Identifying features of the level of digitalization of banking services in different countries

DOI:

https://doi.org/10.15587/1729-4061.2024.312341Keywords:

digitalization of banking services, banking services, non-cash payments, digital technologies, GDPAbstract

The object of the study is digitalization of banking services. The problem of assessing the level of digitalization of banking services in different countries is solved. The results obtained are:

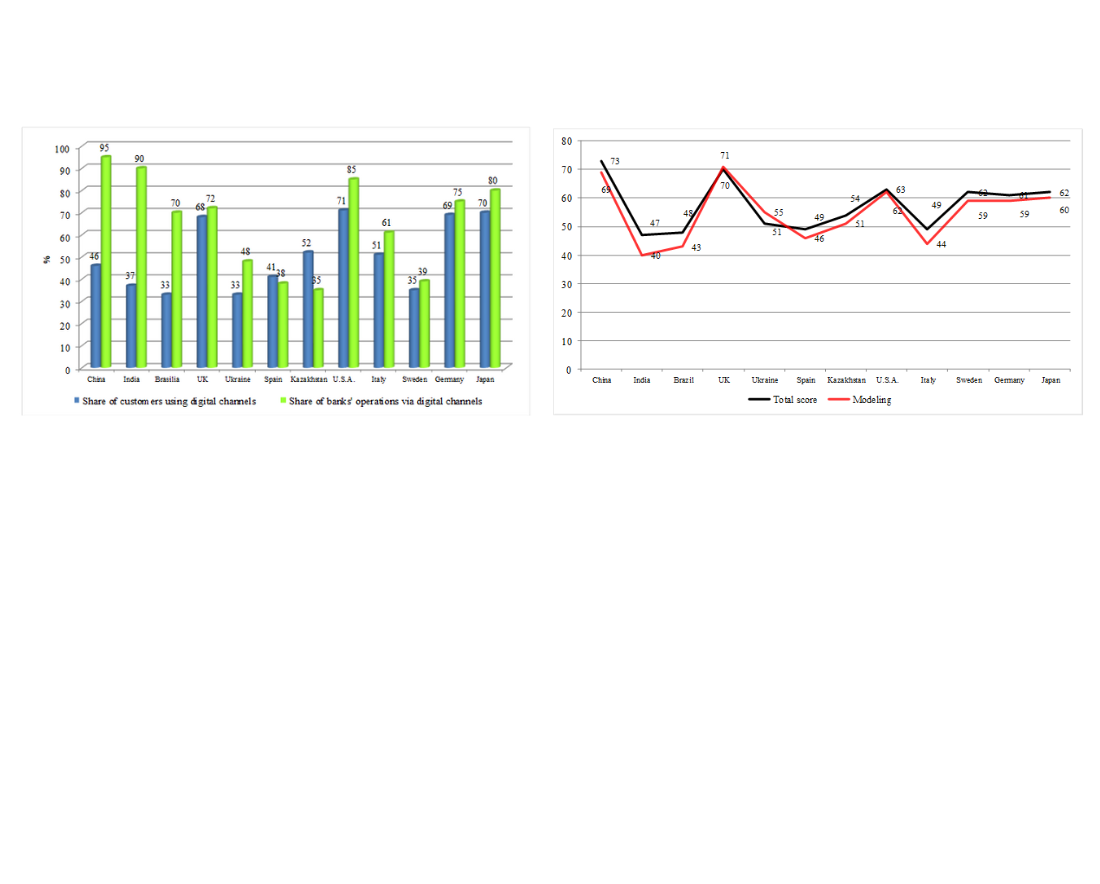

– classification of countries by the level of digitalization of banking services: high level (China, England), medium level (USA, Sweden, Germany, Japan, Ukraine, Kazakhstan) and low level (Spain, Italy, India, Brazil);

– a reliable (R2=0.78) positive dependence of the level of digitalization of banking services on the ratio of non-cash payments to GDP and on the rating of favorable conditions for doing business was revealed;

– additional competitive factors were added to the model: the positive dependence of the level of digitalization of banking services on the ratio of non-cash payments to GDP (t=3.338) and on the rating of favorable conditions for doing business (t=3.250) was confirmed.

The obtained results are explained by the assumption of linear dependence of the level of digitalization of banking services, the volume of non-cash payments and Doing business rating and the construction of an econometric regression model of the dependence of the level of digitalization of banking services of a particular country on the factors affecting the development of digital technologies in the banking sector. The peculiarities of the results obtained consist in the development of a score assessment of the level of digitalization of banking services using three criteria derived from international statistics and its testing on 12 countries of different economic levels of development.

The practical significance of this study is the possibility of applying the findings to increase the level of digitalization of banking services in the amount and conditions appropriate to the national economy.

References

- Kemp, S. (2023). Digital 2023: Global Overview Report. Available at: https://datareportal.com/reports/digital-2023-global-overview-report

- Vukovic, D. B., Maiti, M., Grigorieva, E. M. (Eds.) (2022). Digitalization and the Future of Financial Services. Contributions to Finance and Accounting. Springer International Publishing. https://doi.org/10.1007/978-3-031-11545-5

- Nursapina, K., Kuangaliyeva, T., Uryngaliyeva, A., Ibadildin, N., Serikbayev, S., Tulegenova, A., Kenzhin, Z. (2024). Mutual influence of energy efficiency and innovation activity in the industrial sector of the economy. Eastern-European Journal of Enterprise Technologies, 2 (13 (128)), 6–14. https://doi.org/10.15587/1729-4061.2024.299654

- Bai, Z., Ban, Y., Hu, H. (2024). Banking competition and digital transformation. Finance Research Letters, 61, 105068. https://doi.org/10.1016/j.frl.2024.105068

- Rodrigues, L. F., Oliveira, A., Rodrigues, H. (2023). Technology management has a significant impact on digital transformation in the banking sector. International Review of Economics & Finance, 88, 1375–1388. https://doi.org/10.1016/j.iref.2023.07.040

- Yusuf Dauda, S., Lee, J. (2015). Technology adoption: A conjoint analysis of consumers׳ preference on future online banking services. Information Systems, 53, 1–15. https://doi.org/10.1016/j.is.2015.04.006

- Adiningtyas, H., Auliani, A. S. (2024). Sentiment analysis for mobile banking service quality measurement. Procedia Computer Science, 234, 40–50. https://doi.org/10.1016/j.procs.2024.02.150

- Kim, L., Wichianrat, K., Yeo, S. F. (2024). An integrative framework enhancing perceived e-banking service value: A moderating impact of e-banking experience. Journal of Open Innovation: Technology, Market, and Complexity, 10 (3), 100336. https://doi.org/10.1016/j.joitmc.2024.100336

- Moşteanu, N. R., Faccia, A., Cavaliere, L. P. L., Bhatia, S. (2020). Digital Technologies’ Implementation within Financial and Banking System during Socio Distancing Restrictions – Back to the Future. International Journal of Advanced Research in Engineering and Technology, 11 (6), 307–315. Available at: https://ssrn.com/abstract=3650810

- Marszałek, P., Szarzec, K. (2021). Digitalization and the Transition to a Cashless Economy. Digitalization and Firm Performance, 251–281. https://doi.org/10.1007/978-3-030-83360-2_10

- Amaliah, I., Ali, Q., Sudrajad, O. Y., Rusgianto, S., Nu’man, H., Aspiranti, T. (2024). Does digital financial inclusion forecast sustainable economic growth? Evidence from an emerging economy. Journal of Open Innovation: Technology, Market, and Complexity, 10 (2), 100262. https://doi.org/10.1016/j.joitmc.2024.100262

- Sembiyeva, L., Zhagyparova, A., Beksultanova, I. (2021). Current Problems of Banking Technology Development in the Republic of Kazakhstan. Financial Space, 1 (41), 29–42. https://doi.org/10.18371/fp.1(41).2021.294346

- de Paula Pereira, G., de Medeiros, J. F., Kolling, C., Ribeiro, J. L. D., Morea, D., Iazzolino, G. (2024). Using dynamic capabilities to cope with digital transformation and boost innovation in traditional banks. Business Horizons, 67 (4), 317–330. https://doi.org/10.1016/j.bushor.2024.03.006

- Shcherbatykh, D., Shpileva, V., Riabokin, M., Zham, O., Zalizniuk, V. (2021). Impact of Digitalization on the Banking System Transformation. International Journal of Computer Science and Network Security, 21 (12), 513–520. https://doi.org/10.22937/IJCSNS.2021.21.12.71

- Bedianashvili, G., Zhosan, H., Lavrenko, S. (2022). Modern digitalization trends of Georgia and Ukraine. Scientific Papers Series Management, Economic Engineering in Agriculture and Rural Development, 22 (3), 57–74. Available at: https://dspace.tsu.ge/handle/123456789/1946

- Pakhnenko, O., Rubanov, P., Hacar, D., Yatsenko, V., Vida, I. (2021). Digitalization of financial services in European countries: Evaluation and comparative analysis. Journal of International Studies, 14 (2), 267–282. https://doi.org/10.14254/2071-8330.2021/14-2/17

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Menslu Sultanova, Akylbek Sultanov, Yelnaz Zhangaliyeva, Gaukhar Zhanibekova, Mainur Ordabayeva, Altynshash Zamanbekova, Nurkhat Ibadildin, Saule Primbetova

This work is licensed under a Creative Commons Attribution 4.0 International License.

The consolidation and conditions for the transfer of copyright (identification of authorship) is carried out in the License Agreement. In particular, the authors reserve the right to the authorship of their manuscript and transfer the first publication of this work to the journal under the terms of the Creative Commons CC BY license. At the same time, they have the right to conclude on their own additional agreements concerning the non-exclusive distribution of the work in the form in which it was published by this journal, but provided that the link to the first publication of the article in this journal is preserved.

A license agreement is a document in which the author warrants that he/she owns all copyright for the work (manuscript, article, etc.).

The authors, signing the License Agreement with TECHNOLOGY CENTER PC, have all rights to the further use of their work, provided that they link to our edition in which the work was published.

According to the terms of the License Agreement, the Publisher TECHNOLOGY CENTER PC does not take away your copyrights and receives permission from the authors to use and dissemination of the publication through the world's scientific resources (own electronic resources, scientometric databases, repositories, libraries, etc.).

In the absence of a signed License Agreement or in the absence of this agreement of identifiers allowing to identify the identity of the author, the editors have no right to work with the manuscript.

It is important to remember that there is another type of agreement between authors and publishers – when copyright is transferred from the authors to the publisher. In this case, the authors lose ownership of their work and may not use it in any way.