Systematic approach to analyzing the impact of monetary processes in the economy on GDP

DOI:

https://doi.org/10.15587/1729-4061.2024.306446Keywords:

monetary processes, GDP, depth of credit information, money supply, domestic creditAbstract

The object of the study is monetary processes and the real sector of the economy. The purpose of the study is to analyze the impact of monetary processes in the economy on GDP based on a systematic approach. The task of analyzing the relationship between the main indicators of monetary processes and GDP on the basis of a wide sample of countries was solved. The results are obtained:

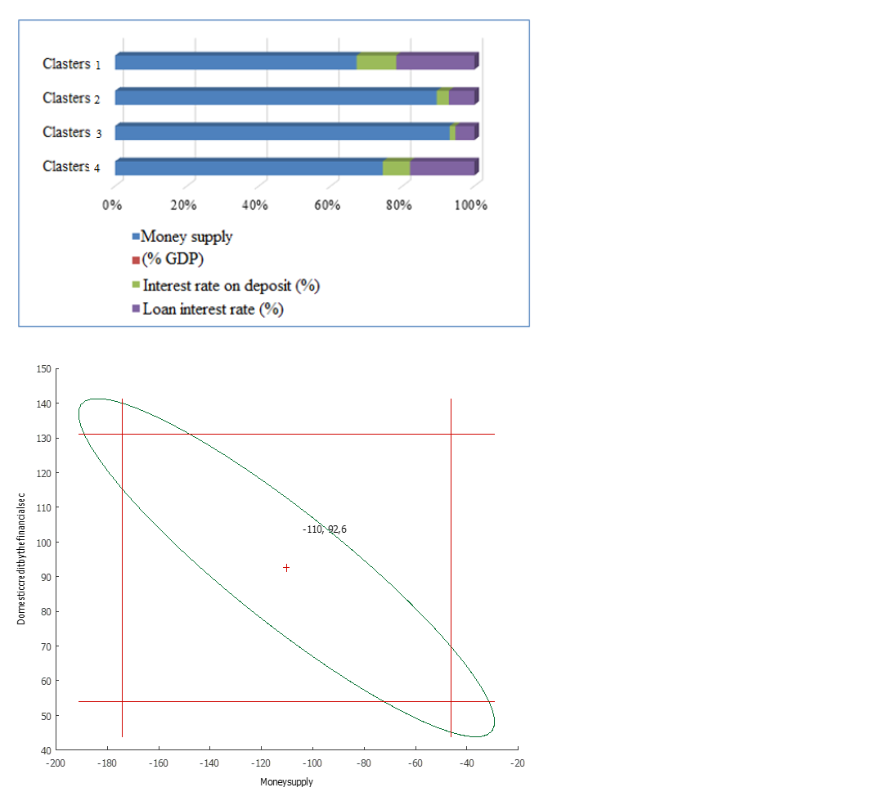

– for the variables included in the cluster analysis, the money supply analyzed: (1st cluster “stable financial environment” – 0, 2nd cluster “high access to credit” – 147.7, 3rd cluster “limited access to credit” – 72.2, 4th cluster “high interest rates” – 30.4 % of GDP);

– 72 countries are divided into 4 clusters, with 13 countries in the first cluster, 15 in the second, 21 in the third, and 23 in the fourth. This allows to determine the nature and place of the economy in the world and to make monetary policy decisions;

– there is a positive correlation between GDP and money supply (r=0.317); there is a weak positive relationship between GDP and the credit information depth index (r=0.203); there is a moderate positive relationship between GDP and domestic lending (r=0.39). Money supply management and domestic credit should be prioritized in monetary management of the economy.

The obtained results are explained by the assumption of linear dependence between the indicators of monetary processes and the real sector of the economy. This assumption was confirmed on the example of different countries, which indicates its universality.

The peculiarities of the results obtained are the application of a combination of cluster and correlation and regression methods of analysis using actual World Bank data

References

- Davis, A. E. (2017). Money as a Social Institution. Routledge. https://doi.org/10.4324/9781315671154

- Huber, J. (2017). Sovereign Money. Springer International Publishing. https://doi.org/10.1007/978-3-319-42174-2

- Mitchell. W., Wray. L. R., Watts, W. (2019). Macroeconomics. London: Macmillan, 604.

- Lastauskas, P., Nguyen, A. D. M. (2024). Spillover effects of US monetary policy on emerging markets amidst uncertainty. Journal of International Financial Markets, Institutions and Money, 92, 101956. https://doi.org/10.1016/j.intfin.2024.101956

- Peykani, P., Sargolzaei, M., Takaloo, A., Valizadeh, S. (2023). The Effects of Monetary Policy on Macroeconomic Variables through Credit and Balance Sheet Channels: A Dynamic Stochastic General Equilibrium Approach. Sustainability, 15 (5), 4409. https://doi.org/10.3390/su15054409

- De Grauwe, P. (2022). Economics of Monetary Union. Oxford: Oxford University Press. Available at: https://eprints.lse.ac.uk/122822/

- Fegatelli, P. (2022). A central bank digital currency in a heterogeneous monetary union: Managing the effects on the bank lending channel. Journal of Macroeconomics, 71, 103392. https://doi.org/10.1016/j.jmacro.2021.103392

- Altavilla, C., Boucinha, M., Peydro, J.-L., Smets, F. (2020). Banking Supervision, Monetary Policy and Risk-Taking: Big Data Evidence from 15 Credit Registers. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3512892

- Ball, L., Carvalho, C., Evans, C., Ricci, L. A. (2023). Weighted Median Inflation Around the World: A Measure of Core Inflation. National Bureau of Economic Research. https://doi.org/10.3386/w31032

- Correa, R., Paligorova, T., Sapriza, H., Zlate, A. (2021). Cross-Border Bank Flows and Monetary Policy. The Review of Financial Studies, 35 (1), 438–481. https://doi.org/10.1093/rfs/hhab019

- Ridwan, M. (2022). Determinants of Inflation: Monetary and Macroeconomic Perspectives. KINERJA: Jurnal Manajemen Organisasi Dan Industri, 1 (1), 1–10. https://doi.org/10.37481/jmoi.v1i1.2

- Chatziantoniou, I., Gabauer, D., Stenfors, A. (2021). Interest rate swaps and the transmission mechanism of monetary policy: A quantile connectedness approach. Economics Letters, 204, 109891. https://doi.org/10.1016/j.econlet.2021.109891

- Baibulekova, L. A., Kasymbekova, G. R., Zaitenova, N. K. (2019). Activity of the banking sector and its influence on the stock market of Kazakhstan. Central Asian Economic Review, 2, 200–213. Available at: https://caer.narxoz.kz/jour/article/view/180

- Louzis, D. P. (2022). Greek GDP Revisions and Short-Term Forecasting. Bank of Greece Economic Bulletin, 48 (3). Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4171789

- Bianchi, J., Bigio, S. (2022). Banks, Liquidity Management, and Monetary Policy. Econometrica, 90 (1), 391–454. https://doi.org/10.3982/ecta16599

- D’Avernas, A., Vandeweyer, Q. (2021). Intraday liquidity and money market dislocations. Available at: http://ewfs.org/wp-content/uploads/2022/01/108.pdf

- Greenwald, D. L., Krainer, J., Paul, P. (2020). The Credit Line Channel. Federal Reserve Bank of San Francisco, Working Paper Series, 1.000-96.000. https://doi.org/10.24148/wp2020-26

- Rodionova, T., Piatkov, A. (2020). Analysis of the efficiency of state, private and foreign banks of Ukraine. The Journal of V. N. Karazin Kharkiv National University. Series: International Relations. Economics. Country Studies. Tourism, (12), 171–182. https://doi.org/10.26565/2310-9513-2020-12-18

- Coibion, O., Gorodnichenko, Y., Kumar, S., Pedemonte, M. (2020). Inflation expectations as a policy tool? Journal of International Economics, 124, 103297. https://doi.org/10.1016/j.jinteco.2020.103297

- Lypnytskyi, D., Lypnytska, P. (2022). Money supply impact on investment and GDP: statistical analysis. Economy of Industry, 1 (97), 89–102. https://doi.org/10.15407/econindustry2022.01.089

- Wilson-Doenges, G. (2021). SPSS for Research Methods. W. W. Norton & Company Ltd. Available at: https://wwnorton.co.uk/books/9780393543063-spss-for-research-methods-acba3977-d7e8-4c3b-b3f0-69b042b45f42

- Robinson, T. R. (2020). International Financial Statement Analysis. Wiley, 1008.

- World Bank Open Data. The World Bank. Available at: https://data.worldbank.org/

- Kvasha, T. (2021). Potential GDP and its factors assessment. Technology Audit and Production Reserves, 6 (4 (62)). https://doi.org/10.15587/2706-5448.2021.245593

- Todorović, M., Kalinović, M. (2023). The contribution of development factors to economic growth on various gdp levels – the middle-income trap. TEME, 1029. https://doi.org/10.22190/teme220520054t

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Gumar Anuarbekkyzy, Gaukhar Zhanibekova, Munira Imramziyeva, Togzhan Zholdasbayeva, Bessekey Yerkin, Zhaxat Kenzhin

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.