602a01c992851c4ed5718576/ARTIFICIAL-INTELLIGENCE-IN-PUBLIC-SECTOR.pdf

- Mann, A. (2019). How AI is transforming the jobs of accountants, Accounting Today. Available at: https://www.accountingtoday.com/opinion/how-ai-is-transforming-the-jobs-of-accountants

- Madiega, Т., Ilnicki, R. (2024). AI investment: EU and global indicators. EPRS | European Parliamentary Research Service. Available at: https://www.europarl.europa.eu/RegData/etudes/ATAG/2024/760392/EPRS_ATA(2024)760392_EN.pdf

- Аrtificial intelligence: current and future usage within investment management (2024). Final Report from the Technology Working Group. Available at: https://www.theia.org/sites/default/files/2024-10/Technology%20Working%20Group%20AI%20Report%20Oct%202024.pdf

- Artificial intelligence in UK financial services - 2024. The Bank of England and Financial Conduct Authority conducted a third survey of artificial intelligence and machine learning in UK financial services. Available at: https://www.bankofengland.co.uk/report/2024/artificial-intelligence-in-uk-financial-services-2024

- Sharma, A.-M. (2024). Artificial Intelligence News. Available at: https://www.gtai.de/en/invest/industries/digital-economy/artificial-intelligence-news-august-2024-1812588

- AI Guidelines for Business Ver1.0 (2024). Available at: https://www.meti.go.jp/shingikai/mono_info_service/ai_shakai_jisso/pdf/20240419_9.pdf

- Madakam, S., Holmukhe, R. M., Jaiswal, D. K. (2019). The Future Digital Work Force: Robotic Process Automation (RPA). Journal of Information Systems and Technology Management, 16. https://doi.org/10.4301/s1807-1775201916001

- Liang, Y., Jiang, G., He, Y. (2024). Integrating AI with Financial Accounting Processes: Innovations and Challenges. International Journal of Computer Science and Information Technology, 3 (3), 1–10. https://doi.org/10.62051/ijcsit.v3n3.01

- How Much Does it Cost to Build a Custom AI-based Accounting Software? (2024). Available at: https://appinventiv.com/blog/ai-accounting-software-development-cost/

- Nykyforak, I., Dutchak, I., Roshko, N. (2024). Innovations in accounting in Ukraine: the study of the impact of new developments. Economics. Finances. Law, 2/2024, 67–71. https://doi.org/10.37634/efp.2024.2.14

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Tetiana Larikova, Pavlo Ivankov, Liudmyla Novichenko, Kydysiuk Khrystyna

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.