Assessment of the impact of digitalized management on the financial risks of industrial enterprises

DOI:

https://doi.org/10.15587/1729-4061.2022.268024Keywords:

digitalized management, financial risks, industrial enterprises, digital technologies, level of digitalizationAbstract

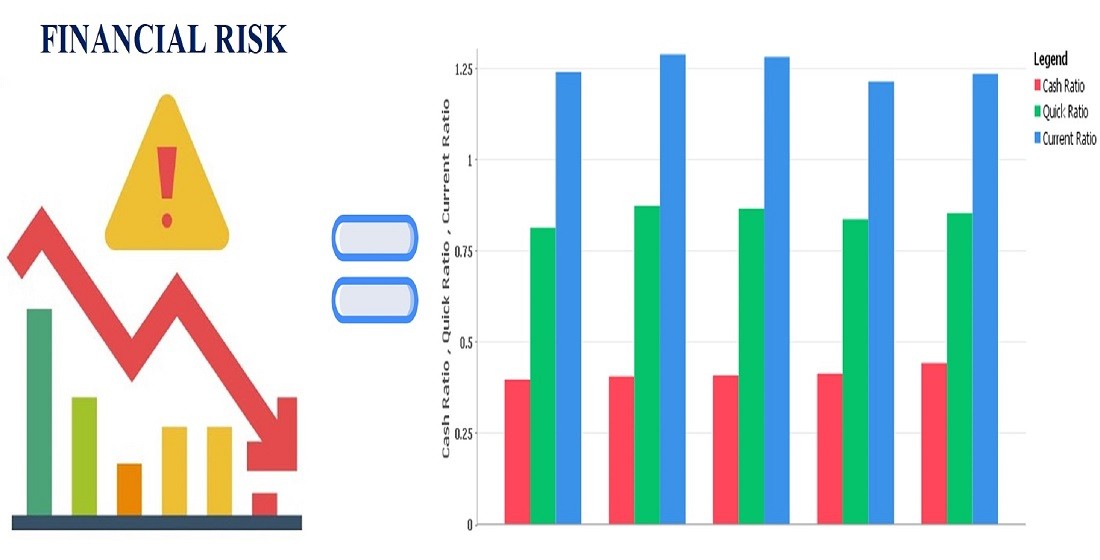

This paper considers the process of influence of digitalized management on the financial risks of industrial enterprises. An algorithm for determining the category of financial risks of industrial enterprises has been developed. Depending on the values of the coefficient of variation of deviations of financial ratios from the standards, five categories of financial risks have been distinguished – minimum, low permissible, critical, catastrophic. The categories of financial risks of industrial enterprises of the energy sector on the basis of liquidity indicators were determined. The indicators with the help of which it is possible to determine the level of digitalized management have been systematized. The parameters of low, medium, and high levels of digitalized management of industrial enterprises were substantiated. The relationship between the level of digitalized management of industrial enterprises and the categories of financial risks has been established. To assess the impact of digitalized management on the financial risks of industrial enterprises, a cross matrix "level of digitalized management – category of financial risk" is proposed. This has made it possible to justify the expediency of using three strategic directions of influence of digitalized management on the financial risks of industrial enterprises – the strategy of an innovator, follower, and observer. It has been established that while the innovator's strategy assumes the maximum, the observer's strategy is a minimum of effort and aims to actively use digital tools to manage this process. The practical use of the proposed directions of influence of digitalized management on the financial risks of industrial enterprises will provide an integrative combination of quantitative and qualitative results. In particular, achieving a stable financial condition of industrial enterprises in the context of digital transformation of the economy

References

- Nazarova, K., Bezverkhyi, K., Hordopolov, V., Melnyk, T., Poddubna, N. (2021). Risk analysis of companies’ activities on the basis of non-financial and financial statements. Agricultural and Resource Economics: International Scientific E-Journal, 7 (4), 180–199. doi: https://doi.org/10.51599/are.2021.07.04.10

- Korepanov, G., Yatskevych, I., Popova, O., Shevtsiv, L., Marych, M., Purtskhvanidze, O. (2020). Managing the financial stability potential of crisis enterprises. International Journal of Advanced Research in Engineering and Technology, 11 (4), 359–371. Available at: https://iaeme.com/MasterAdmin/Journal_uploads/IJARET/VOLUME_11_ISSUE_4/IJARET_11_04_036.pdf

- Bzhalava, L., Hassan, S. S., Kaivo-oja, J., Köping Olsson, B., Imran, J. (2021). Mapping the Wave of Industry Digitalization by Co-Word Analysis: An Exploration of Four Disruptive Industries. International Journal of Innovation and Technology Management, 19 (02). doi: https://doi.org/10.1142/s0219877022500018

- Letiagina, E. N., Trifonov, Y. V., Vizgunov, A. N., Tanchuk, R. S., Brykalov, S. M. (2022). Digital Economy: Research, Approaches, and Development Strategies. Advances in Science, Technology & Innovation, 863–865. doi: https://doi.org/10.1007/978-3-030-90324-4_140

- Betaneli, F. T., Nikitina, N. V., Zhelev, P. (2020). Managing the Financial Stability of an Enterprise in a Digital Economy. Lecture Notes in Networks and Systems, 267–272. doi: https://doi.org/10.1007/978-3-030-47458-4_31

- Arkadeva, O., Berezina, N. (2020). Digitalization in state financial risk management. Proceedings of the 2nd International Scientific Conference on Innovations in Digital Economy: SPBPU IDE-2020. doi: https://doi.org/10.1145/3444465.3444491

- Vovchenko, N. G., Andreeva, O. V., Orobinsky, A. S., Sichev, R. A. (2019). Risk Control in Modeling Financial Management Systems of Large Corporations in the Digital Economy. International Journal of Economics and Business Administration, VII, 3–15. doi: https://doi.org/10.35808/ijeba/247

- Luneva, N. N., Levina, T. M., Evdokimova, N. G. (2022). Methodology for Assessing Information Security Risks at Oil Refining Enterprises. Lecture Notes in Networks and Systems, 679–690. doi: https://doi.org/10.1007/978-3-030-93244-2_74

- Fedorenko, I. N., Makarov, V. V. (2021). Internal control as a tool for anti-crisis stability of metallurgical companies. Chernye Metally, 12, 79–83. doi: https://doi.org/10.17580/chm.2021.12.14

- Bharodia, N., Chen, W. (2021). What can we learn from what a machine has learned? Interpreting credit risk machine learning models. The Journal of Risk Model Validation, 15 (2). doi: https://doi.org/10.21314/jrmv.2020.235

- Poiasnennia finansovoho ryzyku (2019). Available at: https://academy.binance.com/uk/articles/financial-risk-explained

- Horiachyi, Yu., Andriichenko, Zh. (2018). Sutnist poniattia «finansovyi ryzyk» pidpryiemstva. Pidtrymka pidpryiemnytstva ta innovatsiynoi ekonomiky v pravi YeS, Latviyi ta Ukrainy: I Mizhnarodna mizhhaluzeva konferentsiya. Ryha: Baltic International Academy, 82–86. Available at: https://openarchive.nure.ua/handle/document/13371?locale=en

- Zhyhor, O. B., Shtehan, M. O. (2013). Essence of the concept of "financial risk" and its classification. Naukovyi visnyk NLTU Ukrainy, 23.10, 145–150. Available at: http://nbuv.gov.ua/UJRN/nvnltu_2013_23.10_26

- Dyakov, S. A., Mikhleva, I. I., Madzhuga, S. E. (2021). Management and assessment of financial risks of the enterprise using digital technologies. Estestvenno-gumanitarnye issledovaniya, 36 (4), 117–122. doi: https://doi.org/10.24412/2309-4788-2021-11281

- Zhang, C. (2021). The Application of Financial Analysis Based on the Perspective of Big Data. 2021 International Wireless Communications and Mobile Computing (IWCMC). doi: https://doi.org/10.1109/iwcmc51323.2021.9498798

- Broby, D. (2022). The use of predictive analytics in finance. The Journal of Finance and Data Science, 8, 145–161. doi: https://doi.org/10.1016/j.jfds.2022.05.003

- Nazarchuk, T. V., Kosiuk, O. M. (2016). Menedzhment orhanizatsiy. Kyiv: «Tsentr uchbovoi literatury», 560. Available at: http://pdf.lib.vntu.edu.ua/books/2017/menedzhment_org.pdf

- Finansova zvitnist pidpryiemstv za 2020 rik (2021). Available at: http://mpe.kmu.gov.ua/minugol/control/uk/publish/article?art_id=245525331&cat_id=245194014

- Chaika, T. Yu., Loshakova, S. Ye., Vodoriz, Ya. S. (2018). Calculation of liquidity factors by the balance, accounting financial and industrial features of the enterprise in the coefficient analysis of liquidity. Ekonomika i suspilstvo, 15, 900–908. Available at: https://economyandsociety.in.ua/journals/15_ukr/139.pdf

- Melnyk, T. A., Lobach, K. V. (2016). Metody otsinky likvidnosti pidpryiemstva. Naukovi zapysky, 20, 79–93. Available at: https://core.ac.uk/download/pdf/158807233.pdf

- Khachaturyan, M. V. (2021). Risk management of business processes' digital transformation in the conditions of a pandemic. Kreativnaya ekonomika, 15 (1), 45–58. doi: https://doi.org/10.18334/ce.15.1.111515

- Bolotnova, E. A., Salo, A. D., Utkin, A. I. (2021). The role of information technology in financial risk management. Vestnik Akademii znaniy, 43 (2), 351–355. doi: https://doi.org/10.24412/2304-6139-2021-11094

- Dunayev, I., Kud, A., Latynin, M., Kosenko, A., Kosenko, V., Kobzev, I. (2021). Improving methods for evaluating the results of digitizing public corporations. Eastern-European Journal of Enterprise Technologies, 6 (13 (114)), 17–28. doi: https://doi.org/10.15587/1729-4061.2021.248122

- Ostapchuk, O., Baksalova, O., Babiy, I. (2022). The essence and trends of changes in financial management in theconditions of increased digitalization of the economy. Modeling the Development of the Economic Systems, 2, 167–172. doi: https://doi.org/10.31891/mdes/2022-4-22

- Giuca, O., Popescu, T. M., Popescu, A. M., Prostean, G., Popescu, D. E. (2020). A Survey of Cybersecurity Risk Management Frameworks. Advances in Intelligent Systems and Computing, 240–272. doi: https://doi.org/10.1007/978-3-030-51992-6_20

- Novak, I. M., Ermakov, O. Y., Demianyshyna, O. A., Revytska, A. A. (2020). Digitalization as a vector of technological changes of Ukraine. International Journal of Scientific and Technology Research, 9 (1), 3429–3434. Available at: http://www.ijstr.org/final-print/jan2020/Digitalization-As-A-Vector-Of-Technological-Changes-Of-Ukraine.pdf

- Osyka, D. (2021). Tsyfrovizatsiya yak zaporuka staloho rozvytku enerhetychnoi haluzi. Available at: https://ua.interfax.com.ua/news/blog/757318.html

- Timchenko, O., Nebrat, V., Liehr, V., Bykonia, O., Dubas, Y. (2019). Organizational and economic determinants of digital energy development in Ukraine. Ekonomìka ì Prognozuvannâ, 3, 78–100. doi: https://doi.org/10.15407/eip2019.03.078

- Sassanelli, C., Arriga, T., Zanin, S., D’Adamo, I., Terzi, S. (2022). Industry 4.0 Driven Result-oriented PSS: An Assessment in the Energy Management. International Journal of Energy Economics and Policy, 12 (4), 186–203. doi: https://doi.org/10.32479/ijeep.13313

- Trzaska, R., Sulich, A., Organa, M., Niemczyk, J., Jasiński, B. (2021). Digitalization Business Strategies in Energy Sector: Solving Problems with Uncertainty under Industry 4.0 Conditions. Energies, 14 (23), 7997. doi: https://doi.org/10.3390/en14237997

- Zhang, Z., Feng, L., Zheng, Z., Wang, G. (2021). Research on Energy Industry Strategy Based on Intelligent Digital Upgrading. E3S Web of Conferences, 257, 02001. doi: https://doi.org/10.1051/e3sconf/202125702001

- Razumnoe upravlenie riskami v khode tsifrovoy transformatsii (2019). Available at: https://media.rbcdn.ru/media/reports/2019-risk-in-review-rus.pdf

- Pereslavtceva, I. (2019). Risk management in the context of digital transformation. REGION: sistemy, ekonomika, upravlenie, 4 (47), 207–209.

- Tomashuk, I., Tomashuk, I. (2022). Financial risk management of the enterprise as a component of ensuring sustainable functioning of the economic entity. Ekonomika i suspilstvo, 39. doi: https://doi.org/10.32782/2524-0072/2022-39-64

- Kutsyk, P. O., Vasyltsiv, T. H., Sorokivskyi, V. M., Stefaniak, V. I., Sorokivska, M. V. (2016). Upravlinnia finansovymy ryzykamy. Lviv: Rastr-7, 318.

- Financial Risk Management: A Complete Overview. Available at: https://www.inscribe.ai/financial-risk-management

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2022 Liubov Vasylyshyna, Olga Popova, Nataliia Hoholieva, Olena Lyzunova, Maryna Medvedieva, Kateryna Laskavets, Tatyana Mykytenko, Valentyn Diachenko, Andrii Yemets, Serhii Shevchenko

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.