The impact of environmental costs dimensions on the financial performance of Iraqi industrial companies with the role of environmental disclosure as a mediator

DOI:

https://doi.org/10.15587/1729-4061.2022.262991Keywords:

environmental costs, financial performance, environmental disclosure, Iraqi industrial companiesAbstract

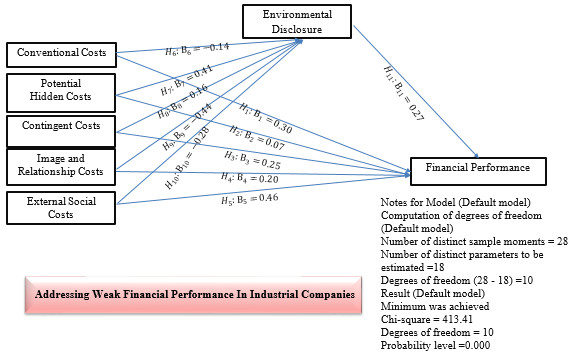

This study aims to examine the impact of environmental costs dimensions on the financial performance of Iraqi industrial companies with the role of environmental disclosure as a mediator. The data was collected from annual reports of 25 selected companies of the Iraqi stock exchange and oil sector from 2014 to 2018. The results show that the average percentage of environmental disclosure in the industrial companies selected in this study was 20.0 % and the mean found was 20.2 %. The results also showed that environmental costs (contingent costs and external social costs) positively influence financial performance, while contingent costs, social costs, hidden costs, and Image & relationship costs show a positive influence on environmental disclosure. The findings revealed that environmental disclosure was positively significant in affecting financial performance. It was found that environmental disclosure fully mediated the relationship between environmental costs (hidden costs and Image & relationship costs) and financial performance. Environmental disclosure partially mediated the relationship between environmental costs (Contingent costs, and social costs) and financial performance. There is no mediation of environmental disclosure for the impact of Conventional costs on financial performance. It was also found that environmental disclosure mediated the impact of environmental costs (Conventional costs, Image & relationship costs, and External social costs) on financial performance. This indicates advantages for companies that produce less moderate environmental disclosure and enables them to gain investors’ confidence. This study's implications provide insights into the implementation of the measurement of environmental costs and environmental disclosure in Iraq.

References

- Gray, R., Bebbington, J., Gray, S. (2010). Social and Environmental Accounting. SAGE Publications Ltd. doi: https://doi.org/10.4135/9781446263440

- Hart, S. L. (1995). A Natural-Resource-Based View of the Firm. Academy of Management Review, 20 (4), 986–1014. doi: https://doi.org/10.5465/amr.1995.9512280033

- Clarkson, P. M., Overell, M. B., Chapple, L. (2011). Environmental Reporting and its Relation to Corporate Environmental Performance. Abacus, 47 (1), 27–60. doi: https://doi.org/10.1111/j.1467-6281.2011.00330.x

- Ditz, D., Ranganathan, J., Banks, R. D. (Eds.) (1995). Green Ledgers: Case Studies in Environmental Accounting. World Resources Institute. Available at: http://pdf.wri.org/greenledgers_bw.pdf

- Gale, R. J. P., Stokoe, P. K. (2001). Environmental Cost Accounting and Business Strategy. Handbook of Environmentally Conscious Manufacturing, 119–136. doi: https://doi.org/10.1007/978-1-4615-1727-6_6

- Jenkins, H., Yakovleva, N. (2006). Corporate social responsibility in the mining industry: Exploring trends in social and environmental disclosure. Journal of Cleaner Production, 14 (3-4), 271–284. doi: https://doi.org/10.1016/j.jclepro.2004.10.004

- Tirumalsety, R., Gurtoo, A. (2019). Financial sources, capital structure and performance of social enterprises: empirical evidence from India. Journal of Sustainable Finance & Investment, 11 (1), 27–46. doi: https://doi.org/10.1080/20430795.2019.1619337

- Beba (2013). Investment Climate Statement - Iraq. US Department of State.

- Al-Tameemi, K. S., Alshawi, M. (2014). The Impact of Organisational Culture and Leadership on Performance Improvement in Iraq. Journal for Global Business Advancement, 7 (3), 1–15.

- Yaacoub, F. A., Dhairab, M. S. (2017). The Impact Of Measure The Financial Costs And Discription On The Decision Business. Al-Kut Journal of Economic and Management Sciences, 26 (6), 132–161.

- Nwaiwu, N. J., Oluka, N. O. (2018). Environmental Cost Disclosure and Financial Performance of Oil and Gas in Nigeria. International Journal of Advanced Academic Research, 4 (2), 1–23. Available at: https://www.ijaar.org/articles/Volume4-Number2/Financial-Management/ijaar-fm-v4n2-feb18-p20.pdf

- Okoye, E., Ebubechukkwu, J., Agweda, F. (2016). Effect of Non-Disclosure of Environment Cost on the Performance of Selected Firm Listed on Nigeria. Managing Diversification for Sustainable Development in Sub-Saharan Africa: Proceedings of 2016 International Conference of the Faculty of Management Sciences. Awka. Available at: https://ssrn.com/abstract=3039452

- Rodríguez, F. J. G., del Mar Armas Cruz, Y. (2007). Relation between social-environmental responsibility and performance in hotel firms. International Journal of Hospitality Management, 26 (4), 824–839. doi: https://doi.org/10.1016/j.ijhm.2006.08.003

- What explains the extent and content of social disclosures on corporate websites (2009). GAD. Available at: https://www.academia.edu/28880517/What_explains_the_extent_and_content_of_social_disclosures_on_corporate_websites

- Xiao, J. Z., Gao, S. S., Heravi, S., Cheung, Y. C. Q. (2005). The Impact of Social and Economic Development on Corporate Social and Environmental Disclosure in Hong Kong and the U.K. Advances in International Accounting, 18, 219–243. doi: https://doi.org/10.1016/s0897-3660(05)18011-8

- Kiende Gatimbu, K., Masinde Wabwire, J. (2016). Effect of Corporate Environmental Disclosure on Financial Performance of Firms Listed at Nairobi Securities Exchange, Kenya. International Journal of Sustainability Management and Information Technologies, 2 (1), 1–6. Available at: http://repository.embuni.ac.ke/bitstream/handle/123456789/1699/On%20a%20Grouping%20Method.pdf?sequence=1&isAllowed=y

- Abubakar, A. A., Moses, S., Inuwa, M. B. (2017). Influence of Firms Attributes on Environmental Disclosure in Listed Brewery Companies in Nigeria. Civil and Environmental Research, 8 (21), 31–35.

- Cho, C. H., Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, Organizations and Society, 32 (7-8), 639–647. doi: https://doi.org/10.1016/j.aos.2006.09.009

- Campbell, D., Craven, B., Shrives, P. (2003). Voluntary social reporting in three FTSE sectors: a comment on perception and legitimacy. Accounting, Auditing & Accountability Journal, 16 (4), 558–581. doi: https://doi.org/10.1108/09513570310492308

- van der Laan, S. (2009). The role of theory in explaining motivation for corporate social disclosures: Voluntary disclosures vs ‘solicited’ disclosures. Australasian Accounting, Business and Finance Journal, 3 (4), 15–30. Available at: https://ro.uow.edu.au/aabfj/vol3/iss4/2/

- Tsai, W. H., Lin, T. W., Chou, W. C. (2010). Integrating activity-based costing and environmental cost accounting systems: a case study. International Journal of Business and Systems Research, 4 (2), 186. doi: https://doi.org/10.1504/ijbsr.2010.030774

- Schaltegger, S., Bennett, M., Burritt, R. (2006). Sustainability Accounting and Reporting: Development, Linkages and Reflection. An Introduction. Sustainability Accounting and Reporting, 1–33. doi: https://doi.org/10.1007/978-1-4020-4974-3_1

- Ezeagba, C. E., Rachael, J.-A. C., Chiamaka, U. (2017). Environmental Accounting Disclosures and Financial Performance: A Study of selected Food and Beverage Companies in Nigeria (2006-2015). International Journal of Academic Research in Business and Social Sciences, 7 (9). doi: https://doi.org/10.6007/ijarbss/v7-i9/3315

- Kinyua, J. K., Gakure, R., Gekara, M., Orwa, G. (2015). Effect of Internal Control Environment on the Financial Performance of Companies Quoted in the Nairobi Securities Exchange. International Journal of Innovative Finance and Economics Research, 3 (4), 29–48. Available at: https://seahipaj.org/journals-ci/dec-2015/IJIFER/full/IJIFER-D-3-2015.pdf

- Duman, H., Yılmaz İçerli, M., Yücenurşen, M., Apak, İ. (2013). Environmental cost management within the sustainable business. The Online Journal of Science and Technology, 3 (2), 86–96. Available at: https://dergipark.org.tr/tr/download/article-file/210437

- Gentzoglanis, A. (2019). Corporate social responsibility and financial networks as a surrogate for regulation. Journal of Sustainable Finance & Investment, 9 (3), 214–225. doi: https://doi.org/10.1080/20430795.2019.1589195

- Natarajan, V., Reddy, O.chandra sekhara, Bekele, H. (2015). Evaluation of The Effectivness of Financial Performance of Cooperatives: Case Study of Lume Adama Farmers Cooperative Union, East Shoa Zone, Oromia Regional State, Ethiopia. International Journal of Latest Research in Science and Technology, 4 (2), 90–96. Available at: https://www.mnkjournals.com/journal/ijlrst/pdf/Volume_4_2_2015/10498.pdf

- Eugénio, T., Costa Lourenço, I., Morais, A. I. (2010). Recent developments in social and environmental accounting research. Social Responsibility Journal, 6 (2), 286–305. doi: https://doi.org/10.1108/17471111011051775

- Gao, S. S., Heravi, S., Xiao, J. Z. (2005). Determinants of corporate social and environmental reporting in Hong Kong: a research note. Accounting Forum, 29 (2), 233–242. doi: https://doi.org/10.1016/j.accfor.2005.01.002

- Tilt, C. A. (2001). The content and disclosure of Australian corporate environmental policies. Accounting, Auditing & Accountability Journal, 14 (2), 190–212. doi: https://doi.org/10.1108/09513570110389314

- Gray, R., Javad, M., Power, D. M., Sinclair, C. D. (2001). Social and Environmental Disclosure and Corporate Characteristics: A Research Note and Extension. Journal of Business Finance & Accounting, 28 (3-4), 327–356. doi: https://doi.org/10.1111/1468-5957.00376

- Lodhia, S. K. (2001). The accounting implications of the sustainable development bill. Social and Environmental Accountability Journal, 21 (1), 8–11. doi: https://doi.org/10.1080/0969160x.2001.9651646

- Ammar Mohammed Hussein, H. M. K. (2018). The Relationship between the Disclosure of Environmental Costs, Economic and Social Effects. The Administration & Economic College Journal, 10 (3), 212–232.

- Hammoud, A., Hammadi, A. A. J. (2016). State of the environment in Iraq.

- Asuquo, A. I. (2012). Environmental Friendly Policies And Their Financial Effects On Corporate Performance Of Selected Oil And Gas Companies In Niger Delta Region Of Nigeria. American International Journal of Contemporary Research, 2 (1), 168–173. Available at: http://www.aijcrnet.com/journals/Vol_2_No_1_January_2012/18.pdf

- Onyinyichi, A. B., Kingsley, O. O., Francis, A. (2017). The Effect of Environmental Cost on Financial Performance of Nigerian Brewery. European Journal of Business and Management, 9 (17), 59–64.

- Al-Tuwaijri, S. A., Christensen, T. E., Hughes, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Accounting, Organizations and Society, 29 (5-6), 447–471. doi: https://doi.org/10.1016/s0361-3682(03)00032-1

- Gozali, N. O., How, J. C. Y., Verhoeven, P. (2002). The economic consequences of voluntary environmental information disclosure. International Congress on Environmental Modelling and Software, 484–489. Available at: https://scholarsarchive.byu.edu/cgi/viewcontent.cgi?article=3878&context=iemssconference

- Stanwick, S. D., Stanwick, P. A. (2000). The relationship between environmental disclosures and financial performance: an empirical study of US firms. Eco-Management and Auditing, 7 (4), 155–164. doi: https://doi.org/10.1002/1099-0925(200012)7:4<155::aid-ema137>3.0.co;2-6

- Teoh, H., Pin, F., Joo, T., Ling, Y. (1998). Environmental Disclosures-Financial Performance Link: Further Evidence From Industrialising Economy Perspective. Second Asian Pacific Interdisciplinary Research in Accounting Conference (APIRA). Available at: https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.202.164&rep=rep1&type=pdf

- Cahaya, F. R., Porter, S. A. (2008). Social disclosure practices by Jakarta Stock Exchange listed entities. Journal of the Asia-Pacific Centre for Environmental Accountability, 14 (1), 2–11. Available at: https://www.unisa.edu.au/siteassets/episerver-6-files/global/business/centres/cags/docs/apcea/apcea_2008_141_cahaya_porter_brown.pdf

- Roberts, R. W. (1992). Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Accounting, Organizations and Society, 17 (6), 595–612. doi: https://doi.org/10.1016/0361-3682(92)90015-k

- Smith, M., Yahya, K., Marzuki Amiruddin, A. (2007). Environmental disclosure and performance reporting in Malaysia. Asian Review of Accounting, 15 (2), 185–199. doi: https://doi.org/10.1108/13217340710823387

- Yang, F.-J., Lin, C.-W., Chang, Y.-N. (2010). The linkage between corporate social performance and corporate financial performance. African Journal of Business Management, 4 (4), 406–413. Available at: https://academicjournals.org/article/article1380708258_Yang%20et%20al.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Abbas Al-Waeli, Zuriadah Ismail, Raad Hanoon, Azam Khalid

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.