Assessing the impact of energy-saving technological changes on the financial condition of enterprises

DOI:

https://doi.org/10.15587/1729-4061.2025.341608Keywords:

technological change, financial condition of an enterprise, investing in energy saving, financial stabilityAbstract

This study investigates the process that assesses the impact of energy-saving technological changes on the financial condition of enterprises. The principal hypothesis of this study assumes such an impact on a significant number of companies.

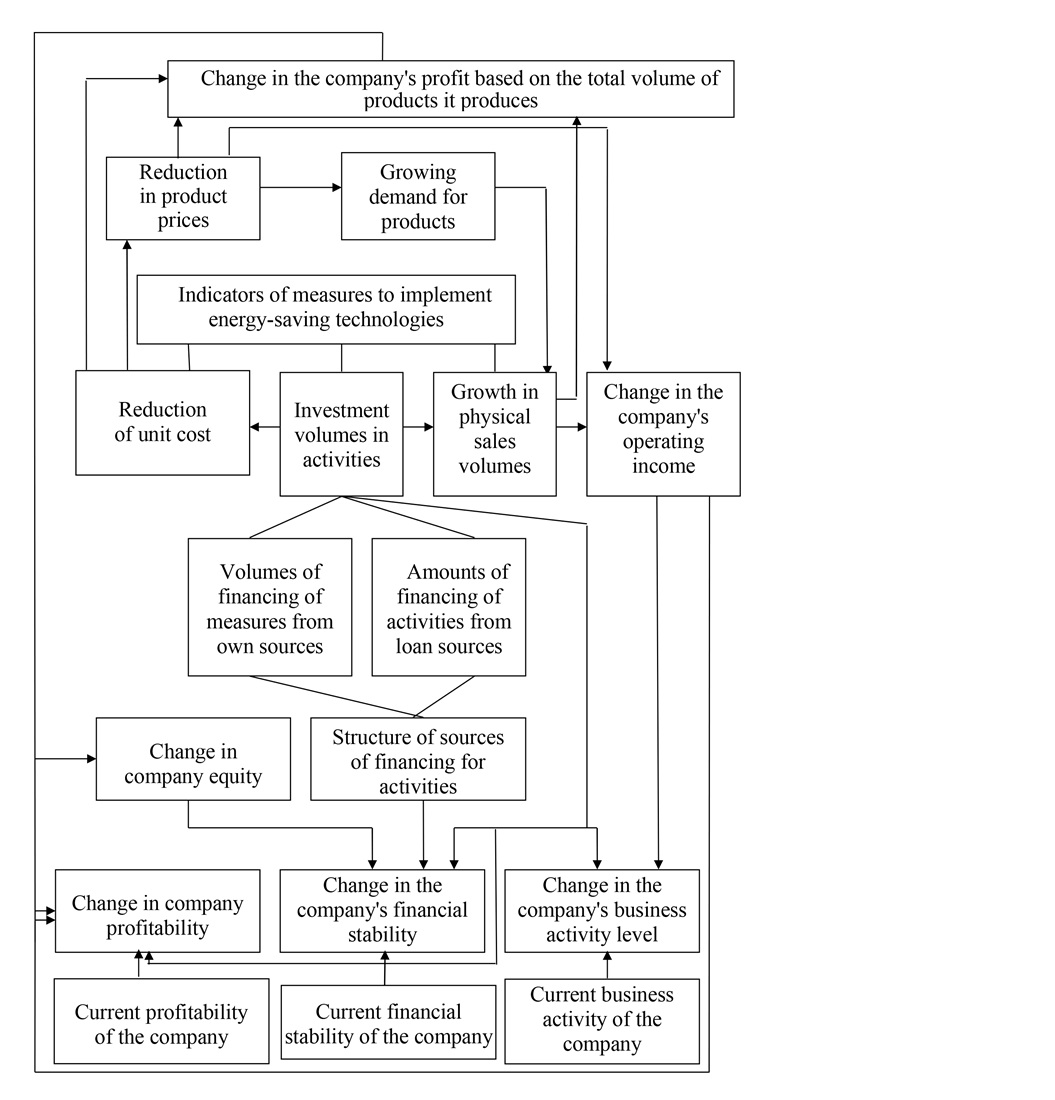

The research has made it possible to contribute to solving the task of improving the financial condition of business entities. In particular, the components of the impact of energy-saving technological changes on the financial condition of companies have been identified. A procedure for assessing the impact of energy-saving technological changes on this condition was devised. This procedure makes it possible to identify dependences between the level of energy-saving technological changes and indicators of the financial condition of enterprises. An integrated indicator of such a condition has been proposed.

The designed toolkit was validated on a sample of 105 enterprises in three industries. A statistically significant relationship was found between the level of energy-saving technological changes and the average values of the integrated indicator of the financial condition of the studied companies. It was established that the implementation of large-scale energy-saving technological changes by enterprises with low energy efficiency would allow these enterprises to increase the average value of the integrated indicator of the financial condition, depending on the industry, by 42–62%. It was found that energy-saving technological changes have the greatest impact on such a characteristic of the financial condition of enterprises as their profitability. This, in turn, provides more than 60% of the total increase in the value of the integrated indicator of the financial condition of companies.

The designed toolkit could be applied both at the level of an individual company and at the industry level. This would allow owners and managers of companies to increase the validity of technological renewal strategies

References

- Yemelyanov, O., Petrushka, T., Lesyk, L., Havryliak, A., Yanevych, N., Kurylo, O. et al. (2023). Assessing the Sustainability of the Consumption of Agricultural Products with Regard to a Possible Reduction in Its Imports: The Case of Countries That Import Corn and Wheat. Sustainability, 15 (12), 9761. https://doi.org/10.3390/su15129761

- Pylypenko, Y., Prokhorova, V., Halkiv, L., Koleshchuk, O., Dubiei, Y. (2022). Innovative intellectual capital in the system of factors of technical and technological development. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 6, 181–186. https://doi.org/10.33271/nvngu/2022-6/181

- Smerichevskyi, S. F., Kryvovyazyuk, I. V., Prokhorova, V. V., Usarek, W., Ivashchenko, A. I. (2021). Expediency of symptomatic diagnostics application of enterprise export-import activity in the disruption conditions of world economy sustainable development. IOP Conference Series: Earth and Environmental Science, 628 (1), 012040. https://doi.org/10.1088/1755-1315/628/1/012040

- Prokhorova, V., Mrykhina, O., Koleshchuk, O., Slastianykova, K., Harmatiy, M. (2023). The holistic evaluation system of R&D results under the circular economy conditions. Eastern-European Journal of Enterprise Technologies, 6 (13 (126)), 15–23. https://doi.org/10.15587/1729-4061.2023.291380

- Akbulaev, N., Guliyeva, N., Aslanova, G. (2020). Economic analysis of tourism enterprise solvency and the possibility of bankruptcy: The case of the Thomas Cook Group. African Journal of Hospitality, Tourism and Leisure, 9 (2), 1–12. Available at: https://www.researchgate.net/publication/339566072_Economic_analysis_of_tourism_enterprise_solvency_and_the_possibility_of_bankruptcy_the_case_of_the_Thomas_Cook_Group

- Izmailova, K., Zapiechna, Y. (2020). Study of unprofitability of ukraine’s large construction enterprises by the dupont method. Three Seas Economic Journal, 1 (4), 84–89. https://doi.org/10.30525/2661-5150/2020-4-12

- Korepanov, G., Yatskevych, I., Popova, O., Shevtsiv, L., Marych, M., Purtskhvanidze, O. (2020). Managing the Financial Stability Potential of Crisis Enterprises. International Journal of Advanced Research in Engineering and Technology, 11 (4), 359–371. Available at: https://ssrn.com/abstract=3599794

- Cheong, C., Hoang, H. V. (2021). Macroeconomic factors or firm-specific factors? An examination of the impact on corporate profitability before, during and after the global financial crisis. Cogent Economics & Finance, 9 (1). https://doi.org/10.1080/23322039.2021.1959703

- Gajdosikova, D., Valaskova, K., Kliestik, T., Kovacova, M. (2023). Research on Corporate Indebtedness Determinants: A Case Study of Visegrad Group Countries. Mathematics, 11 (2), 299. https://doi.org/10.3390/math11020299

- Dinh, H. T., Pham, C. D. (2020). The Effect of Capital Structure on Financial Performance of Vietnamese Listing Pharmaceutical Enterprises. The Journal of Asian Finance, Economics and Business, 7 (9), 329–340. https://doi.org/10.13106/jafeb.2020.vol7.no9.329

- Gill, A. S., Mand, H. S., Sharma, S. P., Mathur, N. (2012). Factors that Influence Financial Leverage of Small Business Firms in India. International Journal of Economics and Finance, 4 (3). https://doi.org/10.5539/ijef.v4n3p33

- Javed, Z. H., Rao, H. H., Akram, B., Nazir, M. F. (2015). Effect of Financial Leverage on Performance of the Firms: Empirical Evidence from Pakistan. SPOUDAI Journal of Economics and Business, 65 (1-2), 87–95. Available at: https://EconPapers.repec.org/RePEc:spd:journl:v:65:y:2015:i:1-2:p:87-95

- Hoque, M. A. (2017). Impact of financial leverage on financial performance: Evidence from textile sector of Bangladesh. IIUC Business Review, 6, 75–84. Available at: https://www.researchgate.net/publication/362644245_Impact_of_financial_leverage_on_financial_performance_Evidence_from_textile_sector_of_Bangladesh

- Adenugba, A. A., Ige, A. A., Kesinro, O. R. (2016). Financial leverage and firms’ value: A study of selected firms in Nigeria. European Journal of Research and Reflection in Management Sciences, 4 (1), 14–32. Available at: https://www.idpublications.org/wp-content/uploads/2016/01/Full-Paper-FINANCIAL-LEVERAGE-AND-FIRMS’-VALUE-A-STUDY-OF-SELECTED-FIRMS-IN-NIGERIA.pdf

- Arshi, N. (2022). Role of artificial intelligence in business risk management. American Journal of Business Management, Economics and Banking, 1, 55–66. https://www.americanjournal.org/index.php/ajbmeb/article/view/37

- Masharsky, A., Azarenkova, G., Oryekhova, K., Yavorsky, S. (2018). Anti-crisis financial management on energy enterprises as a precondition of innovative conversion of the energy industry: case of Ukraine. Marketing and Management of Innovations, 3, 345–354. https://doi.org/10.21272/mmi.2018.3-31

- Ayaydin, H., Karaaslan, İ. (2014). The effect of research and development investment on firms’ financial performance: Evidence from manufacturing firms in turkey. Bilgi Ekonomisi ve Yönetimi Dergisi, 9 (1), 23–39. Available at: https://dergipark.org.tr/en/pub/beyder/issue/3470/47199

- Rostamkalaei, A., Freel, M. (2015). The cost of growth: small firms and the pricing of bank loans. Small Business Economics, 46 (2), 255–272. https://doi.org/10.1007/s11187-015-9681-x

- Bhalli, M. T., Hashmi, S. M., Majeed, A. (2017). Impact of Credit Constraints on Firms Growth: A Case Study of Manufacturing Sector of Pakistan. Journal of Quantitative Methods, 1 (1), 4–40. https://doi.org/10.29145/2017/jqm/010102

- Mufutau Opeyemi, B. (2021). Path to sustainable energy consumption: The possibility of substituting renewable energy for non-renewable energy. Energy, 228, 120519. https://doi.org/10.1016/j.energy.2021.120519

- Prokhorova, V. V., Yemelyanov, O. Y., Koleshchuk, O. Y., Petrushka, K. I. (2023). Tools for assessing obstacles in implementation of energy saving measures by enterprises. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 1, 160–168. https://doi.org/10.33271/nvngu/2023-1/160

- Trianni, A., Cagno, E., Worrell, E., Pugliese, G. (2013). Empirical investigation of energy efficiency barriers in Italian manufacturing SMEs. Energy, 49, 444–458. https://doi.org/10.1016/j.energy.2012.10.012

- Yemelyanov, O., Dziurakh, Y., Danylovych, T., Bondarchuk, N., Demianchuk, O., Kharchuk, Y. (2024). Investing in resource-saving measures as a tool of anti-crisis financial management at enterprises. International Journal for Quality Research, 18 (1), 315–334. https://doi.org/10.24874/ijqr18.01-20

- Tsurkan, M., Andreeva, S., Lyubarskaya, M., Chekalin, V., Lapushinskaya, G. (2017). Organizational and financial mechanisms for implementation of the projects in the field of increasing the energy efficiency of the regional economy. Problems and Perspectives in Management, 15 (3), 453–466. https://doi.org/10.21511/ppm.15(3-2).2017.13

- Musiiovska, O., Koleshchuk, O., Petrushka, K., Yemelyanov, O., Breno, A. (2025). Information Provision as a Factor in the Formation of Enterprises’ Receptivity to Energy-Saving Technologies. Systems, Decision and Control in Energy VII. Cham: Springer, 33–48. https://doi.org/10.1007/978-3-031-90462-2_2

- Prokhorova, V. V., Yemelyanov, O. Y., Koleshchuk, O. Y., Antonenko, N. S., Zaitseva, A. S. (2023). Information support for management of energy-saving economic development of enterprises. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 6, 175–183. https://doi.org/10.33271/nvngu/2023-6/175

- Prokhorova, V., Yemelyanov, O., Koleshchuk, O., Mnykh, O., Us, Y. (2024). Development of tools for assessing the impact of logistics communications on investment activities of enterprises in the context of capital movement. Eastern-European Journal of Enterprise Technologies, 3 (13 (129)), 34–45. https://doi.org/10.15587/1729-4061.2024.304257

- Dong, J., Huo, H. (2017). Identification of Financing Barriers to Energy Efficiency in Small and Medium-Sized Enterprises by Integrating the Fuzzy Delphi and Fuzzy DEMATEL Approaches. Energies, 10 (8), 1172. https://doi.org/10.3390/en10081172

- Zhang, J., Lin Lawell, C.-Y. C. (2017). The macroeconomic rebound effect in China. Energy Economics, 67, 202–212. https://doi.org/10.1016/j.eneco.2017.08.020

- Orea, L., Llorca, M., Filippini, M. (2015). A new approach to measuring the rebound effect associated to energy efficiency improvements: An application to the US residential energy demand. Energy Economics, 49, 599–609. https://doi.org/10.1016/j.eneco.2015.03.016

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Viktoriia Prokhorova, Olexandr Yemelyanov, Orest Koleshchuk, Krystyna Slastianykova, Mykola Mashkovsky

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.