Devising a comprehensive methodology for estimating the economic efficiency of implementing an investment project for ensuring energy security of enterprises: organizational-economic aspect

DOI:

https://doi.org/10.15587/1729-4061.2025.321965Keywords:

economic efficiency, energy security of enterprises, management decisions, organizational-economic aspectAbstract

The subject of this study is the process of assessing the economic efficiency of implementing an investment project aimed at ensuring the energy security of enterprises within the power sector at the microeconomic level.

The task considered was to devise a comprehensive and adaptive approach to assessing the economic efficiency of investments, enabling effective planning, implementation, and adjustment of the investment project for ensuring energy security at enterprises under uncertainty.

The research revealed that conventional approaches, such as cost-benefit analysis, do not adequately account for risks and potential threats that arise during the implementation of investment projects.

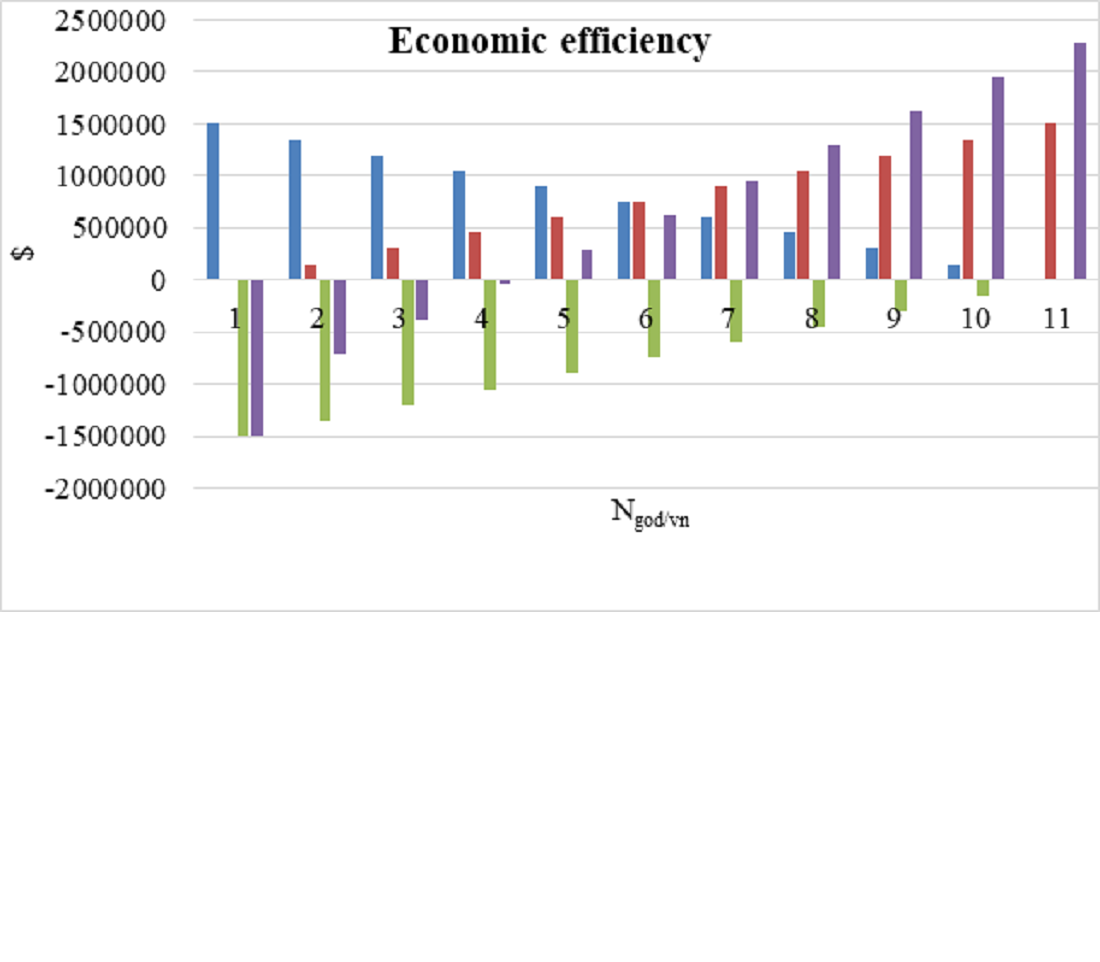

An improved comprehensive method for assessing economic efficiency has been proposed, consisting of eight key stages that are interconnected based on calculations and analysis of the economic efficiency indicators of the investment project for the enterprise.

A distinctive feature of this method is the integration of quantitative and qualitative indicators of investment projects, which allows for evaluating their effectiveness and ensuring real-time adaptation to justify management decisions under uncertainty.

The choice of criteria for evaluating investment objects for forming a system of energy security indicators for enterprises has been substantiated.

A computational algorithm was developed to monitor the dynamics of indicator changes, which helps make timely management decisions to minimize energy security risks.

The practical significance of this study is that it provides enterprises with methodological foundations for optimizing investment strategies.

It has been shown that maximum energy security and financial benefits for enterprises are achieved through the complete prevention of accidents, ensuring profitability at the level of 41 %

References

- Chang, Y., Liu, C., Liu, M., Liu, W., Liu, Z., Zhang, H., Zheng, Y. (2019). Differentiation degree combination weighting method for investment decision-making risk assessment in power grid construction projects. Global Energy Interconnection, 2 (5), 465–477. https://doi.org/10.1016/j.gloei.2019.11.022

- Erfani, A., Tavakolan, M. (2020). Risk Evaluation Model of Wind Energy Investment Projects Using Modified Fuzzy Group Decision-making and Monte Carlo Simulation. Arthaniti: Journal of Economic Theory and Practice, 22 (1), 7–33. https://doi.org/10.1177/0976747920963222

- Wei, Y.-M., Qiao, L., Jiang, S.-M., Lv, X. (2020). A decision-making approach considering technology progress for investment in oil sands projects: An empirical analysis in Canada. Journal of Petroleum Science and Engineering, 195, 107741. https://doi.org/10.1016/j.petrol.2020.107741

- Camanho, A. S., Silva, M. C., Piran, F. S., Lacerda, D. P. (2024). A literature review of economic efficiency assessments using Data Envelopment Analysis. European Journal of Operational Research, 315 (1), 1–18. https://doi.org/10.1016/j.ejor.2023.07.027

- Sassanelli, C., Rosa, P., Rocca, R., Terzi, S. (2019). Circular economy performance assessment methods: A systematic literature review. Journal of Cleaner Production, 229, 440–453. https://doi.org/10.1016/j.jclepro.2019.05.019

- Joppen, R., Kühn, A., Hupach, D., Dumitrescu, R. (2019). Collecting data in the assessment of investments within production. Procedia CIRP, 79, 466–471. https://doi.org/10.1016/j.procir.2019.02.126

- Fuster-Palop, E., Prades-Gil, C., Masip, X., Viana-Fons, J. D., Payá, J. (2021). Innovative regression-based methodology to assess the techno-economic performance of photovoltaic installations in urban areas. Renewable and Sustainable Energy Reviews, 149, 111357. https://doi.org/10.1016/j.rser.2021.111357

- Gong, Y., Gu, W., Ren, W. (2022). Green Energy Economic Efficiency and Enterprise Environmental Cost Control Based on the Internet of Things. Security and Communication Networks, 2022, 1–12. https://doi.org/10.1155/2022/6824493

- Pylypenko, Y., Pylypenko, H., Prokhorova, V. V., Mnykh, O. B., Dubiei, Yu. V. (2021). Transition to a new paradigm of human capital development in the dynamic environment of the knowledge economy. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 6, 170–176. https://doi.org/10.33271/nvngu/2021-6/170

- Prokhorova, V., Protsenko, V., Abuselidze, G., Mushnykova, S., Us, Yu. (2019). Safety of industrial enterprises development: evaluation of innovative and investment component. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 5. https://doi.org/10.29202/nvngu/2019-5/24

- Prokhorova, V., Protsenko, V., Bezuglaya, Y., Us, J. (2018). The optimization algorithm for the directions of influence of risk factors on the system that manages the potential of machine-building enterprises. Eastern-European Journal of Enterprise Technologies, 4 (1 (94)), 6–13. https://doi.org/10.15587/1729-4061.2018.139513

- Shibaeva, N., Baban, T., Prokhorova, V., Karlova, O., Girzheva, O., Krutko, M. (2019). Methodological bases of estimating the efficiency of organizational and economic mechanism of regulatory policy in agriculture. Global Journal of Environmental Science and Management, 5, 160–171. https://doi.org/10.22034/gjesm.2019.05.SI.18

- Pylypenko, H. M., Prokhorova, V. V., Mrykhina, O. B., Koleshchuk, O. Y., Mushnykova, S. A. (2020). Cost evaluation models of R&D products of industrial enterprises. Naukovyi Visnyk Natsionalnoho Hirnychoho Universytetu, 5, 163–170. https://doi.org/10.33271/nvngu/2020-5/163

- Babenko, V., Baksalova, O., Prokhorova, V., Dykan, V., Ovchynnikova, V., Chobitok, V. (2021). Information And Consulting Service Using In The Organization Of Personnel Management. Studies of Applied Economics, 38 (4). https://doi.org/10.25115/eea.v38i4.3999

- Hendren, N. (2020). Measuring economic efficiency using inverse-optimum weights. Journal of Public Economics, 187, 104198. https://doi.org/10.1016/j.jpubeco.2020.104198

- Lv, L., Chen, Y. (2024). The Collision of digital and green: Digital transformation and green economic efficiency. Journal of Environmental Management, 351, 119906. https://doi.org/10.1016/j.jenvman.2023.119906

- Prokhorova, V., Budanov, M., Budanov, P. (2024). Devising an integrated methodology for energy safety assessment at an industrial power-generating enterprise. Transfer of Technologies: Industry, Energy, Nanotechnology, 4 (13 (130)), 118–131. https://doi.org/10.15587/1729-4061.2024.308056

- Cui, X., Zou, P. X. W., Arena, M. (2024). An innovative methodology for assessing the safety of logistics infrastructure considering carrying capacity and catastrophe property of accidents. Transport Policy, 159, 178–189. https://doi.org/10.1016/j.tranpol.2024.10.015

- Qian, X., Dai, J., Jiang, W., Cai, H., Ye, X., Shahab Vafadaran, M. (2024). Economic viability and investment returns of innovative geothermal tri-generation systems: A comparative study. Renewable Energy, 226, 120396. https://doi.org/10.1016/j.renene.2024.120396

- De Pascale, A., Arbolino, R., Szopik-Depczyńska, K., Limosani, M., Ioppolo, G. (2021). A systematic review for measuring circular economy: The 61 indicators. Journal of Cleaner Production, 281, 124942. https://doi.org/10.1016/j.jclepro.2020.124942

- Brockway, P. E., Sorrell, S., Semieniuk, G., Heun, M. K., Court, V. (2021). Energy efficiency and economy-wide rebound effects: A review of the evidence and its implications. Renewable and Sustainable Energy Reviews, 141, 110781. https://doi.org/10.1016/j.rser.2021.110781

- Sadeghi, S., Ghandehariun, S., Rosen, M. A. (2020). Comparative economic and life cycle assessment of solar-based hydrogen production for oil and gas industries. Energy, 208, 118347. https://doi.org/10.1016/j.energy.2020.118347

- Ahmad, M., Ahmed, Z., Majeed, A., Huang, B. (2021). An environmental impact assessment of economic complexity and energy consumption: Does institutional quality make a difference? Environmental Impact Assessment Review, 89, 106603. https://doi.org/10.1016/j.eiar.2021.106603

- Zakari, A., Khan, I., Tan, D., Alvarado, R., Dagar, V. (2022). Energy efficiency and sustainable development goals (SDGs). Energy, 239, 122365. https://doi.org/10.1016/j.energy.2021.122365

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Viktoriia Prokhorova, Mykola Budanov, Pavlo Budanov, Anna Zaitseva, Anzhelika Slastianykova

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.