Construction of an accounting-analytical support model for the public sector based on the synergy between artificial intelligence and blockchain technologies

DOI:

https://doi.org/10.15587/1729-4061.2025.340995Keywords:

accounting-analytical support, information technologies, cloud technologies, artificial intelligence, blockchain, public sectorAbstract

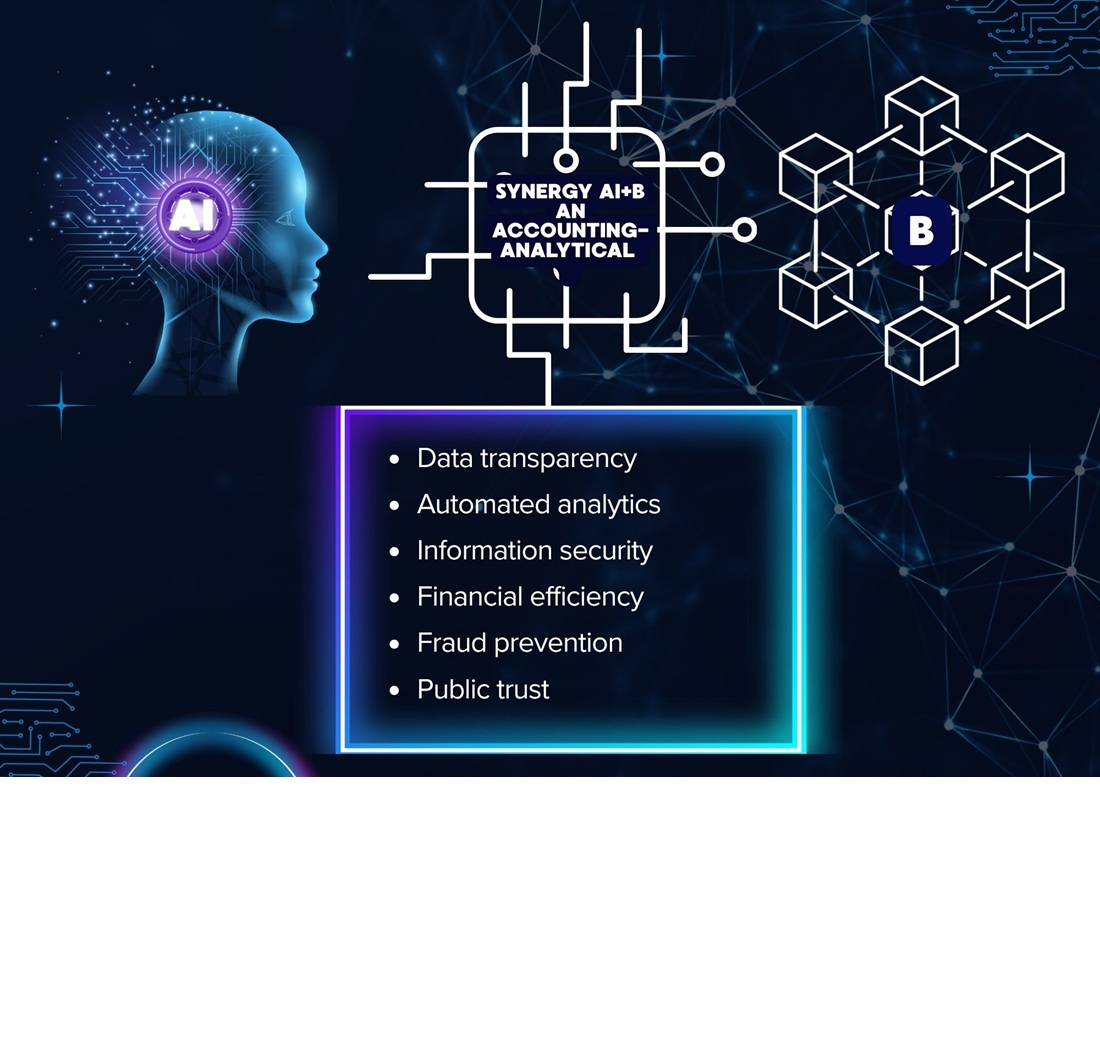

This study investigates artificial intelligence and blockchain technologies as part of the accounting-analytical support system in the public sector.

The problem addressed relates to the task of building an effective model of accounting-analytical support in the public sector, based on the synergy of artificial intelligence and blockchain technologies.

In the process of the study, a model of accounting-analytical support in the public sector was constructed, underlying which is the synergy of artificial intelligence and blockchain technologies. The model was built on the basis of a logical and consistent roadmap for the transition to an intelligent model of budget resource management.

An algorithm for implementing blockchain technology in the accounting-analytical support system in the public sector was developed, which takes into account technical, organizational, legal aspects, and provides a comprehensive approach to the integration of blockchain technologies.

It was substantiated that the model built would make it possible to integrate automated data collection and verification, conduct intellectual analysis, forecast, generate various forms of reporting, as well as warrant security, immutability, and information protection.

The economic effect of investments in the implementation of a model of accounting-analytical support in the public sector based on the synergy of artificial intelligence and blockchain technologies has been analyzed, which has demonstrated the economic feasibility and prospects of the project. It has been determined that after covering the initial investment of USD 644,500, it is expected to receive an additional net economic benefit of more than half a million USD in present value over 7 years of system operation.

It has been determined that the annual economic effect in the amount of 240 thousand USD would be achieved due to the complex influence of factors. In particular, it could be attained through a significant reduction in costs for the preparation and automation of reporting; reducing the number of errors; optimizing the use of budget resources; reducing costs for audit and control measures

References

- AI In Accounting Market Analysis, Size, and Forecast 2025-2029: North America (US and Canada), Europe (France, Germany, Italy, and UK), APAC (China, India, and Japan), South America (Brazil), and Rest of World (ROW) (2025). Technavio. Available at: https://www.technavio.com/report/ai-in-accounting-market-industry-analysis#:~:text=The%20AI%20in%20accounting%20market,for%20automation%20and%20operational%20efficiency

- Maffei, M., Casciello, R., Meucci, F. (2021). Blockchain technology: uninvestigated issues emerging from an integrated view within accounting and auditing practices. Journal of Organizational Change Management, 34 (2), 462–476. https://doi.org/10.1108/jocm-09-2020-0264

- Cao, P. (2023). Research on the impact of artificial intelligence-based e-commerce personalization on traditional accounting methods. International Journal of Intelligent Networks, 4, 193–201. https://doi.org/10.1016/j.ijin.2023.07.004

- Abdullah, A. A. H., Almaqtari, F. A. (2024). The impact of artificial intelligence and Industry 4.0 on transforming accounting and auditing practices. Journal of Open Innovation: Technology, Market, and Complexity, 10 (1), 100218. https://doi.org/10.1016/j.joitmc.2024.100218

- Kumar, S., Lim, W. M., Sivarajah, U., Kaur, J. (2022). Artificial Intelligence and Blockchain Integration in Business: Trends from a Bibliometric-Content Analysis. Information Systems Frontiers. https://doi.org/10.1007/s10796-022-10279-0

- Han, H., Shiwakoti, R. K., Jarvis, R., Mordi, C., Botchie, D. (2023). Accounting and auditing with blockchain technology and artificial Intelligence: A literature review. International Journal of Accounting Information Systems, 48, 100598. https://doi.org/10.1016/j.accinf.2022.100598

- Gotthardt, M., Koivulaakso, D., Paksoy, O., Saramo, C., Martikainen, M., Lehner, O. (2020). Current State and Challenges in the Implementation of Smart Robotic Process Automation in Accounting and Auditing. ACRN Journal of Finance and Risk Perspectives, 9 (1), 90–102. https://doi.org/10.35944/jofrp.2020.9.1.007

- Perdana, A., Lee, W. E., Mui Kim, C. (2023). Prototyping and implementing Robotic Process Automation in accounting firms: Benefits, challenges and opportunities to audit automation. International Journal of Accounting Information Systems, 51, 100641. https://doi.org/10.1016/j.accinf.2023.100641

- Bai, C. A., Cordeiro, J., Sarkis, J. (2019). Blockchain technology: Business, strategy, the environment, and sustainability. Business Strategy and the Environment, 29 (1), 321–322. https://doi.org/10.1002/bse.2431

- Khan, S. N., Loukil, F., Ghedira-Guegan, C., Benkhelifa, E., Bani-Hani, A. (2021). Blockchain smart contracts: Applications, challenges, and future trends. Peer-to-Peer Networking and Applications, 14 (5), 2901–2925. https://doi.org/10.1007/s12083-021-01127-0

- Alkan, B. Ş. (2022). How Blockchain and Artificial Intelligence Will Effect the Cloud-Based Accounting Information Systems? The Impact of Artificial Intelligence on Governance, Economics and Finance, 107–119. https://doi.org/10.1007/978-981-16-8997-0_6

- Stanciu, V., Pugna, I. B., Gheorghe, M. (2020). New coordinates of accounting academic education. A Romanian insight. Journal of Accounting and Management Information Systems, 19 (1). https://doi.org/10.24818/jamis.2020.01007

- Sun, T. Q., Medaglia, R. (2019). Mapping the challenges of Artificial Intelligence in the public sector: Evidence from public healthcare. Government Information Quarterly, 36 (2), 368–383. https://doi.org/10.1016/j.giq.2018.09.008

- Odonkor, B., Kaggwa, S., Uwaoma, P. U., Hassan, A. O., Farayola, O. A. (2024). The impact of AI on accounting practices: A review: Exploring how artificial intelligence is transforming traditional accounting methods and financial reporting. World Journal of Advanced Research and Reviews, 21 (1), 172–188. https://doi.org/10.30574/wjarr.2024.21.1.2721

- Dai, J., Vasarhelyi, M. A. (2017). Toward Blockchain-Based Accounting and Assurance. Journal of Information Systems, 31 (3), 5–21. https://doi.org/10.2308/isys-51804

- Tan, B. S., Low, K. Y. (2019). Blockchain as the Database Engine in the Accounting System. Australian Accounting Review, 29 (2), 312–318. https://doi.org/10.1111/auar.12278

- Hossain, M. Z., Johora, F. T., Raja, M. R., Hasan, L. (2024). Transformative Impact of Artificial Intelligence and Blockchain on the Accounting Profession. European Journal of Theoretical and Applied Sciences, 2 (6), 144–159. https://doi.org/10.59324/ejtas.2024.2(6).11

- Brealey, R. A., Myers, S. C., Allen, F. (2019). Principles of Corporate Finance. McGraw-Hill Education.

- Andrusiak, V., Khoroshylova, I., Smirnova, N. (2025). The Impact of Digital Technologies on the Development of the Accounting and Audit System in Ukraine. Current Issues of Economic Sciences, 7. https://doi.org/10.5281/zenodo.14697272

- Kanaparthi, V. (2024). Exploring the Impact of Blockchain, AI, and ML on Financial Accounting Efficiency and Transformation. Multi-Strategy Learning Environment, 353–370. https://doi.org/10.1007/978-981-97-1488-9_27

- Garanina, T., Ranta, M., Dumay, J. (2021). Blockchain in accounting research: current trends and emerging topics. Accounting, Auditing & Accountability Journal, 35 (7), 1507–1533. https://doi.org/10.1108/aaaj-10-2020-4991

- Pandl, K. D., Thiebes, S., Schmidt-Kraepelin, M., Sunyaev, A. (2020). On the Convergence of Artificial Intelligence and Distributed Ledger Technology: A Scoping Review and Future Research Agenda. IEEE Access, 8, 57075–57095. https://doi.org/10.1109/access.2020.2981447

- Soni, A. (2025). AI accounting startup Rillet raises $70 million in Andreessen Horowitz, ICONIQ-led round. Reuters. Available at: https://www.reuters.com/technology/ai-accounting-startup-rillet-raises-70-million-andreessen-horowitz-iconiq-led-2025-08-06

- Luthfiani, A. D. (2024). The Artificial Intelligence Revolution in Accounting and Auditing: Opportunities, Challenges, and Future Research Directions. Journal of Applied Business, Taxation and Economics Research, 3 (5), 516–530. https://doi.org/10.54408/jabter.v3i5.290

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Tetiana Larikova, Iryna Drozd, Andriy Lyubenko, Vadym Telehin, Liudmyla Novichenko

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.