Generation of machine-readable country-by-country reports with large language models

DOI:

https://doi.org/10.15587/1729-4061.2025.337405Keywords:

transfer pricing, transfer pricing documentation, large language models, XML generationAbstract

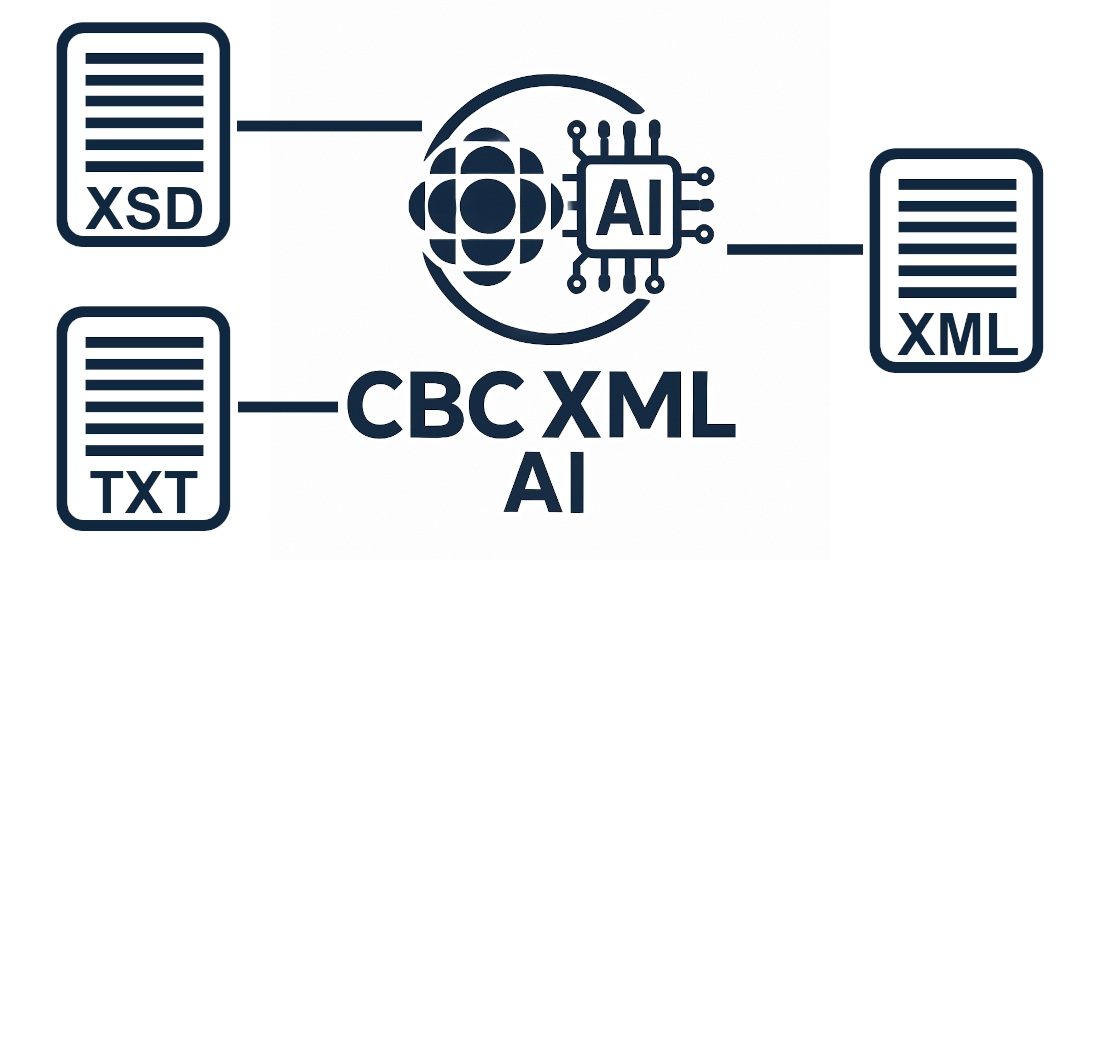

The object of this study is the process that generates machine-readable Country-by-Country reports in XML format using large language models. This paper addresses the task related to the current dependence of the process that generates these reports on specialized software, which leads to additional financial costs.

The research and analysis of the effectiveness of publicly available large language models for generating Country-by-Country reports with new data showed high results, provided that an example model of such generation was prompted. Three large language models out of nine studied yielded results close to ideal (obtained by manual preparation or specialized systems), namely 96 points out of 100 according to the devised evaluation methodology. Four other studied models demonstrated slightly lower efficiency, but their level is also sufficient for practical use. At the same time, the resulting average cost of generating one report (US cents 4.2) is significantly lower than in the case of using specialized systems.

Regarding the effectiveness of general-purpose large language models for generating Country-by-Country reports in the absence of a generation example, it is currently insufficient for practical use. In this case, all of the models studied showed results close to 0 points, i.e., completely incorrect reports were obtained. Such results are attributed to the insufficient amount of sample data during training of publicly available models.

Thus, publicly available large language models could in practice replace specialized software systems designed to generate Country-by-Country reports in XML format, at least in the case of generating new reports

References

- Yi, Z., Cao, X., Chen, Z., Li, S. (2023). Artificial Intelligence in Accounting and Finance: Challenges and Opportunities. IEEE Access, 11, 129100–129123. https://doi.org/10.1109/access.2023.3333389

- Dubey, S. S., Astvansh, V., Kopalle, P. K. (2025). Generative AI Solutions to Empower Financial Firms. Journal of Public Policy & Marketing, 44 (3), 411–435. https://doi.org/10.1177/07439156241311300

- Action Plan on Base Erosion and Profit Shifting (2013). OECD. https://doi.org/10.1787/9789264202719-en

- Dharmapala, D. (2014). What Do We Know about Base Erosion and Profit Shifting? A Review of the Empirical Literature. Fiscal Studies, 35 (4), 421–448. https://doi.org/10.1111/j.1475-5890.2014.12037.x

- Transfer Pricing Documentation and Country-by-Country Reporting, Action 13 - 2015 Final Report. In OECD/G20 Base Erosion and Profit Shifting Project (2015). OECD. https://doi.org/10.1787/9789264241480-en

- Ouelhadj, A., Bouchetara, M. (2021). Contributions of the Base Erosion and Profit Shifting BEPS Project on Transfer Pricing and Tax Avoidance. Financial Markets, Institutions and Risks, 5 (3). https://doi.org/10.21272/fmir.5(3).59-70.2021

- Country-by-Country Reporting XML Schema: User Guide for Tax Administrations. Version 2.0 (2019). Paris: OECD Publishing. Available at: http://www.oecd.org/tax/beps/country-by-country-reporting-xml-schema-user-guide-for-tax-administrations-june-2019.pdf

- Bergmann, S. (2016). Neue Verrechnungspreisdokumentationspflichten für multinationale Unternehmensgruppen. Zeitschrift für Gesellschaftsrecht und angrenzendes Steuerrecht, 148.

- Rezultaty roboty DPS shchodo podatkovoho kontroliu za transfertnym tsinoutvorenniam (2025). Kyiv. Available at: https://tax.gov.ua/data/material/000/780/912318/Dodatok_1.pdf

- Carey, A., Tanguay, B. H. (2025). How Can GenAI Improve My Transfer Pricing Process? Tax Management International Journal. Available at: https://kpmg.com/kpmg-us/content/dam/kpmg/taxnewsflash/pdf/2025/03/KPMG_GenAI_tmij_March2025_final.pdf

- Dinev, D., Wojewoda, A. (2024). Opportunities and limitations of AI in transfer pricing. International Tax Review. Available at: https://www.internationaltaxreview.com/article/2dxro1nggp5h8t2flrtog/sponsored/opportunities-and-limitations-of-ai-in-transfer-pricing

- Khalil, M. (2024). The Role of AI in Enhancing Transfer Pricing Accuracy and Efficiency. Advances in Information Technology, 7 (1), 1–11. Available at: https://acadexpinnara.com/index.php/acs/article/view/350

- Basharat, A. (2024). The Role of AI in Transfer Pricing: Transforming Global Taxation Processes. Aitoz Multidisciplinary Review, 3 (1), 254–260. Available at: https://aitozresearch.com/index.php/amr/article/view/55

- Puttaraju, K. H. (2024). Leveraging AI for Transfer Pricing Strategy Development and Execution: A Practical Approach. Interantional Journal Of Scientific Research In Engineering And Management, 08 (11), 1–6. https://doi.org/10.55041/ijsrem32711

- Moro Visconti, R. (2025). Artificial Intelligence And Transfer Pricing: A Multilayer Network Model for Compliance and Risk Mitigation. https://doi.org/10.2139/ssrn.5209028

- Beuther, A., Fettke, P., Just, V., Riedl, A. (2020). KI-Einsatz für Effizienzgewinne bei Benchmarkstudien im Bereich Transfer Pricing. beck.digitax, 5, 316–323. Available at: https://wts.com/wts.de/publications/fachbeitraege/2020/2020_05_beck_digitax_316_Beuthe_Fettke_Just_Riedl.pdf

- Beuther, A., Rombach, A., Stephan, S., Fettke, P., Köppe-Karkutsch, J., Dönnebrink, M. (2024). Künstliche Intelligenz im Steuerbereich: Innovationsstudie zum Potenzial und zur technologischen Entwicklung. KI Studie. Available at: https://wts.de/wts.de/KI%20Studie/KI-Folgestudie%202024_20240429.pdf

- Aibidia TXM: Verrechnungspreis-Management. TAXPUNK. Available at: https://taxpunk.de/tools/328/aibidia-txm/

- PwC CbC2Go: Workflow-basiertes CbC-Reporting. TAXPUNK. Available at: https://taxpunk.de/tools/65/pwc-cbc2go/

- WTS CbCR-2-XML: Umsetzung der XML-Struktur im Rahmen des CbC-Reportings. TAXPUNK. Available at: https://taxpunk.de/tools/85/wts-cbcr-2-xml/

- TPCBC: OECD konformes Country-by-Country Reporting. TAXPUNK. Available at: https://taxpunk.de/tools/318/tpcbc/

- Chiang, W., Zheng, L., Sheng, Y., Angelopoulos, A. N., Li, T., Li, D. et al. (2024). Chatbot arena: an open platform for evaluating LLMs by human preference. Proceedings of the 41st International Conference on Machine Learning, 8359–8388. Available at: https://dl.acm.org/doi/10.5555/3692070.3692401

- What's new in .NET 8 (2024). Microsoft. Available at: https://learn.microsoft.com/en-us/dotnet/core/whats-new/dotnet-8/overview

- What's new in C# 12 (2024). Microsoft. Available at: https://learn.microsoft.com/en-us/dotnet/csharp/whats-new/csharp-12

- dotnet/command-line-api at 2.0.0-beta4.22272.1. GitHub. Available at: https://github.com/dotnet/command-line-api/tree/2.0.0-beta4.22272.1

- lofcz/LlmTornado at v3.5.18. GitHub. Available at: https://github.com/lofcz/LlmTornado/tree/v3.5.18

- Communication Manual DIP Standard 2.1 BZSt. Available at: https://www.bzst.de/SharedDocs/Downloads/EN/dip_elma/Communication_Manual_DIP_Standard_2.pdf

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Yakiv Yusyn

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.